Current Report Filing (8-k)

September 23 2020 - 4:31PM

Edgar (US Regulatory)

0001465740

false

--12-31

0001465740

2020-09-21

2020-09-21

0001465740

us-gaap:CommonStockMember

2020-09-21

2020-09-21

0001465740

us-gaap:SeriesAPreferredStockMember

2020-09-21

2020-09-21

0001465740

us-gaap:SeriesBPreferredStockMember

2020-09-21

2020-09-21

0001465740

us-gaap:SeriesCPreferredStockMember

2020-09-21

2020-09-21

0001465740

us-gaap:SeriesDPreferredStockMember

2020-09-21

2020-09-21

0001465740

us-gaap:SeriesEPreferredStockMember

2020-09-21

2020-09-21

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND

EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

Current Report

Pursuant to Section

13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): September 23, 2020 (September 21, 2020)

Two Harbors Investment

Corp.

(Exact name of registrant

as specified in its charter)

|

Maryland

|

|

001-34506

|

|

27-0312904

|

|

(State or other jurisdiction of incorporation or organization)

|

|

(Commission File Number)

|

|

(I.R.S. Employer Identification No.)

|

|

601 Carlson Parkway, Suite 1400

|

|

Minnetonka, MN

|

|

55305

|

|

(Address of Principal Executive Offices)

|

|

|

|

(Zip Code)

|

(612) 453-4100

Registrant’s

telephone number, including area code

(Former name or former

address, if changed since last report)

Check the appropriate box below if the

Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

¨

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

¨

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

¨

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

¨

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities Registered Pursuant to Section 12(b) of the

Act:

|

Title of Each Class:

|

|

Trading Symbol(s)

|

|

Name of Exchange on Which Registered:

|

|

Common Stock, par value $0.01 per share

|

|

TWO

|

|

New York Stock Exchange

|

|

8.125% Series A Cumulative Redeemable Preferred Stock

|

|

TWO PRA

|

|

New York Stock Exchange

|

|

7.625% Series B Cumulative Redeemable Preferred Stock

|

|

TWO PRB

|

|

New York Stock Exchange

|

|

7.25% Series C Cumulative Redeemable Preferred Stock

|

|

TWO PRC

|

|

New York Stock Exchange

|

|

7.75% Series D Cumulative Redeemable Preferred Stock

|

|

TWO PRD

|

|

New York Stock Exchange

|

|

7.50% Series E Cumulative Redeemable Preferred Stock

|

|

TWO PRE

|

|

New York Stock Exchange

|

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the

Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging

Growth Company ¨

If an emerging growth company, indicate

by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

|

|

Item 5.02

|

Departure of Directors or Certain

Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

|

On

September 21, 2020, the Board of Directors of Two Harbors Investment Corp. (“Two Harbors” or the “Company”)

approved the appointment of William Greenberg, the Company’s President and Chief Executive Officer, as a member of the Board

with immediate effect. Mr. Greenberg will stand for re-election at the Company’s 2021 annual meeting of stockholders.

William

Greenberg (53) has served as President and Chief Executive Officer of Two Harbors since June 2020. He previously served as Vice

President and Co-Chief Investment Officer since January 2020, with primary responsibility for the investment and hedging strategy

of the Company’s portfolio of conventional MSR portfolio and securities. Prior thereto, he served as Co-Deputy Chief Investment

Officer from June 2018. Mr. Greenberg has over 25 years of experience managing portfolios of structured finance assets. Prior to

joining Two Harbors in 2012, Mr. Greenberg was a Managing Director at UBS AG, holding a variety of senior positions with responsibilities

including managing the mortgage repurchase liability risk related to over $100 billion of RMBS and whole loans issued and/or sold

by UBS. Additionally, Mr. Greenberg was co-head of trading within the SNB StabFund, including managing $40 billion of legacy RMBS,

ABS, and CMBS securities and loans. Prior to joining UBS, Mr. Greenberg was a Managing Director at Natixis NA, where he co-managed

portfolios of RMBS and Agency Mortgage Servicing Rights. Mr. Greenberg holds a B.S. in physics from the Massachusetts Institute

of Technology, and M.S. and Ph.D. degrees in theoretical nuclear physics from the University of Washington.

There

are no arrangements or understandings between Mr. Greenberg and any other person pursuant to which Mr. Greenberg was appointed

as a director, and there are no transactions in which Mr. Greenberg has an interest requiring disclosure under Item 404(a) of Regulation

S-K.

|

Item 5.03

|

Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year.

|

Articles

of Amendment

On

September 21, 2020, the Board of Directors of Two Harbors approved articles of amendment (the “Articles of Amendment”)

to the Company’s amended and restated charter. The Articles of Amendment: (i) increase the Company’s authorized shares

of common stock, par value $0.01 per share (“Common Stock”), from 450,000,000 shares to 700,000,000 shares; and (ii)

increase the Company’s authorized share of preferred stock, par value $0.01 per share, from 50,000,000 shares to 100,000,000

shares. The Articles of Amendment became effective upon their filing with the State Department of Assessments and Taxation of Maryland

on September 23, 2020.

The

above description of the Articles of Amendment is qualified in its entirety by reference to the full text of the Articles of Amendment,

a complete copy of which is attached as Exhibit 3.1 to this Current Report on Form 8-K and is incorporated herein by reference.

Amended

and Restated Bylaws

On

September 21, 2020, the Board of Directors of Two Harbors approved amendments to Article VI, Section 1 of the Company’s Amended

and Restated Bylaws (“Bylaws”), which became effective immediately. As previously disclosed, the management agreement

by and among the Company, Two Harbors Operating Company LLC and PRCM Advisers LLC terminated effective August 14, 2020. The amendments

to the Bylaws eliminate references to a manager acting on behalf of the Company pursuant to a management agreement.

The

above description of the Bylaws is qualified in its entirety by reference to the full text of the Bylaws, a complete copy of which

is attached as Exhibit 3.2 to this Current Report on Form 8-K and is incorporated herein by reference.

|

Item 9.01

|

Financial Statements and Exhibits.

|

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act

of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

TWO HARBORS INVESTMENT CORP.

|

|

|

|

|

|

|

By:

|

/s/ REBECCA B. SANDBERG

|

|

|

|

Rebecca B. Sandberg

|

|

|

|

General Counsel and Secretary

|

|

|

|

|

|

Date: September 23, 2020

|

|

|

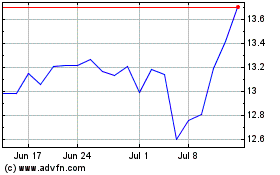

Two Harbors Investment (NYSE:TWO)

Historical Stock Chart

From Mar 2024 to Apr 2024

Two Harbors Investment (NYSE:TWO)

Historical Stock Chart

From Apr 2023 to Apr 2024