By Matt Wirz, Paul J. Davies and Sam Goldfarb

High-yield bonds are weathering the coronavirus scare better

than stocks, underscoring the stark difference in investor

expectations that has prevailed for those markets in recent

months.

The prices of many sub-investment-grade bonds rose Tuesday, with

the price of Kraft Heinz Co.'s bonds due in 2046 jumping about 4%,

according to data from MarketAxess. The Dow Jones industrials fell

785.91 points, or 2.9%, on Tuesday, while the S&P 500 dropped

86.86 points, or 2.8%, in its eighth decline in nine trading

sessions.

The S&P 500 has now dropped 11% since its Feb. 19 record

closing high, while the SPDR Bloomberg Barclays High Yield Bond

exchange-traded fund has declined 2.8% since then. For the year,

the S&P 500 is down 7%, and the SPDR Bloomberg Barclays ETF,

known in the market by its ticker symbol, JNK, is down 2.3%.

Though junk-bond issuance remains slow, a few companies are

pushing forward. Cleveland-Cliffs Inc., an iron-ore miner, issued

$725 million of new secured bonds Monday, and Science Applications

International Corp. said Tuesday it would try to sell $400 million

of bonds due in 2028.

The relative stability of below-investment-grade bonds comes

after widespread warnings last year about dangers lurking in

corporate debt. While investors continue to look at developments in

the bond market, many of them say that junk bonds have continued to

be priced conservatively compared with stocks, which have spent

much of the past five years in valuation territory that makes many

buyers uncomfortable.

"One of the reasons we think credit is performing well compared

to stocks is that stocks have been really expensive and pricing in

double-digit earnings growth this year," said Will Smith, a

high-yield portfolio manager at AllianceBernstein.

Rising Treasury bond prices have also given some ballast to the

junk-debt market. The 10-year U.S. Treasury yield fell Tuesday

below 1% intraday for the first time ever before ending the day at

1.005%, an all-time closing low. Lower bond yields mean higher

prices.

The larger the spread between the yield on junk debt and

Treasurys, the more attractive below-investment-grade debt becomes

as an alternative to investors.

"If you're looking at how to generate income in a portfolio when

the 10-year yields below 1%, high yield with spreads approaching

5.50 [percentage points] starts to look much more attractive," said

Robert Hoffman, head of research for the money manager FS

Investments.

Fallout from the coronavirus epidemic has weighed heavily on the

bonds of such firms as the tourism group TUI AG and the energy

company Chesapeake Energy Corp. Average yields increased in the

junk debt market to 6.06% on March 2 from about 5% in mid-February,

according to Bloomberg Barclays Indices data.

Even so, yields are well below levels reached during the selloff

at the end of 2018, when traders and analysts grappled with fears

that the U.S. was headed for recession. Back then the yields on the

Bloomberg Barclays U.S. High Yield Index hit a high of 8.12%.

The market for leveraged loans -- junk-rated debt that is

typically used to fund private-equity deals -- has also experienced

declines, but not as severe as at the end of 2018, according to

data from S&P Global Market Intelligence's LCD loan-research

service. The price of the corporate loans of Uber Technologies Inc.

has dropped about 1% since mid-February, according to Analytics

Data Inc., compared with a roughly 17% drop in the ride-hailing

company's stock.

The extreme tumult in the stock market is making bonds look

relatively safe.

"If you invested in equities, you were up 30% last year, but now

you're down 15% in a week," said Craig Russ, a loan-portfolio

manager at Eaton Vance. "That's why you have fixed income in your

portfolio, to dampen the volatility in equities."

The problem for investors in riskier bonds now centers on

uncertainty about how severe the economic effect of the coronavirus

epidemic will be and how individual investors will react. Heavy

outflows hit mutual funds that invest in high-yield bonds and loans

last week, and although the pace abated in recent days, it could

accelerate again on news of more outbreaks, fund managers said.

Some wonder if the junk-bond market isn't the one that is now

looking too optimistic.

"Equity markets are pricing in a good probability of a mild

recession, but the credit market isn't," said Alberto Gallo, head

of macro strategies at the London-based fund manager Algebris.

"Central bank action will probably cut the recession [risk] so we

don't get a lot of defaults, but we also know that quantitative

easing doesn't lift all boats."

Even so, some see a buying opportunity in junk bonds as prices

fall from these levels.

Mark Benbow, investment manager for high yield at Kames Capital,

is looking to pick up bonds from companies he likes such as the

supercar maker McLaren, which he says should be less susceptible to

economic-slowdown fears than other car makers and has a strong

order book.

Others say picking spots in markets can help mitigate risk.

"We know there is a demand shock coming; we just don't know how

big it is going to be," said Maya Bhandari, multiasset-portfolio

manager at Columbia Threadneedle. "We've seen credit spreads widen

quite meaningfully and a bit more value and opportunity opening up

in high yield. But there is some vulnerability too, particularly in

U.S. energy, while autos and auto parts have been hit."

Write to Matt Wirz at matthieu.wirz@wsj.com, Paul J. Davies at

paul.davies@wsj.com and Sam Goldfarb at sam.goldfarb@wsj.com

(END) Dow Jones Newswires

March 04, 2020 08:14 ET (13:14 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

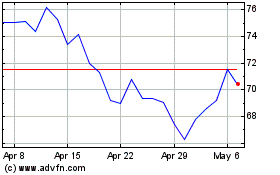

Uber Technologies (NYSE:UBER)

Historical Stock Chart

From Mar 2024 to Apr 2024

Uber Technologies (NYSE:UBER)

Historical Stock Chart

From Apr 2023 to Apr 2024