By Sahil Patel

The internet may be steadily transforming the TV business, but

there is one day a year when viewers and advertisers still act like

almost nothing has changed: Super Bowl Sunday.

Fox Corp. charged up to $5.6 million for 30 seconds of TV ad

time during this year's Super Bowl, and said it was sold out in

late November.

It sought $300,000 to $400,000 for streaming-only ads during the

game, which took slightly longer to sell out, according to people

familiar with the matter. For example, sneaker brand Saucony bought

its streaming-only Super Bowl ad in December.

Fox sold streaming-only ads that will appear on its own sites

and apps, using time slots that go to local ads during the

traditional TV broadcast.

The differences largely reflect how marketers expect audiences

to watch when the San Francisco 49ers face the Kansas City Chiefs

on Sunday.

In the past decade, Super Bowl viewership in the U.S. on

traditional TV has routinely surpassed 100 million viewers a

minute.

But the number of those who watched it on a free live stream in

the last two years was much lower, based on data released by recent

game broadcasters CBS Corp. and Comcast Corp.'s NBC. Last year's

Super Bowl averaged 2.6 million live streaming viewers a minute,

according to CBS.

That was an increase from more than 2 million streaming viewers

a minute in 2018, the figure reported by NBC at the time, but still

far below the traditional TV audience.

Fox has told advertisers that this year's game will attract

millions of live streamers, according to a person familiar with the

matter. It will be available free on a number of sites and apps

owned by the network, the National Football League and Verizon

Communications Inc. -- similar to the arrangement last year, when

the game was carried by CBS.

The rise of streaming has changed how TV viewers watch

programming such as scripted and unscripted shows, which they

increasingly consume on services such as Netflix Inc. But telecasts

of live sports have proven more resistant to change, largely

because of the games' immediate nature and teams' passionate

followings. Even as the National Basketball Association's TV

ratings have declined this season -- a development the league

blames in part on player injuries -- the NFL's ratings have grown.

Meanwhile, Netflix last year said that U.S. viewership on its

service dropped 32% during the Super Bowl, compared with a typical

Sunday.

Better focus

Saucony bought a streaming-only ad in the Super Bowl to promote

a new biodegradable shoe.

Saucony made the buy partly because of the growth in streaming

viewing, including among younger viewers, said Don Lane, chief

marketing officer of Saucony, which is owned by Wolverine World

Wide Inc.

Streaming video viewers tend to be more engaged with what is

playing on the screen than their linear TV counterparts, Mr. Lane

added, citing the experience of a previous streaming ad campaign

that Saucony ran in November and conversations the brand has had

with Fox.

"People who are tuning in through a streaming service are paying

more attention and less distracted than the broader audience," he

said. "We might be sacrificing reach by not being on the broadcast,

but I think where we gain is in getting impact."

But networks still sell Super Bowl ads primarily as one big

package, and every national TV ad during the Super Bowl on Fox will

also play in the live stream.

With the game's immense scale and high ad prices, broadcasters

don't feel pressure to split up inventory based on how people are

choosing to view the game, said Mark Zagorski, chief executive

officer of Telaria Inc., which sells internet-connected TV ads on

behalf of video publishers and recently agreed to merge with

Rubicon Project Inc., another ad tech company servicing

publishers.

"The big game is still the big game," Mr. Zagorski said.

That doesn't mean they want outsiders selling Super Bowl ads --

even in streaming viewing, where other companies would ordinarily

have opportunities to serve ads into programming.

Online TV services such as Hulu Live TV, YouTube TV, Sling TV

and FuboTV don't have any in-game Super Bowl ad inventory to sell,

people familiar with the matter said.

"It's pretty typical for the Super Bowl: The networks lock it

down pretty tightly," Mr. Zagorski said. "They don't want third

parties selling against it."

The exception is Verizon, which can sell Super Bowl ads within

its mobile live stream as a result of a multiyear rights and

sponsorship deal. Like Fox, its streaming-only Super Bowl ad

inventory replaces local Fox TV stations' ad time.

Verizon still has inventory available, people familiar with the

situation said.

One key difference between Fox's digital-only ads and Verizon's

digital ads is that Fox will serve the same ad to everyone

live-streaming the game on its websites and apps, while Verizon

plans to use its digital ad technology to serve different ads to

different viewers, which opens up more ad inventory for Verizon to

sell, people familiar with the situation said.

Fox Corp. and Wall Street Journal parent News Corp share common

ownership.

Perhaps unsurprisingly, the Super Bowl has provided a boost to

ad prices for streaming programming before and after the game --

similar to its impact on linear TV programming.

Streaming-only ads can cost between $200,000 to $300,000 during

the pregame window, according to a person familiar with the matter.

A linear TV buy within the same window could cost anywhere from 2

1/2 to 10 times more, this person said.

Write to Sahil Patel at sahil.patel@wsj.com

(END) Dow Jones Newswires

January 31, 2020 13:51 ET (18:51 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

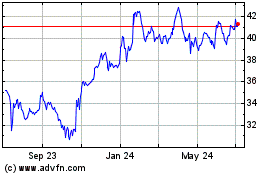

Verizon Communications (NYSE:VZ)

Historical Stock Chart

From Mar 2024 to Apr 2024

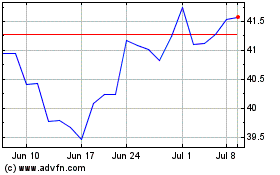

Verizon Communications (NYSE:VZ)

Historical Stock Chart

From Apr 2023 to Apr 2024