By AnnaMaria Andriotis, Paul J. Davies and Juliet Chung

Collapsed payments processor Wirecard AG miscoded gambling

transactions and had high levels of stolen card purchases and

reversed transactions, leading to hefty fines from card networks

Visa Inc. and Mastercard Inc., according to people familiar with

the matter.

Visa and Mastercard each imposed fines exceeding $10 million

more than a decade ago, and the networks remained wary of

Wirecard's business. Since at least 2015, Visa executives were

concerned that Wirecard was a problem, according to some of the

people familiar with the matter.

Visa asked Wirecard to cut off certain merchants and said too

much of its business originated from risky areas such as gambling,

pornography and unregulated health-care products known as

nutraceuticals, those people said. Some of Wirecard's clients

changed names to avoid being identified as problem merchants.

Such high-risk clients were highly lucrative to Wirecard.

Pornjapan, a pornography purveyor, paid 10% fees for transactions

handled by Wirecard in 2017, according to internal Wirecard

documents viewed by The Wall Street Journal. Mainstream merchants

tend to pay 2% to 3% for U.S. credit-card purchases.

A Visa spokesperson declined to comment. A Wirecard spokesman

declined to comment.

A Mastercard spokesman said it actively monitors its network for

violations of law and noncompliance with its rules. "Where we see

areas of potential concern, we thoroughly investigate and work with

our customers to remediate any issues we identify. This may include

corrective action, fines or the suspension or termination of a

license under certain circumstances."

Wirecard, which crumbled into bankruptcy last month when it

admitted a $2 billion hole in its accounts, processed payments on

behalf of shops and online merchants. Like other processors, it

acted as a feeder of card transaction data into Visa's and

Mastercard's vast networks, which connect to banks and handle

hundreds of millions of transactions a day.

German prosecutors are investigating whether Wirecard executives

used access to the financial system to launder money dating back as

far as 2010. It has also charged executives for taking part in a

multiyear fraud going back to at least 2015. Wirecard is also under

scrutiny in the U.S. by federal prosecutors in connection with an

alleged bank-fraud conspiracy that might have relied on Wirecard as

a transaction processor and offshore merchant bank.

Visa and Mastercard watch over companies such as Wirecard that

help bring payments into their networks. While the Federal Trade

Commission has taken a more active role identifying card fraud --

and recently brought a string of cases accusing individuals and

companies of processing unsavory purchases -- the industry relies

in part on self regulation, especially outside the U.S.

The networks have powers to fine payment processors like

Wirecard. Fines, which generally aren't made public, can be imposed

for reasons including too many disputed transactions, or for

disguising the true nature of transactions. Banks and card

processors can also directly terminate relationships with

merchants.

Payments processors like Wirecard are supposed to play a

front-line role in detecting and reducing fraud by merchants,

according to Scott Talbott, vice president of government affairs at

the Electronic Transactions Association, an industry body.

"Processors can go rogue and engage in fraudulent activity --

either through willful blindness or by aiding and abetting fraud,"

he said. "The card networks are a strong link in the chain to

defend against that."

As investigators piece together the nature of Wirecard's

activities, one focus is on its practice of managing payments for

merchants other companies would avoid. Wirecard's business leaned

on servicing pornography, gambling and nutraceuticals, according to

former employees and the people familiar with the matter.

Wirecard could charge higher fees to handle these types of

payments, which are seen as riskier because customers often dispute

the charges. Sellers of goods and services pay a merchant discount

rate when they accept card payments, which include network and

processor fees as well as interchange fees paid to the card

issuer.

In the first quarter of 2017, internal Wirecard documents seen

by the Journal show merchant discount rates averaged more than 7%

for transactions done through one of Wirecard's key business

partners. Pornjapan, the pornography merchant, paid a discount rate

of 10%. Wirecard used partners to process payments in countries

where it didn't have licenses.

Card payments are accompanied by a merchant category code, which

describes the type of merchant where a consumer is shopping and

occasionally describes specific goods or services.

In 2008, Mastercard fined Wirecard GBP11 million for processing

gambling transactions under the wrong codes, according to a person

familiar with the fine. In 2010, Mastercard wrote to Wirecard's

banking unit about fresh concerns that it was rerouting through

miscoded merchants gambling transactions that banks had previously

declined. Banks would then approve these payments thinking they

weren't gambling related, according to a letter from Mastercard to

Wirecard seen by the Journal.

During several periods over the past dozen years, both Visa and

Mastercard executives have been concerned about a high number of

Wirecard transactions being disputed by cardholders, referred to as

chargebacks. These transactions often involved cards being used

fraudulently on Wirecard clients' websites, according to the people

familiar with the matter.

In 2009, Visa fined Wirecard's banking unit $12 million for high

chargebacks that occurred in October and November 2009, according

to documents publicly disclosed in an FTC suit not directly related

to Wirecard. Wirecard's total revenue for the fourth quarter of

2009, in comparison, was about $79 million.

Visa currently considers chargebacks to be high when they exceed

about 1% of purchases made at a merchant.

In October 2009, some of Wirecard's clients had chargeback rates

ranging from 2% to 15% including merchants in the nutraceutical

sector, according to documents filed in the FTC suit. Chargebacks

were even higher in November among the worst-offending merchants.

Several were well above 100%, suggesting that disputes were higher

than transactions that month. Wirecard didn't appeal the fines,

according to the documents.

Write to AnnaMaria Andriotis at annamaria.andriotis@wsj.com,

Paul J. Davies at paul.davies@wsj.com and Juliet Chung at

juliet.chung@wsj.com

(END) Dow Jones Newswires

July 27, 2020 14:49 ET (18:49 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

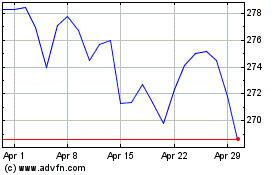

Visa (NYSE:V)

Historical Stock Chart

From Mar 2024 to Apr 2024

Visa (NYSE:V)

Historical Stock Chart

From Apr 2023 to Apr 2024