|

Item 1.01

|

Entry into a Material Definitive Agreement.

|

Purchase Agreement

On April 6, 2020, Wayfair Inc. (“Wayfair” or the “Company”) and Wayfair LLC agreed to sell and issue to GHEP VII Aggregator, L.P. (“Great Hill”), CBEP Investments, LLC (“Charlesbank”) and The Spruce House Partnership LLC (“Spruce House”, and collectively with Great Hill and Charlesbank, the “Purchasers”) $535,000,000 in aggregate original principal amount of 2.50% Accreting Convertible Senior Notes due 2025 (the “Notes”). The transactions (the “Transactions”) contemplated by the purchase agreement (which was subsequently amended and restated on April 7, 2020, such amended and restated version, the “Purchase Agreement”) are expected to close upon satisfaction of the closing conditions set forth in the Purchase Agreement.

The Purchase Agreement includes customary representations, warranties and covenants. Under the terms of the Purchase Agreement, the Company has agreed to indemnify the Purchasers against certain liabilities.

Board Representation

Pursuant to the terms of the Purchase Agreement, Great Hill and Charlesbank will each be entitled to nominate an individual to the Company’s Board of Directors (the “Board”). The Great Hill designee will be Michael Kumin, Managing Partner at Great Hill Partners, LP and Manager of the ultimate general partner of Great Hill and a current member of the Board, and the Charlesbank designee will be Michael Choe, Managing Director and Chief Executive Officer of Charlesbank Capital Partners, the ultimate general partner of Charlesbank. The Company expects to appoint Mr. Choe at the next regularly scheduled meeting of the Board.

For so long as each of Great Hill and Charlesbank, together with each of their affiliates, continue to own at least 50% of the Notes (or after a conversion, the underlying Class A common stock) issued to them, respectively, pursuant to the Purchase Agreement, Great Hill and Charlesbank will each maintain the right to nominate an individual for election to the Board. Subject to the terms of the Purchase Agreement, for so long as Great Hill and Charlesbank each has the right to nominate a director to the Board under the Purchase Agreement, the Company has, subject to the terms of the Purchase Agreement, agreed to include such person in its slate of nominees for election to the Board at each of the Company’s annual meeting of stockholders at which directors are to be elected.

The foregoing description of the Purchase Agreement is qualified in its entirety by reference to the Purchase Agreement attached as Exhibit 10.1 to this Current Report on Form 8-K and is incorporated herein by reference.

Indenture

The Notes are expected to be issued pursuant to an indenture (the “Indenture”) among the Company, Wayfair LLC, our wholly-owned subsidiary, as Guarantor (the “Guarantor”), and U.S. Bank National Association, as trustee (the “Trustee”). The Notes will be fully and unconditionally guaranteed on a senior unsecured basis by the Guarantor.

No cash interest will be payable on the Notes. Instead, the Notes will accrue interest at a rate of 2.50% per annum which will accrete to the principal amount on April 1 and October 1 of each year, beginning on October 1, 2020.

The Notes are convertible based upon an initial conversion price of $72.50 per share of the Company’s Class A common stock (the “Common Stock”). The Company will settle any conversion of Notes with a number of shares of Common Stock per $1,000 original principal amount of Notes equal to the accreted principal amount of such original principal amount of Notes divided by the conversion price. The conversion price will be subject to adjustment upon the occurrence of certain specified events, including certain distributions and dividends to all or substantially all of the holders of Common Stock, but will not be adjusted for accrued and unpaid interest. Holders of Notes who convert their Notes in connection with a make-whole fundamental change (as will be defined in the Indenture) may be entitled to a premium in a form of additional shares of Common Stock.

The Notes will mature on April 1, 2025, unless earlier purchased, redeemed or converted. Holders may convert all or a portion of their Notes at any time prior to the second business immediately day preceding the maturity date. The Company may not redeem the Notes prior to May 9, 2023. On or after May 9, 2023, the Company may redeem for cash all or part of the Notes if the last reported sale price of Common Stock equals or exceeds 276% of the conversion price then in effect for at least 20 trading days (whether or not consecutive), including at least one of the five trading days immediately preceding the date on which the Company provides notice of redemption, during any 30 consecutive trading days ending on, and including the trading day immediately preceding the date on which the Company provides notice of the redemption. The redemption price will be 100% of the accreted principal amount of the Notes to be redeemed, including accrued interest, if any, to, but excluding, the redemption date.

Upon the occurrence of a fundamental change (as will be defined in the Indenture), holders may require the Company to repurchase all or a portion of their Notes for cash at a price equal to 100% of the accreted principal amount of the Notes to be repurchased (which accreted principal amount upon repurchase will include interest, if any, accrued to, but excluding, the fundamental change repurchase date).

The Indenture will contain customary terms and covenants, including that upon certain events of default occurring and continuing, either the Trustee or the holders of not less than 25% in aggregate principal amount of the Notes then outstanding may declare the entire principal amount of all the Notes plus accrued interest, if any, to be immediately due and payable.

When issued, the notes and the related guarantee will be the Company’s and the Guarantor’s respective general senior unsecured obligations and will rank equally with all of the Company’s and the Guarantor’s existing and future senior indebtedness; will be effectively subordinated to all of the Company’s and the Guarantor’s secured indebtedness, including borrowings under the Company’s and the Guarantor’s senior secured revolving credit facility, to the extent of the value of the collateral securing such indebtedness; and will be structurally subordinated to all existing and future indebtedness and other liabilities of the Company’s and the Guarantor’s subsidiaries.

The foregoing description of the Indenture is qualified in its entirety by reference to the form of Indenture and the form of 2.50% Accreting Convertible Senior Notes due 2025, which are attached as Exhibits 4.1 and 4.2, respectively, to this Current Report on Form 8-K and are incorporated herein by reference.

Registration Rights Agreement

In connection with the Purchase Agreement and concurrently with the issuance of the Notes, the Company expects that it will enter into a Registration Rights Agreement with the Purchasers (the “RRA”). Subject to certain limitations, the RRA provides that the Company will, by no later than five months from the closing, prepare, file and use reasonable efforts to cause to be declared effective a shelf registration statement registering the public resale of the shares of Common Stock issuable upon conversion of the Notes.

The foregoing description of the RRA is qualified in its entirety by reference to the form of RRA attached as Exhibit 10.2 to this Current Report on Form 8-K and is incorporated herein by reference.

Related Party Transaction

The Transactions constitute a “related party transaction” as defined by Item 404 of Regulation S-K because of Mr. Kumin’s positions as a director of the Company and a Managing Partner at Great Hill Partners, LP and Manager of the ultimate general partner of Great Hill, and because of the limited partnership interests held by Niraj Shah and Steve Conine, our co-founders and co-chairmen, in affiliates of Great Hill and Charlesbank.

Because of this, the Board formed a transaction committee consisting of disinterested directors, Jeffrey Naylor and James Miller (the “Transaction Committee”). The Transaction Committee was responsible for reviewing, negotiating and approving the structure of the transaction and the associated terms of the Purchase Agreement, the Indenture, the RRA and related agreements.

Additionally, the Company has a written policy that the Audit Committee is responsible for the review and approval of any “related party transaction”, as such term is defined in Item 404 of Regulation S-K, after it has reviewed and considered all relevant facts and circumstances, including, but not limited to, whether the transaction is on terms comparable to those that could be obtained in an arm’s length transaction and the extent of the related party’s interest in the transaction.

This transaction was approved by the disinterested members of the Board on April 5, 2020, upon the recommendation of the Transaction Committee and the Audit Committee.

Advisors

Goldman Sachs & Co. LLC served as the lead transaction advisor to the Company. Citigroup Global Markets Inc. also acted as an advisor to the Company. Goodwin Procter LLP served as legal counsel to the Company.

|

Item 2.03

|

Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant

|

The information related to the issuance of the Notes contained in Item 1.01 of this Current Report on Form 8-K is incorporated by reference.

|

Item 3.02

|

Unregistered Sales of Equity Securities.

|

On April 6, 2020, the Company entered in to the Purchase Agreement, pursuant to which it will issue $535,000,000 in aggregate original principal amount of the Notes to the Purchasers in a private placement pursuant to an exemption from the registration requirements of the Securities Act of 1933, as amended (the “Securities Act”). The Company plans to issue the Notes to the Purchasers in reliance on the exemption from registration provided by Section 4(a)(2) of the Securities Act. The Company relied on this exemption from registration based in part on representations made by the Purchasers in the Purchase Agreement.

The information related to the issuance of the Notes contained in Item 1.01 of this Current Report on Form 8-K is incorporated by reference.

On April 6, 2020, the Company issued a press release announcing a business update, as well as the entry into the Purchase Agreement and the associated transactions related to the Notes. A copy of the press release is filed as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference.

Forward-Looking Statements.

This Current Report on Form 8-K contains forward-looking statements within the meaning of federal and state securities laws. All statements other than statements of historical fact contained in this Current Report on Form 8-K, including statements regarding the transactions contemplated by the Purchase Agreement and the consummation thereof, including the expected timing and conditions to closing, entry into the Indenture and the RRA and the issuance of the Notes and expectations as to the related director designees, are forward-looking statements. In some cases, forward-looking statements can be identified by terms such as “may,” “will,” “should,” “expects,” “plans,” “anticipates,” “could,” “intends,” “target,” “projects,” “contemplates,” “believes,” “estimates,” “predicts,” “potential” or “continue” or the negative of these terms or other similar expressions.

Forward-looking statements are based on current expectations of future events. The Company the Company’s guarantee that any forward-looking statement will be accurate, although the Company believes that it has been reasonable in the Company’s expectations and assumptions. Investors should realize that if underlying assumptions prove inaccurate or that known or unknown risks or uncertainties materialize, actual results could vary materially from the Company’s expectations and projections. Investors are therefore cautioned not to place undue reliance on any forward-looking statements. These forward-looking statements speak only as of the date of this press release and, except as required by applicable law, the Company undertakes no obligation to publicly update or revise any forward-looking statements contained herein, whether as a result of any new information, future events or otherwise. Many of the foregoing risks and uncertainties may be exacerbated by the COVID-19 pandemic and any worsening of the global business and economic environment as a result.

A list and description of risks, uncertainties and other factors that could cause or contribute to differences in the Company’s results can be found in its filings with the SEC, including the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2019 and subsequent filings. The Company qualifies all of its forward-looking statements by these cautionary statements.

|

Item 9.01

|

Financial Statements and Exhibits.

|

(d) Exhibits

|

|

|

|

|

|

|

Exhibit

No.

|

|

|

Description

|

|

|

|

|

|

|

|

|

4.1

|

|

|

Form of Indenture by and between Wayfair Inc., Wayfair LLC, as Guarantor, and U.S. Bank National Association, as trustee.

|

|

|

|

|

|

|

|

|

4.2

|

|

|

Form of 2.50% Accreting Convertible Senior Notes due 2025 (included in Exhibit 4.1).

|

|

|

|

|

|

|

|

|

10.1

|

|

|

Amended and Restated Purchase Agreement, dated as of April 7, 2020, by and among Wayfair Inc., Wayfair LLC, GHEP VII Aggregator, L.P., CBEP Investments, LLC and The Spruce House Partnership LLC.

|

|

|

|

|

|

|

|

|

10.2

|

|

|

Form of Registration Rights Agreement by and between Wayfair Inc. and GHEP VII Aggregator, L.P., CBEP Investments, LLC and The Spruce House Partnership LLC.

|

|

|

|

|

|

|

|

|

99.1

|

|

|

Press Release, dated April 6, 2020.

|

|

|

|

|

|

|

|

|

104

|

|

|

Inline XBRL for the cover page of this Current Report on Form 8-K.

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

WAYFAIR INC.

|

|

|

|

|

|

|

|

|

|

Date: April 8, 2020

|

|

|

|

By:

|

|

/s/ ENRIQUE COLBERT

|

|

|

|

|

|

|

|

Enrique Colbert

|

|

|

|

|

|

|

|

General Counsel and Secretary

|

Wayfair (NYSE:W)

Historical Stock Chart

From Mar 2024 to Apr 2024

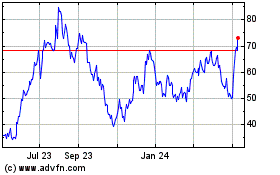

Wayfair (NYSE:W)

Historical Stock Chart

From Apr 2023 to Apr 2024