Free Writing Prospectus - Filing Under Securities Act Rules 163/433 (fwp)

June 08 2021 - 6:05AM

Edgar (US Regulatory)

Issuer Free Writing Prospectus

Filed Pursuant to Rule 433

Registration File No. 333-226642

Relating to Preliminary Prospectus Supplement

Dated June 7, 2021

to

Prospectus Dated August 7, 2018

Pricing Term Sheet

TPG RE Finance Trust, Inc.

6.25% Series C Cumulative Redeemable Preferred Stock

(Liquidation Preference $25.00 Per Share)

This pricing term sheet is qualified in its entirety by reference to the preliminary prospectus supplement dated June 7, 2021 and the accompanying

prospectus (together, the “Preliminary Prospectus”) of TPG RE Finance Trust, Inc. (the “Issuer”) relating to the securities described therein. The information in this pricing term sheet supplements the Preliminary Prospectus and

updates and supersedes the information in the Preliminary Prospectus to the extent it is inconsistent with the information in the Preliminary Prospectus. Capitalized terms used and not defined herein have the meanings assigned to them in the

Preliminary Prospectus.

|

|

|

|

|

Issuer:

|

|

TPG RE Finance Trust, Inc.

|

|

|

|

|

Security:

|

|

6.25% Series C Cumulative Redeemable Preferred Stock

|

|

|

|

|

Size:

|

|

7,000,000 shares

|

|

|

|

|

Underwriters’ Over-allotment Option:

|

|

1,050,000 shares

|

|

|

|

|

Rating:

|

|

BBB by Egan-Jones Ratings Company. A rating is not a recommendation to buy, sell or hold securities. Ratings may be subject to revision or withdrawal at any time by the assigning rating organization. Each rating should be evaluated

independently of any other rating.

|

|

|

|

|

Trade Date:

|

|

June 7, 2021

|

|

|

|

|

Settlement Date:

|

|

June 14, 2021 (T+5)*

|

|

|

|

|

Maturity:

|

|

Perpetual (unless redeemed by the Issuer on or after June 14, 2026 or pursuant to its special optional redemption right, repurchased by the Issuer in the open market or converted by an investor in connection with a Change of

Control)

|

|

|

|

|

Public offering price:

|

|

$25.00 per share; $175,000,000 total (assuming the over-allotment option is not exercised)

|

|

|

|

|

Underwriting Discount and Commissions:

|

|

$0.7875 per share; $5,512,500 total ($6,339,375 if the underwriters exercise their over-allotment option in full)

|

|

|

|

|

Net Proceeds (before expenses):

|

|

$169,487,500 ($194,910,625 if the underwriters exercise their over-allotment option in full)

|

|

|

|

|

Dividend Rate:

|

|

6.25% per annum (or $1.5625 per share per annum), accruing from, and including, June 14, 2021

|

|

|

|

|

Dividend Payment Dates:

|

|

On or about the 30th day of each March, June, September and December, commencing on September 30, 2021. The first dividend payment will cover the period from, and including, June 14, 2021 to, but not including,

September 30, 2021 and will be in the amount of $0.4601 per share.

|

|

|

|

|

Liquidation Preference:

|

|

$25.00 per share, plus any accrued and unpaid distributions

|

|

|

|

|

|

Optional Redemption:

|

|

On and after June 14, 2026, redeemable in whole, at any time, or in part, from time to time, at a redemption price equal to $25.00 per share, plus any accrued and unpaid dividends (whether or not declared) to, but not including, the

date of redemption. If the Issuer exercises its redemption right, by sending the required notice, with respect to some or all of the Series C Preferred Stock in connection with a Change of Control, holders of the Series C Preferred Stock will not be

permitted to exercise the conversion rights described below in respect of any Series C Preferred Stock called for redemption, and any Series C Preferred Stock subsequently called for redemption that has been tendered for conversion will be redeemed

on the applicable date of redemption instead of converted on the applicable Change of Control Conversion Date.

|

|

|

|

|

Special Optional Redemption:

|

|

In the event of a Change of Control, the Issuer will have the option to redeem the Series C Preferred Stock, in whole or in part, within 120 days after the first date on which such Change of Control has occurred for cash at a

redemption price of $25.00 per share, plus any accrued and unpaid dividends (whether or not declared) to, but not including, the date of redemption. If the Issuer exercises its redemption right, by sending the required notice, with respect to some

or all of the Series C Preferred Stock, the holders of Series C Preferred Stock will not be permitted to exercise the conversion rights described below in respect of any Series C Preferred Stock called for redemption.

|

|

|

|

|

Change in Control Conversion Rights:

|

|

Except to the extent that the Issuer has elected to exercise its optional redemption right or its special optional redemption right by providing notice of redemption prior to the Change of Control Conversion Date, upon the

occurrence of a Change of Control, each holder of Series C Preferred Stock will have the right to convert some or all of the Series C Preferred Stock held by such holder on the Change of Control Conversion Date into a number of the Issuer’s

shares of common stock per share of Series C Preferred Stock to be converted equal to the lesser of:

|

|

|

|

|

|

|

• the quotient obtained by dividing (i) the sum of the $25.00 liquidation

preference plus the amount of any accrued and unpaid dividends (whether or not declared) to, but not including, the Change of Control Conversion Date (unless the Change of Control Conversion Date is after a record date for a Series C Preferred Stock

dividend payment and prior to the corresponding Series C Preferred Stock dividend payment date, in which case no additional amount for such accrued and unpaid dividend will be included in this sum) by (ii) the Common Stock Price;

and

|

|

|

|

|

|

|

• 3.723 (the Share Cap), subject to certain adjustments

subject, in each case, to provisions for the receipt of alternative

consideration upon conversion as described in the Preliminary Prospectus.

|

|

|

|

|

|

|

|

If the Issuer has provided or provides a redemption notice with respect to some or all of the Series C Preferred Stock, holders of any shares of Series C Preferred Stock that the Issuer has called for redemption will not be

permitted to exercise their Change of Control Conversion Right in respect of any of their shares of Series C Preferred Stock that have been called for redemption, and any Series C Preferred Stock subsequently called for redemption that has been

tendered for conversion will be redeemed on the applicable date of redemption instead of converted on the Change of Control Conversion Date.

|

|

|

|

|

|

|

Except as provided above in connection with a Change of Control, the Series C Preferred Stock is not convertible into or exchangeable for any other securities or property.

|

|

|

|

|

|

|

A “Change of Control” will be deemed to have occurred at such time after the original issuance of the Series C Preferred Stock when the following have occurred and are continuing:

|

|

|

|

|

|

|

• the acquisition by any person, including any syndicate or group deemed to be a

“person” under Section 13(d)(3) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), of beneficial ownership, directly or indirectly, through a purchase, merger or other acquisition transaction or series

of purchases, mergers or other acquisition transactions of shares of the Issuer’s capital stock entitling that person to exercise more than 50% of the total voting power of all shares of the Issuer’s capital stock entitled to vote

generally in elections of directors (except that such person will be deemed to have beneficial ownership of all securities that such person has the right to acquire, whether such right is currently exercisable or is exercisable only upon the

occurrence of a subsequent condition); and

|

|

|

|

|

|

|

• following the closing of any transaction referred to in the bullet point

above, neither the Issuer nor the acquiring or surviving entity has a class of common securities (or ADRs representing such securities) listed on the NYSE, the NYSE American LLC or Nasdaq, or listed or quoted on an exchange or quotation system that

is a successor to the NYSE, the NYSE American LLC or Nasdaq.

|

|

|

|

|

|

|

The “Common Stock Price” will be: (i) if the consideration to be received in the Change of Control by the holders of the Issuer’s common stock is solely cash, the amount of cash consideration per share of the

Issuer’s common stock or (ii) if the consideration to be received in the Change of Control by holders of the Issuer’s common stock is other than solely cash (x) the average of the closing sale prices per share of the

Issuer’s common stock (or, if no closing sale price is reported,

|

|

|

|

|

|

|

|

|

|

|

the average of the closing bid and ask prices or, if more than one in either case, the average of the average closing bid and the average closing ask prices) for the ten consecutive trading days immediately preceding, but not

including, the effective date of the Change of Control as reported on the principal U.S. securities exchange on which the Issuer’s common stock is then traded, or (y) the average of the last quoted bid prices for the Issuer’s common

stock in the over-the-counter market as reported by OTC Markets Group Inc. or similar organization for the ten consecutive trading days immediately preceding, but not

including, the effective date of the Change of Control, if the Issuer’s common stock is not then listed for trading on a U.S. securities exchange.

|

|

|

|

|

|

|

The “Change of Control Conversion Date” will be a business day selected by the Issuer that is no fewer than 20 days nor more than 35 days after the date on which the Issuer provides the required notice of the occurrence of

a Change of Control.

|

|

|

|

|

CUSIP / ISIN:

|

|

87266M 206 / US 87266M2061

|

|

|

|

|

Listing:

|

|

The Issuer intends to file an application to list the Series C Preferred Stock with the NYSE under the symbol “TRTX PrC.” If the application is approved, trading is expected to begin within 30 days after the Series C

Preferred Stock is first issued. The representative of the underwriters has advised the Issuer that it intends to make a market in the Series C Preferred Stock prior to the commencement of trading on the NYSE. The representative will have no

obligation to make a market in the shares, however, and may cease market making activities, if commenced, at any time.

|

|

|

|

|

Book-Running Managers:

|

|

Raymond James & Associates, Inc. and TPG Capital BD, LLC

|

|

|

|

|

Distribution:

|

|

SEC registered

|

|

|

|

|

Use of Proceeds:

|

|

The Issuer intends to use the net proceeds from the sale of the shares of the Series C Preferred Stock to partially fund the redemption of all of the outstanding shares of the Issuer’s Series B Preferred Stock.

|

* We expect that delivery of the Series C Preferred Stock will be made to investors on or about the fifth business day

following the date of this prospectus (such settlement being referred to as “T+5”). Under Rule 15c6-1 under the Exchange Act, trades in the secondary market are required to settle in two business

days, unless the parties to any such trade expressly agree otherwise. Accordingly, purchasers who wish to trade shares of Series C Preferred Stock prior to their delivery will be required, by virtue of the fact that the shares of Series C Preferred

Stock initially settle in T+5, to specify an alternate settlement arrangement at the time of any such trade to prevent a failed settlement. Purchasers of the Series C Preferred Stock who wish to trade the Series C Preferred Stock prior to their date

of delivery should consult their advisors.

The Issuer has filed a registration statement (including a prospectus and a prospectus supplement) with the

SEC for the offering to which this communication relates. Before you invest, you should read the prospectus and the prospectus supplement in that registration statement and other documents the Issuer has filed with the SEC for more complete

information about the Issuer and the offering to which this communication relates. You may obtain these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the Issuer, any underwriter or any dealer participating in

the offering will arrange to send you the prospectus and the prospectus supplement if you request it by calling Raymond James & Associates, Inc. at (800) 248-8863.

Any disclaimer or other notice that may appear below is not applicable to this communication and should be disregarded. Such disclaimer or notice was

automatically generated as a result of this communication being sent by Bloomberg or another email system.

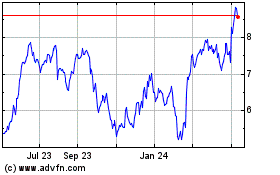

TPG Real Estate Finance (NYSE:TRTX)

Historical Stock Chart

From Mar 2024 to Apr 2024

TPG Real Estate Finance (NYSE:TRTX)

Historical Stock Chart

From Apr 2023 to Apr 2024