By Nat Ives

Five new CMOs began this year facing challenges that went beyond

the usual, at Facebook Inc., Uber Technologies Inc., the National

Football League, Chipotle Mexican Grill Inc. and Under Armour Inc.

Here's what happened next.

Facebook

Facebook's earnings have soared throughout the controversies

over its privacy and content practices, giving CMO Antonio Lucio

room and resources for a strategic shift that could more than

double the company's ad spending in two to three years.

"By being silent, by not reacting on time, people created a

story around us evaluating who we are, why we do things and even

the intention behind [our] leaders, he said. "So we needed to

create a more proactive framework."

Mr. Lucio built a corporate brand system to distinguish the

company from its consumer apps, began marketing those apps

individually and rebranded them to make clear that Facebook owns

them. "People around the world want to know where their products

and services come from," he said.

In February, Facebook will bring its ad campaign for Facebook

Groups -- which positions the platform as a uniter, not a divider

-- to the Super Bowl.

Still, Mr. Lucio was faced with challenges in his first year as

several problems worsened. Facebook and other tech giants became

the subject of multiple federal investigations. Meanwhile, Sen.

Elizabeth Warren and others hammered Facebook for not fact-checking

the political ads it accepts. If elected president, Ms. Warren

promises to break up Facebook, Amazon.com Inc. and Google.

The Facebook brand's net favorability score, a measure of

consumer perception from tech survey company Morning Consult, fell

again this year after declining in 2018.

The going is still early, Mr. Lucio said. "We tried to lay the

foundation for what is going to be a five-year-plus journey."

Uber

Uber was already trying to put its problems behind it by the

time Rebecca Messina came in as CMO in the fall of 2018.

Travis Kalanick had left the chief executive post more than a

year before she was hired, following allegations against the

company of failure to act on sexual harassment, theft of trade

secrets, and mistreatment of drivers and riders.

But the work was far from done. "There certainly are some

populations around the world who haven't forgotten or forgiven the

company's mistakes from a few years ago, and that's completely

fair," Ms. Messina said a few months after she was hired.

"We'll probably only be able to convince them through our

actions," she said of the company's critics. "But I do think we

have come a long way already, in both who we are and how people see

us, and my job is focused on continuing that momentum and

consistently expanding the meaning of what Uber stands for."

She didn't get the chance.

In June, CEO Dara Khosrowshahi announced Ms. Messina's departure

after only nine months, eliminated the CMO role and called the

brand still challenged. He soon cut another 400 people from the

marketing department.

On other fronts, the company released a safety report to

increase transparency in an area where it and other ride-sharing

services have been criticized. It said it received 5,981 reports of

sexual assault involving U.S. passengers or drivers during 2017 and

2018.

Uber also took steps toward putting allegations of sexual

harassment behind it, settling with the Equal Employment

Opportunity Commission after the agency found it had allowed a

culture of harassment and retaliated against people who

complained.

The company increased revenue in the third quarter, and Mr.

Khosrowshahi projected that it would deliver its first full-year

profit on an adjusted basis in 2021.

NFL

The National Football League hired CMO Tim Ellis in 2018 amid

sliding ratings and controversy over player protests during the

national anthem at games.

By some measures, the NFL is still recovering. Its net

favorability score is improving but still below its 2017 level,

Morning Consult said.

But audiences rose 6% through the season's 15th week ended Dec.

16, according to media metrics and research firm Nielsen.

The league settled the grievance filed by protest leader and

former San Francisco 49ers quarterback Colin Kaepernick. And

renewed acrimony over an attempted workout for teams that could

bring Mr. Kaepernick back to play quickly faded from headlines.

Mr. Ellis said he restructured the marketing department to

improve its competency in social, influencer and data-driven

marketing. He tried to humanize players with a "helmets off"

strategy that included social-media training to help them build

personal brands. "That ultimately benefits the NFL brand," he

said.

The league also hired content creators to keep social-media

video and photos flowing.

Audiences for games on digital platforms are up 50% from a year

earlier, the league said.

Chipotle

Chipotle continued to put distance between itself and repeated

food-safety problems in prior years. The fast-casual restaurant

chain introduced a nationwide loyalty program, emphasized delivery

and called its new carne asada menu item a success.

CMO Chris Brandt said he also centralized marketing, pulled back

on promotions and tried to make Chipotle more relevant in pop

culture. "Driving culture may have been a little bit of a reach for

us because of where the brand was, but hey, you certainly have to

have some aspirations," he said.

Not all of the company's initiatives have paid off. There was a

late-night push that didn't really work, for example.

But online sales grew 88% during Chipotle's third quarter, now

accounting for 18% of business, while same-store sales growth of

11% beat analyst expectations.

Under Armour

CMO Alessandro de Pestel joined Under Armour in the fall of

2018, just before The Wall Street Journal reported on a corporate

culture that female employees found demeaning, including strip-club

visits on the company dime.

Founder and CEO Kevin Plank promised to do better, but 2019

delivered new bumps in the road for the sports-apparel company.

High-profile endorser Stephen Curry broke his hand early in the

National Basketball Association season, sidelining him until at

least the spring.

North American revenue declined 3.4% in the first three quarters

of the year, compared with the period a year prior, and the company

lowered its 2019 forecast.

"2019 marked another year of strategic and operational

transformation for Under Armour," a spokeswoman said in an email.

The company continued to focus on greater media efficiency and

effectiveness, using consumer insights to inform highly targeted,

high-return strategies, she said.

Under Armour plans to begin a global brand campaign in

January.

Write to Nat Ives at nat.ives@wsj.com

(END) Dow Jones Newswires

December 20, 2019 16:25 ET (21:25 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

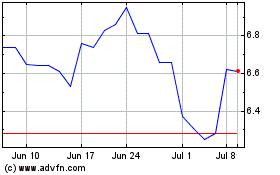

Under Armour (NYSE:UA)

Historical Stock Chart

From Mar 2024 to Apr 2024

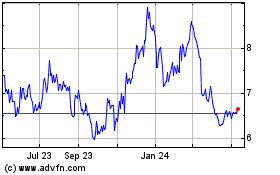

Under Armour (NYSE:UA)

Historical Stock Chart

From Apr 2023 to Apr 2024