Free Writing Prospectus - Filing Under Securities Act Rules 163/433 (fwp)

February 06 2020 - 4:03PM

Edgar (US Regulatory)

Filed Pursuant to Rule 433

Registration No. 333-233608

Final Term Sheet

February 6, 2020

VERIZON

COMMUNICATIONS INC.

$2,385,000,000 3.600% Notes due 2060

|

|

|

|

|

Issuer:

|

|

Verizon Communications Inc.

|

|

|

|

|

Title of Securities:

|

|

3.600% Notes due 2060 (the “Notes”)

|

|

|

|

|

Issue Currency:

|

|

USD

|

|

|

|

|

Pricing Date:

|

|

February 6, 2020

|

|

|

|

|

Settlement Date (T+11):

|

|

February 24, 2020

|

|

|

|

|

Maturity Date:

|

|

February 24, 2060

|

|

|

|

|

Interest Payment Dates:

|

|

Semiannually on each February 24 and August 24, commencing on August 24, 2020.

|

|

|

|

|

Aggregate Principal Amount Offered:

|

|

$2,385,000,000

|

|

|

|

|

Public Offering Price:

|

|

100.00% plus accrued interest, if any, from February 24, 2020

|

|

|

|

|

Underwriting Commission:

|

|

0.10%

|

|

|

|

|

Proceeds to Verizon (before expenses):

|

|

99.90%

|

|

|

|

|

Interest Rate:

|

|

3.600% per annum

|

|

|

|

|

Denominations:

|

|

Minimum of $100,000 and integral multiples of $1,000 in excess thereof

|

|

|

|

|

Optional Redemption:

|

|

Not redeemable prior to February 24, 2025. On each February 24 on or after February 24, 2025 (each a “Redemption Date”), the Notes will be redeemable on not less than 10 nor more than 60 days’

notice, in whole but not in part, at the option of the Company, at 100% of the principal amount of the Notes being redeemed plus accrued and unpaid interest on the principal amount of notes being redeemed to, but excluding, the date of redemption.

In addition, on the first Redemption Date with respect to which the

|

|

|

|

|

|

|

|

Company exercises its option to redeem Notes, the Company also has the option to instead only redeem 50% of the aggregate principal amount of the Notes then outstanding at the redemption price described above. If the Company

exercises its option to redeem 50% of the aggregate principal amount of the Notes then outstanding on a Redemption Date, any remaining Notes can be redeemed at the Company’s option on a future Redemption Date in whole but not in part.

|

|

|

|

|

Listing:

|

|

Application will be made to list the Notes on the Taipei Exchange (the “TPEx”). No assurance can be given that such application will be approved or that the TPEx listing will be maintained.

|

|

|

|

|

Selling Restrictions:

|

|

The Notes have not been, and shall not be, offered, sold or re-sold, directly or indirectly, to investors other than “professional institutional investors” as defined under

Paragraph 2, Article 4 of the Financial Consumer Protection Act of the Republic of China (“ROC”), which currently include: (i) overseas or domestic banks, securities firms, futures firms and insurance companies

(excluding insurance agencies, insurance brokers and insurance surveyors), the foregoing as further defined in more detail in Paragraph 3 of Article 2 of the Organization Act of the Financial Supervisory Commission of the ROC, (ii) overseas or

domestic fund management companies, government investment institutions, government funds, pension funds, mutual funds, unit trusts, and funds managed by financial service enterprises pursuant to the ROC Securities Investment Trust and Consulting

Act, the ROC Future Trading Act or the ROC Trust Enterprise Act or investment assets mandated and delivered by or transferred for trust by financial consumers, and (iii) other institutions recognized by the Financial Supervisory Commission of

the ROC. Purchasers of the Notes are not permitted to sell or otherwise dispose of the Notes except by transfer to a professional institutional investor. No PRIIPs key information document (“KID”) has been prepared as EEA retail investors

are not targeted.

|

|

|

|

|

ISIN:

|

|

XS2116430997

|

|

|

|

|

|

|

|

|

|

Common Code:

|

|

|

211643099

|

|

|

|

|

|

|

|

Allocation:

|

|

|

Principal Amount of Notes

|

|

|

|

|

|

Deutsche Bank AG, Taipei Branch

|

|

|

$1,012,500,000

|

|

|

|

|

Morgan Stanley Taiwan Limited

|

|

|

$ 360,000,000

|

|

|

|

|

BNP Paribas, Taipei Branch

|

|

|

$1,012,500,000

|

|

|

|

|

|

|

|

|

|

|

|

|

Total

|

|

|

$2,385,000,000

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Joint Bookrunning Managers:

|

|

|

Deutsche Bank AG, Taipei Branch

|

|

|

|

|

Morgan Stanley Taiwan Limited

|

|

|

|

|

BNP Paribas, Taipei Branch

|

|

|

|

|

Global Structuring Agents:

|

|

|

Deutsche Bank AG, Taipei Branch

|

|

|

|

|

Morgan Stanley & Co. LLC

|

|

|

|

|

Junior Structuring Agents:

|

|

|

Banco Santander, S.A.

|

|

|

|

|

BNP Paribas, Taipei Branch

|

|

|

|

|

C.L. King & Associates, Inc.

|

|

|

|

|

ICBC Standard Bank Plc

|

|

|

|

|

Loop Capital Markets LLC

|

|

|

|

|

Mischler Financial Group, Inc.

|

|

|

|

|

Samuel A. Ramirez & Company, Inc.

|

|

|

|

|

Siebert Williams Shank & Co., LLC

|

|

|

|

|

|

Structuring Agents’ Fee:

|

|

|

$14,310,000

|

|

|

|

|

|

|

|

Reference Document:

|

|

|

Preliminary Prospectus Supplement, subject to completion, dated February 5, 2020;

Prospectus dated September 4, 2019.

|

The issuer has filed a registration statement (including a prospectus) with the U.S. Securities and Exchange Commission

(the “SEC”) for the offering to which this communication relates. Before you invest, you should read the prospectus in that registration statement and other documents the issuer has filed with the SEC for more complete information

about the issuer and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the issuer, any underwriter or any dealer participating in the offering will arrange to send you the

prospectus if you request it by contacting the issuer at:

Investor Relations

Verizon Communications Inc.

One Verizon

Way

Basking Ridge, New Jersey 07920

Telephone: (212) 395-1525

The TPEx is not responsible for the content of this Final Term Sheet and no representation is made by the

TPEx as to the accuracy or completeness of this Final Term Sheet. The TPEx expressly disclaims any and all liability for any losses arising from, or as a result of the reliance on, all or part of the contents of this Final Term Sheet. Admission to

the listing and trading of the Notes on the TPEx shall not be taken as an indication of the merits of Verizon or the Notes.

Under Rule 15c6-1 of the Securities Exchange Act of 1934, as amended, trades in the secondary market generally are required to settle in two business days, unless the parties to a trade expressly agree otherwise. Accordingly,

purchasers who wish to trade notes prior to the second business day before the settlement date will be required, by virtue of the fact that the notes initially will settle in T+11, to specify alternative settlement arrangements to prevent a failed

settlement.

Any disclaimers or other notices that may appear below are not applicable to this communication and should be disregarded. Such

disclaimers or other notices were automatically generated as a result of this communication being sent via Bloomberg or another email system.

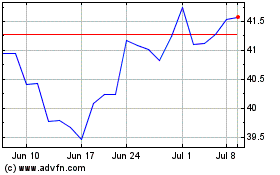

Verizon Communications (NYSE:VZ)

Historical Stock Chart

From Mar 2024 to Apr 2024

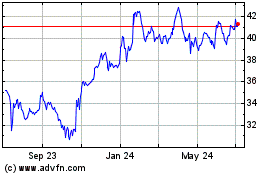

Verizon Communications (NYSE:VZ)

Historical Stock Chart

From Apr 2023 to Apr 2024