UnitedHealth 1Q Revenue, Profit Grow as Membership Expands -- 2nd Update

April 15 2021 - 12:25PM

Dow Jones News

By Anna Wilde Mathews and Matt Grossman

UnitedHealth Group Inc. recorded a first-quarter profit that

beat Wall Street's expectations and raised its projection on

results for the full year, as membership grew in its insurance

business and costs for Covid-19 care declined.

The Minnetonka, Minn.-based company, parent of insurer

UnitedHealthcare and the Optum health-services business, said its

earnings for the first three months of 2021 rose to $5.08 a share,

compared with $3.52 a share in 2020's first quarter.

In his first earnings presentation as chief executive, Andrew

Witty emphasized efforts to tie UnitedHealth's insurance business

to Optum's huge and growing footprint in direct patient care, which

includes an expanding network of physician groups and clinics. Mr.

Witty highlighted a California clinic and community center that

offers services ranging from pharmacy and labs to a gym, and said

the company has "been opening a wide number of different types of

clinics depending on the environment or the locality."

Mr. Witty also pointed to expanding use of the payment method

called capitation, which generally involves insurers paying

healthcare providers set amounts to care for patients, rather than

fees for each service they provide.

The company said it now has around 56,000 doctors employed,

contracted or affiliated with Optum.

With overall unemployment still higher than pre-pandemic levels,

and people expected to catch up on medical care they had delayed

earlier in the pandemic, UnitedHealth said it expected the

public-health crisis to weigh on its results. The company forecast

the pandemic will cause a net reduction in its full-year adjusted

profit of approximately $1.80 a share.

Still, UnitedHealth raised its full-year outlook, citing the

trend in its results from the first three months of 2021.

UnitedHealth said it now expects a full-year adjusted profit of

$18.10 to $18.60 a share. In January, the company had forecast a

full-year adjusted profit of $17.75 to $18.25 a share.

In the first quarter, the company said its adjusted profit was

$5.31 a share. Total revenue grew 9% to $70.2 billion, up from

$64.4 billion in the same three months a year earlier. Revenue from

premiums improved to $55.49 billion, from $50.64 billion a year

earlier.

Analysts surveyed by FactSet had forecast an adjusted profit of

$4.39 a share, on revenue of $69.07 billion.

Shares of UnitedHealth were up 4.2% in morning trading.

The company's first-quarter performance was largely powered by

UnitedHealthcare. In February and March, the insurer saw Covid-19

care at about half the level it saw in January, though it ticked up

slightly after the quarter ended. The company said the

first-quarter Covid-19 costs were still higher than it had

expected.

Non-Covid-19 healthcare use generally rose as expenses related

to the virus dropped off, and overall, medical costs were

"marginally below seasonal baseline," said John Rex, UnitedHealth's

chief financial officer. He said the company expected medical costs

will likely rise later in the year because "people are going to be

more able to access previously deferred care" that they delayed due

to the pandemic, and that they might need "higher acuity levels as

a result of missed or postponed treatments."

The insurer's first-quarter medical-loss ratio, or the share of

premiums spent on healthcare costs, was 80.9%, lower than Wall

Street analysts had generally projected.

In the latest quarter, the number of people served by

UnitedHealthcare's medical plans grew by more than one million to

49.5 million, driven by expansion of the number of people on its

Medicare Advantage plans.

A Medicaid contract award in Oklahoma, growth in specialty

products such as dental and vision plans, and a strong selling

season for commercial benefits also contributed to the insurance

division's first-quarter growth, UnitedHealth said.

Revenue from the company's Optum business grew by 10.8% to $36.4

billion. For the OptumHealth division, which served 99 million

people, revenue per customer grew by nearly a third, in part

because of the increasing acuity of the care provided.

Write to Anna Wilde Mathews at anna.mathews@wsj.com and Matt

Grossman at matt.grossman@wsj.com

(END) Dow Jones Newswires

April 15, 2021 12:10 ET (16:10 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

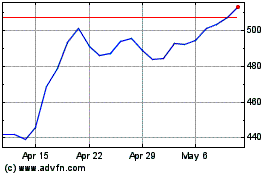

UnitedHealth (NYSE:UNH)

Historical Stock Chart

From Mar 2024 to Apr 2024

UnitedHealth (NYSE:UNH)

Historical Stock Chart

From Apr 2023 to Apr 2024