UNITED STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

14A

Proxy

Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

| Filed

by the Registrant x |

|

| |

|

| Filed

by a Party other than the Registrant o |

|

| |

|

| Check

the appropriate box: |

|

| |

|

| o

Preliminary Proxy Statement |

|

| o

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x

Definitive Proxy Statement |

|

| o

Definitive Additional Materials |

|

| o

Soliciting Material Pursuant to §240.14a-12 |

Uber Technologies, Inc.

(Name

of Registrant as Specified In Its Charter)

(Name

of Person(s) Filing Proxy Statement, if Other than the Registrant)

| Payment

of Filing Fee (Check the appropriate box): |

| x |

No fee required. |

| o |

Fee computed on table below per Exchange Act Rules 14a-6(i) and 0-11. |

| |

|

(1) |

Title

of each class of securities to which transaction applies: |

| |

|

|

|

| |

|

|

|

| |

|

(2) |

Aggregate

number of securities to which transaction applies: |

| |

|

|

|

| |

|

|

|

| |

|

(3) |

Per

unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11(set forth the amount on which

the filing fee is calculated and state how it was determined). |

| |

|

|

|

| |

|

|

|

| |

|

(4) |

Proposed

maximum aggregate value of transaction: |

| |

|

|

|

| |

|

|

|

| |

|

(5) |

Total

fee paid: |

| |

|

|

|

| |

|

|

|

| o |

Fee paid previously with preliminary materials. |

| o |

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration number, or on the Form or Schedule and the date of its filing. |

| |

|

(1) |

Amount

previously paid: |

| |

|

|

|

| |

|

|

|

| |

|

(2) |

Form,

Schedule or Registration Statement No.: |

| |

|

|

|

| |

|

|

|

| |

|

(3) |

Filing

Party: |

| |

|

|

|

| |

|

|

|

| |

|

(4) |

Date

Filed: |

| |

|

|

|

| |

|

|

|

Notice

of 2020 Annual Meeting of Stockholders

| |

|

|

|

|

|

Date

& Time

May

11, 2020

11:00

a.m. Pacific Time |

Location

Virtual

A

live webcast of the Annual

Meeting

will be available at

www.virtualshareholdermeeting.com/uber2020 |

Record

Date

March

16, 2020 |

| |

|

|

Items

of business:

| Proposal

1: |

Election

of the nine director nominees named in this

proxy

statement.

|

✓

For

each nominee

|

| |

|

|

| Proposal

2: |

Approval,

by non-binding vote, of the compensation paid to the company’s named executive

officers as disclosed in this proxy statement (the “say-on-pay vote”). |

✓

For

|

| |

|

|

| Proposal

3: |

Approval,

by non-binding vote, of the frequency (i.e., every one, two, or three years) of the say-on-pay

vote. |

✓

For annual vote |

| |

|

|

| Proposal

4: |

Ratification

of the appointment of PricewaterhouseCoopers LLP as our independent registered public

accounting firm for 2020.

|

✓

For

|

| |

|

|

Stockholders

may participate in the annual meeting by logging in at www.virtualshareholdermeeting.com/uber2020. Please see page 74 of the proxy

for additional information regarding participation in the virtual meeting.

Your

vote is very important to us. You can be sure your shares are represented at the meeting if you are a stockholder of record

by promptly voting electronically over the Internet or by telephone or by returning your completed proxy card in the pre-addressed,

postage-paid return envelope (which will be provided to those stockholders who request to receive paper copies of these materials

by mail) or, if your shares are held in street name, by returning your completed voting instruction card to your broker. If, for

any reason, you desire to revoke or change your proxy, you may do so at any time before it is exercised. The proxy is solicited

by the board of directors of Uber Technologies, Inc.

We

cordially invite you to attend the meeting.

To

Vote Prior to Annual Meeting

| By

Internet |

By

telephone |

By

mail |

|

|

|

Go

to

www.proxyvote.com

and follow the instructions |

Call

1-800-690-6903 |

Sign,

date and return your proxy card

in the postage-paid envelope |

| |

By

Order of the Board of Directors |

| |

|

| |

|

| |

|

| |

Derek

Anthony West |

| |

Chief

Legal Officer and Corporate Secretary

San Francisco, CA |

| |

March

30, 2020 |

2020 Proxy Statement 1

Important

Information About Uber’s Virtual Annual Meeting

Uber’s 2020 Annual Meeting

will be conducted virtually, via live webcast. If you were a holder of record of Uber common stock at the close of business on

March 16, 2020, you are entitled to participate in the Annual Meeting on May 11, 2020. Below are some frequently asked questions

regarding our Annual Meeting.

Ronald Sugar

Chairperson

of the Board |

Why

did the Board decide to adopt a virtual format for the 2020 Annual Meeting? |

| |

“As

a global company operating in over 69 countries with employees and stockholders around the world, we recognize the importance

of providing convenient access to promote attendance and participation in our first Annual Meeting. The Board believes the

virtual format will enhance attendance by providing safe and convenient meeting access to all of our stockholders, regardless

of where they live—especially in light of concerns and restrictions on travel related to the recent global COVID-19

pandemic. This year, even stockholders without an Internet connection or a computer will be able to listen to the meeting

by calling a toll-free telephone number.

|

In

addition, we believe the virtual format will provide a better opportunity for stockholders to communicate with your Board

by submitting questions before and during the meeting the virtual portal. Finally, the virtual meeting format will also eliminate

many of the costs associated with holding a physical meeting, which is a smart choice for Uber and its stockholders. We look

forward to high participation this year while lowering operating costs for the Company.” |

| |

|

|

How

can I view and participate in the Annual Meeting? To participate, visit www.virtualshareholdermeeting.com/uber2020

and login with your 16-digit control number included in your proxy materials.

When

can I join the virtual Annual Meeting? You may begin to log into the meeting platform beginning at 10:45 a.m. Pacific

Time on May 11, 2020. The meeting will begin promptly at 11:00 a.m. Pacific Time on May 11, 2020.

How

can I ask questions and vote? We encourage you to submit your questions and vote in advance by visiting www.proxyvote.com.

Stockholders may also vote and submit questions virtually during the meeting (subject to time restrictions). To participate

in the meeting webcast visit www.virtualshareholdermeeting.com/uber2020. |

|

What

if I lost my 16-digit control number? You will be able to login as a guest. To view

the meeting webcast visit www.virtualshareholdermeeting.com/uber2020 and register

as a guest. If you login as a guest, you will not be able to vote your shares or ask

questions during the meeting.

What

if I don’t have Internet access? Please call 1-877-328-2502 (toll free) or 1-412-317-5419 (international) to

listen to the meeting proceedings. You will not be able to vote your shares or ask questions during the meeting.

What

if I experience technical difficulties? Please call 800-586-1548 (U.S.) or 303-562-9288 (international) for

assistance.

Where

can I find additional information? For additional information about how to attend the Annual Meeting, please see “Additional

Information” on page 74. |

If

there are questions pertinent to meeting matters that cannot be answered during the Annual Meeting due to time constraints, management

will post answers to a representative set of such questions at investor.uber.com. The questions and answers will remain available

until Uber’s 2021 Proxy Statement is filed. We also encourage you to read our Annual Report on Form 10-K available at www.proxyvote.com.

Your

vote is important to us!

Please vote today at www.proxyvote.com

2 2020 Proxy Statement

Letter

from the CEO

Dara

Khosrowshahi

Chief

Executive Officer

|

Dear

Stockholders,

While

this proxy is retrospective and reflects a 2019 full of challenges and accomplishments, today we face our greatest challenge:

the spread of COVID-19, and our collective response to it. We are confident in our ability to weather this crisis and

emerge stronger. Our immediate focus is not just on ourselves, but on how we can play our part in “flattening the

curve” of transmission, and how we can be a vital resource to cities by bringing our network and logistics expertise

to bear.

Our

technology is global, but our presence is hyper-local, so our teams are putting every effort into keeping cities moving

safely, helping healthcare workers and first responders where we can, and powering local commerce and small businesses,

while prioritizing the health and well-being of drivers, delivery people and everyone who uses Uber.

Looking

back, I am proud of what our team accomplished in 2019. We completed a historic initial public offering, raising over

$8 billion in proceeds; our platform grew to over 100 million monthly active platform consumers, generating over $65 billion

in gross bookings; we made critical acquisitions like Careem; and we took big steps forward on safety, including the release

of our industry- first U.S. Safety Report. |

As

we move into our next decade, we are more focused than ever on innovating for our consumers,

continuing to create tremendous economic opportunity for the millions of people earning

on our platform, and relentlessly executing against our strategy to drive sustainable,

and profitable, growth.

I will leave you with something I have constantly said to

the executive leadership team, our managers, and the whole company: at the end of the

day, execution matters most. To execute well, we must lean in to the qualities that have

been core to Uber from day one—tenacity, relentlessness, and grit—while ensuring

that we build diverse teams of exceptionally talented people in the process. This means

creating a culture of “faster, farther, together” driven by ownership, accountability,

and doing the right thing for all of the communities and constituencies we serve.

Today

we must execute not just for our families and our company, but also, most importantly,

for our communities and the cities in which we live and operate.

As

ever, thank you for your continued support as stockholders. It’s an honor to be

on this journey with you. We won’t let you down.

|

| |

|

|

2020 Proxy Statement 3

Letter

from the Chairperson of the Board

Ronald

Sugar

Chairperson

of the Board of Directors

|

Dear

Stockholders,

On behalf of our entire Board, thank you for your investment and continued support of

Uber.

When stockholders have a real voice, and boards have real oversight, everyone benefits. That’s why

best-in-class governance is so important to us at Uber, and why we have worked hard to reshape the governance practices,

composition and independence of our Board and committees as we transitioned last year to become a newly-public company.

Since our IPO we have ensured every share of Uber’s stock comes with equal voting rights, instituted annual

elections of all directors by majority voting, and implemented stock ownership guidelines, along with a clawback policy

and an anti-hedging policy for all executive officers.

Recent director rotations have allowed us to further

strengthen the experience base, independence and diversity of our Board, consistent with our large capitalization public

company position. Eight of the nine directors |

proposed

for election are independent, including the Chairperson, and one third are women. Most

recently, we welcomed Mandy Ginsberg and Robert Eckert to the Board, and we look forward

to drawing on their tremendous expertise as seasoned executives and corporate directors

as we profitably grow Uber in the years ahead.

I

would like to take this opportunity to offer my heartfelt thanks to our colleague Garrett Camp, Uber’s co-founder

and retiring board member, as he transitions into his new roles as board observer and product advisor following the 2020

Annual Meeting. Garrett is a tech innovator and entrepreneur to his core, having conceived and written the original Uber

app. We are grateful for his decade of Board service and look forward to his continuing contributions as our partner going

forward.

Your

Board is excited about the opportunities that lie ahead for this very special company, and we are glad to have you along

for the ride.

|

| |

|

|

4 2020 Proxy Statement

Table

of Contents

2020 Proxy Statement 5

Proxy

Summary

We

believe deeply in our bold mission. Every minute of every day, consumers and Drivers on our platform can tap a button and get

a ride or tap a button and get work. We revolutionized personal mobility with ridesharing, and we are leveraging our platform

to redefine the massive meal delivery and logistics industries. The foundation of our platform is our massive network, leading

technology, operational excellence, and product expertise. Together, these elements power movement from point A to point B.

*

Financial measures in the Proxy Summary and Business and Performance Highlights in this proxy statement, unless otherwise indicated,

are reproduced from our Annual Report on Form 10-K for the year ended December 31, 2019, filed with the SEC on March 2, 2020.

6 2020 Proxy Statement

Proxy Summary

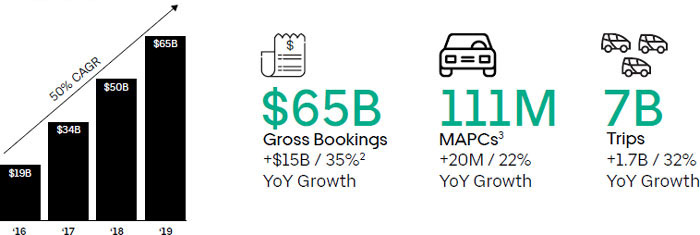

Unparalleled

growth at scale with significant, loyal monthly active users across multiple products & segments1

Gross

Bookings

| (1) |

Gross

Bookings, Trips are FY 2019. MAPCs are as of Q4 2019. |

| (2) |

Gross

Booking YoY growth rates shown in constant currency. |

| (3) |

Monthly

Active Platform Consumers. |

Leveraging

our unique platform assets to launch, scale, and optimize our businesses

Leading

technology

Differentiated,

proprietary demand prediction, dispatching, matching, pricing, routing, and payments technologies are utilized across

all segments

Operational

excellence

Regional

on-the-ground operations enable better support for platform users, enhance relationships with cities and regulators, and

accelerate new product launches

Massive

network

Massive,

efficient, and intelligent; our network becomes smarter with every trip, utilizing data to power movement at the touch of a button |

|

Brand

recognition

Named

a top 100 brand; leverage brand and reach to launch and scale new businesses

Product

expertise

Set

the standard for powering on-demand movement, and provide users with a safe, intuitive, and continuously improving experience

Scale

efficiency

Our

global scale provides significant operational cost and efficiency advantages |

2020 Proxy Statement 7

Proxy Summary

Business

and Performance Highlights

|

(in

millions) |

FY

2019 GAAP

Revenue |

YoY

Change |

FY

2019 Adjusted

Net

Revenue1,2 |

YoY

Change |

| Rides

connect consumers with Drivers who provide rides in a variety of vehicles, such as cars, auto rickshaws, motorbikes,

minibuses or taxis. Rides also includes activity related to our Uber for Business, Financial Partnerships and Vehicle Solutions

offerings. |

$ 10,745 |

14% |

$ 10,622 |

16% |

| Eats

allows consumers to search for and discover local restaurants, order a meal and either pick-up at the restaurant or

have the meal delivered. |

$ 2,510 |

72% |

$

1,383 |

82% |

| Freight

connects carriers with shippers on our platform, and gives carriers upfront, transparent pricing and the ability to

book a shipment. |

$ 731 |

105% |

$

731 |

105% |

| Other

Bets consists of multiple investment stage offerings. The largest investment within the segment is our New Mobility

offering that refers to products that provide consumers with access to rides through a variety of modes, including dockless

e-bikes and e-scooters. It also includes Transit, UberWorks and our Platform Incubator group. |

$ 119 |

* |

$

119 |

* |

| Advanced

Technology Group and Other Technology Programs supports the development and commercialization of autonomous vehicle

and ridesharing technologies, as well as Uber Elevate. |

$ 42 |

* |

$

42 |

* |

| Total |

$ 14,147 |

26% |

$ 12,897 |

25% |

| (1) |

See

Appendix A at the end of this proxy statement for additional information on Key Terms for Our Key Metrics and Non-GAAP Financial

Measures, Definitions of Non-GAAP Financial Measures and Reconciliations of Non-GAAP Financial Measures. |

| (2) |

“Freight

Adjusted Net Revenue”, “Other Bets Adjusted Net Revenue” and “ATG and Other Technology Programs Adjusted

Net Revenue” are equal to GAAP net revenue in all periods presented. |

*Percentage

not meaningful

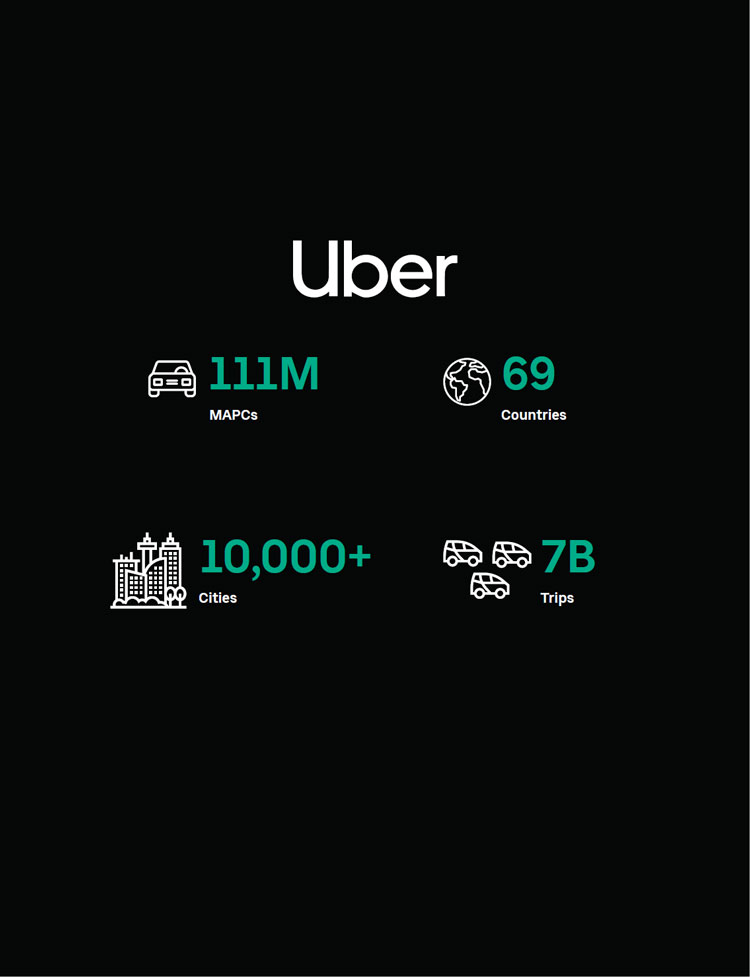

| Gross

Bookings |

Monthly

Active Platform Consumers |

Trips |

$65

Billion

35%

YoY growth on constant currency basis |

111

Million MAPCs

22%

YoY growth |

6.9

Billion

32%

YoY growth |

| Adjusted

Net Revenue |

GAAP

Net Loss / Adjusted EBITDA |

Rides

Adjusted EBITDA |

$12.9

Billion

28%

YoY growth on constant

currency basis |

$(8.5)

Billion**/$(2.7)

Billion |

$2.07 Billion

34%

YoY growth |

** Includes stock-based compensation, including $3.9 billion of stock-based compensation expenses in Q2 2019, primarily due to RSU

expense recognition in connection with our initial public offering.

Note:

All financial and operational measures are for the year ended December 31, 2019 other than MAPCs which are as of Q4 2019. See

Appendix A at the end of this proxy statement for additional information on Key Terms for Our Key Metrics and Non-GAAP Financial

Measures, Definitions of Non-GAAP Financial Measures and Reconciliations of Non-GAAP Measures.

Significant

Progress Achieved Since IPO

| ✓ |

Continued

growth at scale in 2019 with Gross Bookings and Adjusted Net Revenue growing $15B and $2.6B YoY, respectively |

| ✓ |

Improved

or maintained leadership position in key Rides and Eats markets |

| ✓ |

Increased

Take Rate from 19% in Q1 2019 to 21% in Q4 2019 |

| ✓ |

Improved

Adjusted EBITDA margin as a % of Adjusted Net Revenue by 15% from Q1 2019 to Q4 2019; Rides Segment Adjusted EBITDA

of $742M covered Corporate G&A and Platform R&D by $98M in Q4 2019 |

| ✓ |

Continued

product innovation to improve loyalty (Rewards), access new customer segments (Comfort), and provide leading safety features |

| ✓ |

Increased

reporting transparency by reporting Gross Bookings, Adjusted Net Revenue, and EBITDA for our 5 business segments starting

in Q3 2019 |

8 2020 Proxy Statement

Proxy Summary

Nominees

for Board of Directors

You

are being asked to vote on the election of the nine directors listed below. Additional information about each nominee’s

background and experience can be found beginning on page 19.

| |

|

|

|

|

|

|

|

|

Ronald

Sugar †

Former

Chairman and

CEO, Northrop Grumman |

|

|

Ursula

Burns*

Chairman,

and Former

CEO, VEON |

|

|

Robert

Eckert*

Partner,

FFL Partners;

Former CEO, Mattel |

Age:

71

Board

Tenure: 1.6 Years

Committee

Memberships:

Nominating and Governance (Chair);

Compensation |

|

Age:

61

Board

Tenure: 2.4 Years

Committee

Memberships:

Audit;

Nominating and Governance |

|

Age:

65

Board

Tenure: <0.1 Years

Committee Memberships:

Nominating and Governance;

Compensation |

| |

|

|

|

|

|

|

|

|

Amanda

Ginsberg*

Former

CEO, Match

Group

|

|

|

Dara

Khosrowshahi

CEO,

Uber |

|

|

Wan

Ling Martello*

Co-founder

and Partner,

BayPine; Former

Executive Vice President,

Nestlé |

Age:

50

Board

Tenure: 0.1 Years

Committee Memberships:

Audit |

|

Age:

50

Board

Tenure: 2.5 Years

Committee Memberships:

None |

|

Age:

61

Board

Tenure: 2.8 Years

Committee Memberships:

Nominating and Governance;

Compensation |

| |

|

|

|

|

|

|

|

|

Yasir

Al-Rumayyan*

Managing

Director,

The Public Investment

Fund

|

|

|

John

Thain*

Former

Chairman and

CEO, CIT Group |

|

|

David

Trujillo*

Partner,

TPG |

Age:

50

Board

Tenure: 3.8 Years

Committee Memberships:

Audit |

|

Age:

64

Board

Tenure: 2.4 Years

Committee Memberships:

Audit (Chair) |

|

Age:

44

Board

Tenure: 2.7 Years

Committee Memberships:

Nominating and Governance;

Compensation (Chair) |

Note:

Age and Board tenure measured as of March 30, 2020

† Independent Chairperson of the Board

* Independent Director

2020 Proxy Statement 9

Proxy Summary

Corporate

Governance Highlights

We strive to maintain the highest governance standards

in our business. Our commitment to effective corporate governance is illustrated by the following practices:

✓

What

We Do

· Independent chairperson

· Look for qualified women and underrepresented minorities for every open Board seat

· Fully independent Audit, Compensation, and Nominating and Governance Committees that meet at least quarterly

· Annual elections for all directors

· Directors elected by majority vote in uncontested elections

· Board oversight of management succession planning

· Board, committee, and individual director evaluation process

· Stock ownership guidelines for directors and executive officers

· Clawback policy in our executive compensation program

· Incorporate Safety and D&I metrics into executive

compensation

|

✕

What

We Don’t Do

· Dual class stock

· Allow hedging of Uber stock by directors or employees

· Allow pledging of Uber stock by directors

or employees for margin loans or similar speculative transactions

· Have a shareholder rights plan (“poison pill”)

· Have

a classified board |

10 2020 Proxy Statement

Proxy Summary

Executive

Compensation Highlights

We

are focused on our mission of igniting opportunity by setting the world in motion. We operate in rapidly evolving and highly competitive

markets worldwide. To succeed in these environments and execute our strategy of building our platform, we must increase the scale

of our global network, continue to develop and update our technology, use our product expertise and operational excellence, invest

in new offerings on our platform, partner with other cities, and encourage our executives to model and reinforce our cultural

norms while successfully accomplishing our long-term strategic goals.

Objectives.

Our executive compensation program is designed to achieve the following objectives:

|

Attract

and retain a highly talented team of executives who possess and demonstrate strong leadership, exceptional followership, and world-class

management capabilities. |

|

Align

the executive officer’s incentives with Company performance and the interests of our stockholders. |

|

Reward

our executive officers for their performance and to motivate them to achieve the Company’s short- and long-term

strategic goals. |

|

Promote

doing the right thing, working tirelessly to earn the trust of our consumers and users, acting like owners, valuing ideas

over hierarchy, making big bold bets, and celebrating our differences and drive to harness the power of global technology

in achieving Company success. |

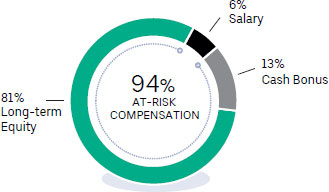

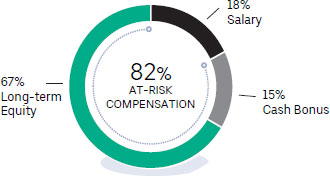

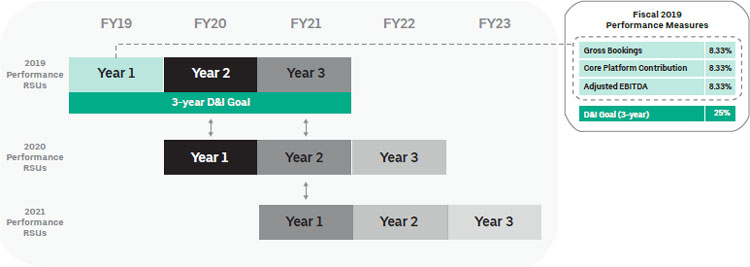

Compensation

Structures and Incentive Program Links to Strategy. As illustrated in the charts below, and as further discussed in “Compensation

Discussion and Analysis” in this proxy statement, our primary focus in compensating executives is on the long-term elements

of target total direct compensation. Under our executive compensation program, over 90% of Mr. Khosrowshahi’s 2019 target

total direct compensation (excluding his sign-on award) was variable and at risk, and on average, over 80% was variable and at

risk for our other named executive officers (“NEOs”).

CEO

Target Compensation

|

Other

NEOs Average Target Compensation

|

|

|

The

Compensation Committee aims to align executive interests with long-term stockholder value creation and to link compensation to

the key drivers of our business. The Committee annually reviews individual executive officer compensation, including our cash-based

and equity- based incentive compensation programs, to ensure that the interests of our senior management team continue to align

with those of our stockholders.

2020 Proxy Statement 11

Proxy Summary

Investor

Engagement Efforts

We

believe effective corporate governance includes constructive conversations with our stockholders on topics such as strategy, operating

performance, corporate governance, executive compensation, environmental sustainability, and corporate responsibility and social

impact issues, and that these conversations drive increased corporate accountability, improve decision-making, and ultimately

create long-term stockholder value. Our Nominating and Governance Committee is expected to provide guidance no less than annually

to our board of directors and senior management about the framework for our board of directors’ oversight of, and involvement

in, stockholder engagement.

Even

before becoming a publicly-traded company, our senior management team worked to establish and implement a culture of transparency,

by regularly engaging with our stockholders and providing updates on our financial and business performance. As we approached

our initial public offering in 2019, we substantially reshaped our corporate governance structure, policies, and procedures based

on input from our stockholders. Since then, we have also engaged our largest stockholders and other key constituents on areas

of interest related to corporate governance and specific concerns for this proxy season.

We

believe these engagement efforts with our stockholders will allow us to better understand our stockholders’ priorities and

perspectives and provide us with useful input concerning our corporate strategy, our compensation, and corporate governance practices.

| |

|

|

|

In

2019

Held

calls and meetings

with over 75% of our top

100

stockholders since our IPO in May 2019

Engaged

with all of our

top 50 stockholders,

representing over 70%

of

shares outstanding

|

|

How

we engaged with

investors

|

| |

|

We

invited our largest investors to discuss any topics they desire |

| |

|

|

| |

|

We

regularly reported our investors’ views to our Board of Directors

|

| |

|

|

| |

|

We

engaged with analysts through quarterly conference calls, our investor relations

website, and meetings and calls

|

| |

|

|

| |

|

Our

Chairperson of the Board

participated

in investor outreach

|

| |

|

Topics

discussed with our

investors

|

| › |

sustainable

growth rate |

| › |

path

to profitability |

| › |

capital

allocation |

| › |

regulatory

issues |

| › |

geographic

strategy |

| › |

governance

and financial performance of the company |

| › |

our

executive compensation program, the say-on-pay proposal, and other agenda items for the annual meeting |

| › |

ESG

and sustainability matters |

| › |

strategy

and risk management, including cyber risk, Board composition and succession, and increasing Board diversity |

| › |

recent

improvements in our disclosures |

12 2020 Proxy Statement

Proxy Summary

Our

Cultural Norms

Our

leadership team has sought to fundamentally reform our workplace culture by improving our governance structure,

strengthening our compliance program, creating and embracing new cultural norms, committing to Diversity and Inclusion

(“D&I”), and rebuilding our relationships with employees, Drivers, consumers, cities, and regulators. We

embrace the future with optimism, and we work towards our mission based on eight cultural norms. Our team came together to

write these cultural norms from the ground up to reflect who we are and where we are going:

We

do the right thing |

Period. |

We

build globally, we live locally |

We

harness the power and scale of our global operations to deeply connect with the cities, communities, Drivers, and riders

that we serve every day. |

We

are customer obsessed |

We

work tirelessly to earn our customers’ trust and business by solving their problems, maximizing their earnings,

or lowering their costs. We surprise and delight them. We make short- term sacrifices for a lifetime of loyalty. |

We

celebrate differences |

We

stand apart from the average. We ensure people of diverse backgrounds feel welcome. We encourage different opinions and

approaches to be heard, and then we come together and build. |

We

act like owners |

We

seek out problems, and we solve them. We help each other and those who matter to us. We have a bias for action and accountability.

We finish what we start, and we build Uber to last. And when we make mistakes, we’ll own up to them. |

We

persevere |

We

believe in the power of grit. We don’t seek the easy path. We look for the toughest challenges, and we push. Our

collective resilience is our secret weapon. |

We

value ideas over hierarchy |

We

believe that the best ideas can come from anywhere, both inside and outside our company. Our job is to seek out those

ideas, to shape and improve them through candid debate, and to take them from concept to action. |

We

make big bold bets |

Sometimes

we fail, but failure makes us smarter. We get back up, we make the next bet, and we go! |

2020 Proxy Statement 13

Proxy Summary

Moving

Everyone Forward

| |

|

|

“People

say it’s good, this is the first time we see Saudi women driving. I feel happy transferring my knowledge to other women

who will then also pass it on. It is the pinnacle of happiness. I would like to put my mark on the beginning of the history

of women driving in Saudi Arabia.”

Badriyah

Driver / Riyadh |

|

|

| |

|

|

“For

me, driving brings freedom and independence and I think it’s very important for women to fight for empowerment. Not

just in Brazil, but all over the world.”

Glaucia

Driver / Sao Paulo |

|

|

| |

|

|

“If

I see someone with a suitcase I open the trunk, grab the suitcase. It’s just the way I am, It’s all in a days

work. I don’t think it gets much better. Only thing I’d rather be doing than driving is playing

golf.”

Jerry

Driver / Los

Angeles |

|

|

| |

|

|

“Delivery

service in New York, it’s a necessity. I’m doing God’s work out here, feeding people!”

Sunny

Driver / New York City |

|

|

14 2020 Proxy Statement

Proxy Summary

Our

Commitment to Cities, Employees, and Drivers

The

following highlights our commitment to cities, Drivers, and employees and exemplifies how we integrate our cultural norms internally

and extend them externally with just a few of our stakeholders:

Cities

Our

leadership team is committed to using a proactive and collaborative approach with cities and regulators. As a result, we are rebuilding

and strengthening our relationships with cities and regulators around the world, and engaging in an ongoing, constructive dialogue.

For example:

| · |

Actively

worked in Berlin and Munich with regulators to introduce eco-friendly products, such as dockless e-bikes and our all-electric

vehicle product, Uber Green, to help those cities decrease air pollution, reduce urban congestion, and increase access to

clean transportation options. |

| · |

Announced

a Clean Air Plan in London designed to play a part in helping to reduce congestion in London, including by helping Drivers

upgrade to cleaner vehicles. |

| · |

Expanded

our active partnerships with public transport agencies, including the Massachusetts Bay Transportation Authority and Dallas

Area Rapid Transit, to offer even more first and last mile, late night rides, paratransit, and microtransit programs. |

| · |

Launched

Public Transit Journey Planning in our app in 14 markets in 2019 in partnership with Moovit to enable riders to plan their

journey with transit. |

| · |

Partnered

with Shared Streets, a non-profit focused on curbside management in collaboration with cities, in support of pilots in cities

including Washington DC, Pittsburgh, Toronto, Los Angeles, Minneapolis, Seattle, Chicago, Boston, and San Francisco, in addition

to pilots that we initiated on our own to reduce congestion and improve travel efficiency across all mode. |

| · |

Expanded our

Uber Movement offering, a data visualization tool, to help cities with urban planning and informed decision-making. |

| · |

Launched rider

bike lane alerts, to build awareness of rider and cyclist safety when drop-off occurs on a road with a bike lane. |

Employees

Our

leadership team remains focused on fundamentally reforming our workplace culture and embracing our cultural norms. Examples of

our programs and associated efforts to set, reinforce, and embrace our values internally include:

| · |

Engaging

in an awareness campaign regarding our mission and cultural norms, including publicly releasing our annual diversity report

since 2017. |

| · |

Soliciting

feedback from our employees through our culture survey and instituting action plans based on the survey results, including

an equal and expanded parental leave policy for all parents regardless of gender or caregiver status. |

| · |

Putting

our cultural norms in action by expanding the number of Employee Resource Groups (ERGs) to 12 and the number of ERG members

to over 12,000 as of December 31, 2019. |

Drivers

Our

leadership team is also focused on strengthening our commitment to Drivers through initiatives including:

| · |

Scaled Uber

Pro, a program which rewards and recognizes Drivers for their commitment and quality, to over 3.8 million Drivers globally. |

| · |

Scaled

access to tuition-free college education through Uber Pro, with over 6,000 Drivers and their family members having enrolled

in ASU Online in college degree programs as well as certificate courses in Entrepreneurship and English Language learning

as of the end of 2019. |

| · |

Launched

Appreciation Award & Stock Purchase Program in advance of our IPO, giving $300M in cash appreciation awards to qualifying

Drivers and providing the option to them to purchase Uber stock in our IPO. |

| · |

Launched

the Driver Beta Program in the U.S., providing Drivers access to the beta app allowing them to try new product features, file

tickets with our engineering team, and provide feedback to Uber directly. |

| · |

Rolled

out upfront trip information to the majority of Eats Drivers in the U.S. providing more trip information including trip fare,

estimated time and location prior to accepting the trip. |

2020 Proxy Statement 15

Proxy Summary

Environmental,

Social, and Governance Highlights

We strive to set ambitious goals and make strategic

investments to advance our corporate responsibility and sustainability, improve our D&I and have a positive social impact

on the communities in which we operate. Below are some additional metrics against which we measure our progress with respect to

corporate responsibility and sustainability and progress we have made in 2019.

| Metric |

Progress

in 2019 |

| Employee

Engagement |

·

Over 90% of our employees participated in our company-wide Pulse Survey in June 2019 (formerly Culture Survey).

·

Key strengths included:

·

mission with 84.5% (+7.6% vs. 2018) favorable on passion for Uber’s mission;

·

pride with 82.5% (+5.9% vs. 2018) feeling pride working at Uber; and

·

attrition risk with 60.4% (+7.3% vs. 2018) intending to stay at Uber even if offered similar compensation and benefits

at another company. |

| Safety |

· Added

RideCheck for both riders and Drivers complementing existing safety features such as the Safety Toolkit, ShareTrip and

Emergency Button. Using sensors and GPS data, RideCheck can help detect if a trip goes unusually off-course or a possible

crash has occurred and alerts us to such events so we can check in and offer tools to get help.

· Released

our first U.S. Safety Report in 2019. The Safety Report is the first comprehensive publication of its kind, sharing details

on Uber’s safety progress, processes, and data related to reports of the most serious safety incidents occurring on our

platform. |

| Diversity

& Inclusion / Social Impact |

·

Issued our diversity report for the third consecutive year.

·

Won multiple awards recognizing our D&I efforts including a Best Place to Work by the Disability Equality Index and

Human Rights Campaign.

·

Launched a comprehensive Global Self-ID campaign inclusive of 8 diversity dimensions across all our countries to create

a more holistic picture of our workforce to better measure our D&I efforts and a sponsorship pilot program to address

retention and advancement of women and underrepresented minorities.

·

Created a Social Impact team dedicated to using our technology and resources to help remove barriers that block people

from pursuing opportunity. |

| Carbon

Impact |

·

Developed energy reduction programs in our workplaces and data centers in the U.S. to track our carbon footprint.

·

Pledged to match 100% of our US electricity consumption in our workplaces with renewable energy by 2025. |

| Transparency |

·

Committed to publicly disclose the environmental impact of rides on Uber’s platform and plan to disclose two key metrics:

travel efficiency and carbon intensity. |

| Data

Privacy |

·

Launched a privacy champions program company-wide, educating employees from across business units to advocate and serve as

a privacy resource for their team and assist in moving products and services to the privacy impact assessment process. |

| Community

Impact |

·

Held Spring and Fall Weeks of Service, supporting over 645 events in 100 cities with 7,600 employees participating representing

a fifth of the workforce.

·

Announced additional new partnerships that span five continents and sixteen countries to support survivors and help prevent

gender-based violence. |

| Human

Capital Management |

·

Over 6,000 drivers and their family members have enrolled in ASU Online through our Uber Pro program in college degrees

courses or certificate courses including in Entrepreneurship and English language.

·

Launched a pilot partnership to train former Drivers as software engineers and onboarded first class of interns in fall

of 2019. |

16 2020 Proxy Statement

Proxy Summary

Social

Responsibility

We

recognize the importance of positively impacting the communities we operate in and serve. Efforts in environmental sustainability,

community service, D&I, and social impact all play an important role in both positively impacting communities and creating

long-term value for our stockholders.

| ✓ |

Committed

to publicly disclose environmental impact of rides on Uber’s platform by disclosing two key metrics: travel efficiency

and carbon intensity. |

| ✓ |

Pledged to match

100% of our U.S. workplace electricity consumption with renewable energy by 2025. |

| ✓ |

Expanded Uber

Transit, which we believe will support cities and increase car-free travel. |

| ✓ |

Expanded

our electric vehicle efforts with partnerships across dozens of cities globally, including with urban fast-charging efforts

EVgo and Powerdot. |

| ✓ |

Launched a Clean

Air Plan in London with a goal of ensuring every car on Uber’s platform in that city is electric by 2025. |

| ✓ |

Grew

to 17 Green Teams across the company focused on educating employees on environmental sustainability and identifying opportunities

for positive environmental changes including volunteer initiatives. |

Community

Impact

|

|

|

| |

|

|

Committed

over $1 million in cash

and in-kind

contributions to help

tackle hunger in connection with a

partnership with Feeding America.

|

Our

Community Impact Initiative provided

grants to over 70

non-profits to offer

rides to people in need. |

Announced

partnerships in five

continents and

16 countries to support

survivors

and help prevent gender-based

violence; committing to provide an

additional $2.5

million in funding to non-

profit organizations to help prevent sexual

violence

before it begins. |

|

|

|

| |

|

|

Supported

over 645 community

service events in 100 cities

with

7,600 employees participating

during a Fall and Spring Week of

Service. |

|

Partnered

with African Management

Institute to offer development

and

entrepreneurship programs in South

Africa and Kenya including to women

drivers. |

Awards

and Recognition in 2019

2020 Proxy Statement 17

Proxy Summary

Voting

Agenda

| |

|

|

|

|

| Proposal

1 |

Election

of Directors

The

Board of Directors recommends a vote FOR each of the following director nominees to hold office until the 2021 annual

meeting of stockholders and until their successors are elected. |

|

✓ |

Our

Board

recommends a

vote FOR each nominee |

| |

|

See

page 19

for more information |

| |

|

|

|

|

| |

|

|

|

|

| Proposal

2 |

Advisory

Vote to Approve 2019 Named Executive Officer Compensation

The

Board of Directors recommends a vote “for” the approval, on a non-binding advisory basis, of the 2019 compensation

of our NEOs (the “say-on-pay vote”). |

|

✓ |

Our

Board

recommends a

vote FOR the say-on-pay

vote |

| |

|

See

page 69

for

more information |

| |

|

|

|

|

| |

|

|

|

|

| Proposal

3 |

Advisory

Vote to Approve the Frequency of the Advisory Vote on Executive Compensation

The Board of Directors recommends a vote, on a

non-binding advisory basis, for future stockholder advisory votes on NEO compensation to be held every year. |

|

✓ |

Our

Board

recommends a

vote FOR annual vote |

| |

|

See

page 70

for

more information |

| |

|

|

|

|

| |

|

|

|

|

| Proposal

4 |

Ratification

of Appointment of Independent Registered Public Accounting Firm

The

Board of Directors recommends a vote “for” the ratification of the appointment of PricewaterhouseCoopers LLP

as the company’s independent registered public accounting firm for 2020. |

|

✓ |

Our

Board

recommends a

vote FOR ratification |

| |

|

See

page 71

for

more information |

| |

|

|

|

|

18 2020 Proxy Statement

Proposal

1 — Election of Directors

Our

board of directors has nominated the nine director nominees listed below for election at the 2020 Annual Meeting. Each of the

director nominees currently serves on the board. The current term of all directors will expire at the 2020 Annual Meeting when

their successors are elected, and the board has nominated each of these individuals for a new one-year term that will expire at

the 2021 annual meeting when their successors are elected. |

|

Each

of the director nominees identified in this proxy statement has consented to being named as a nominee in our proxy materials

and has accepted the nomination and agreed to serve as a director if elected by the Company’s stockholders. If any

nominee becomes unable or for good cause unwilling to serve between the date of the proxy statement and the 2020 Annual

Meeting, the board may designate a new nominee, and the persons named as proxies will vote on that substitute

nominee. |

| Name |

Age |

Position |

| Ronald

Sugar(1)(2) |

71 |

Independent

Chairperson of the Board of Directors |

| Ursula

Burns(2)(3) |

61 |

Director |

| Robert

Eckert(1)(2) |

65 |

Director |

| Amanda

Ginsberg(3) |

50 |

Director |

| Dara

Khosrowshahi |

50 |

Director

and CEO |

| Wan

Ling Martello(1)(2) |

61 |

Director |

| Yasir

Al-Rumayyan(3) |

50 |

Director |

| John

Thain(3) |

64 |

Director |

| David

Trujillo(1)(2) |

44 |

Director |

| (1) |

Compensation

Committee member. |

| (2) |

Nominating

and Governance Committee member. |

| (3) |

Audit

Committee member. |

2020 Proxy Statement 19

Proposal 1: Election of Directors

Director

Nominees

The

board of directors recommends a vote FOR each of the following director nominees to hold office until the 2021 annual meeting

of stockholders and until their successors are elected.

Ronald

Sugar

Age:

71

Former

Chairman

and CEO, Northrop

Grumman

Other

Public

Company Boards:

Apple, Inc.

Amgen

Inc.

Chevron

Corporation

Air Lease Corporation*

*will

not stand for

re-election

to Air Lease

Board in May 2020

|

Biography

Dr.

Sugar has served as the chairperson of our board of directors since July 2018. Dr. Sugar was Chairman of the board of

directors and Chief Executive Officer of Northrop Grumman Corporation, a global aerospace and defense company, from 2003

until his retirement in 2010 and President and Chief Operating Officer from 2001 until 2003. He was President and Chief

Operating Officer of Litton Industries, Inc. from 2000 until the company was acquired by Northrop Grumman Corporation in

2001. Prior to that time, he served as Chief Financial Officer of TRW Inc. Dr. Sugar is also an adviser to Ares Management

LLC, Bain & Company, Northrop Grumman Corporation, and Singapore’s Temasek Investment Company. Dr. Sugar is a

trustee of the University of Southern California, board of visitors member of the University of California, Los Angeles

Anderson School of Management, past Chairman of the Aerospace Industries Association, and a member of the National Academy of

Engineering. Dr. Sugar has been a director of Amgen Inc. since 2010, Apple Inc. since 2010, Air Lease Corporation since 2010,

and Chevron Corporation since 2005. Dr. Sugar has notified the board of directors of Air Lease Corporation that he will not

stand for reelection to its board of directors at its annual meeting of stockholders in May 2020.

Qualifications

Dr.

Sugar was selected to serve on our board of directors because of his experience as the leader of a global company, particularly

as Chairman of the Board and Chief Executive Officer of Northrop Grumman Corporation, his innovation, technology, and high-growth

experience, consumer and digital experience, particularly his experience on Apple’s board of directors, his financial expertise,

and his government, policy, and regulatory experience. |

Ursula

Burns

Age:

61

Chairman

and Former

CEO, VEON

Other

Public

Company Boards:

VEON, Ltd.

Nestle

S.A.

Exxon

Mobil

|

Biography

Ms.

Burns has served on our board of directors since September 2017. Ms. Burns has served as the Chairman of VEON, Ltd., an

international telecommunications and technology company, since December 2018. She served as the Chairman of VEON, Ltd. from

July 2017 to March 2018, as Executive Chairman from March 2018 to December 2018 and as Chief Executive Officer of VEON, Ltd.

from December 2018 to March 2020. Ms. Burns served as Chairman of Xerox Corporation, a print technology and work solutions

company, from July 2009 to May 2017, and Chief Executive Officer of Xerox Corporation from July 2009 to December 2016, prior

to which she advanced through many engineering and management positions after joining the company in 1980. U.S. President

Barack Obama appointed Ms. Burns to help lead the White House national program on Science, Technology, Engineering and Math

(STEM) from 2009 to 2016, and she served as chair of the President’s Export Council from 2015 to 2016 after service as

vice chair from 2010 to 2015. Ms. Burns currently serves on the board of directors of VEON, Ltd., Nestlé S.A., and

Exxon Mobil Corporation. Ms. Burns previously served on the board of directors of American Express Company from January 2004

to May 2018 and Xerox Corporation from April 2007 to May 2017.

Qualifications

Ms.

Burns was selected to serve on our board of directors because of her experience as the leader of a global company, particularly

her experience as Chairman and Chief Executive Officer of Xerox, her technology and digital experience, her financial

expertise, and her government, policy, and regulatory experience. |

20 2020 Proxy Statement

Proposal 1: Election of Directors

Robert

Eckert

Age:

65

Partner,

FFL Partners,

LLC; Former CEO,

Mattel, Inc.

Other

Public

Company Boards:

Amgen, Inc.

Levi

Strauss & Co.

McDonald’s Corporation |

Biography

Mr.

Eckert has served on our board of directors since March 2020. Mr. Eckert has been an Operating Partner of FFL Partners, LLC,

a private equity firm, since September 2014. Mr. Eckert is also Chairman Emeritus of Mattel, Inc., a role he has held since

January 2013. He was Mattel’s Chairman and Chief Executive Officer from May 2000 until December 2011, and he continued

to serve as its Chairman until December 2012. He previously worked for Kraft Foods, Inc. for 23 years, and served as

President and Chief Executive Officer from October 1997 until May 2000. From 1995 to 1997, Mr. Eckert was Group Vice

President of Kraft Foods, and from 1993 to 1995, Mr. Eckert was President of the Oscar Mayer foods division of Kraft Foods.

Mr. Eckert is currently a director of McDonald’s Corporation, Amgen, Inc., Levi Strauss & Co., Eyemart Express

Holdings, LLC, Enjoy Beer Holdings, LLC, and Quinn Company.

Qualifications

Mr.

Eckert was selected to serve on our board of directors due to his leadership experience as a chief executive officer of large

global public companies and his extensive experience leading global consumer brands at Mattel and Kraft and financial expertise

as a partner of FFL Partners, LLC and his government, policy and regulatory experience. |

Amanda

Ginsberg

Age:

50

Former

CEO, Match

Group, Inc.

Other

Public

Company Boards:

J.C. Penney Company |

Biography

Ms.

Ginsberg has served on our board of directors since February 2020. Ms. Ginsberg previously served as Chief Executive Officer

of Match Group, Inc. from December 2017 to March 2020. Prior to this role, Ms. Ginsberg served as Chief Executive Officer

of Match Group Americas from December 2015 to December 2017, where she was responsible for the Match U.S. brand, Match

Affinity Brands, OkCupid, PlentyOfFish, ParPerfeito and overall North and South American expansion. Previously, she served

as the Chief Executive Officer of The Princeton Review from July 2014 to December 2015, where she expanded its services

to include online services, including tutoring and college counseling for a new generation of students. Ms. Ginsberg has

served on the board of directors of J.C. Penney Company, Inc. since July 2015. Ms. Ginsberg previously served on the board

of directors of Care.com from February 2012 to December 2014 and Match Group, Inc. from December 2017 to March 2020.

Qualifications

Ms.

Ginsberg was selected to serve on our board of directors principally based on her extensive operational, innovation and

high-growth experience with consumer and digital companies and global company leadership, including serving as CEO of

a leading provider of Internet-based dating products and a leading test preparation company and on-demand learning solutions

company. |

Dara

Khosrowshahi

Age:

50

CEO,Uber

Other

Public

Company Boards:

Expedia Group

|

Biography

Mr.

Khosrowshahi has served as our Chief Executive Officer and as a member of our board of directors since September 2017. Prior

to joining Uber, Mr. Khosrowshahi served as President and Chief Executive Officer of Expedia, Inc., an online travel company,

from August 2005 to August 2017. From August 1998 to August 2005, Mr. Khosrowshahi served in several senior management roles

at IAC/InterActiveCorp, a media and internet company, including Chief Executive Officer of IAC Travel, a division of

IAC/InterActiveCorp, from January 2005 to August 2005, Executive Vice President and Chief Financial Officer of

IAC/InterActiveCorp from January 2002 to January 2005, and as IAC/InterActiveCorp’s Executive Vice

President, Operations and Strategic Planning, from July 2000 to January 2002. Mr. Khosrowshahi worked at Allen &

Company LLC from 1991 to 1998, where he served as Vice President from 1995 to 1998. Mr. Khosrowshahi currently serves on the

board of directors of Expedia Group. Mr. Khosrowshahi previously served as a member of the supervisory board of trivago,

N.V., a global hotel search company, from December 2016 to September 2017, and previously served on the board of directors

for the following companies: The New York Times Company, a news and media company, from May 2015 to September 2017, and

TripAdvisor, Inc., an online travel company, from December 2011 to February 2013.

Qualifications

Mr.

Khosrowshahi was selected to serve on our board of directors based on the perspective and experience he brings as our

Chief Executive Officer, as a former leader of Expedia, a global company, his innovation, technology, and high- growth

experience, consumer and digital experience, and his financial expertise. |

2020 Proxy Statement 21

Proposal 1: Election of Directors

Wan

Ling Martello

Age:

61

Co-founder

and

Partner, BayPine;

Former Executive Vice

President, Nestlé

Other

Public

Company Boards:

Alibaba Group |

Biography

Ms.

Martello has served on our board of directors since June 2017. Ms. Martello currently serves as a partner and co- founder at

BayPine, a private equity firm, a role she has held since February 2020. From May 2015 to December 2018, Ms. Martello served

as Executive Vice President and Chief Executive Officer of the Asia, Oceania, and sub-Saharan Africa regions at Nestlé

S.A., a Swiss multinational food and beverage company. From April 2012 to May 2015, Ms. Martello served as

Nestlé’s global Chief Financial Officer, and from November 2011 to April 2012 she served as Nestle’s

Executive Vice President of Finance and Control. From November 2005 to November 2011, Ms. Martello was a senior executive at

Walmart Stores, Inc., a retail corporation, where she served as Executive Vice President, Chief Operating Officer for Global

eCommerce, and Senior Vice President, Chief Financial Officer & Strategy for Walmart International. Prior to Walmart, Ms.

Martello was the CFO and then President, U.S.A., at NCH Marketing Services, Inc., a marketing services company, from 1998 to

2005. Prior to NCH Marketing, Ms. Martello held various positions at Borden Foods and at Kraft Inc. (now known as the Kraft

Heinz Company). Ms. Martello has served on the board of directors of Alibaba Group since September 2015.

Qualifications

Ms.

Martello was selected to serve on our board of directors because of her experience as a senior executive of Nestlé, a global

company, her consumer experience as a director of Alibaba, her financial expertise as the Chief Financial Officer at Nestlé,

and her global experience. |

Yasir

Al-Rumayyan

Age:

50

Managing

Director, The

Public Investment Fund

Other

Public

Company Boards:

Saudi Arabian Oil

Company

SoftBank Group Corp. |

Biography

H.E.

Al-Rumayyan has served on our board of directors since June 2016. H.E. Al-Rumayyan has been a managing director at The

Public Investment Fund, a sovereign wealth fund owned by Saudi Arabia, since September 2015. Prior to The Public Investment Fund, H.E. Al-Rumayyan held the position of Chief Executive Officer at Saudi

Fransi Capital, a financial services company, from January 2011 to February 2015. From April 2008 to December 2010, H.E

Al-Rumayyan served as Director of Corporate Finance of the Capital Market Authority of Saudi Arabia. H.E Al-Rumayyan currently

serves on the board of directors of The Public Investment Fund of Saudi Arabia, the Saudi Arabian Oil Company, Saudi Industrial

Development Fund, Saudi Decision Support Center, Sanabil Investments, Arm Limited, and SoftBank Group Corp. H.E Al-Rumayyan

previously served on the board of directors of Saudi Fransi Capital from January 2011 to February 2015 and Tadawul, the

Saudi Stock Exchange, from February 2014 to January 2015.

Qualifications

H.E. Al-Rumayyan was selected to serve on our board

of directors because of his financial expertise, particularly in his roles at The Public Investment Fund, his extensive

government, policy and regulatory experience highlighted by his time at the Saudi Stock Exchange, and his extensive leadership

experience in the Middle East. |

22 2020 Proxy Statement

Proposal 1: Election of Directors

John

Thain

Age:

64

Former

Chairman and

CEO, CIT Group

Other

Public

Company Boards:

None |

Biography

Mr.

Thain has served on our board of directors since September 2017. Mr. Thain is the founding partner of Pine Island Capital

Partners LLC, a private investment firm, and has served as Chairman since October 2017. Mr. Thain served as Chairman and

Chief Executive Officer of CIT Group, from February 2010 until March 2016, and as Chairman of CIT Group until May 2016. In

January 2009, prior to joining CIT Group, Mr. Thain was President of Global Banking, Securities and Wealth Management for

Bank of America. From December 2007 to January 2009, prior to its merger with Bank of America, Mr. Thain was Chairman and

Chief Executive Officer of Merrill Lynch & Co., Inc. From June 2006 to December 2007, Mr. Thain served as Chief Executive

Officer and a director of NYSE Euronext, Inc. following the NYSE Group and Euronext N.V. merger. Mr. Thain joined the New

York Stock Exchange in January 2004, serving as Chief Executive Officer and a director. From June 2003 through January 2004,

Mr. Thain was the President and Chief Operating Officer of The Goldman Sachs Group Inc., and from May 1999 through June 2003

he was President and Co-Chief Operating Officer. From December 1994 to March 1999, Mr. Thain served as Chief Financial

Officer and Head of Operations, Technology and Finance, and from July 1995 to September 1997 he was also Co-Chief Executive

Officer for European operations for The Goldman Sachs Group, L.P. Mr. Thain currently serves on the Supervisory Board of

Deutsche Bank AG. Mr. Thain previously served on the board of directors of Goldman Sachs Group Inc. from 1998 to January

2004.

Qualifications

Mr.

Thain was selected to serve on our board of directors because of his experience as Chief Executive Officer of several

global companies, his financial expertise from his roles at CIT Group, Merrill Lynch, and NYSE Euronext, and his government,

policy, and regulatory experience. |

David

I. Trujillo

Age:

44

Partner,

TPG

Other

Public

Company Boards:

None |

Biography

Mr.

Trujillo has served on our board of directors since June 2017. Mr. Trujillo is a Partner of TPG, a private equity firm with

$119 billion in assets under management, and leads TPG’s Internet, Digital Media and Communications investing efforts

across TPG Capital and TPG Growth and is the Managing Partner of TPG Tech Adjacencies and Integrated Media Co. Prior to

joining TPG in 2006, Mr. Trujillo was with GTCR, a Chicago based private equity fund, from 1998 through 2005. Mr. Trujillo is

currently a Director of the following non-public companies: Astound Broadband, Azoff Music Company, Calm, Creative Artists

Agency (CAA), Entertainment Partners, Ipsy, Univision Communications and Vice Media. Mr. Trujillo led TPG’s investments

in Airbnb and Spotify. Mr. Trujillo previously served on the boards of Layer3 TV (sold to T-Mobile in 2018), Lynda.com (sold

to LinkedIn in 2015) and Fenwal Therapeutics (sold to Fresenius SE in 2012).

Qualifications

Mr.

Trujillo was selected to serve on our board of directors, having led TPG’s investment in us in 2013, and because

of his extensive experience in technology, high-growth, consumer, and digital companies, such as Airbnb and Spotify, as

well as his financial expertise as a Partner of TPG. |

Voting

Agreement

Each

of our current directors, other than Amanda Ginsberg and Robert Eckert, was initially appointed to our board of directors pursuant

to the provisions of a voting agreement between us and certain of our stockholders. This agreement terminated upon the closing

of our initial public offering and each director nominee will be subject to election annually by majority voting at the 2020 Annual

Meeting.

Board

Leadership Structure

Our

corporate governance guidelines provide that the roles of chairperson of the board and CEO must be held by separate persons, and

the chairperson of our board of directors must be independent. Dr. Sugar currently serves as the independent chairperson of our

board of directors. In this role, he provides independent leadership and oversight of the board of directors and serves as a liaison

between our board of directors and senior management. An independent chairperson helps enable independent directors to raise issues

and concerns to the independent chairperson for consideration by our board of directors before involving senior management.

2020 Proxy Statement 23

Proposal 1: Election of Directors

Director

Skills, Experience, and Background

Uber has

a diverse set of director skills and experience on the board. Listed below are certain skills and experiences that we consider

important for our board of directors in light of our current business and structure.

| |

Burns |

Camp |

Eckert |

Ginsberg |

Khosrowshahi |

Martello |

Al-Runmayyan |

Sugar |

Thain |

Trujillo |

Total |

Diversity

of Background

Directors with varied genders, ages, ethnicities, races, national

origins, geographical backgrounds, and experiences bring diverse perspectives to the boardroom and foster our culture of valuing

diversity throughout our company. |

· |

|

|

· |

· |

· |

· |

|

|

· |

6 |

Global

Company Leadership

We value leadership experiences of chief executive officers and

operating executives at businesses and organizations that operate on a global scale and face significant competition, utilize

technology, or have other rapidly evolving business models. We value public company board experience. |

· |

· |

· |

· |

· |

· |

· |

· |

· |

|

9 |

Financial

Expertise

Knowledge of financial markets, financing operations and accounting,

and financial reporting processes assists our directors in understanding, advising on, and overseeing our capital structure,

financing, and investing activities, and our financial reporting and internal controls. Directors with a background in business

or corporate development can provide insight into designing and implementing strategies for growing our business. |

· |

|

· |

· |

· |

· |

· |

· |

· |

· |

9 |

Consumer

and Digital Experience

We value directors with a background in the development and improvement

of consumer experiences with a company’s products, services, and brand, including through a digital interface. |

· |

· |

· |

· |

· |

· |

|

· |

|

· |

8 |

Innovation,

Technology, and High-Growth Experience

We believe that experience in identifying and developing emerging

products, technologies, and business models, and generating disruptive innovation is useful for understanding our research

and development strategy, competing technology, and our market segments. |

· |

· |

|

· |

· |

|

|

· |

|

· |

6 |

Government,

Policy, and Regulatory Experience

We interact with governments worldwide and are subject to laws

and regulations in many jurisdictions. Directors who have experience navigating a complex legal and regulatory landscape can

assist our board of directors in fulfilling its strategy and compliance oversight function. |

· |

|

· |

|

|

|

· |

· |

· |

|

5 |

*

Figures above include current members of the board of directors; Garrett Camp, a current member of the board of directors, is

not standing for re-election at the Annual Meeting

Vote

Required and Recommendation of the Board of Directors

To be elected, each director nominee requires the affirmative

vote of the majority of votes properly cast (i.e., the number of shares voted “FOR” the nominee must exceed the number

of shares voted “AGAINST” the nominee). Abstentions and “broker non-votes” will have no effect on the

outcome of the vote.

|

Our board of directors recommends a vote “FOR”

each of the NINE director nominees listed above. |

24 2020 Proxy Statement

Board Operations

Corporate

Governance Policies and Practices

We

strive to maintain the highest governance standards in our business. Our commitment to effective corporate governance is illustrated

by the following practices:

Corporate

Governance Guidelines

Our

corporate governance guidelines embody many of our governance policies, practices, and procedures, which are the foundation

of our commitment to effective corporate governance. The Nominating and Governance Committee will review the corporate

governance guidelines periodically and recommend amendments to our board of directors as appropriate. The corporate governance

guidelines outline the responsibilities, operations, qualifications, and composition of our board of directors, among

other matters. The full text of our corporate governance guidelines is posted on the investor relations page of our website,

www.uber.com. We also intend to disclose on our website any future amendments of our corporate governance guidelines.

Committees

of the Board of Directors

Our

corporate governance guidelines and committee charters require all members of the Audit and Nominating and Governance

Committees to be independent and all members of the Compensation Committee to be independent within one year of the initial

public offering. The Compensation Committee is composed solely of independent directors. The Nominating and Governance

Committee recommends committee composition and committee chairs to the board of directors at least annually. The board

of directors and each committee has the authority to engage, and approve the fees of, independent legal, financial, or

other advisors as they may deem necessary, without consulting with or obtaining the approval of management.

Additional

Board Service

Pursuant

to the corporate governance guidelines, no director may serve on more than four other public company boards or on more than

one other public company board if the director is also our Chief Executive Officer or the chief executive officer of another

public company. The Nominating and Governance Committee may approve exceptions if it determines that the additional service

will not impair the director’s effectiveness as a member of our board of directors.

Majority

Voting for Directors

In

an uncontested election, each director will be elected by a majority of the votes cast. If an incumbent director in an

uncontested election fails to receive the required vote for re-election, our board of directors will evaluate whether it

should accept the director’s resignation, which must be tendered to our board of directors |

|

pursuant

to our governance documents. Our board of directors may consider any factors it deems relevant in deciding whether to

accept a resignation from such director.

Role

of our Board of Directors in Succession Planning

The

responsibilities of our board of directors, or a committee thereof as determined by our board of directors, include

periodically reviewing succession planning for our executive officers, including our Chief Executive Officer. The goal of our

board of directors is to have a long-term and continuing program for effective senior leadership development and succession.

We have a contingency plan in place for emergencies such as the death, disability, or unexpected or sudden departure of an

executive officer.

Annually,

the Board of Directors reviews a succession assessment for our senior leaders including our NEOs. The assessment profiles

each potential NEO successor and includes strengths, opportunities, overall readiness and information regarding

diversity.

Prohibition

on Hedging and Pledging Shares

Our

insider trading policy prohibits our directors and employees from hedging their economic exposures to Uber stock, or using

their Uber stock as collateral for margin loans and other similar speculative transactions.

Stock

Ownership Guidelines

In

an effort to align our directors’ and executive officers’ interests with those of our stockholders, we have

adopted stock ownership guidelines. Within three years of becoming subject to the guidelines, our non-employee directors are

generally expected to hold Uber stock valued at ten times their annual cash retainer. Within five years of becoming subject

to the guidelines, our executive officers are expected to hold Uber stock valued at a multiple of their annual base salaries,

consisting of ten times annual base salary for our Chief Executive Officer and three times annual base salary for our other

executive officers.

Clawback

Policy

Under