Current Report Filing (8-k)

May 12 2020 - 4:08PM

Edgar (US Regulatory)

false0001616707

0001616707

2020-05-12

2020-05-12

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of report (Date of earliest event reported): May 12, 2020

WAYFAIR INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

Delaware

|

|

001-36666

|

|

36-4791999

|

|

(State or other jurisdiction of

incorporation or organization)

|

|

(Commission

File Number)

|

|

(I.R.S. Employer

Identification No.)

|

4 Copley Place

Boston, MA 02116

(Address of principal executive offices, including zip code)

(617) 532-6100

(Registrant’s telephone number, including area code)

N/A

(Former name, former address and former fiscal year, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

|

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

Title of each class

|

Trading symbol(s)

|

Name of each exchange on which registered

|

|

Class A Common Stock, $0.001 par value per share

|

W

|

The New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

As previously disclosed on Wayfair Inc.’s (the “Company”) Current Report on Form 8-K filed April 8, 2020, pursuant to the terms of the purchase agreement (the “Purchase Agreement”) for the sale and issuance of $535,000,000 in aggregate original principal amount of 2.50% Accreting Convertible Senior Notes due 2025, the Company expected to appoint Michael W. Choe as the CBEP Investments, LLC (“Charlesbank”) designee to the Company’s Board of Directors (the “Board”) at the next regularly scheduled meeting of the Board. On May 12, 2020, the Board held its next regularly scheduled meeting and elected Mr. Choe to the Board, effective immediately. Mr. Choe was also appointed to the Audit Committee.

The transactions contemplated in the Purchase Agreement (the “Transactions”) constituted a “related party transaction” as defined by Item 404 of Regulation S-K because of Mr. Choe’s positions as a director of the Company and Managing Director and Chief Executive Officer of Charlesbank Capital Partners, LLC, the sole owner of the ultimate general partner of Charlesbank, a party to the Purchase Agreement, and Michael Kumin’s positions as a director of the Company and a Managing Partner at Great Hill Partners, LP, Manager of the ultimate general partner of GHEP VII Aggregator, L.P. (“Great Hill”), a party to the Purchase Agreement, and because of the limited partnership interests held by Niraj Shah and Steve Conine, the Company’s co-founders and co-chairmen, in affiliates of Great Hill and Charlesbank. The Transactions were approved by the disinterested members of the Board on April 5, 2020, upon the recommendation of a transaction committee consisting of two disinterested directors (the “Transaction Committee”) and the Audit Committee. The Transaction Committee was responsible for reviewing, negotiating and approving the structure of the Transactions and the associated terms of the Purchase Agreement and other related agreements, and the Audit Committee is responsible for the review and approval of any “related party transaction”, as such term is defined in Item 404 of Regulation S-K.

The Board has determined that Mr. Choe and Mr. Kumin are “independent” under the rules and regulations of the New York Stock Exchange and the Securities and Exchange Commission.

In connection with his appointment to the Board, the Board granted Mr. Choe a restricted stock unit award under the Company's 2014 Incentive Award Plan with a value of $200,000 as of the date of grant, subject to a three year vesting schedule. In addition, the Company entered into its standard form of indemnification agreement with Mr. Choe. Under the indemnification agreement, the Company agrees to indemnify Mr. Choe to the fullest extent permitted by Delaware law for certain liabilities to which he may become subject as a result of his service as a director of the Company. A copy of the Company’s form of indemnification agreement is filed as Exhibit 10.1 to the Company’s Current Report on Form 8-K filed January 8, 2018.

Item 5.05. Amendments to the Registrant's Code of Ethics, or Waiver of a Provision of the Code of Ethics.

On May 12, 2020, the Board approved a new Code of Business Conduct and Ethics (the “Code”), which applies to all directors, officers and employees of the Company and its subsidiaries. The new Code was adopted to reflect current best practices, reduce complexity and improve readability in order to make the new Code more accessible to the Company’s global employee base. The adoption of the new Code did not relate to or result in any waiver, whether explicit or implicit, of any provision of the existing code.

The new Code is available in the Investor Relations section of the Company’s website, located at investor.wayfair.com under the link for “Governance”. The contents of the Company’s website are not incorporated by reference in this report or made a part hereof for any purpose.

Item 5.07. Submission of Matters to a Vote of Security Holders.

The Company held its 2020 Annual Meeting of Stockholders (the “Annual Meeting”) on May 12, 2020. At the Annual Meeting:

|

|

|

|

1.

|

The stockholders voted to elect each of the seven (7) nominees for director.

|

|

|

|

|

2.

|

The stockholders voted to ratify the appointment of Ernst & Young LLP as the Company’s independent registered public accounting firm for fiscal 2020.

|

|

|

|

|

3.

|

The stockholders approved, on an advisory basis, the compensation of the Company's named executive officers.

|

Holders of the Company’s Class A common stock are entitled to one vote per share and holders of the Company’s Class B common stock are entitled to ten votes per share. Holders of Class A common stock and Class B common stock voted together as a single class on all matters submitted to a vote of stockholders at the Annual Meeting.

The Company’s inspector of elections certified the following vote tabulations:

Proposal 1: Election of Directors

|

|

|

|

|

|

|

|

|

|

|

Nominee

|

|

For

|

|

Abstain

|

|

Broker Non-Votes

|

|

Niraj Shah

|

|

320,959,872

|

|

378,686

|

|

9,930,821

|

|

Steven Conine

|

|

321,058,994

|

|

279,564

|

|

9,930,821

|

|

Julie Bradley

|

|

321,221,122

|

|

117,436

|

|

9,930,821

|

|

Andrea Jung

|

|

321,202,770

|

|

135,788

|

|

9,930,821

|

|

Michael Kumin

|

|

321,098,389

|

|

240,169

|

|

9,930,821

|

|

Jeffrey Naylor

|

|

321,219,263

|

|

119,295

|

|

9,930,821

|

|

Anke Schäferkordt

|

|

321,251,244

|

|

87,314

|

|

9,930,821

|

Proposal 2: Ratification of Selection of Independent Registered Public Accounting Firm

|

|

|

|

|

|

|

|

|

|

|

|

For

|

|

Against

|

|

Abstain

|

|

Broker Non-Votes

|

|

331,110,366

|

|

110,344

|

|

48,669

|

|

—

|

|

Proposal 3: Non-Binding Advisory Vote to Approve Executive Compensation

|

|

|

|

|

|

|

|

|

|

|

For

|

|

Against

|

|

Abstain

|

|

Broker Non-Votes

|

|

320,278,910

|

|

963,831

|

|

95,817

|

|

9,930,821

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

WAYFAIR INC.

|

|

|

|

|

|

|

|

Date: May 12, 2020

|

By:

|

/s/ ENRIQUE COLBERT

|

|

|

|

Enrique Colbert

|

|

|

|

General Counsel and Secretary

|

Wayfair (NYSE:W)

Historical Stock Chart

From Mar 2024 to Apr 2024

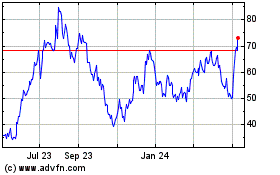

Wayfair (NYSE:W)

Historical Stock Chart

From Apr 2023 to Apr 2024