Transactions At Visa Hit Record of $3 Trillion -- WSJ

January 31 2020 - 3:02AM

Dow Jones News

By Maria Armental

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (January 31, 2020).

Visa Inc. reported record quarterly profit and processed more

than $3 trillion in transactions, a record for the quarter, driving

a 10% revenue growth.

Still, revenue and net income fell slightly short of Wall Street

projections, according to FactSet, even as per-share profit matched

expectations.

Shares, which have been trading near record levels, closed

Thursday at $208.21 and fell 3% to $201.61 in after-hours

trading.

Overall, Visa's first-quarter profit rose 10% to $3.27 billion,

or $1.46 a Class A share, the company said Thursday. Net revenue

rose 10% to $6.05 billion.

Analysts expected $1.46 a share on $6.08 billion.

Higher spending has helped credit-card companies post record

results. Mastercard Inc. and American Express Co. this month also

reported quarterly results that beat analysts' projections, though

Discover Financial Services' revenue results for the most recent

quarter fell slightly shy of targets.

The company's board approved an additional $9.5 billion to buy

back stock, adding to the roughly $1.7 billion left as of Dec. 31

from a previous authorization, Visa said.

Payments volume, adjusted for foreign-currency fluctuations,

rose 8%. Meanwhile, volume from cross-border transactions, which

typically carry larger fees, rose 9%.

The San Francisco-based company paid $1.75 billion during the

quarter in client incentives, or long-term contracts with

merchants, clients and other partners to expand its network and

payment volume.

This year Visa projects incentives to eat away about 22.5% to

23.5% of gross revenue.

Visa is the largest U.S. card network, and its clients have

largely included banks that issue credit and debit cards. This

month, it made a big bet on digital payments with a roughly $5.3

billion deal to buy Plaid Inc., which connects apps like

mobile-payment services Venmo and robo adviser Betterment to users'

bank accounts.

"We see it as a natural extension of our network of networks,"

Chief Executive Al Kelly said Tuesday at the annual shareholders'

meeting.

The company still expects per-share profit for the year to

increase by a midteen percentage and revenue to increase by a low

double-digit percentage. The Plaid acquisition isn't factored into

the guidance, the company said.

Company officials said it was too early to estimate the impact

from a deadly virus outbreak in China. The World Health

Organization on Thursday declared the outbreak a public health

emergency of international concern, which recognizes that

international public-health authorities consider the respiratory

virus a significant threat beyond China and seeks to gain political

and financial support to stop it.

Write to Maria Armental at maria.armental@wsj.com

(END) Dow Jones Newswires

January 31, 2020 02:47 ET (07:47 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

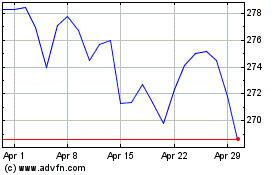

Visa (NYSE:V)

Historical Stock Chart

From Mar 2024 to Apr 2024

Visa (NYSE:V)

Historical Stock Chart

From Apr 2023 to Apr 2024