Thermo Fisher Deal to Buy Gatan From Roper Investigated by CMA

December 19 2018 - 3:12AM

Dow Jones News

By Oliver Griffin

The U.K.'s monopoly watchdog, the Competition and Markets

Authority, said Wednesday that it is investigating Thermo Fisher

Scientific Inc.'s (TMO) $925 million acquisition of Roper

Technologies Inc.'s (ROP) Gatan business.

The CMA said it is worried the deal, which was first announced

in June, will adversely affect Thermo Fisher's two rivals in the

sector, who use Gatan peripherals with their electron

microscopes.

Alternatives to peripherals made by Gatan are at best extremely

limited, the CMA said.

As a result, the competition regulator said it is concerned the

deal could weaken Thermo Fisher's competitors and enhance its

already strong market position, which could potentially lead to

higher prices for customers.

The CMA said its investigation also raised concerns that the

merger will leave Thermo Fisher with insufficient competition in

the market for direct detection cameras, as Gatan is currently one

of only two competitors in the supply of these instruments.

This in turn could reduce the incentive for further product

development, the CMA said.

The CMA said that if the merging businesses can't address these

concerns, the deal will be referred for an in-depth phase two

investigation.

Write to Oliver Griffin at oliver.griffin@dowjones.com;

@OliGGriffin

(END) Dow Jones Newswires

December 19, 2018 02:57 ET (07:57 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

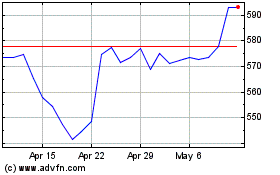

Thermo Fisher Scientific (NYSE:TMO)

Historical Stock Chart

From Mar 2024 to Apr 2024

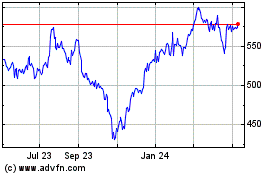

Thermo Fisher Scientific (NYSE:TMO)

Historical Stock Chart

From Apr 2023 to Apr 2024