Exor Nears $200 Million Investment in Ride-Share Company Via

March 30 2020 - 11:59AM

Dow Jones News

By Cara Lombardo

Exor NV, the holding company of Italy's Agnelli family, is

nearing an investment in ride-share company Via Transportation Inc.

that would mark its first big foray into the technology sector.

Exor plans to invest $200 million in New York-based Via,

according to people familiar with the matter. The investment would

give Exor just under a 9% stake in Via and would value Via at

roughly $2.3 billion, they said. Via had last been valued at

roughly $1 billion in late 2017, according to Pitchbook.

Via would become one of Exor's primary investments alongside

significant stakes in Fiat Chrysler Automobiles NV, Ferrari NV,

Italian soccer club Juventus and the Economist magazine, among

others.

Via was founded in 2012 by Daniel Ramot and Oren Shoval, two

friends who met in the Israeli army, and launched in New York City

the following year. Unlike larger rivals Uber Technologies Inc. and

Lyft Inc., which tend to ferry individual riders, Via's focus is

arranging carpools and partnering with cities, companies and

schools to provide software to make shuttle and public transit

routes more responsive to demand. In some cases, it also operates

the routes.

For example, the company has a contract with the New York City

Department of Education to use its software to plan school-bus

routes, and it operates on-demand vans in cities including

Seattle.

Via, which operates in 70 cities around the world, like many

startups has been focused on expansion and hasn't yet posted a

profit, this person said.

The investment would help Via increase in scale and apply its

platform not just to personal travel but also deliveries, the

people said. It isn't being made with an eye toward combining Via

with one of Exor's automobile holdings, they said.

Exor, run by chairman and CEO John Elkann, previously made a

small investment in Via through its Exor Seeds venture fund,

according to its website. Noam Ohana, who runs Exor Seeds, is

expected to join the board of Via as part of the deal being

discussed, they said.

Like its competitors, Via has suspended shared rides in some

areas in response to the coronavirus pandemic and has retooled some

of its services. For example, it said last week it was partnering

with the Berlin transit system to give rides to health-care workers

in off-hours.

Even before recent widespread shutdowns caused ride numbers to

plummet, Via and other startups faced increased scrutiny from

investors who have become more wary of unprofitable companies in

the wake of WeWork's aborted IPO and last year's disappointing

debuts of Uber and Lyft.

As of Friday, Uber and Lyft were worth roughly $47 billion and

$8.5 billion, respectively, a significant drop from their IPOs. Via

has said its focus on shared rides makes it more sustainable and

less likely to cause congestion than other ride-hailing

services.

The Agnelli family owns 53% of Exor through a holding company

controlled by more than 100 descendants of Mr. Elkann's

great-great-grandfather, who co-founded Fiat at the end of the 19th

century.

Exor owns 30% of Fiat Chrysler, a stake that will be cut in half

when the Italian-American car maker completes its merger with

Peugeot maker PSA Group by early next year. The holding company

also owns 23% of luxury car maker Ferrari, almost two-thirds of

Juventus and 27% of agricultural-equipment maker CNH Industrial

NV.

Exor also owns reinsurer PartnerRe Ltd., which it recently

agreed to sell for roughly $9 billion to French insurer Covéa

Coopérations.

Write to Cara Lombardo at cara.lombardo@wsj.com

(END) Dow Jones Newswires

March 30, 2020 11:44 ET (15:44 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

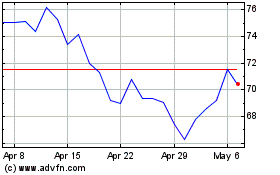

Uber Technologies (NYSE:UBER)

Historical Stock Chart

From Mar 2024 to Apr 2024

Uber Technologies (NYSE:UBER)

Historical Stock Chart

From Apr 2023 to Apr 2024