Current Report Filing (8-k)

March 26 2020 - 6:02AM

Edgar (US Regulatory)

false

0000884219

0000884219

2020-03-23

2020-03-23

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): March 23, 2020

Viad Corp

(Exact name of registrant as specified in its charter)

|

Delaware

|

001-11015

|

36-1169950

|

|

(State or other jurisdiction

of incorporation)

|

(Commission File Number)

|

(IRS Employer

Identification No.)

|

|

|

|

|

|

1850 North Central Avenue, Suite 1900,

Phoenix, Arizona

|

|

85004-4565

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

Registrant’s telephone number, including area code: (602) 207-1000

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

|

Trading

Symbol(s)

|

|

Name of each exchange on which registered

|

|

Common Stock, $1.50 Par Value

|

|

VVI

|

|

New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02. Departure of Directors or Principal Officers; Election of Directors; Appointment of Principal Officers; Compensatory Arrangements of Certain Officers.

Changes to Executive Compensation Program

On March 23, 2020, we announced that due to current industry-wide conditions, including the uncertainty created by the effects of the novel coronavirus (COVID-19), our executive management team has reduced its base salaries. President and Chief Executive Officer, Steve W. Moster, and President of Pursuit, David W. Barry, have each voluntarily reduced their base salary by 50%, our Chief Financial Officer, Ellen M. Ingersoll, has agreed to voluntarily reduce her base salary by 30%, and President of GES, Jay A. Altizer, General Counsel and Corporate Secretary, Derek P. Linde, Chief Human Resources Officer, Trisha L. Fox, Chief Information Officer, Richard A. Britton, and Chief Accounting Officer, Leslie S. Striedel, have each voluntarily reduced their base salary by 20%. Each of these salary reductions are expected to be in effect for 90 days.

In addition, each non-employee member of our Board of Directors has agreed to reduce their annual cash retainer and Committee retainers by 50% for payments otherwise typically made to them in the second quarter of 2020. These cash amounts are paid quarterly in arrears.

Item 7.01. Regulation FD Disclosure.

On March 23, 2020, we also announced that as part of our proactive measures to mitigate the negative financial and operational impacts of COVID-19 as travel restrictions and social distancing efforts become more widespread, we are implementing aggressive cost reduction actions, including furloughs, mandatory unpaid time off, and salary reductions for all other employees across the enterprise for up to 90 days with those actions beginning on March 25, 2020. Furloughed employees will continue to receive health care benefits during this period. We intend to continue to evaluate and implement additional cost-cutting measures as is necessary to mitigate the negative financial and operational impact of COVID-19. The information in this Item 7.01 of this report will not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section and it will not be incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such a filing.

FORWARD-LOOKING STATEMENTS

This current report on Form 8-K contains a number of forward-looking statements. Words, and variations of words, such as “will,” “may,” “expect,” “would,” “could,” “might,” “intend,” “plan,” “believe,” “estimate,” “anticipate,” “deliver,” “seek,” “aim,” “potential,” “target,” “outlook,” and similar expressions are intended to identify our forward-looking statements. Similarly, statements that describe our business strategy, outlook, objectives, plans, intentions or goals also are forward-looking statements. These forward-looking statements are not historical facts and are subject to a host of risks and uncertainties, many of which are beyond our control and could cause actual results to differ materially from those in the forward-looking statements.

Important factors that could cause actual results to differ materially from those described in our forward-looking statements include, but are not limited to the following:

|

|

•

|

the effects on our business of the COVID-19 pandemic;

|

|

|

•

|

the impact of the pandemic and actions taken in response to the pandemic on global and regional economies, travel and economic activity;

|

|

|

•

|

the pace of recovery when the COVID-19 pandemic subsides;

|

|

|

•

|

general economic uncertainty in key global markets and a worsening of global economic conditions;

|

|

|

•

|

our ability to successfully integrate and achieve established financial and strategic goals from acquisitions;

|

|

|

•

|

our dependence on large exhibition event clients;

|

|

|

•

|

the importance of key members of our account teams to our business relationships;

|

|

|

•

|

the competitive nature of the industries in which we operate;

|

|

|

•

|

travel industry disruptions;

|

|

|

•

|

unanticipated delays and cost overruns of our capital projects, and our ability to achieve established financial and strategic goals for such projects;

|

|

|

•

|

seasonality of our businesses;

|

|

|

•

|

transportation disruptions and increases in transportation costs;

|

|

|

•

|

natural disasters, weather conditions, and other catastrophic events;

|

|

|

•

|

our multi-employer pension plan funding obligations;

|

1

|

|

•

|

our exposure to labor cost increases and work stoppages related to unionized employees;

|

|

|

•

|

liabilities relating to prior and discontinued operations;

|

|

|

•

|

adverse effects of show rotation on our periodic results and operating margins;

|

|

|

•

|

our exposure to currency exchange rate fluctuations;

|

|

|

•

|

our exposure to cybersecurity attacks and threats;

|

|

|

•

|

compliance with laws governing the storage, collection, handling, and transfer of personal data and our exposure to legal claims and fines for data breaches or improper handling of such data;

|

|

|

•

|

the effects of the United Kingdom’s exit from the European Union; and

|

|

|

•

|

changes affecting the London Inter-bank Offered Rate.

|

For a more complete discussion of the risks and uncertainties that may affect our business or financial results, refer to “Risk Factors” in Part 1, Item 1A of our Annual Report on Form 10-K for the year ended December 31, 2019. We disclaim and do not undertake any obligation to update or revise any forward-looking statement in this current report on Form 8-K except as required by applicable law or regulation.

|

Exhibit

Number

|

|

Description

|

|

|

|

|

|

104

|

|

Cover Page Interactive Data File (embedded within the Inline XBRL document)

|

|

|

|

|

|

|

|

|

2

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

|

|

Viad Corp

|

|

|

|

(Registrant)

|

|

|

|

|

|

|

March 25, 2020

|

|

By:

|

/s/ Leslie S. Striedel

|

|

|

|

|

Leslie S. Striedel

|

|

|

|

|

Chief Accounting Officer

|

3

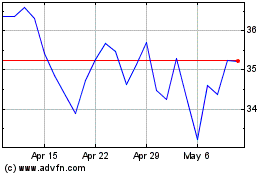

Viad (NYSE:VVI)

Historical Stock Chart

From Mar 2024 to Apr 2024

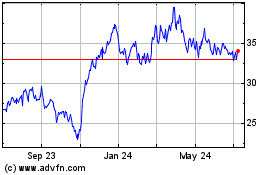

Viad (NYSE:VVI)

Historical Stock Chart

From Apr 2023 to Apr 2024