Chief of Uber Eats Is Leaving As It Exits Some Markets -- WSJ

February 27 2020 - 3:02AM

Dow Jones News

By Sarah E. Needleman

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (February 27, 2020).

The head of Uber Technologies Inc.'s food-delivery business is

leaving the company, a departure that comes as the unit works to

exit markets where it isn't a dominant player in a bid to boost

profits.

Uber on Tuesday said the departing executive, Jason Droege, will

be succeeded at Uber Eats by the head of its international rides

business, Pierre-Dimitri Gore-Coty. Mr. Gore-Coty joined the

company in 2012.

Uber didn't say why Mr. Droege, who came on board the San

Francisco company in 2014 to spearhead new ventures, was leaving.

Mr. Droege will be available until June to help with the

transition, Uber said. Uber couldn't immediately be reached for

additional comment.

Eats has helped Uber boost its revenue, but has weighed on its

bottom line. The unit posted an adjusted loss before interest,

taxes, depreciation and amortization of $461 million for the three

months ended Dec. 31.

To stem such losses, Chief Executive Dara Khosrowshahi has been

pulling Eats out of markets where it isn't among the top two

food-delivery services. Last month Uber agreed to sell its Indian

food-delivery unit to a local rival. Last year the company also

discontinued food-delivery operations in Vienna and pulled out of

South Korea.

Uber has also been seeking to shore up its finances possibly by

merging with a competitor such as DoorDash Inc. or Postmates Inc.

So far, though, discussions haven't resulted in any deals.

Mr. Khosrowshahi has said the Uber Eats exits are helping put

the company on a faster path to profitability. On an earnings call

earlier this month, he said he now sees the company being

profitable on an adjusted Ebitda basis by the end of this year.

Previously he said the company hoped to reach that mark by the end

of 2021.

Uber has said it expects pricing in food delivery, its

second-biggest business after ride-hailing, will become more

reasonable and the discounts and promotions will begin to fade. The

company is already starting to keep more money from each

meal-delivery transaction. Adjusted net revenue, which excludes

driver incentives and referral bonuses for Eats, was $1.38 billion

in 2019, up 82% from a year earlier.

Uber still faces challenges ahead. Its core ride-sharing

business is under regulatory scrutiny in some of its most lucrative

markets. In California, which accounts for about 9% of Uber's gross

bookings, a new law known as AB5 may require the company to

reclassify its drivers as employees, which would dramatically raise

costs. And in London, which makes up about 5% of its ride bookings,

the company was stripped of its license to operate in November, a

ruling by local authorities it is appealing.

--Preetika Rana contributed to this article.

Write to Sarah E. Needleman at sarah.needleman@wsj.com

(END) Dow Jones Newswires

February 27, 2020 02:47 ET (07:47 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

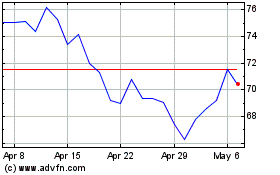

Uber Technologies (NYSE:UBER)

Historical Stock Chart

From Mar 2024 to Apr 2024

Uber Technologies (NYSE:UBER)

Historical Stock Chart

From Apr 2023 to Apr 2024