Verizon Communications On Pace for 7-Day Losing Streak -- Data Talk

October 21 2020 - 1:18PM

Dow Jones News

Verizon Communications Inc. (VZ) is currently at $57.10, down

$0.15 or 0.25%

-- Would be lowest close since July 27, 2020, when it closed at

$56.87

-- Currently down seven consecutive days; down 4.11% over this

period

-- Earlier Wednesday, Verizon Communications reported that

third-quarter profit fell to $4.5 billion, or $1.05 a share, from

$5.34 billion, or $1.25 a share, for the year-earlier period. Total

revenue dropped 4.1%, to $31.54 billion. Analysts polled by FactSet

had predicted $31.59 billion for the latest period

-- Longest losing streak since Sept. 8, 2017, when it fell for

nine straight trading days

-- Worst seven day stretch since the seven days ending June 26,

2020, when it fell 6.16%

-- Down 4.01% month-to-date

-- Down 7% year-to-date; on pace for worst year since 2008, when

it fell 22.06%

-- Down 8.33% from its all-time closing high of $62.29 on Oct.

4, 1999

-- Down 6.20% from 52 weeks ago (Oct. 23, 2019), when it closed

at $60.88

-- Down 8% from its 52 week closing high of $62.07 on Dec. 20,

2019

-- Up 14.35% from its 52 week closing low of $49.94 on March 25,

2020

-- Traded as low as $56.85

-- Down 0.7% at today's intraday low

-- Subtracted 0.99 points from the DJIA so far today

All data as of 12:41:06 PM

Source: Dow Jones Market Data, FactSet

(END) Dow Jones Newswires

October 21, 2020 13:03 ET (17:03 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

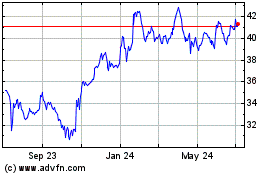

Verizon Communications (NYSE:VZ)

Historical Stock Chart

From Mar 2024 to Apr 2024

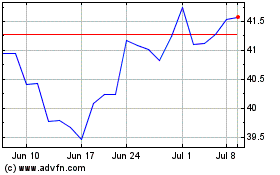

Verizon Communications (NYSE:VZ)

Historical Stock Chart

From Apr 2023 to Apr 2024