UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-A

FOR REGISTRATION OF CERTAIN CLASSES OF SECURITIES

PURSUANT TO SECTION 12(b) OR 12(g) OF THE

SECURITIES EXCHANGE ACT OF 1934

Viad Corp

(Exact name of registrant as specified in its charter)

|

Delaware

|

|

36-1169950

|

|

(State or other jurisdiction

of incorporation or organization)

|

|

(IRS Employer

Identification No.)

|

|

|

|

|

|

1850 North Central Avenue, Suite 1900,

Phoenix, Arizona

|

|

85004-4565

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

Securities to be registered pursuant to Section 12(b) of the Act:

|

Title of each class to be so registered

|

|

Name of each exchange on which each class is to be registered

|

|

Preferred Stock Purchase Rights

|

|

New York Stock Exchange

|

|

If this form relates to the registration of a class of securities pursuant to Section 12(b) of the Exchange Act and is effective pursuant to General Instruction A.(c) or (e), check the following box. ☒

|

|

If this form relates to the registration of a class of securities pursuant to Section 12(g) of the Exchange Act and is effective pursuant to General Instruction A.(d) or (e), check the following box. ☐

|

|

If this form relates to the registration of a class of securities concurrently with a Regulation A offering, check the following box. ☐

|

|

Securities Act registration statement or Regulation A offering statement file number to which this form relates: Not applicable (If applicable)

|

Securities to be registered pursuant to Section 12(b) of the Act:

Item 1. Description of Registrant’s Securities to be Registered

On March 30, 2020, Viad Corp (the “Company”) entered into a Rights Agreement between the Company and Equiniti Trust Company, as Rights Agent (as amended from time to time, the “Rights Agreement”) that was previously approved by the Board of Directors of the Company.

In connection with the Rights Agreement, a dividend was declared of one preferred stock purchase right (individually, a “Right” and collectively, the “Rights”) for each share of common stock, par value $1.50 per share (the “Common Stock”), of the Company outstanding at the close of business on April 13, 2020 (the “Record Date”). Each Right will entitle the registered holder thereof, after the Rights become exercisable and until February 28, 2021 (or the earlier redemption, exchange or termination of the Rights), to purchase from the Company one one-hundredth of a share of Junior Participating Preferred Stock, par value $0.01 per share (the “Junior Preferred”), of the Company at a price of $115.00 per one one-hundredth of a share of Junior Preferred (the “Purchase Price”). Until the earlier to occur of (i) the close of business on the tenth business day following a public announcement that a person or group of affiliated or associated persons has acquired, or obtained the right to acquire, beneficial ownership of 10% (20% in the case of a passive institutional investor) or more of the Common Stock (an “Acquiring Person”) or (ii) the close of business on the tenth business day (or such later date as may be determined by action of the Board of Directors prior to such time as any person or group of affiliated or associated persons becomes an Acquiring Person) following the commencement or announcement of an intention to make a tender offer or exchange offer the consummation of which would result in a person or group becoming an Acquiring Person (the earlier of (i) and (ii) being called the “Distribution Date”), the Rights will be evidenced, with respect to any of the Common Stock certificates outstanding as of the Record Date, by such Common Stock certificates, or, with respect to any uncertificated Common Stock registered in book entry form, by notation in book entry, in either case together with a copy of the Summary of Rights attached as Exhibit B to the Rights Agreement. Under the Rights Agreement, synthetic ownership of Common Stock in the form of derivative securities counts towards the ownership threshold, to the extent actual shares of Common Stock equivalent to the economic exposure created by the derivative security are directly or indirectly beneficially owned by a counterparty to such derivative security.

The Rights Agreement provides that any person who beneficially owned 10% (20% in the case of a passive institutional investor) or more of the Common Stock immediately prior to the first public announcement of the adoption of the Rights Agreement, together with any affiliates and associates of that person (each an “Existing Holder”), shall not be deemed to be an “Acquiring Person” for purposes of the Rights Agreement unless an Existing Holder becomes the beneficial owner of one or more additional shares of Common Stock (other than pursuant to a dividend or distribution paid or made by the Company on the outstanding Common Stock in Common Stock or pursuant to a split or subdivision of the outstanding Common Stock) and upon acquiring such additional shares, the Existing Holder beneficially owns 10% or more (20% or more in the case of a passive institutional investor) of the Common Stock then outstanding.

The Rights will be transferred only with the Common Stock until the Distribution Date (or earlier redemption, exchange, termination or expiration of the Rights). As soon as practicable following the Distribution Date, separate certificates evidencing the Rights (“Right Certificates”) will be mailed to holders of record of the Common Stock as of the close of business on the Distribution Date and such separate Right Certificates alone will evidence the Rights.

The Rights are not exercisable until the Distribution Date. The Rights will expire on February 28, 2021, subject to the Company’s right to extend such date, unless earlier redeemed or exchanged by the Company or terminated. The Rights will at no time have any voting rights.

Each share of Junior Preferred purchasable upon exercise of the Rights will be entitled, when, as and if declared, to a minimum preferential quarterly dividend payment of $1.00 per share or, if greater, an aggregate dividend of 100 times the dividend, if any, declared per share of Common Stock. In the event of liquidation, dissolution or winding up of the Company, the holders of the Junior Preferred will be entitled to a minimum preferential liquidation payment of $100 per share (plus any accrued but unpaid dividends), provided that such holders of the Junior Preferred will be entitled to an aggregate payment of 100 times the payment made per share of Common Stock. Each share of Junior Preferred will have 100 votes and will vote together with the Common Stock. Finally, in the event of any merger, consolidation or other transaction in which shares of the Common Stock are exchanged, each share of Junior Preferred will be entitled to receive 100 times the amount received per share of Common Stock. The Junior Preferred will not be redeemable. The Rights are protected by customary anti-dilution provisions. Because of the nature of the Junior Preferred’s dividend and liquidation rights, the value of one one-hundredth of a share of Junior Preferred purchasable upon exercise of each Right should approximate the value of one share of Common Stock.

The Purchase Price payable, and the number of one one-hundredths of a share of Junior Preferred or other securities or property issuable, upon exercise of the Rights are subject to adjustment from time to time to prevent dilution (i) in the event of a stock dividend on, or a subdivision, combination or reclassification of, the Junior Preferred, (ii) upon the grant to holders of the Junior Preferred of certain rights or warrants to subscribe for or purchase Junior Preferred or convertible securities at less than the current market price of the Junior Preferred or (iii) upon the distribution to holders of the Junior Preferred of evidences of indebtedness, cash,

1

securities or assets (excluding regular periodic cash dividends at a rate not in excess of 125% of the rate of the last regular periodic cash dividend theretofore paid or, in case regular periodic cash dividends have not theretofore been paid, at a rate not in excess of 50% of the average net income per share of the Company for the four quarters ended immediately prior to the payment of such dividend, or dividends payable in shares of Junior Preferred (which dividends will be subject to the adjustment described in clause (i) above)) or of subscription rights or warrants (other than those referred to above).

In the event that a person becomes an Acquiring Person or if the Company were the surviving corporation in a merger with an Acquiring Person or any affiliate or associate of an Acquiring Person and shares of the Common Stock were not changed or exchanged in such merger, each holder of a Right, other than Rights that are or were acquired or beneficially owned by the Acquiring Person (which Rights will thereafter be void), will thereafter have the right to receive upon exercise that number of shares of Common Stock having a market value of two times the then current Purchase Price of one Right. In the event that, after a person has become an Acquiring Person, the Company were acquired in a merger or other business combination transaction or more than 50% of its assets or earning power were sold, proper provision shall be made so that each holder of a Right shall thereafter have the right to receive, upon the exercise thereof at the then current Purchase Price of the Right, that number of shares of common stock of the acquiring company which at the time of such transaction would have a market value of two times the then current Purchase Price of one Right.

At any time after a person becomes an Acquiring Person and prior to the earlier of one of the events described in the last sentence of the previous paragraph or the acquisition by such Acquiring Person of 50% or more of the then outstanding Common Stock, the Board of Directors may cause the Company to exchange the Rights (other than Rights owned by an Acquiring Person which have become void), in whole or in part, for shares of Common Stock at an exchange rate of one share of Common Stock per Right (subject to adjustment).

The Rights may be redeemed in whole, but not in part, at a price of $0.01 per Right (the “Redemption Price”) by the Board of Directors at any time prior to the time that an Acquiring Person has become such. The redemption of the Rights may be made effective at such time, on such basis and with such conditions as the Board of Directors in its sole discretion may establish. Immediately upon any redemption of the Rights, the right to exercise the Rights will terminate and the only right of the holders of Rights will be to receive the Redemption Price.

Until a Right is exercised, the holder thereof, as such, will have no rights as a shareholder of the Company beyond those as an existing shareholder, including, without limitation, the right to vote or to receive dividends.

Any of the provisions of the Rights Agreement may be amended by the Board of Directors of the Company, or a duly authorized committee thereof, for so long as the Rights are then redeemable, and after the Rights are no longer redeemable, the Company may amend or supplement the Rights Agreement in any manner that does not adversely affect the interests of the holders of the Rights (other than an Acquiring Person or any affiliate or associate of an Acquiring Person).

One Right will be distributed to shareholders of the Company for each share of Common Stock owned of record by them on April 13, 2020. As long as the Rights are attached to the Common Stock, the Company will issue one Right with each new share of Common Stock so that all such shares will have attached Rights. The Company has agreed that, from and after the Distribution Date, the Company will reserve and keep available out of its authorized and unissued Junior Preferred the number of shares of Junior Preferred that will be sufficient to permit the exercise in full of all outstanding Rights.

The Rights are designed to assure that all of the Company’s shareholders receive fair and equal treatment in the event of any proposed takeover of the Company and to guard against partial tender offers, open market accumulations and other abusive or coercive tactics to gain control of the Company without paying all shareholders a control premium. The Rights will cause substantial dilution to a person or group that acquires 10% or more (20% or more in the case of a passive institutional investor) of the Common Stock on terms not approved by the Company’s Board of Directors. The Rights should not interfere with any merger or other business combination approved by the Board of Directors at any time prior to the first date that a person or group has become an Acquiring Person.

The Rights Agreement specifying the terms of the Rights and the text of the press release announcing the declaration of the Rights are incorporated herein by reference as exhibits to this registration statement. The foregoing summary of the Rights Agreement is qualified in its entirety by reference to such exhibits.

2

Item 2. Exhibits

|

|

1.

|

Rights Agreement, dated as of March 30, 2020, between Viad Corp and Equiniti Trust Company, which includes the Form of Right Certificate as Exhibit A and the Summary of Rights to Purchase Preferred Stock as Exhibit B (incorporated by reference to Exhibit 4.1 of the Current Report on Form 8‑K dated March 30, 2020 of Viad Corp).

|

|

|

2.

|

Press Release of Viad Corp, dated March 30, 2020 (incorporated by reference to Exhibit 99.1 of the Current Report on Form 8-K dated March 30, 2020 of Viad Corp).

|

3

SIGNATURES

Pursuant to the requirements of Section 12 of the Securities Exchange Act of 1934, the registrant has duly caused this registration statement to be signed on its behalf by the undersigned, thereto duly authorized.

|

|

|

Viad Corp

|

|

|

|

(Registrant)

|

|

|

|

|

|

|

March 30, 2020

|

|

By:

|

/s/ Steven W. Moster

|

|

|

|

Name:

|

Steven W. Moster

|

|

|

|

Title:

|

President and Chief Executive Officer

|

4

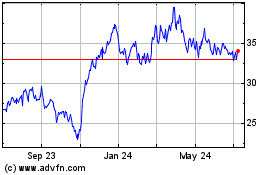

Viad (NYSE:VVI)

Historical Stock Chart

From Mar 2024 to Apr 2024

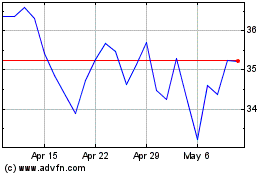

Viad (NYSE:VVI)

Historical Stock Chart

From Apr 2023 to Apr 2024