By Anna Wilde Mathews and Dave Sebastian

UnitedHealth Group Inc. said its insurance arm gained from

widespread cancellations of medical procedures but its surgery

centers were hurt by falling volumes, results that showed the

pandemic's emerging impact on the U.S. health-care system.

The company on Wednesday played down the effects of the new

coronavirus on its first-quarter performance, however, saying they

were minimal and emerged toward the end of March. The results beat

analysts' expectations. The company also said it wasn't adjusting

its guidance for the rest of 2020 and warned of significant

uncertainty.

The pandemic has had a mixed impact on the U.S. health-care

industry so far. Across the nation, surgeries have been canceled as

hospitals and other health-care providers brace for expected surges

of coronavirus patients. Americans are also avoiding clinics and

emergency rooms amid infection fears and stay-at-home orders. But

in parts of the country, such as New York, hospitals are

overwhelmed by patients sick with Covid-19, the illness caused by

the novel virus.

"The elective deferrals to date are offsetting Covid-19 costs,"

UnitedHealth Chief Executive David Wichmann said in a conference

call with analysts and investors.

UnitedHealth is the parent of the biggest U.S. health insurer as

well as, through its Optum arm, the owner of a large network of

surgery centers, urgent-care clinics and doctor practices.

Investors consider its results a bellwether for important segments

of the health-care industry.

Earlier this week another industry bellwether, Johnson &

Johnson, lowered its forecast for its performance this year, citing

the slowdown in patient visits to doctor's offices and in spinal

surgeries, knee replacements and other elective medical

procedures.

Gary Taylor, an analyst with JPMorgan Chase & Co., said

UnitedHealth's first-quarter results likely foreshadow far more

dramatic financial impacts across the health-care industry that

will become clearer later this year.

Hospitals have reported revenue drop-offs of around half, due

largely to the deferred surgeries, he said. So far, their

reimbursement for Covid-19 treatment, with the surge in cases

spread unevenly around the country, doesn't appear enough to make

up that deficit.

"This is a dramatic, unprecedented change in the last month," he

said. In the second quarter, he suggested, insurers might report

some of the strongest results in history if those fall-offs in care

continue. UnitedHealth's comments are "directionally supportive" of

those trends, he said.

UnitedHealth said medical expenses could be significantly lower

in the second quarter but might rebound later in the year as people

pursue care they had deferred.

Overall, UnitedHealth's first-quarter earnings were $3.38

billion, or $3.52 a share, compared with $3.47 billion, or $3.56 a

share, in the same period last year. Adjusted earnings were $3.72 a

share. Analysts polled by FactSet were looking for earnings of

$3.44 a share, or $3.63 a share on an adjusted basis.

First-quarter revenue was $64.4 billion, up 6.8% from $60.3

billion in the same period a year earlier.

The medical-loss ratio of UnitedHealthcare, the company's

insurance arm, which measures the share of premiums paid out in

claims, was 81%, when a consensus of analysts polled by FactSet had

expected 82%.

Yet OptumHealth, the unit that owns surgery centers, physician

practices and urgent-care clinics, fell short of some analysts'

projections.

Like the rest of the health-care system, UnitedHealth has seen a

drop-off in elective care, Mr. Wichmann said. The falloff helped

insurance results, as UnitedHealthcare didn't have to pay for the

forgone surgeries and other care. UnitedHealthcare reported

first-quarter earnings from operations of $2.9 billion, on revenue

of $51.1 billion.

The drop hit UnitedHealth's Optum health-care operations,

however. "Most traditional procedural work has been postponed" at

Optum's surgery centers, Mr. Wichmann said.

Nonetheless, UnitedHealth said OptumHealth had met its financial

expectations overall, as the unit is often paid in ways that aren't

tied to the amount of health-care provided. OptumHealth reported

earnings from operations of $712 million, on revenue of $9.2

billion.

UnitedHealth Chief Financial Officer John Rex said uncertainty

about how the pandemic would unfold makes it hard to make

projections. "The situation is just so different than anything

we've seen before," he said.

The insurer will also face expenses tied to hospitalizations and

other care received by Covid-19 patients. UnitedHealth pointed to a

range of actions it had taken to bolster coverage and care during

the crisis, including accelerating payments to doctors and

hospitals, starting with about $2 billion, and offering more

telemedicine.

UnitedHealth said it expects a drop-off in its membership in

employer plans due to layoffs and closed businesses as large parts

of the U.S. economy shut down, but that could partly be offset by

increases in Medicaid and individual-coverage enrollment.

Also on Wednesday, the company said Andrew Witty, UnitedHealth's

president and the chief executive of Optum, will take a leave of

absence to assist with the World Health Organization's efforts in

pursuit of a Covid-19 vaccine.

Write to Anna Wilde Mathews at anna.mathews@wsj.com and Dave

Sebastian at dave.sebastian@wsj.com

(END) Dow Jones Newswires

April 15, 2020 12:27 ET (16:27 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

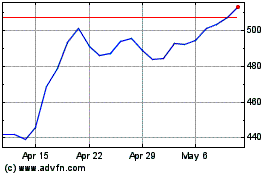

UnitedHealth (NYSE:UNH)

Historical Stock Chart

From Mar 2024 to Apr 2024

UnitedHealth (NYSE:UNH)

Historical Stock Chart

From Apr 2023 to Apr 2024