By Sarah Nassauer and Charity L. Scott

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (February 29, 2020).

In nearly two decades, online home-goods seller Wayfair Inc. has

grown quickly by burning through profits.

Now the e-commerce company is trying to show investors it can

moderate its losses as revenue growth slows and investor appetite

for unprofitable companies dries up.

"Ultimately every company needs to be self-financing,"

co-founder and Chief Executive Niraj Shah wrote in an email to

staff earlier this month, explaining his decision to cut about 550

jobs after hiring thousands of people in recent years.

On Friday Wayfair said it lost $330 million in the quarter ended

Dec. 31, more than twice as much as it lost a year earlier.

Quarterly sales rose 26% from a year before, but operating expenses

jumped 44%. The company's annual net loss nearly doubled to $985

million.

Mr. Shah promised to moderate costs across the company in 2020,

specifically calling out advertising spending on Wayfair's

fourth-quarter earnings call. "We want to re-emphasize across

Wayfair that scarcity is an asset, and this applies to marketing as

well," he said. Executives said it would take until 2021 for the

company's U.S. business to generate consistent operating

earnings.

Wayfair isn't like traditional furniture chains such as West Elm

or IKEA, which stock stores and warehouses with curated inventory.

It sells sofas and tables much like Amazon sells books and toys. It

has filled its website with millions of listings and promises free

shipping on much of it.

It spends heavily on marketing to attract web shoppers. It keeps

minimal inventory and often ships directly from suppliers. That has

quickly created a company with more than $9 billion in annual sales

but also with losses every year since it went public in 2014.

It was a formula that investors mostly embraced until recently.

The Boston company's stock tumbled in October after it reported a

steep quarterly loss, and the shares have lost more than 50% of

their value over the past 12 months. The stock fell 18% Friday

morning, amid a broader market selloff.

After years of pushing growth, top executives began to

prioritize profitability in presentations to managers late last

year, according to former employees. In one December meeting, Mr.

Shah showed how hiring was growing faster than revenue, said one of

these people. In past group meetings Mr. Shah primarily spoke about

"compounding growth," said this person. A spokeswoman declined to

comment on the meetings.

"Since we founded the company in 2002 we have always had periods

where we invested very heavily in the business and periods where we

have worked to drive greater efficiency," Mr. Shah wrote in his

memo earlier this month. "On reflection, this last period of

investment went on too long."

Both startups and public companies have found investors cooling

on companies that don't generate profits since office-rental giant

WeWork's IPO plans unraveled last year. Mattress seller Casper

Sleep Inc. recently had to slash its valuation to go public and its

shares are now trading below the IPO price.

Wayfair's strategy to gain dominance in the online furnishings

category has been to deliver large, bulky items better than its

competitors through supply-chain investments, said Brian Nagel, an

analyst at Oppenheimer & Co.

The retailer is following a similar playbook to Amazon.com Inc.

and has taken advantage of cheap capital to "lose money and build a

competitive moat around the business that will help support the

business long term," Mr. Nagel said.

But it is difficult for traditional and online furniture chains

to generate profits amid stiff pricing competition and the high

costs of shipping bulky furniture. Homegoods chain Pier 1 Imports

Inc., which was slow to embrace online sales, filed for bankruptcy

protection earlier this month. In January, Walmart Inc. laid off

most of the headquarters staff at Hayneedle, an online furniture

seller it acquired in 2016, as it works to make its U.S. e-commerce

business more profitable.

Wayfair spent $311 million on advertising in the fourth quarter,

amounting to about $28 per order. Even excluding all its

advertising costs, the company barely broke even in the holiday

period, analysts said.

Executives said growth would slow in the current quarter as they

pull back on advertising. They predicted revenue rising between 15%

to 17% year over year, which would make it the slowest quarterly

rate since the company went public.

Some analysts remain unconvinced that Wayfair can wean itself

from spending. "Revenue growth seems more intertwined with ad

spend, promotions and ongoing investments than the market

appreciates," Morgan Stanley analyst Simeon Gutman said in a note

this week, downgrading the company to the equivalent of a sell

rating.

"The market is less tolerant of unprofitable online

retailers."

Despite the desire of some investors to see Wayfair focus on

profits, the company's leadership can't afford to become complacent

about competition, with both Amazon and Walmart poised to become

more aggressive in the home category, said Colin Sebastian, an

analyst at Robert W. Baird & Co.

"There's just a window of opportunity for them," he said. "So

why would they try to harvest profits when there's a lot more at

stake over the very long term?"

Write to Sarah Nassauer at sarah.nassauer@wsj.com and Charity L.

Scott at Charity.Scott@wsj.com

(END) Dow Jones Newswires

February 29, 2020 02:47 ET (07:47 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

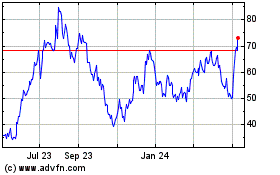

Wayfair (NYSE:W)

Historical Stock Chart

From Mar 2024 to Apr 2024

Wayfair (NYSE:W)

Historical Stock Chart

From Apr 2023 to Apr 2024