Filed by Uber Technologies, Inc.

Pursuant to Rule 425 under the Securities Act of 1933

and deemed filed pursuant to Rule 14a-12

under the Securities Exchange Act of 1934

Subject Company: Postmates Inc.

(Commission File No. 001-38902)

Date: July 6, 2020

Uber to Acquire

Postmates

Combination of platforms to provide

more choice and convenience for consumers, increased demand and tailored technology offerings for restaurants, and new income opportunities

for delivery people

SAN FRANCISCO — Uber Technologies,

Inc. (NYSE: UBER) and Postmates Inc. today announced that they have reached a definitive agreement under which Uber will acquire

Postmates for approximately $2.65 billion in an all-stock transaction.

This transaction brings together Uber’s global Rides

and Eats platform with Postmates’ distinctive delivery business in the U.S. Postmates is highly complementary to Uber Eats,

with differentiated geographic focus areas and customer demographics, and Postmates’ strong relationships with small- and

medium-sized restaurants, particularly local favorites that draw customers to the Postmates brand. Additionally, Postmates has

been an early pioneer of “delivery-as-a-service,” which complements Uber’s growing efforts in the delivery of

groceries, essentials, and other goods.

For restaurants and merchants, Postmates and Uber Eats will

together offer more tools and technology to more easily and cost-effectively connect with a bigger consumer base. Consumers will

benefit from expanded choice across a wider range of restaurants and other merchants. And delivery people will enjoy more opportunities

to earn income, with increased batching of orders to make better use of their time. Following the closing of the transaction, Uber

intends to keep the consumer-facing Postmates app running separately, supported by a more efficient, combined merchant and delivery

network.

“Uber and Postmates have long

shared a belief that platforms like ours can power much more than just food delivery—they can be a hugely important part

of local commerce and communities, all the more important during crises like COVID-19. As more people and more restaurants have

come to use our services, Q2 bookings on Uber Eats are up more than 100 percent year on year. We’re thrilled to welcome Postmates

to the Uber family as we innovate together to deliver better experiences for consumers, delivery people, and merchants across the

country,” said Uber CEO Dara Khosrowshahi.

“Over the past eight years we have been focused on a

single mission: enable anyone to have anything delivered to them on-demand. Joining forces with Uber will continue that mission

as we continue to build Postmates while creating an even stronger platform that brings this mission to life for our customers.

Uber and Postmates have been strong allies working together to advocate and create the best practices across our industry, especially

for our couriers. Together we can ensure that as our industry continues to grow, it will do so for the benefit of everyone in the

communities we serve,” said Postmates Co-Founder and CEO Bastian Lehmann.

Uber currently estimates that it will

issue approximately 84 million shares of common stock for 100% of the fully diluted equity of Postmates.

The boards of directors of both companies

have approved the transaction, and stockholders representing a majority of Postmates’ outstanding shares have committed to

support the transaction. The transaction is subject to the approval of Postmates stockholders, regulatory approval and other customary

closing conditions and is expected to close in Q1 2021. Wachtell, Lipton, Rosen & Katz served as legal counsel to Uber. J.P.

Morgan Securities LLC served as financial advisor and Latham & Watkins LLP as legal counsel to Postmates.

Conference Call with Uber Executives

to Discuss Transaction

Today at 5:30 a.m. Pacific Time (8:30

a.m. Eastern Time), Uber CEO Dara Khosrowshahi will host a conference call with Uber CFO Nelson Chai to discuss the transaction

and answer questions from financial analysts. The live webcast of the conference call and a slide presentation will be available

on the Uber Investor Relations website at investor.uber.com.

Uber Second Quarter 2020 Results

Conference Call

Uber will hold its quarterly conference

call to discuss its financial results for the second quarter of 2020 on Thursday, August 6, 2020, at 1:30 p.m. Pacific Time (4:30

p.m. Eastern Time).

A live webcast of the conference call

and earnings release materials can be found on Uber’s Investor Relations website at investor.uber.com. A replay of the conference

call will be accessible for at least 90 days.

Forward-Looking Statements

This communication contains forward-looking statements

regarding Uber Technologies, Inc.’s (“Uber,” “we” or “our”) future business expectations

which involve risks and uncertainties. Actual results may differ materially from the results predicted, and reported results should

not be considered as an indication of future performance. Forward-looking statements include all statements that are not historical

facts and can be identified by terms such as “anticipate,” “believe,” “contemplate,” “continue,”

“could,” “estimate,” “expect,” “hope,” “intend,” “may,”

“might,” “objective,” “ongoing,” “plan,” “potential,” “predict,”

“project,” “should,” “target,” “will,” or “would” or similar expressions

and the negatives of those terms. Forward-looking statements involve known and unknown risks, uncertainties and other factors that

may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements

expressed or implied by the forward-looking statements. These risks, uncertainties and other factors relate to, among others: risks

and uncertainties related to our pending acquisition of Postmates Inc. (“Postmates”), including the failure to obtain,

or delays in obtaining, required regulatory approvals, any reverse termination fee that may be payable by us in connection with

any failure to obtain regulatory approvals, the risk that such approvals may result in the imposition of conditions that could

adversely affect us or the expected benefits of the proposed transaction, or the failure to satisfy any of the closing conditions

to the proposed transaction on a timely basis or at all; costs, expenses or difficulties related to the acquisition of Postmates,

including the integration of the Postmates’ business; failure to realize the expected benefits and synergies of the proposed

transaction in the expected timeframes or at all; the potential impact of the announcement, pendency or consummation of the proposed

transaction on relationships with our and/or Postmates’ employees, customers, suppliers and other business partners; the

risk of litigation or regulatory actions to us and/or Postmates; inability to retain key personnel; changes in legislation or government

regulations affecting us or Postmates; developments in the COVID-19 pandemic and resulting business and operational impacts on

us and/or Postmates; and economic, financial, social or political conditions that could adversely affect us, Postmates or the proposed

transaction. For additional information on other potential risks and uncertainties that could cause actual results to differ from

the results predicted, please see our Annual Report on Form 10-K for the year ended December 31, 2019 and subsequent Form 10-Qs

or Form 8-Ks filed with the Securities and Exchange Commission (the “SEC”). All information provided in this communication

is as of the date of this communication and any forward-looking statements contained herein are based on assumptions that we believe

to be reasonable, and information available to us, as of such date. We undertake no duty to update this information unless required

by law.

No Offer or Solicitation

This communication shall not constitute an offer to sell

or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any jurisdiction in which such

offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction.

No offering of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the U.S. Securities

Act of 1933, as amended.

Important Additional Information Will be Filed with

the SEC

Uber will file with the SEC a registration statement on

Form S-4, which will include a prospectus of Uber. INVESTORS ARE URGED TO CAREFULLY READ THE REGISTRATION STATEMENT AND OTHER RELEVANT

DOCUMENTS TO BE FILED WITH THE SEC IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION

ABOUT UBER, POSTMATES, THE PROPOSED TRANSACTION AND RELATED MATTERS. Investors will be able to obtain free copies of the registration

statement and other documents filed with the SEC through the website maintained by the SEC at www.sec.gov and on Uber’s website

at investor.uber.com.

About Uber

Uber’s mission is to create opportunity through movement.

We started in 2010 to solve a simple problem: how do you get access to a ride at the touch of a button? More than 15 billion trips

later, we're building products to get people closer to where they want to be. By changing how people, food, and things move through

cities, Uber is a platform that opens up the world to new possibilities.

About Postmates

Postmates is a leader in on-demand food delivery. The platform

gives customers access to the most selection of merchants in the US with more than 600,000 restaurants and retailers available

for delivery and pickup, many of which are exclusive to Postmates. The market leader in Los Angeles, Postmates operates in all

50 states. Customers can get free delivery on all merchants by joining Postmates Unlimited, the industry's first subscription service.

Learn more or start a delivery by downloading the app or visiting www.postmates.com.

Contacts

|

Press:

For Uber:

press@uber.com

|

For Postmates:

press@postmates.com

|

|

Investors and Analysts:

For Uber:

investor@uber.com

|

|

Global All Hands Uber Acquisition of Postmates July 6, 2020 Uber

Forward Looking Statements This communication contains forward-looking statements regarding Uber Technologies, Inc.'s ("Uber," "we" or "our") future business expectations which involve risks and uncertainties. Actual results may differ materially from the results predicted, and reported results should not be considered as an indication of future performance. Forward-looking statements include all statements that are not historical facts and can be identified by terms such as "anticipate," "believe," "contemplate," "continue," "could," "estimate," "expect," "hope," "intend," "may," "might," "objective," "ongoing," "plan," "potential," "predict," "project," "should," "target," "will," or "would" or similar expressions and the negatives of those terms. Forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. These risks, uncertainties and other factors relate to, among others: risks and uncertainties related to our pending acquisition of Postmates Inc. ("Postmates"), including the failure to obtain, or delays in obtaining, required regulatory approvals, any reverse termination fee that may be payable by us in connection with any failure to obtain regulatory approvals, the risk that such approvals may result in the imposition of conditions that could adversely affect us or the expected benefits of the proposed transaction, or the failure to satisfy any of the closing conditions to the proposed transaction on a timely basis or at all; costs, expenses or difficulties related to the acquisition of Postmates, including the integration of the Postmates' business; failure to realize the expected benefits and synergies of the proposed transaction in the expected timeframes or at all; the potential impact of the announcement, pendency or consummation of the proposed transaction on relationships with our and/or Postmates' employees, customers, suppliers and other business partners; the risk of litigation or regulatory actions to us and/or Postmates; inability to retain key personnel; changes in legislation or government regulations affecting us or Postmates; developments in the COVID-19 pandemic and resulting business and operational impacts on us and/or Postmates; and economic, financial, social or political conditions that could adversely affect us, Postmates or the proposed transaction. For additional information on other potential risks and uncertainties that could cause actual results to differ from the results predicted, please see our Annual Report on Form 10-K for the year ended December 31, 2019 and subsequent Form 10-Qs and Form 8-Ks filed with the Securities and Exchange Commission (the "SEC"). All information provided in this communication is as of the date of this communication and any forward-looking statements contained herein are based on assumptions that we believe to be reasonable, and information available to us, as of such date. We undertake no duty to update this information unless required by law.

Additional Information Postmates' Operating Results Postmates' financial and operational measures presented in this presentation are derived from Postmates' historical unaudited financial statements for the twelve months ended December 31, 2019 and the three months ended March 31, 2020. The information on Postmates' business provided in this presentation, including the financial and operational measures, are based solely on information provided to Uber by Postmates as part of the announced transaction and has not been independently verified, audited or reviewed by Uber or our independent registered public accounting firm. No Offer or Solicitation This communication shall not constitute an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offering of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the U.S. Securities Act of 1933, as amended. Important Additional Information Will be Filed with the SEC Uber will file with the SEC a registration statement on Form S-4, which will include a prospectus of Uber. INVESTORS ARE URGED TO CAREFULLY READ THE REGISTRATION STATEMENT AND OTHER RELEVANT DOCUMENTS TO BE FILED WITH THE SEC IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT UBER, POSTMATES, THE PROPOSED TRANSACTION AND RELATED MATTERS. Investors will be able to obtain free copies of the registration statement and other documents filed with the SEC through the website maintained by the SEC at www.sec.gov and on Uber's website at https:// investor.uber.com.

Contents 01 Transaction Overview 02 Strategic Rationale

Transaction Overview

The Deal o Uber to acquire 100% of Postmates in an all stock transaction Expected to enhance Uber Eats' financial profile and accelerate Uber's path to profitability o Estimated $200M+ of run-rate synergies, expected to achieve one year after close o The transaction is valued at approximately $2.65 billion, on a fully diluted basis, subject to a net debt adjustment o Postmates stockholders will receive 100% stock consideration o Uber equity issued in the transaction will be valued at $31.45, based on Uber's 10-day VWAP as of June 29, 2020 o Uber has committed to provide bridge financing to Postmates during the process of obtaining regulatory approvals o Postmates stockholders representing a majority of Postmates' outstanding shares have committed to support the transaction o The transaction is subject to customary closing conditions including applicable regulatory approvals and approval of Postmates stockholders o Expected to close in Q1 2021 Transaction Overview Financial Impact Timing and Approvals

Postmates Overview $643M Gross Bookings1 Engagement - Q1 2020 10M+ Active Customers2 115K+ Partner Restaurants $107M Revenue Southwest regional leadership with high-quality restaurant selection o Strong Southwest presence, key cities include: Los Angeles, Las Vegas, Orange County, San Diego, Phoenix o 115K+ active, partnered restaurants, with significant exposure to SMBs o Popular, local "hero" brands: Sugarfish, Tocaya Organica, Ono Hawaiian BBQ and Sweetfin Beloved brand and strong customer relationships o 10M+ active customers2 o Significant subscription program, with Postmates Unlimited accounting for 30%+ of orders3, driving increased spend per order and increased order frequency Innovative technology assets and operational expertise o Industry-leading courier efficiency (nearly 3 trips / hour in strategic markets) o Technology and operations to facilitate delivery for non-partnered merchants o Delivery-as-a-service, which offers merchants the ability to add delivery capabilities to their websites and apps to fulfill on-demand orders Financial Performance - Q1 2020 1 Reflects Uber's definition of Gross Bookings; orders from restaurants account for the significant majority of Postmates' Gross Bookings; Postmates' Gross Bookings grew over 50% quarter-over-quarter in Q2 2020 2 Active customer defined as any customer who has placed at least one order on the platform during a trailing 12-month period 3 In the twelve months ended March 31, 2020

Strategic Rationale

Strategic Rationale 01 Large, growing and dynamic industry 02 Complementary assets that broaden and strengthen the combined company 03 Transaction expected to benefit consumers, restaurants and delivery people while delivering significant synergies and shareholder value

Strategic Rationale 01 Online food delivery is large, growing and dynamic Online food delivery represents only a fraction of the total opportunity 13 6 6 21 6 27 32 7 37 7 43 7 48 8 53 8 2018 2019E 2020E 2021E 2022E 2023E 2024E 2025E 0 10 20 30 40 50 60 70 80 $ in billions % penetration 0 2% 4% 6% 8% 10% 12% 14% 6% 8% 9% 10% 11% 12% 12% 13% Aggregators Restaurant Site / App Total Online Delivery Penetration Online Delivery Penetration (2018A-2025E) Combination positions us to compete with a growing set of players Rapidly changing food delivery environment with engagement from numerous players1 Uber Eats Grubhub DoorDash Postmates EatStreet Delivery.com Favor Slice Ritual Waitr EZCater Google Maps Facebook/ Instagram Instacart Whole Foods Amazon Fresh Target/Shipt Walmart Grocery GoPuff Blue Apron Hello Fresh Sun Basket Domino's Panera Bread JimmyJohns Strategic Rationale 01 Dynamic environment, with innovation across multiple categories, including new delivery and POS models Source: Uber analysis, Cowen, Morgan Stanley Feb 21, 2020 Research Report 1 Reflects select sample of players, not exhaustive

Strategic Rationale 02 Uber Eats + Postmates UberEats Postmates Gross Bookings Q2 Gross Bookings growth of over 100% YoY1 Q2 Gross Bookings growth of over 67%2 YoY and over 50% QoQ Geographic Mix Global: Operations in 34 countries and leading3 position representing significant majority of Bookings (includes: US, UK, France, Mexico, Japan, Australia) Key cities: London, Paris, Lisbon, Tokyo, Taipei, Sydney, Toronto, Mexico City Key cities: Los Angeles, Las Vegas, Orange County, San Diego, Phoenix Restaurants 400K partnered restaurants4 115K partnered merchants5 Customer Base 111M Monthly Active Platform Consumers6 10M+ Active Customers7 Significant subscription program, with Postmates Unlimited accounting for 30%+ of orders Brand Uber is one of the most recognizable brands in the world Beloved brand, especially among Millennials Key Merchant Partners McDonald's, KFC, Burger King Popular, local "hero" brands: Sugarfish, Tocaya Organica, Ono Hawaiian BBQ and Sweetfin Technology World-class marketplace technology (routing, dispatching, dynamic pricing, matching) Batching and chaining capabilities Technology and operations to facilitate delivery for non-partnered merchants Other Adjacencies Expanding into grocery and other item delivery in several markets Early player in Delivery-as-a-service Uber Eats + Postmates o Combines global scale and local category strengths to drive operating efficiency and accelerate path to profitability o Improved high-quality restaurant selection, including SMB restaurants and local favorites o Expanded and strong customer base o Addition of strong, trusted consumer and restaurant facing brand o Integrated platform with improved batching and chaining capabilities, technology and operations to facilitate delivery for non-partnered merchants, and acceleration of delivery-as-a-service efforts 1 Q2 2020 Results are preliminary 2 Reflects Uber's definition of Gross Bookings; Q2 results are preliminary 3 Leading position reflects countries with #1 or #2 category position 4 As of December 31, 2019 5 As of March 31, 2020 6 As of December 31, 2019; Monthly Active Platform Consumers (MAPCs) is the number of unique consumers who completed a Rides or New Mobility ride or received an Eats meal on our platform at least once in a given month, averaged over each month in the quarter 7 As of March 31, 2020; Active customer defined as any customer who has placed at least one order on the platform during a trailing 12-month period

Strategic Rationale 03 Combination benefits all sides of the marketplace Increase in scale is expected to enable significant cost synergies Opportunity to eliminate redundant expenditures while improving operating efficiency o Anticipate $200+ million of run-rate synergies one year after close o Transaction is expected to accelerate our path to profitability

Strategic Rationale 03 Combination drives shareholder value Consumers More choices and lower prices Restaurants Increased demand and lower costs Delivery People More work opportunities and improved earnings

Uber

Excerpts

from Transcript of Uber Technologies, Inc.’s Conference Call Regarding Postmates Inc. Acquisition

July 6, 2020 | 8:30 a.m. Eastern Time

Call Participants

EXECUTIVES

Dara Khosrowshahi

CEO & Director

Emily Maher

Head of Investor Relations

Nelson Juseuk Chai

Chief Financial Officer

ANALYSTS

Brian Nicholas Fitzgerald

Wells Fargo Securities, LLC, Research

Division

Brian Thomas Nowak

Morgan Stanley, Research Division

Heath Patrick Terry

Goldman Sachs Group Inc., Research Division

Mark Stephen F. Mahaney

RBC Capital Markets, Research Division

Pierre C. Ferragu

New Street Research LLP

Ross Adam Sandler

Barclays Bank PLC, Research Division

Steven Bryant Fox

Fox Advisors LLC

Presentation

Operator

Ladies and gentlemen, thank you

for standing by, and welcome to the Uber’s Acquisition of Postmates Conference Call. [Operator Instructions] I would now like to

hand the conference over to your speaker today, Emily Reuter, Investor Relations.

Emily Maher

Head of Investor Relations

Thank you, operator. Good morning, everybody, and

welcome to today’s conference call regarding Uber’s agreement to acquire Postmates. On the call today, we have Dara Khosrowshahi

and Nelson Chai. We also have Kent Schofield, and this is Emily Reuter from the Investor Relations team. We will start today with

remarks from Dara and Nelson and then host a brief Q&A session. We have allotted 30 minutes for this call.

Certain statements on this call may be deemed to be

forward-looking statements concerning the proposed transaction and other matters related to Uber and Postmates that are subject

to risks and uncertainties. Actual results may differ materially from these forward-looking statements, and we do not undertake

any obligation to update any forward-looking statements we make today. For more information about factors that may cause actual

results to differ materially from forward-looking statements, please refer to the risks and uncertainties included in our SEC filings,

including our filings on Form 10-K, 10-Q and 8-K.

In addition, in connection with the proposed transaction,

we will file with the SEC a registration statement on Form S-4 to include a prospectus of Uber. Investors are urged to carefully

read the registration statement and other relevant documents to be filed with the SEC in their entirety when they become available

as they will contain important information about Uber-Postmates’ proposed transaction and related matters.

Investors will be able to obtain free copies of the

registration statement and other documents filed with the SEC through the website maintained by the SEC at www.sec.gov and on our

Investor Relations website at investor.uber.com. You can find today’s press release, a deal-focused investor presentation and any

additional materials to be filed by Uber with the SEC in connection with the proposed transaction on investor.uber.com.

With that, let me hand it over to Dara.

Dara Khosrowshahi

CEO & Director

Thanks, Emily. I’m excited to announce that we signed

an agreement to acquire Postmates in an all-stock transaction valued at approximately $2.65 billion. This acquisition is going

to allow us to drive continued growth, improve our operating efficiency and accelerate our path to profitability through this combination

of Uber and Postmates’ scale, technology and complementary geographic strengths.

* * *

We said that we would be a consolidator for the right

assets at the right price, which brings us today to the announcement with Postmates. This transaction combines our Rides and Eats

platform and deep logistics expertise with Postmates’ brand and distinctive delivery assets in the U.S. I want to spend a few minutes

highlighting some of the valuable and differentiated products, technology and expertise that Postmates will bring to Uber, including

$643 million in Q1 gross bookings, growing over 67% year-on- year and over 50% quarter-on-quarter in Q2; a geographic presence

with strength in the U.S. Southwest, including Los Angeles, Las Vegas, Orange County, Phoenix and San Diego that complements our

existing Eats presence; differentiated restaurant selection of over 115,000 partner restaurants, a number of which are new to the

Uber Eats platform, including relationships with popular local hero brands such as Sugarfish, Tocaya Organica, Ono Hawaiian BBQ

and Sweetfin; a well-loved brand with over 10 million loyal active customers who placed an order in the last 12 months ending March

31; industry-leading delivery efficiency and batching at nearly 3 deliveries per hour in established geographies, which we intend

to leverage through combined dispatch efforts to further improve our own delivery efficiency; a sizable subscription base with

30% of orders coming from Postmates Unlimited; technology and operations to facilitate delivery for non-partner merchants that’s

much more reliable for consumers and delivery people and significantly less disruptive for merchants than the approach of many

competitors; and an accelerated delivery as a service effort, which complements our own efforts on grocery and B2C delivery.

The combination of Uber Eats and Postmates is also

expected to drive significant efficiencies and cost savings that will allow us to bring benefits to all sides of the marketplace,

including consumers and restaurants. We believe we can achieve over $200 million of run rate synergies 1 year after close. Additionally,

we believe that over time, we can offer wider selection and lower prices for consumers, generate increased demand, lower costs,

streamlined operations with fewer tablets for restaurants and provide more work opportunities and improved earnings for delivery

people. We believe all of this will ultimately drive value for Uber as well.

And with that, I’ll turn it over to Nelson for more details

on the transaction.

Nelson Juseuk Chai

Chief Financial Officer

Thanks, Dara. Turning now to the details of the

transaction. The transaction is valued at approximately $2.65 billion on a fully diluted basis, subject to net debt adjustments.

Postmates’ stockholders will receive 100% cash consideration. Uber common stock issued in the transaction will be valued at $31.45

based on Uber’s 10-day VWAP as of June 29, 2020.

Postmates’ stockholders representing more than 55%

of its outstanding shares have committed to approve the transaction. Uber is committed to provide bridge financing to Postmates

during the process of obtaining regulatory approval. Postmates will be combined with the Uber Eats business unit led by Pierre-

Dimitri Gore-Coty, Vice President of our Delivery business.

We estimate synergies to be over $200 million of run

rate savings 1 year after close driven by efficiencies in G&A, sales and marketing, courier utilization and payment fees. We

believe the combination accelerates our path to profitability. We expect to provide more details on the efficiencies we’ll be able

to achieve as well as other acquisition-related financial impacts once the deal closes.

In terms of process and timing, the transaction is

subject to customary closing positions, including applicable regulatory approval. As such, we expect to close the transaction in

Q1 of 2021.

I’m sorry, I think I said that the transaction

was cash. It’s all stock. I apologize, I misspoke. And with that, let’s move to Q&A. Please be mindful that we will not comment

on Q2 performance, so please keep questions focused on this transaction. Operator, please open the line for questions.

Question and Answer

Operator

[Operator Instructions] Our first question this morning

comes from Brian Nowak from Morgan Stanley.

Brian Thomas Nowak

Morgan Stanley, Research Division

I have 2. Just the first one, could you give us any

rough idea on the Postmates current EBITDA profit or loss run rate just so we have an idea for the way to think about the business

after the synergies? Then the second one, just on the efficiency, 3 orders -- nearly 3 orders per courier per hour is, I think,

is pretty strong. Maybe talk to us about what drives that. Is there anything differentiated with Postmates’ tech stack or the routing

technology or anything that you can leverage from that perspective to maybe make Uber Eats run even more efficiently?

Dara Khosrowshahi

CEO & Director

Brian, thanks for the question. We’re not going to

disclose Postmates’ run rate at this point, although I can tell you that the business was getting much closer to profits on a run

rate basis. And the company under Bastian’s leadership was feeling very, very good about the direction. We think with synergies,

this will be a profitable deal for us if you look at the deal on a stand-alone basis.

In terms of the Postmates --- the number of transactions

per hour, we -- what they’ve done is very, very impressive. As a smaller player in the field, I think the team was very focused

on making sure that they have the most efficient cost base that they could. Part of what Postmates does quite effectively is their

batching technology. And because they have a pretty good concentration in a smaller number of markets, L.A., Orange County, the

markets that we went over, they can use their technologies to batch quite efficiently.

And I think that we are certainly going to talk to

them, and I’m sure that this is a technology that can be leveraged across Uber and Uber Eats on a global basis. And they got a

number of tips per drop, so to speak, so delivery -- so their earnings increase as well. And for restaurants, it brings them more

business because it reduces essentially the cost of delivery.

Operator

Our next question comes from Brian Fitzgerald from Wells

Fargo.

Brian Nicholas Fitzgerald

Wells Fargo Securities, LLC, Research Division

Just looking at some of the numbers from a -- [ second

] measure. It looks like the combined entity will have leadership positions in L.A., Atlanta, Phoenix, those are strong; Miami;

#2 in New York; and San Fran, I call it half market share there. So can you talk a little bit about how you view entering those

2 cities in particular? And maybe are -- is -- [ states ] seeing any of this kind of feedback from local officials about take rates

and “Hey, you’re extracting a toll from these restaurants while they’re under duress?”

Dara Khosrowshahi

CEO & Director

Sorry, which 2 cities in particular were you pointing out?

Brian Nicholas Fitzgerald

Wells Fargo Securities, LLC, Research Division

San Fran and New York.

Dara Khosrowshahi

CEO & Director

Okay. Listen, I think first of all, when you look at

the market and the size of the market, we really believe that the market is much bigger than, let’s say, the traditional delivery

players, right? Like we look at -- grocery is a category. There’s a lot of hot food being delivered. We look at essentials as a

category that we are going to go after as well. So make no mistake. When we look at the category, for us, it started with food,

but it’s much more expansive than that. It’s essentials, it’s grocery.

And by the way, we expect the grocery players and

players in kind of adjacent categories as well as the big restaurants themselves to get into our category as well. So while we

have good share in those markets, we kind of view the market share and the market much more broadly than the category positions

that most of these services measure.

In terms of NYC and SF, there are very big players

there. We are going to be a decent player in those markets as well. We don’t think we’re going to have any particular trouble in

those markets because they’re very competitive. They’ve got some big players and again, big players in both the traditional restaurant

category as well as grocery, et cetera.

So I think that this is a deal that, again, it’s going

to be good for us. It’s going to be good for restaurants, it’s going to be good for delivery people. And while I’m sure we will

have plenty of discussions on a local basis, I don’t see any kind of big red flags, so to speak.

Operator

Our next question comes from Mark Mahaney from RBC.

Mark Stephen F. Mahaney

RBC Capital Markets, Research Division

Two questions, please. Could you double-click a little

bit more on the $200 million of run rate synergies? And Nelson, I think you just went through the list pretty quickly, but spend

a little bit more time on how you came up with those numbers. And then you talked about the transaction accelerating the path to

profitability. You may not quantify it, but are we talking about a couple of months, a couple of quarters, anything that puts a

little more color around how -- that rate of acceleration?

Nelson Juseuk Chai

Chief Financial Officer

No, the market opportunity...

Dara Khosrowshahi

CEO & Director

Is that...

Nelson Juseuk Chai

Chief Financial Officer

Dara, I got it. So Mark, as I said in my prepared comments,

we’ll spend a little bit more time as we get closer to. But we went through their financials quite closely and obviously ours as

well. And so we obviously see pretty straightforward integration opportunities here. As you know, we’ll continue with -- Postmates

has a tremendous following in the markets in where they are, and so we’ll continue to do that. But it’s actually a relatively straightforward

G&A, sales and marketing, kind of standard playbook-type stuff that you’ll see us continue to execute there. So again, I think

from that perspective, again, we’ll give more color, as I said.

In terms of accelerating the path to profitability, I think

both businesses continue to benefit for what’s going on regarding -- outside in the world and COVID and how it’s pushed

forward a lot of food delivery. Their business has continued to do quite well. They’ve continued to narrow their loss, if

you will. We continue to grow our business, as Dara said, and we look forward to talking about our business more when we do our

second quarter earnings. We put the -- a line in the sand next year regarding profitability. And our ability to get there is predicated

a little bit, a lot on recovery more broadly, but certainly on improving our Eats economics, which we believe we are doing.

Operator

Our next question comes from Steven Fox from Fox Advisors.

Steven Bryant Fox

Fox Advisors LLC

Just as a follow-up to everything you’ve talked about.

Can you maybe expand on the competitive environment as you implement more technology into the delivery system and network? Is there

certain advantages you think you come out of that with -- relative to all the entrants that you cited?

Dara Khosrowshahi

CEO & Director

Sure. I think that one huge advantage that we have

is the same technology stack that essentially is powering our Uber rides service is the -- and many of the elements of that technology

stack in terms of our routing, our mapping, our pricing. Even if you look at batching, which is taking 2 or 3 or 4 orders up and

delivering it, which creates -- increases efficiency, that technology is broadly similar to our Pool -- UberPool technology, which

isn’t running now because of COVID.

But a lot of the underlying technology, the matching

technology that we got comes out of the Uber ride service and is being built on top of that core service for Uber Eats, and that

just provides an enormous advantage in terms of the talent that you can hire as far as the engineers go, the efficiency of the

systems and your ability to drive more and more efficiency out of these systems in a way that some of our competitors can’t.

When you put that together with some of the really

smart work that we’ve seen from Postmates -- and we really like the combination there. And I think that team has been very scrappy,

very entrepreneurial, and we can use some of the learnings of their systems and build on top of our systems in order to build a

better service overall for everyone involved.

And then on the competitive sector, listen, these

are big markets. We expect competition in this category for many, many years to come. And because of the innovation of Postmates,

kind of the over-the-top service that they built where they essentially deliver anything, not just food but groceries, pharmacy,

et cetera, we think that’s a very promising area. We’ve been developing our own over-the-top services as well in order to broaden

our offering.

And really, the vision for us is to become an everyday

service. And your being able to use Uber rides to go any place in a city, however you want to get there, whether it’s with a car

or a taxi or mass transit, or if you want anything delivered to your home within a couple of hours, you can come to Uber Eats.

And if it’s food, it’s great, but if you want groceries, pharmacy, again, any other category, you can have it delivered to your

home as well.

So Postmates, we think, is a great step along that

vision. Any place you want to go, anything you want to deliver to your home, Uber is going to be there with you. And we think these

everyday frequent interactions create habit, create a connection with customers.

We talked about Postmates Unlimited, their subscription

service. Our subscription service as well was growing at very, very rapid rates. And we think over a period of time, we can have

a technological edge, we can have a brand edge and we can just have a frequency edge over the other competitors out there. But

we think it’s -- these are big, big markets. And again, we’ll be running against a lot of competitors as we look to build our own

service.

Steven Bryant Fox

Fox Advisors LLC

Great. That’s extremely helpful. Good luck with the transaction.

Operator

Our next question comes from Ross Sandler from Barclays.

Ross Adam Sandler

Barclays Bank PLC, Research Division

So Dara, you mentioned that Postmates has really good

efficiency metrics in terms of fleet or delivery cost per order. So the question is, I guess, how wide is the gap in delivery efficiency

between Postmates and Uber? And is there technology that Postmates is using that you could deploy on the Uber Eats side to potentially

improve the delivery efficiency on both sides of the house? And I guess what do you think is the long-term opportunity to increase

take rate at both Postmates and at Uber Eats from that?

Dara Khosrowshahi

CEO & Director

Yes, absolutely. So in terms of the delivery efficiency,

we do think that there’s real potential there. Now I will caution you that not all delivery networks are born equal in that the

geography in which you operate is -- can significantly differ, let’s say, how much you can batch the routing, the number of drops

per hour. Obviously, even more concentrated, let’s say, the geography is, like the L.A. area, the more you can -- the more aggressive

you can be with this kind of batching.

That said, we do think that we at Uber have the opportunity

to batch more and to increase our own efficiency metrics and the efficiencies of the deal. The synergies of the deal that we talked

about, the $200 million plus, don’t include significant numbers as it relates to network efficiency. If we’re able to draw significant

numbers on network efficiencies, the synergies can be substantially beyond the $200 million. We wanted to be conservative in our

planning as we are in every part of our business. But again, the network efficiency, we think, is -- has potential, and that potential

can actually improve on the synergies that we talked to you about.

In terms of take rate, et cetera, I wouldn’t expect

any significant moves on the take rate front. As you know, take rates in general have been moving up for us. I think our take rate

is very low considering that the cost of delivery generally is [ contra ] revenue for us. And the deal isn’t about increasing take

rates. This deal is actually about creating kind of larger industrial logic and efficiencies that will allow us to actually keep

take rates low, as low as we can for restaurants and grocery partners because that is essentially a great way to, from a long-term

perspective, grow the business going forward. We will build tools like advertising, for example, for restaurants who want more

promotion on the network one way or the other. But I actually think that this is a pretty good way of keeping take rates nice and

low because this is a very, very large TAM that’s ahead of us.

Operator

Our next question comes Pierre Ferragu from New Street

Research.

Pierre C. Ferragu

New Street Research LLP

Dara, I was wondering if you could share your thoughts

on how you see the U.S. market evolving from here. So now if I look at the latest numbers, Postmates is #1. You guys are -- sorry,

I meant DoorDash is #1. You guys with this combination will be 2/3 of their size. And we’ll still have GrubHub as the #3 and for

now like on the share trajectory.

So my question was do you think there is room for further

consolidation of user experience in the last few weeks that regulation is going to prevent that? And so do you think the U.S. market

becomes like a 3- player market? And then if that’s the case, is that the kind of environment that you had implied in your 30%

EBITDA margin -- contribution margin target and your [ 16% ] take rate target for it?

Dara Khosrowshahi

CEO & Director

Yes, Pierre. This is -- it’s very difficult to speculate

where the U.S. market is going, and I certainly wouldn’t think that it is going to reduce from 3 to 2. And remember, I do think

the way that we view this category is very broad. Ourselves, DoorDash, I’m actually not sure about GrubHub, are all looking to

get into adjacent categories and really looking to power local commerce and different types of delivery to the home. This is a

business that Amazon is in. This is a business that Walmart is in.

So I do think that kind of the category and the markets

are going to start overlapping with a lot of other players -- the TAMs here, the total addressable markets are huge. I think that

there is plenty of room in the U.S. markets. And if you want to stick to the traditional players, I think that there is room for

3 players. It’s a big enough market, and there is room certainly for 3 players to be profitable and to do very well.

That said, we like our position. We’re never satisfied,

but we think that this Postmates deal gets us stronger in the U.S. I think it brings a terrific brand, a really strong management

team and the opportunity to increase efficiencies. And we think that it puts us in a very strong position going forward in what

is our largest market.

Operator

Our final question comes from Heath Terry from Goldman

Sachs.

Heath Patrick Terry

Goldman Sachs Group Inc., Research Division

Dara, Postmates has obviously been one of the more

aggressive in the market in terms of customer acquisition with the ubiquitous $100 cards at restaurants as their primary strategy

there. I’m wondering how that factored into you and the team’s view on the value of their customers, sort of the sustainability

of their customers, both in terms of the asset at Postmates and then also the impact that maybe having Postmates as a more rational

competitor to Uber Eats within the company would have on the overall value of the business.

Dara Khosrowshahi

CEO & Director

Well, I think that Postmates, for us, we’ve always

admired Postmates, I guess, begrudgingly from afar in that it was a competitor who was able to compete aggressively and to be a

leader in some very important markets with a much smaller capital base than a lot of its competition, including ourselves. And

I think that they did it with some aggressive tactics, but I think they’ve also built a great brand. It’s a very scrappy brand

out there. They have a number of great kind of top, top local restaurants. It’s seen as a very local kind of brand that has real

substance behind it. We really like what they’ve done with their subscription program.

So I do think that some of these tactics that they

brought to bear, these are the tactics of great entrepreneurs. And these are tactics that we can learn from as well and we can

take into our company as we build our services. So we like what they’ve done. We like some of these tactics, and you can expect

to see some of these tactics at Uber Eats. And of course, you can expect us to continue to do what we’re doing.

Again, for a little perspective, we have gone from

essentially 0. And in Eats -- from the Eats side, pretty much 100% organically, until now, have built the largest food delivery

company outside of China and the world. So we think the combination of kind of Uber Eats’ scale, hyper-growth on top of the technology

platform that we’ve got here, and then some of the really good work that Postmates has done in terms of delivery efficiency and

in terms of just building a really terrific brand that resonates with millennials, we think, is just a wonderful combination. And

it’s a combination that will work for restaurants, that will work for consumers and will work for couriers as well. So we’re pretty

excited about it.

I think that’s it. Emily, anything else to add?

Emily Maher

Head of Investor Relations

No, that’s it. Thank you all for joining this morning.

Dara Khosrowshahi

CEO & Director

All right. Thank you very much for joining. We’re thrilled

to move forward on this transaction. Congratulations to the folks who worked on this deal and congratulations to the Postmates

folks. Thank you.

Operator

Ladies and gentlemen, this concludes today’s conference call.

Thank you for participating. You may now disconnect.

Disclaimer

The information herein is based on sources

we believe to be reliable but is not guaranteed by us and does not purport to be a complete or error-free statement or summary

of the available data. As such, we do not warrant, endorse or guarantee the completeness, accuracy, integrity, or timeliness of

the information. You must evaluate, and bear all risks associated with, the use of any information provided hereunder, including

any reliance on the accuracy, completeness, safety or usefulness of such information. This information is not intended to be used

as the primary basis of investment decisions. It should not be construed as advice designed to meet the particular investment needs

of any investor. This report is published solely for information purposes, and is not to be construed as financial or other advice

or as an offer to sell or the solicitation of an offer to buy any security in any state where such an offer or solicitation would

be illegal. Any information expressed herein on this date is subject to change without notice.

THE INFORMATION PROVIDED TO YOU HEREUNDER IS PROVIDED “AS

IS,” AND TO THE MAXIMUM EXTENT PERMITTED BY APPLICABLE LAW, WE DISCLAIM ALL WARRANTIES WITH RESPECT TO THE SAME, EXPRESS,

IMPLIED AND STATUTORY, INCLUDING WITHOUT LIMITATION ANY IMPLIED WARRANTIES OF MERCHANTABILITY, FITNESS FOR A PARTICULAR PURPOSE,

ACCURACY, COMPLETENESS, AND NON-INFRINGEMENT. TO THE MAXIMUM EXTENT PERMITTED BY APPLICABLE LAW, NEITHER WE NOR OUR OFFICERS, MEMBERS,

DIRECTORS, PARTNERS, AFFILIATES, BUSINESS ASSOCIATES, LICENSORS OR SUPPLIERS WILL BE LIABLE FOR ANY INDIRECT, INCIDENTAL, SPECIAL,

CONSEQUENTIAL OR PUNITIVE DAMAGES, INCLUDING WITHOUT LIMITATION DAMAGES FOR LOST PROFITS OR REVENUES, GOODWILL, WORK STOPPAGE,

SECURITY BREACHES, VIRUSES, COMPUTER FAILURE OR MALFUNCTION, USE, DATA OR OTHER INTANGIBLE LOSSES OR COMMERCIAL DAMAGES, EVEN IF

ANY OF SUCH PARTIES IS ADVISED OF THE POSSIBILITY OF SUCH LOSSES, ARISING UNDER OR IN CONNECTION WITH THE INFORMATION PROVIDED

HEREIN OR ANY OTHER SUBJECT MATTER HEREOF.

Important Additional Information Will be Filed with the SEC

Uber will file with the SEC a registration statement on Form S-4,

which will include a prospectus of Uber. INVESTORS ARE URGED TO CAREFULLY READ THE REGISTRATION STATEMENT AND OTHER RELEVANT DOCUMENTS

TO BE FILED WITH THE SEC IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT UBER,

POSTMATES, THE PROPOSED TRANSACTION AND RELATED MATTERS. Investors will be able to obtain free copies of the registration statement

and other documents filed with the SEC through the website maintained by the SEC at www.sec.gov and on Uber’s website at

https://investor.uber.com.

No Offer or Solicitation

This communication shall not constitute an offer to sell or the

solicitation of an offer to buy any securities, nor shall there be any sale of securities in any jurisdiction in which such offer,

solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction.

No offering of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the U.S. Securities

Act of 1933, as amended.

Forward-Looking Statements

This communication contains forward-looking statements regarding

Uber Technologies, Inc.’s (“Uber,” “we” or “our”) future business expectations that involve

risks and uncertainties. Actual results may differ materially from the results predicted, and reported results should not be considered

as an indication of future performance. Forward-looking statements include all statements that are not historical facts and can

be identified by terms such as “anticipate,” “believe,” “contemplate,” “continue,”

“could,” “estimate,” “expect,” “hope,” “intend,” “may,”

“might,” “objective,” “ongoing,” “plan,” “potential,” “predict,”

“project,” “should,” “target,” “will,” or “would” or similar expressions

and the negatives of those terms. Forward-looking statements involve known and unknown risks, uncertainties and other factors that

may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements

expressed or implied by the forward-looking statements. These risks, uncertainties and other factors relate to, among others: risks

and uncertainties related to our pending acquisition of Postmates Inc. (“Postmates”), including the failure to obtain,

or delays in obtaining, required regulatory approvals, any reverse termination fee that may be payable by us in connection with

any failure to obtain regulatory approvals, the risk that such approvals may result in the imposition of conditions that could

adversely affect us or the expected benefits of the proposed transaction, or the failure to satisfy any of the closing conditions

to the proposed transaction on a timely basis or at all; costs, expenses or difficulties related to the acquisition of Postmates,

including the integration of the Postmates’s business; failure to realize the expected benefits and synergies of the proposed

transaction in the expected timeframes or at all; the potential impact of the announcement, pendency or consummation of the proposed

transaction on relationships with our and/or Postmates’s employees, customers, suppliers and other business partners; the

risk of litigation or regulatory actions to us and/or Postmates; inability to retain key personnel; changes in legislation or government

regulations affecting us or Postmates; developments in the COVID-19 pandemic and resulting business and operational impacts on

us and/or Postmates; and economic, financial, social or political conditions that could adversely affect us, Postmates or the proposed

transaction. For additional information on other potential risks and uncertainties that could cause actual results to differ from

the results predicted, please see our Annual Report on Form 10-K for the year ended December 31, 2019 and subsequent Form 10-Qs

or Form 8-Ks filed with the Securities and Exchange Commission (the “SEC”). All information provided in this communication

is as of the date of this communication and any forward-looking statements contained herein are based on assumptions that we believe

to be reasonable, and information available to us, as of such date. We undertake no duty to update this information unless required

by law.

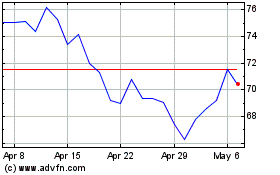

Uber Technologies (NYSE:UBER)

Historical Stock Chart

From Mar 2024 to Apr 2024

Uber Technologies (NYSE:UBER)

Historical Stock Chart

From Apr 2023 to Apr 2024