Initial Statement of Beneficial Ownership (3)

August 05 2020 - 5:46PM

Edgar (US Regulatory)

FORM 3

|

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

INITIAL STATEMENT OF BENEFICIAL OWNERSHIP OF SECURITIES

|

OMB APPROVAL

OMB Number:

3235-0104

Estimated average burden

hours per response...

0.5

|

|

Filed pursuant to Section 16(a) of the Securities Exchange Act of 1934 or Section 30(h) of the Investment Company Act of 1940

|

|

|

1. Name and Address of Reporting Person

*

Crestview Partners IV GP, L.P. |

2. Date of Event Requiring Statement (MM/DD/YYYY)

8/5/2020

|

3. Issuer Name and Ticker or Trading Symbol

VIAD CORP [VVI]

|

|

(Last)

(First)

(Middle)

C/O CRESTVIEW PARTNERS, 590 MADISON AVENUE, 42ND FLOOR |

4. Relationship of Reporting Person(s) to Issuer (Check all applicable)

__X__ Director ___X___ 10% Owner

_____ Officer (give title below) _____ Other (specify below)

|

|

(Street)

NEW YORK, NY 10022

(City)

(State)

(Zip)

| 5. If Amendment, Date Original Filed(MM/DD/YYYY)

| 6. Individual or Joint/Group Filing(Check Applicable Line)

___ Form filed by One Reporting Person

_X_ Form filed by More than One Reporting Person

|

Table I - Non-Derivative Securities Beneficially Owned

|

1.Title of Security

(Instr. 4) | 2. Amount of Securities Beneficially Owned

(Instr. 4) | 3. Ownership Form: Direct (D) or Indirect (I)

(Instr. 5) | 4. Nature of Indirect Beneficial Ownership

(Instr. 5) |

| Common Stock | 0 (1)(2) | I | See Footnotes (1)(3)(4)(5) |

Table II - Derivative Securities Beneficially Owned (e.g., puts, calls, warrants, options, convertible securities)

|

1. Title of Derivate Security

(Instr. 4) | 2. Date Exercisable and Expiration Date

(MM/DD/YYYY) | 3. Title and Amount of Securities Underlying Derivative Security

(Instr. 4) | 4. Conversion or Exercise Price of Derivative Security | 5. Ownership Form of Derivative Security: Direct (D) or Indirect (I)

(Instr. 5) | 6. Nature of Indirect Beneficial Ownership

(Instr. 5) |

| Date Exercisable | Expiration Date | Title | Amount or Number of Shares |

| 5.5% Series A Convertible Preferred Stock (1)(2) | (1)(2) | (1)(2) | Common Stock | (1)(2) | (1)(2) | I | See Footnotes (1)(3)(4)(5) |

| Explanation of Responses: |

| (1) | The Reporting Persons do not hold any shares of Common Stock of the Issuer, par value $1.50 per share ("Common Stock"). Crestview IV VC TE Holdings, LLC, Crestview IV VC Holdings L.P. and Crestview IV VC CI Holdings, L.P. (collectively, the "Crestview Funds") hold, in the aggregate, 135,000 shares of 5.5% Series A Convertible Preferred Stock of the Issuer, par value $0.01 per share ("Preferred Stock"). The shares of Preferred Stock held by the Reporting Persons are subject to the terms and conditions of the Certificate of Designations and the Investment Agreement between the Issuer and the Crestview Funds. |

| (2) | Subject to the terms of the Certificate of Designations and the Investment Agreement, the shares of Preferred Stock held by the Crestview Funds are convertible at any time by the Crestview Funds at an initial conversion price equal to $21.25 per share, which such conversion price is subject to (i) customary anti-dilution adjustments (including in the event of any stock split, stock dividend, recapitalization or similar events) and (ii) adjustment for certain dilutive issuances of Common Stock at a price below the then-current market price and repurchases of Common Stock at a price above the then-current market price. |

| (3) | Crestview Partners IV GP, L.P. may be deemed to have beneficial ownership of the shares of Preferred Stock held by the Crestview Funds. Crestview Partners IV GP, L.P. exercises voting and dispositive power over the shares of Preferred Stock (and, following conversion thereof, the underlying shares of Common Stock) held by the Crestview Funds, which decisions are made by the investment committee of Crestview Partners IV GP, L.P. and the chairman of such investment committee. |

| (4) | Brian P. Cassidy is a member of the Issuer's board of directors, and is a Partner of Crestview, L.L.C. (which is the general partner of Crestview Partners IV GP, L.P.) and Crestview Advisors, L.L.C. (which provides investment advisory and management services to investment funds owning interests in the Crestview Funds). |

| (5) | Each Reporting Person disclaims beneficial ownership of the reported securities except to the extent of its pecuniary interest therein. |

Remarks:

Exhibit 24 - Power of Attorney Exhibit 99 - Joint Filer Statement |

Reporting Owners

|

| Reporting Owner Name / Address | Relationships |

| Director | 10% Owner | Officer | Other |

Crestview Partners IV GP, L.P.

C/O CRESTVIEW PARTNERS

590 MADISON AVENUE, 42ND FLOOR

NEW YORK, NY 10022 | X | X |

|

|

Crestview IV VC TE Holdings, LLC

C/O CRESTVIEW PARTNERS

590 MADISON AVENUE, 42ND FLOOR

NEW YORK, NY 10022 | X | X |

|

|

Crestview IV VC Holdings, L.P.

C/O CRESTVIEW PARTNERS

590 MADISON AVENUE, 42ND FLOOR

NEW YORK, NY 10022 | X | X |

|

|

Crestview IV VC CI Holdings, L.P.

C/O CRESTVIEW PARTNERS

590 MADISON AVENUE, 42ND FLOOR

NEW YORK, NY 10022 | X | X |

|

|

Crestview Advisors, L.L.C.

C/O CRESTVIEW PARTNERS

590 MADISON AVENUE, 42ND FLOOR

NEW YORK, NY 10022 | X | X |

|

|

Cassidy Brian P

C/O CRESTVIEW PARTNERS

590 MADISON AVENUE, 42ND FLOOR

NEW YORK, NY 10022 | X |

|

|

|

Signatures

|

| By: Crestview, L.L.C., the general partner of the Designated Filer, By: /s/ Ross A. Oliver, General Counsel | | 8/5/2020 |

| **Signature of Reporting Person | Date |

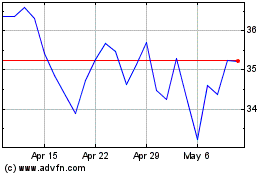

Viad (NYSE:VVI)

Historical Stock Chart

From Mar 2024 to Apr 2024

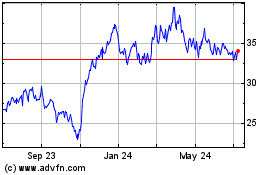

Viad (NYSE:VVI)

Historical Stock Chart

From Apr 2023 to Apr 2024