Is it Worth Investing in Unprofitable Companies? We Ran the Numbers -- Journal Report

March 08 2020 - 11:36PM

Dow Jones News

By Derek Horstmeyer | Graphics by Vanessa Qian

Uber, Pinterest, Peloton, Lyft, Snap -- the list of unprofitable

companies trading on U.S. exchanges is a long one.

In fact, of listings on the New York Stock Exchange and Nasdaq

with at least one year of the relevant earnings data, more than 35%

were unprofitable in their cumulative results for the four quarters

ended Sept. 30, 2019.

While some of these unprofitable companies may be perceived as

disrupters of future business and embraced by certain investors,

most of their shareholders probably don't fully realize the set of

risks they are taking on. Indeed, while there will always be

investors who wind up looking smart for investing in, say, an

Amazon.com, when the chips were down, in most cases the stocks of

unprofitable companies eventually head in one direction: lower.

These companies exhibit greater risk than profitable companies

across the board: Their shares on average return less, are more

volatile and are prone to a type of risk more typically associated

with bonds -- interest-rate risk.

Taking the full set of all NYSE- and Nasdaq-listed companies

disclosing earnings for the past five years, and using the

cumulative net income over the prior four quarters in a given year,

I deemed those with positive net income as "profitable," and those

with negative net income as "unprofitable." To avoid any look-ahead

bias in the data, measures of profitability were based on the year

preceding the start date of any one-year stock returns

calculated.

First, the shares of unprofitable companies have vastly

underperformed those of profitable companies over the past five

years. No surprise there. Among the profitable companies, the

median annualized share return was 16.0%, compared with 4.2% for

the unprofitable firms. This amounts to an annualized difference of

11.8 percentage points.

That the average share return of the unprofitable companies was

positive at all will perhaps surprise some. But this can be

attributed to two things: One, there are a lot of shareholders who

don't want to miss "the next big thing," so they bet on the

riskiest companies; and two, markets are imperfect.

Next up, volatility. Unprofitable companies as a group were far

more volatile than their profitable counterparts. In fact,

volatility for the unprofitable companies was twice as high as it

was for the profitable companies over the past five years (standard

deviation in returns of 59.3% v. 29.2%).

And, finally, interest-rate risk, or, how returns were affected

each time the Fed raised rates. Most equity investors don't pay

that much attention to this data point. Rate increases typically

have more direct consequence for bond investors; when interest

rates rise, the value of bonds purchased earlier tends to fall. For

stocks, meanwhile, although rate increases tend to be seen as

putting an immediate drag on earnings in general, for the five

years I studied, the unprofitable companies showed 50% greater

interest-rate risk than profitable ones.

To be precise, for the 30 days following each of the nine rate

increases in the past five years, the returns of unprofitable

companies fell an average of 2.2%, compared with 0.8% for

profitable companies. This highlights that unprofitable companies

are much more sensitive to Fed rate increases than profitable

compares are.

All in all, even though younger investors might like these

unprofitable companies, the historical evidence paints a much

bleaker picture -- greater interest-rate risk, volatility and

general underperformance all add up to not the best thing to add to

one's portfolio.

Dr. Horstmeyer is an associate professor of finance at George

Mason University's Business School in Fairfax, Va. He can be

reached at reports@wsj.com.

(END) Dow Jones Newswires

March 08, 2020 23:21 ET (03:21 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

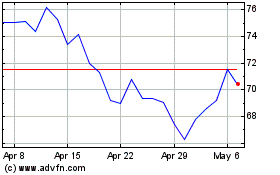

Uber Technologies (NYSE:UBER)

Historical Stock Chart

From Mar 2024 to Apr 2024

Uber Technologies (NYSE:UBER)

Historical Stock Chart

From Apr 2023 to Apr 2024