Visa Profit Falls on Lower Payments Volume -- Update

July 28 2020 - 6:26PM

Dow Jones News

By Orla McCaffrey

A drop in payments activity pushed Visa Inc. earnings down 23%

in the quarter that ended in June.

The largest U.S. card network said payments volume fell 10% from

the year-earlier period.

Credit-card payments volume dropped 20%. Debit-card payments

volume rose 3%.

"All of the business drivers were significantly impacted by the

pandemic, " Visa Chief Executive Alfred Kelly said on a call with

analysts Tuesday afternoon.

The company declined to provide an earnings outlook for the

remainder of the fiscal year, citing "significant uncertainty in

the global economy" caused by the coronavirus pandemic.

Still, Visa said U.S. payments activity "meaningfully improved"

each month of the quarter, and spending picked up globally

throughout the quarter.

Suppressed travel activity helped push cross-border

transactions, excluding those within Europe, down 47% in the

quarter, Mr. Kelly said.

Net income fell to $2.4 billion from $3.1 billion. Revenue

dropped 17% from the year-earlier period to $4.8 billion, matching

analysts' estimates.

Visa's shares closed Tuesday down slightly at $196.74, just

before the company reported. The shares fell sharply in after-hours

trading.

Last week, Democratic Sen. Richard Durbin asked the Federal

Reserve to probe allegedly anticompetitive practices forcing

merchants to pay excessive debit-card fees levied by large networks

like Visa and Mastercard Inc. The Electronic Payments Coalition,

which represents card networks and issuers, said at the time that

merchants do have options when they route transactions.

Mastercard is set to report earnings on Thursday.

Write to Orla McCaffrey at orla.mccaffrey@wsj.com

(END) Dow Jones Newswires

July 28, 2020 18:11 ET (22:11 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

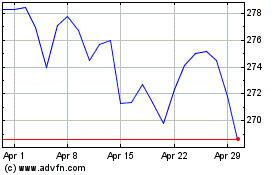

Visa (NYSE:V)

Historical Stock Chart

From Mar 2024 to Apr 2024

Visa (NYSE:V)

Historical Stock Chart

From Apr 2023 to Apr 2024