UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D/A

Under the Securities Exchange Act of 1934

(Amendment No. 13)

(Name of Issuer)

Texas Pacific Land Trust

(Title of Class of Securities)

Sub-share Certificates

(CUSIP Number)

882610108

Name, Address and Telephone Number of Person Authorized to

Receive Notices and Communications)

Jay Kesslen

c/o Horizon Kinetics LLC

470 Park Avenue South

New York, NY 10016

(Date of Event which Requires Filing of this Statement)

January 11, 2021

If the filing person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of §§240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following box. ☒

Note: Schedules filed in paper format shall include a signed original and five copies of the schedule, including all exhibits. See Rule.13d-7 for other parties to whom copies are to be sent.

* The remainder of this cover page shall be filled out for a reporting person's initial filing on this form with respect to the subject class of securities, and for any subsequent amendment containing information which would alter disclosures provided in a prior cover page.

The information required on the remainder of this cover page shall not be deemed to be "filed" for the purpose of Section 18 of the Securities Exchange Act of 1934 ("Act") or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however, see the Notes).

|

1. Names of Reporting Persons.

Horizon Kinetics Asset Management LLC

13-3776334

|

|

2. Check the Appropriate Box if a Member of a Group

|

|

(a) ☐

|

|

(b) ☐

|

|

|

|

3. SEC Use Only

|

|

4. Source of Funds

WC

|

|

|

|

5. Check if Disclosure of Legal Proceedings Is Required Pursuant to Items 2(d) or 2(e)

|

|

☐

|

|

6. Citizenship or Place of Organization

|

|

Delaware

|

|

Number of Shares

Beneficially

Owned by

Each Reporting

Person With:

|

7. Sole Voting Power

|

|

0

|

|

|

|

8. Shared Voting Power

|

|

|

|

|

|

9. Sole Dispositive Power

|

|

0

|

|

|

|

10. Shared Dispositive Power

|

|

|

|

|

|

11. Aggregate Amount Beneficially Owned by Each Reporting Person

|

|

0

|

|

12. Check if the Aggregate Amount in Row (11) Excludes Certain Shares

|

|

☐

|

|

13. Percent of Class Represented by Amount in Row (11)

|

|

0

|

|

14. Type of Reporting Person

|

|

IA

|

This Amendment No. 13 to the Schedule 13D (this "Amendment No. 13") relates to the sub-share certificates of proprietary interests (the "Shares") of Texas Pacific Land Trust ("TPL") and amends the Schedule 13D Amendment 12 filed on December 14, 2020 (the "Schedule 13D 12" and, together with this Amendment No. 13, the "Schedule 13D"). Capitalized terms used and not defined in this Amendment No. 13 have the meanings set forth in the Original Schedule 13D.

This Amendment No. 13 is being filed by Horizon Kinetics Asset Management LLC ("Horizon") a Delaware limited liability company, a wholly owned subsidiary of Horizon Kinetics LLC.

As a result of the Termination Agreement (as defined below) and the "corporate reorganization" (as described below), on January 11, 2021, Horizon ceased to be the beneficial owner of 5% or more of the Shares. The filing of this Amendment No. 13 represents the final amendment to the Original Schedule 13D and constitutes an exit filing for Horizon.

ITEM 4. PURPOSE OF TRANSACTION

Item 4 of the Schedule 13D is amended by adding the following:

The Trustees of the Trust previously approved a plan for reorganizing the Trust from its current structure to a corporation formed under the laws of the State of Delaware named Texas Pacific Land Corporation ("TPL Corporation"). In connection with the corporate reorganization, the trading of the Shares ceased prior to the market opening on January 11, 2021 and the new common stock of TPL Corporation began trading on the New York Stock Exchange. The Trust distributed all of the shares of common stock, par value $0.01, of TPL Corporation to holders of Shares, on a pro rata basis in accordance with their interests in the Trust. At or about such time, the Shares were cancelled. Accordingly, Horizon ceased to beneficially own more than 5% of the Shares and became stockholders of TPL Corporation.

Prior to the market opening on January 11, 2021, Horizon and SoftVest Advisors by mutual written agreement, terminated their cooperation agreement dated March 15, 2019 (as amended), pursuant to which the parties had agreed to take certain actions with respect to the Issuer's securities (the "Termination Agreement"). Accordingly, Horizon and SoftVest Advisors may no longer be deemed to be a "group" for purposes of Section 13(d)(3) of the Exchange Act and Rule 13d-5(b) promulgated thereunder.

The foregoing description of the Termination Agreement is qualified by the full text of the Termination Agreement, which is attached hereto as Exhibit 12 and is incorporated by reference herein.

ITEM 5. INTEREST IN SECURITIES OF THE ISSUER

Item 5(a), (b), (c) and (e) of the Schedule 13D is amended and restated as follows:

(a) (b) In connection with the corporate reorganization, as of the close of business on January 11, 2021, Horizon no longer beneficially own any Shares.

(c) The response set forth in Item 4 of this Amendment No. 13 is incorporated herein by reference and is qualified in its entirety by reference to the Merger Agreement.

(e) In connection with the Termination Agreement and the corporate reorganization, on January 11, 2021 Horizon ceased to beneficially own more than 5% of the Shares.

The right to dividends from, or proceeds from the sale of such Shares resides with the beneficial owners of such accounts, and Horizon with respect to its proprietary accounts. Transactions effected by Horizon in the last 60 days are as listed below. All sales were the result of a client direction or account limitation, and no sales were made in any proprietary account.

|

Name of Reporting Person

|

Date of Transaction

|

Buy/Sale

|

Aggregate Amount of Securities

|

Average Price Per Share

|

|

Horizon Kinetics Asset Management LLC

|

11/13/2020

|

Buy

|

99

|

549.85

|

|

Horizon Kinetics Asset Management LLC

|

11/13/2020

|

Sale

|

104

|

549.85

|

|

Horizon Kinetics Asset Management LLC

|

11/16/2020

|

Buy

|

121

|

579.99

|

|

Horizon Kinetics Asset Management LLC

|

11/16/2020

|

Sale

|

174

|

576.15

|

|

Horizon Kinetics Asset Management LLC

|

11/17/2020

|

Buy

|

142

|

583.01

|

|

Horizon Kinetics Asset Management LLC

|

11/17/2020

|

Sale

|

176

|

582.21

|

|

Horizon Kinetics Asset Management LLC

|

11/18/2020

|

Buy

|

116

|

581.59

|

|

Horizon Kinetics Asset Management LLC

|

11/20/2020

|

Buy

|

404

|

579.17

|

|

Horizon Kinetics Asset Management LLC

|

11/20/2020

|

Sale

|

270

|

575.63

|

|

Horizon Kinetics Asset Management LLC

|

11/24/2020

|

Buy

|

10

|

630.00

|

|

Horizon Kinetics Asset Management LLC

|

11/24/2020

|

Sale

|

5

|

618.05

|

|

Horizon Kinetics Asset Management LLC

|

11/25/2020

|

Buy

|

111

|

622.98

|

|

Horizon Kinetics Asset Management LLC

|

11/25/2020

|

Sale

|

110

|

617.34

|

|

Horizon Kinetics Asset Management LLC

|

11/27/2020

|

Buy

|

160

|

591.87

|

|

Horizon Kinetics Asset Management LLC

|

11/27/2020

|

Sale

|

129

|

591.23

|

|

Horizon Kinetics Asset Management LLC

|

11/30/2020

|

Buy

|

108

|

609.92

|

|

Horizon Kinetics Asset Management LLC

|

11/30/2020

|

Sale

|

113

|

609.92

|

|

Horizon Kinetics Asset Management LLC

|

12/1/2020

|

Buy

|

116

|

614.01

|

|

Horizon Kinetics Asset Management LLC

|

12/1/2020

|

Sale

|

121

|

614.01

|

|

Horizon Kinetics Asset Management LLC

|

12/2/2020

|

Buy

|

122

|

620.20

|

|

Horizon Kinetics Asset Management LLC

|

12/2/2020

|

Sale

|

130

|

620.16

|

|

Horizon Kinetics Asset Management LLC

|

12/3/2020

|

Buy

|

189

|

640.52

|

|

Horizon Kinetics Asset Management LLC

|

12/3/2020

|

Sale

|

204

|

639.79

|

|

Horizon Kinetics Asset Management LLC

|

12/4/2020

|

Buy

|

187

|

669.96

|

|

Horizon Kinetics Asset Management LLC

|

12/4/2020

|

Sale

|

192

|

669.96

|

|

Horizon Kinetics Asset Management LLC

|

12/7/2020

|

Buy

|

167

|

669.39

|

|

Horizon Kinetics Asset Management LLC

|

12/7/2020

|

Sale

|

176

|

669.39

|

|

Horizon Kinetics Asset Management LLC

|

12/8/2020

|

Buy

|

167

|

672.00

|

|

Horizon Kinetics Asset Management LLC

|

12/8/2020

|

Sale

|

305

|

668.83

|

|

Horizon Kinetics Asset Management LLC

|

12/9/2020

|

Buy

|

167

|

682.88

|

|

Horizon Kinetics Asset Management LLC

|

12/9/2020

|

Sale

|

452

|

677.60

|

|

Horizon Kinetics Asset Management LLC

|

12/10/2020

|

Buy

|

167

|

693.02

|

|

Horizon Kinetics Asset Management LLC

|

12/10/2020

|

Sale

|

172

|

693.02

|

|

Horizon Kinetics Asset Management LLC

|

12/11/2020

|

Buy

|

156

|

692.00

|

|

Horizon Kinetics Asset Management LLC

|

12/11/2020

|

Sale

|

201

|

692.00

|

|

Horizon Kinetics Asset Management LLC

|

12/14/2020

|

Buy

|

106

|

684.00

|

|

Horizon Kinetics Asset Management LLC

|

12/14/2020

|

Sale

|

280

|

679.38

|

|

Horizon Kinetics Asset Management LLC

|

12/15/2020

|

Buy

|

101

|

700.00

|

|

Horizon Kinetics Asset Management LLC

|

12/15/2020

|

Sale

|

163

|

699.15

|

|

Horizon Kinetics Asset Management LLC

|

12/16/2020

|

Buy

|

103

|

719.90

|

|

Horizon Kinetics Asset Management LLC

|

12/16/2020

|

Sale

|

266

|

712.81

|

|

Horizon Kinetics Asset Management LLC

|

12/17/2020

|

Buy

|

190

|

723.53

|

|

Horizon Kinetics Asset Management LLC

|

12/17/2020

|

Sale

|

195

|

723.53

|

|

Horizon Kinetics Asset Management LLC

|

12/18/2020

|

Buy

|

108

|

740.62

|

|

Horizon Kinetics Asset Management LLC

|

12/18/2020

|

Sale

|

118

|

740.62

|

|

Horizon Kinetics Asset Management LLC

|

12/21/2020

|

Buy

|

279

|

724.50

|

|

Horizon Kinetics Asset Management LLC

|

12/21/2020

|

Sale

|

1040

|

729.25

|

|

Horizon Kinetics Asset Management LLC

|

12/22/2020

|

Buy

|

111

|

700.00

|

|

Horizon Kinetics Asset Management LLC

|

12/22/2020

|

Sale

|

248

|

709.31

|

|

Horizon Kinetics Asset Management LLC

|

12/23/2020

|

Buy

|

223

|

698.33

|

|

Horizon Kinetics Asset Management LLC

|

12/23/2020

|

Sale

|

228

|

698.55

|

|

Horizon Kinetics Asset Management LLC

|

12/24/2020

|

Buy

|

1061

|

693.06

|

|

Horizon Kinetics Asset Management LLC

|

12/24/2020

|

Sale

|

1106

|

692.51

|

|

Horizon Kinetics Asset Management LLC

|

12/28/2020

|

Buy

|

111

|

694.00

|

|

Horizon Kinetics Asset Management LLC

|

12/28/2020

|

Sale

|

112

|

694.00

|

|

Horizon Kinetics Asset Management LLC

|

12/29/2020

|

Buy

|

115

|

686.06

|

|

Horizon Kinetics Asset Management LLC

|

12/29/2020

|

Sale

|

121

|

686.06

|

|

Horizon Kinetics Asset Management LLC

|

12/30/2020

|

Buy

|

109

|

723.49

|

|

Horizon Kinetics Asset Management LLC

|

12/30/2020

|

Sale

|

129

|

721.59

|

|

Horizon Kinetics Asset Management LLC

|

12/31/2020

|

Buy

|

172

|

727.00

|

|

Horizon Kinetics Asset Management LLC

|

12/31/2020

|

Sale

|

196

|

727.00

|

|

Horizon Kinetics Asset Management LLC

|

1/4/2021

|

Buy

|

91

|

756.56

|

|

Horizon Kinetics Asset Management LLC

|

1/4/2021

|

Sale

|

136

|

756.03

|

|

Horizon Kinetics Asset Management LLC

|

1/5/2021

|

Buy

|

90

|

795.00

|

|

Horizon Kinetics Asset Management LLC

|

1/5/2021

|

Sale

|

107

|

793.43

|

|

Horizon Kinetics Asset Management LLC

|

1/6/2021

|

Buy

|

113

|

793.02

|

|

Horizon Kinetics Asset Management LLC

|

1/6/2021

|

Sale

|

236

|

793.60

|

|

Horizon Kinetics Asset Management LLC

|

1/7/2021

|

Buy

|

103

|

778.68

|

|

Horizon Kinetics Asset Management LLC

|

1/7/2021

|

Sale

|

108

|

778.68

|

|

Horizon Kinetics Asset Management LLC

|

1/8/2021

|

Buy

|

113

|

801.00

|

|

Horizon Kinetics Asset Management LLC

|

1/8/2021

|

Sale

|

123

|

801.00

|

ITEM 6. CONTRACTS, ARRANGEMENTS, UNDERSTANDINGS OR RELATIONSHIPS WITH RESPECT TO SECURITIES OF THE ISSUER

Item 6 of the Schedule 13D is amended by adding the following:

The response to Item 4 of this Amendment No. 13 is incorporated herein by reference.

ITEM 7. MATERIAL TO BE FILED AS EXHIBITS

Item 7 of the Schedule 13D is amended by adding thereto the following:

SIGNATURE

After reasonable inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

Dated: January 11, 2021

/s/ Jay Kesslen

Jay Kesslen

General Counsel

Horizon Kinetics LLC

Horizon Kinetics Asset Management LLC

TERMINATION AGREEMENT

January 11, 2021

Reference is made to (i) that certain Cooperation Agreement, dated March 15, 2019 (as amended, the "Cooperation Agreement") by and among SoftVest Advisors, LLC ("SoftVest"), Horizon Kinetics LLC ("Horizon"), Tessler Family Limited Partnership, and ART-FGT Family Partners Limited and (ii) that certain Agreement, dated March 27, 2020 whereby the Tessler Family Limited Partnership, and ART-FGT Family Partners Limited withdrew as parties to the Cooperation Agreement.

The Trustees of Texas Pacific Land Trust (the "Trust") have approved a plan for reorganizing the Trust from its current structure to a corporation formed under the laws of the State of Delaware which will be named Texas Pacific Land Corporation ("TPL Corporation"). The trading of sub-share certificates of the Trust will cease prior to the market opening and the new common stock of TPL Corporation will begin trading on the New York Stock Exchange on January 11, 2021.

SoftVest and Horizon hereby mutually agree to terminate the Cooperation Agreement, effective immediately (the "Termination"). Each of SoftVest and Horizon agree and acknowledge that as of the execution hereof (i) they have no agreement, arrangement or understanding whatsoever among themselves with respect to the acquisition, holding, voting or disposition of securities of the Trust of TPL Corporation and (ii) each may vote or dispose of any securities of the Trust and TPL Corporation that they may beneficially own in their sole discretion, subject to any contractual obligations each may have to other third parties.

For the avoidance of doubt, Sections 5, 6(d), 7, 8 and 9 of the Cooperation Agreement shall survive the Termination.

[The remainder of this page was intentionally left blank.]

The parties have caused this Termination Agreement to be executed as of January 11, 2021.

|

|

HORIZON KINETICS LLC

|

|

|

|

|

|

|

|

|

By:

|

/s/Jay Kesslen

|

|

|

|

|

Name:

|

Jay Kesslen

|

|

|

|

|

Title:

|

General Counsel

|

|

|

|

SOFTVEST ADVISORS, LLC

|

|

|

|

|

|

|

|

By:

|

/s/Eric L. Oliver

|

|

|

|

|

Name:

|

Eric L. Oliver

|

|

|

|

|

Title:

|

President

|

|

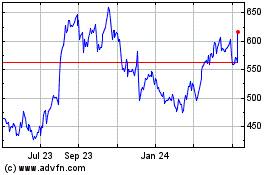

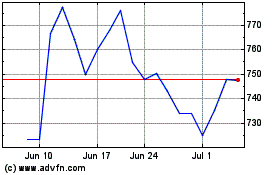

Texas Pacific Land (NYSE:TPL)

Historical Stock Chart

From Mar 2024 to Apr 2024

Texas Pacific Land (NYSE:TPL)

Historical Stock Chart

From Apr 2023 to Apr 2024