By Leslie Scism

Travelers Cos. booked $86 million in pretax charges in the first

quarter related to the coronavirus pandemic, including for billings

that hard-hit policyholders haven't paid.

In its quarterly earnings report, the insurance company also

said it expects increased litigation over disputed business-income

coverage stemming from Covid-19. The charges and expected

litigation expenses are among the many ramifications still

unfolding at Travelers and other property-casualty insurers from

the unparalleled shutdown of swaths of the U.S. to slow the spread

of the new coronavirus.

Still, Travelers shareholders seemed relieved that the financial

damage for the first quarter wasn't more extensive. The company's

shares were ahead for most of Tuesday's trading session before

closing unchanged on a down day for the broader market.

Travelers, which is part of the Dow Jones Industrial Average, is

among the largest sellers of insurance to U.S. businesses and, as

well, sells car and home insurance to individuals and families. It

is one of the earliest big property-casualty insurers to post

earnings each quarter, and its results are watched closely as a

bellwether for others.

The insurer reported lower profit in the first quarter, down 25%

at $600 million. Besides the pandemic-related charge, results were

depressed by higher costs from tornadoes and other storms labeled

as catastrophes.

Investors and analysts were less focused on operational

specifics in a Tuesday morning earnings call and instead peppered

management with questions about Covid-19 fallout. As a leading

seller of property insurance to small and midsize businesses,

Travelers is among a raft of insurers already facing litigation

from policyholders who contend their insurers should pay for income

losses suffered as lockdown orders took effect and forced them to

limit, or entirely shutter, their businesses.

Those government health directives have resulted in increasingly

desperate small businesses, and owners have been seeking help

wherever they can find it. That includes flooding banks with

applications for a piece of a $350 billion small-business loan

program within the federal stimulus package passed in late March,

leading Congress to consider a second round of funding.

Many entrepreneurs with insurance policies are also eyeing

so-called business-interruption features as a lifeline, and have

filed claims that could eventually total hundreds of billions of

dollars, according to industry brokers, lawyers and executives.

Even celebrity chefs have turned to President Trump to push the

insurance industry to make good on claims they contend are

legitimate, among policyholders' other appeals to state and federal

lawmakers and regulators.

Travelers Chief Executive Alan Schnitzer said in Tuesday's

earnings call that the insurer's standard policy form specifically

excludes loss or damage caused by or resulting from a virus. That

is similar to other insurers' policy wording, adopted around 2006

after the SARS outbreak.

Mr. Schnitzer said the insurer has received some claims seeking

business-income payouts, and Travelers declined most of the claims

consistent with policy terms.

At an insurer as big as Travelers, "we're certainly going to

find a pocket here or there that doesn't have that specific

exclusion," Mr. Schnitzer said. The insurer's anticipated exposure

on those policies was reflected in the first-quarter charge, he

said. Barring legislative action to nullify the existing

exclusions, "we really do not think we have a material exposure

from business interruption," he said.

Lawmakers in a handful of big states have proposed such

nullifications, which Mr. Schnitzer said would likely be subject to

a constitutional challenge.

The likelihood of a challenge notwithstanding, Travelers added a

new risk factor in its regulatory filings, according to Credit

Suisse analyst Michael Zaremski.

Travelers inserted that "the effects of emerging claim and

coverage issues on the Company's business are uncertain, and court

decisions or legislative or regulatory changes...can result in an

unexpected increase in the number of claims and have an adverse

impact on the Company's results of operations."

Other business lines exposed to Covid-19 claims include workers'

compensation, a mandatory coverage for employers to pay their

workers' health care and lost wages resulting from on-the-job

injuries.

Travelers said it would have exposure to claims from some

essential workers but noted that it doesn't have a significant

business providing the coverage to health-care workers and other

first responders.

On Monday, Travelers went on the offensive on the litigation

front and filed a complaint in federal court in California against

a policyholder seeking a business-income payout. Travelers'

complaint asks the court for a review of its policy to confirm that

"the claims do not fall within the policies' grants of coverage,"

the filing states.

The policyholder is a Los Angeles law firm, Geragos &

Geragos, that had filed for such a judicial review in a state court

in California only days earlier. Geragos is representing other

policyholders that also are suing Travelers.

"We welcome the opportunity to fight on behalf of small

businesses," said Mr. Geragos in a statement.

In Travelers' quarterly results, pretax catastrophe losses, net

of reinsurance, were $333 million, up from $193 million a year

earlier. First-quarter revenue rose more than 3% to $7.91 billion,

with net premiums written rising about 4% to $7.35 billion.

Chubb Ltd. said in an earnings release late Tuesday that its

first-quarter results weren't affected by the Covid-19 outbreak.

But Chief Executive Evan Greenberg said premium growth would slow

in the current quarter "as insurance exposures in important areas

shrink" with the pandemic dealing a severe blow to the global

economy.

--

Allison Prang contributed to this article.

Write to Leslie Scism at leslie.scism@wsj.com

(END) Dow Jones Newswires

April 21, 2020 17:12 ET (21:12 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

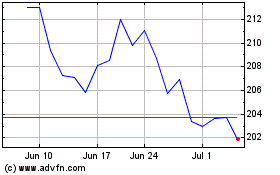

The Travelers Companies (NYSE:TRV)

Historical Stock Chart

From Mar 2024 to Apr 2024

The Travelers Companies (NYSE:TRV)

Historical Stock Chart

From Apr 2023 to Apr 2024