TEN, Ltd (TEN) (NYSE: TNP) (the “Company”) today reported results

(unaudited) for the quarter ended March 31, 2020.

Q1 2020 Summary ResultsGross

revenues for the first quarter of 2020 came at approximately $180

million, $32 million higher than in the 2019 first quarter.

Operating income doubled to $54.7 million from

$27.8 million in the 2019 first quarter.

Net income, exclusive of a non-cash bunker hedge

effect, increased 250% to $39.3 million, and to a solid $21.2

million after taking into account the impact of non-cash items.

Earnings per share, after non-cash bunker hedges and preferred

stock dividends, increased to $0.12 in the first quarter of 2020

from $0.01 in the first quarter of 2019.

EBITDA amounted to about $90 million, 40% higher

than in the 2019 first quarter.

The daily average TCE per vessel reached $26,629

compared to $21,054 in the first quarter of 2019.

This performance was a reflection of the strong

market that started in the latter months of 2019 and continued into

the first and second quarter of 2020. As a result, TEN once again

benefited by chartering its vessels on long-term contracts hence

securing future earnings and allowing the fleet to achieve a high

fleet utilization, reaching 97% with only one vessel undergoing

scheduled dry docking.

Fleet operating expenses increased modestly to

$45.5 million from $43.3 million in the first quarter of 2019,

partly due to the size of the fleet and calculated increases in

provisions and stores taken onboard vessels for precautionary

reasons as the Covid-19 pandemic began to spread, threatening

access to terminals.

On a daily average per vessel basis, operating

expenses were once again controlled to about $7,900 due to strict

cost checks.

G&A expenses increased by $1.17 million

mainly due to a slightly higher fleet from the first quarter of

2019.

Depreciation and amortization combined were

about $0.5 million lower than in the 2019 first quarter due to

vessel sales.

In the first quarter of 2020, interest and

finance costs reached $33.6 million which included hedge related

payments and $16.0 million non-cash negative changes in bunker

valuations. These non-cash items have already reversed due to the

rebalancing of the oil market in terms of oil production and

expected to have a positive impact on the balance sheet going

forward.

Actual bank loan interest payments fell by $4.4

million due to lower interest rates and declining outstanding loans

from scheduled repayments and vessel sales.

By the end of the 2020 first quarter, total

outstanding indebtedness fell by a net $53.5 million and

correspondingly TEN’s net debt to capital declined to 46.5%.

Concurrently, TEN’s cash balances reached a level well beyond

earlier expectations, with cash reserves at a healthy $221

million.

In January 2020, TEN took delivery of the

newbuilding aframax Caribbean Voyager which immediately commenced

its five-year bareboat employment to a US oil major, sistership to

the Mediterranean Voyager delivered in October 2019 to the same

charterer for identical employment.

Dividend – Common

SharesFollowing the March 24, 2020 announcement of a 5

cents per common share dividend, the Company’s Board of Directors

have subsequently approved to increase, for this time, that amount

by 50% and pay a total of 7.5 cents per common share on June 26,

2020. The record date has been set for June 22, 2020 with

ex-dividend date June 19, 2020.

Corporate Strategy & OutlookThe primary

objective of management since the beginning of the year has been to

ensure that the fleet’s crew is safe and sound in these challenging

times, especially as government actions around the world have

applied harsh, but necessary restrictions to contain the Covid-19

pandemic.

In this unprecedented environment, with 65

vessels navigating all corners of the world and crewed by 2,000

seafarers, management’s goal has been to ensure their health and

safety. We are proud to have safeguarded our employees to the best

of our ability, so far.

During this period, the silver lining has been

the strength of the tanker market, due to its solid fundamentals

and the strong demand for our services during the first six months

of 2020. In this environment, TEN took the opportunity to agree

long-term accretive charters, that will secure the Company’s

positive performance for the remainder of 2020.

Maintaining a strong balance sheet by increasing

liquidity and reducing debt obligations continues to be a priority.

As previously stated, it remains management’s intention to initiate

the, at par, redemption of its Series C preferred shares next

quarter.

“In the first quarter of 2020, the pandemic was

accompanied by a strong tanker market that continued well into the

second quarter. During that period, TEN fixed long-term charters

for its vessels that will secure positive returns for the remainder

of the year and beyond,” Mr. George Saroglou, COO of TEN commented.

“Management continues to be in discussions with first-class

charterers for similar accretive employments to safeguard cash flow

visibility, a core element in TEN’s strategy. The safety of our

seafarers was, is and remains our top priority as TEN continues its

long established and market tested operating model to achieve the

highest utilization levels and long-term profitability. This is the

fourth and most challenging crisis we have successfully navigated

in 28 years of operations. We would like to thank all our

colleagues for their efforts during these extraordinary times and

wish them to remain safe and healthy,” Mr. Saroglou concluded.

Reverse Share Split At the

Company’s Annual General Meeting which was held on May 28, 2020 it

was resolved by shareholders to undertake a one-for-five reverse

split of our common shares by which one new common share will be

given in exchange for every five currently held. This is scheduled

to take effect at the opening of trading on July 1st, 2020 and

management expects this to increase the universe of investors with

the ability to invest in TEN. Further details will be provided in a

Press Release on this topic.

Conference Call

details:Participants should dial into the call 10

minutes before the scheduled time using the following numbers: +1

(844) 824-7423 (US Toll Free Dial In), +1 (918) 922-6416 (Standard

International Dial In) or +44 (0) 8000 288 438 (UK Toll Free Dial

In). Please quote "Tsakos" to the operator.

A telephonic replay of the conference call will

be available until Thursday, June 18, 2020 by dialing +1(855)

859-2056 (US Toll Free Dial In), or (800) 585-8367 (Standard

International Dial In). Access Code:

3680608#

Simultaneous Slides and Audio

Webcast:There will also be a simultaneous live,

and then archived, slides webcast of the conference call, available

through TEN's website (www.tenn.gr). The slides webcast will also

provide details related to fleet composition and deployment and

other related company information. This presentation will be

available on the Company's corporate website reception page at

www.tenn.gr. Participants for the live webcast should register on

the website approximately 10 minutes prior to the start of the

webcast.

ABOUT TENTEN, founded in 1993

and celebrating this year 27 years as a public company, is one of

the first and most established public shipping companies in the

world. TEN’s diversified energy fleet currently consists of 69

double-hull vessels, including two suezmax tankers and one LNG

carrier under construction, constituting a mix of crude tankers,

product tankers and LNG carriers, totalling 7.6 million dwt. Of the

proforma fleet today, 48 vessels trade in crude, 15 in products,

three are shuttle tankers and three are LNG carriers.

TEN’s Growth Program

|

# |

Name |

Type |

Delivery |

Built |

Financed |

Employment |

|

1 |

HN8041 |

Suezmax |

2020 |

South Korea |

Yes |

Yes |

|

2 |

HN8042 |

Suezmax |

2020 |

South Korea |

Yes |

Yes |

|

3 |

HN3157 |

LNG |

2021 |

South Korea |

TBD |

TBD |

ABOUT FORWARD-LOOKING

STATEMENTS Except for the historical information contained

herein, the matters discussed in this press release are

forward-looking statements that involve risks and uncertainties

that could cause actual results to differ materially from those

predicted by such forward-looking statements. TEN undertakes no

obligation to publicly update any forward-looking statement,

whether as a result of new information, future events, or

otherwise.

For further information please contact:

CompanyTsakos Energy Navigation

Ltd.George SaroglouCOO+30210 94 07 710gsaroglou@tenn.gr

Investor Relations /

MediaCapital Link, Inc.Nicolas BornozisMarkella Kara+212

661 7566 ten@capitallink.com

|

|

|

TSAKOS ENERGY NAVIGATION LIMITED AND

SUBSIDIARIES |

|

Selected Consolidated Financial and Other Data |

|

(In Thousands of U.S. Dollars, except share, per share and fleet

data) |

|

|

|

|

|

|

|

|

| |

|

Three months ended |

| |

|

March 31 (unaudited) |

|

STATEMENT OF OPERATIONS DATA |

|

2020 |

|

|

|

2019 |

|

|

|

|

|

|

|

|

|

Voyage revenues |

$ |

178,899 |

|

|

|

$ |

147,046 |

|

| |

|

|

|

|

|

|

|

Voyage expenses |

|

32,711 |

|

|

|

|

31,566 |

|

|

Charter hire expense |

|

5,140 |

|

|

|

|

2,669 |

|

|

Vessel operating expenses |

|

45,488 |

|

|

|

|

43,324 |

|

|

Depreciation and amortization |

|

34,828 |

|

|

|

|

35,285 |

|

|

General and administrative expenses |

|

7,603 |

|

|

|

|

6,436 |

|

|

Gain on sale of vessel |

|

(1,638 |

) |

|

|

|

- |

|

|

Total expenses |

|

124,132 |

|

|

|

|

119,280 |

|

|

|

|

|

|

|

|

|

|

Operating income |

|

54,767 |

|

|

|

|

27,766 |

|

|

|

|

|

|

|

|

|

|

Interest and finance costs, net |

|

(33,593 |

) |

|

|

|

(17,593 |

) |

|

Interest income |

|

391 |

|

|

|

|

774 |

|

|

Other, net |

|

408 |

|

|

|

|

(29 |

) |

|

Total other expenses, net |

|

(32,794 |

) |

|

|

|

(16,848 |

) |

|

Net income |

|

21,973 |

|

|

|

|

10,918 |

|

|

|

|

|

|

|

|

|

|

Less: Net (income) loss attributable to the noncontrolling

interest |

|

(752 |

) |

|

|

|

311 |

|

|

Net income attributable to Tsakos Energy Navigation

Limited |

$ |

21,221 |

|

|

|

$ |

11,229 |

|

|

|

|

|

|

|

|

|

|

Effect of preferred dividends |

|

(10,207 |

) |

|

|

|

(10,204 |

) |

|

Net income attributable to common stockholders of Tsakos

Energy Navigation Limited |

$ |

11,014 |

|

|

|

$ |

1,025 |

|

|

|

|

|

|

|

|

|

|

Earnings per share, basic and diluted |

$ |

0.12 |

|

|

|

$ |

0.01 |

|

| |

|

|

|

|

|

|

|

Weighted average number of common shares, basic and diluted |

|

95,613,804 |

|

|

|

|

87,604,645 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

BALANCE SHEET DATA |

|

March 31 |

|

|

|

December 31 |

|

|

|

2020 |

|

|

|

2019 |

|

Cash |

|

220,851 |

|

|

|

|

197,770 |

|

|

Other assets |

|

234,029 |

|

|

|

|

261,607 |

|

|

Vessels, net |

|

2,655,529 |

|

|

|

|

2,633,251 |

|

|

Advances for vessels under construction |

|

49,200 |

|

|

|

|

61,475 |

|

|

Total assets |

$ |

3,159,609 |

|

|

|

$ |

3,154,103 |

|

| |

|

|

|

|

|

|

|

Debt, net of deferred finance costs |

|

1,481,080 |

|

|

|

|

1,534,296 |

|

|

Other liabilities |

|

214,520 |

|

|

|

|

147,488 |

|

|

Stockholders' equity |

|

1,464,009 |

|

|

|

|

1,472,319 |

|

|

Total liabilities and stockholders' equity |

$ |

3,159,609 |

|

|

|

$ |

3,154,103 |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

| |

|

Three months ended |

|

OTHER FINANCIAL DATA |

|

March 31 |

|

|

|

2020 |

|

|

|

2019 |

|

Net cash from operating activities |

$ |

57,453 |

|

|

|

$ |

39,238 |

|

|

Net cash provided by (used in) investing activities |

$ |

22,546 |

|

|

|

$ |

(20,830 |

) |

|

Net cash used in financing activities |

$ |

(56,918 |

) |

|

|

$ |

(47,179 |

) |

| |

|

|

|

|

|

|

|

TCE per ship per day |

$ |

26,629 |

|

|

|

$ |

21,054 |

|

| |

|

|

|

|

|

|

|

Operating expenses per ship per day |

$ |

7,886 |

|

|

|

$ |

7,522 |

|

|

Vessel overhead costs per ship per day |

$ |

1,279 |

|

|

|

$ |

1,117 |

|

| |

|

9,165 |

|

|

|

|

8,639 |

|

| |

|

|

|

|

|

|

|

FLEET DATA |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Average number of vessels during period |

|

65.3 |

|

|

|

|

64.0 |

|

|

Number of vessels at end of period |

|

65.0 |

|

|

|

|

64.0 |

|

|

Average age of fleet at end of period |

Years |

9.0 |

|

|

|

|

8.5 |

|

|

Dwt at end of period (in thousands) |

|

6,998 |

|

|

|

|

6,936 |

|

|

|

|

|

|

|

|

|

|

Time charter employment - fixed rate |

Days |

2,511 |

|

|

|

|

2,393 |

|

|

Time charter employment - variable rate |

Days |

1,735 |

|

|

|

|

1,674 |

|

|

Period employment (coa) at market rates |

Days |

89 |

|

|

|

|

180 |

|

|

Spot voyage employment at market rates |

Days |

1,421 |

|

|

|

|

1,328 |

|

|

Total operating days |

|

5,756 |

|

|

|

|

5,575 |

|

|

Total available days |

|

5,943 |

|

|

|

|

5,760 |

|

|

Utilization |

|

96.9% |

|

|

|

|

96.8% |

|

| |

|

|

|

|

|

|

|

Non-GAAP Measures |

|

Reconciliation of Net income to Adjusted

EBITDA |

|

|

|

Three months ended |

|

|

|

March 31 |

|

|

|

2020 |

|

|

|

2019 |

|

|

|

|

|

|

|

|

|

Net income attributable to Tsakos Energy Navigation Limited |

|

21,221 |

|

|

|

|

11,229 |

|

|

Depreciation and amortization |

|

34,828 |

|

|

|

|

35,285 |

|

|

Interest Expense |

|

33,593 |

|

|

|

|

17,593 |

|

|

Gain on sale of vessel |

|

(1,638 |

) |

|

|

|

- |

|

|

Adjusted EBITDA |

$ |

88,004 |

|

|

|

$ |

64,107 |

|

| |

|

|

|

|

|

|

|

The Company reports its financial results in accordance with U.S.

generally accepted accounting principles (GAAP). However,

management believes that certain non-GAAP measures used within the

financial community may provide users of this financial information

additional meaningful comparisons between current results and

results in prior operating periods as well as comparisons between

the performance of Shipping Companies. Management also uses these

non-GAAP financial measures in making financial, operating and

planning decisions and in evaluating the Company’s performance. We

are using the following Non-GAAP measures: |

|

|

|

(i) TCE which represents voyage revenue less voyage expenses is

divided by the number of operating days less 200 days lost for the

first quarter of 2020 and 90 days for the prior year quarter of

2019 as a result of calculating revenue on a loading to discharge

basis. |

|

(ii) Vessel overhead costs are General & Administrative

expenses, which also include Management fees, Stock compensation

expense and Management incentive award. |

|

(iii) Operating expenses per ship per day which exclude Management

fees, General & Administrative expenses, Stock compensation

expense and Management incentive award. |

|

(iv) EBITDA. See above for reconciliation to net income. |

|

Non-GAAP financial measures should be viewed in addition to and not

as an alternative for, the Company’s reported results prepared in

accordance with GAAP. |

|

The Company does not incur corporation tax. |

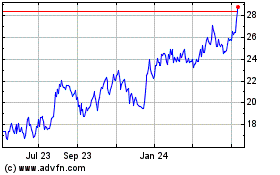

Tsakos Energy Navigation (NYSE:TNP)

Historical Stock Chart

From Mar 2024 to Apr 2024

Tsakos Energy Navigation (NYSE:TNP)

Historical Stock Chart

From Apr 2023 to Apr 2024