Comp Store Net Sales Increase 4.3%: EPS of

$0.21

Non-GAAP EPS of $0.24 Excluding Secondary

Offering Costs

Introduces Fourth Quarter Outlook

Tilly’s, Inc. (NYSE: TLYS) today announced financial results for

the third quarter and first three quarters of fiscal 2018 ended

November 3, 2018.

“Tillys continued its positive momentum with its tenth

consecutive quarter of flat to positive comparable store net sales

and its strongest back-to-back quarterly comparable store net sales

performance since the first half of fiscal 2012," commented Ed

Thomas, President and Chief Executive Officer. "We believe we are

well positioned to continue our momentum during the holiday

season."

Third Quarter Results Overview

The following comparisons refer to operating results for the

third quarter of fiscal 2018 versus the third quarter of fiscal

2017 ended October 28, 2017:

- Comparable store net sales, including

e-commerce, increased 4.3%. Comparable store net sales in physical

stores increased 1.3% and represented approximately 86% of total

net sales. E-commerce net sales increased 26.7% and represented

approximately 14% of total net sales. Comparable store net sales,

including e-commerce, increased 1.5% in the third quarter last

year.

- Total net sales of $146.8 million

decreased by $6.0 million, or 3.9%, from $152.8 million last year,

due to the calendar shift impact of last year's 53rd week in the

retail calendar. This retail calendar shift caused a portion of the

back-to-school season to shift into the second quarter this year

from the third quarter last year, reducing last year's comparable

net sales base for the third quarter by approximately $14 million.

This retail calendar shift impact was partially offset by an

aggregate increase of approximately $8 million in comparable store

net sales and net sales from seven net new stores.

- Gross profit of $45.8 million decreased

by $4.3 million, or 8.6%, from $50.1 million last year, primarily

due to the calendar shift impact on net sales described above.

Gross margin, or gross profit as a percentage of net sales,

decreased to 31.2% from 32.8% last year due to the retail calendar

shift impact on net sales. Buying, distribution and occupancy costs

deleveraged 200 basis points against lower total net sales. Product

margins improved 40 basis points, primarily due to lower total

markdowns as a percentage of net sales.

- Selling, general and administrative

expenses ("SG&A") were $37.6 million, or 25.6% of net sales,

compared to $36.0 million, or 23.5% of net sales, last year. As

expected, SG&A deleveraged 210 basis points compared to last

year primarily due to the calendar shift impact on net sales

described above. The $1.6 million increase in SG&A was

primarily attributable to an increase in store payroll of $0.9

million due in part to minimum wage increases, expenses of $0.7

million associated with our secondary offering completed in early

September 2018, and increased online marketing costs of $0.6

million associated with e-commerce net sales growth, partially

offset by a legal matter accrual of $0.7 million in the prior

year.

- Operating income was $8.2 million, or

5.6% of net sales, compared to $14.1 million, or 9.2% of net sales,

last year. The $5.9 million reduction in operating income was

attributable to the retail calendar shift impact on net sales

described above.

- Income tax expense was $2.4 million, or

26.8% of pre-tax income, compared to $5.7 million, or 39.6% of

pre-tax income last year. The reduction in this year's income tax

rate was attributable to the change in corporate tax rates signed

into law late last year.

- Net income was $6.4 million, or $0.21

per diluted share, compared to $8.8 million, or $0.30 per diluted

share, last year. The $0.09 decrease in earnings per share was

attributable to the combination of the retail calendar shift impact

on net sales of approximately $0.11 per diluted share and costs

associated with the secondary offering completed in early September

2018 of approximately $0.02 per diluted share. The remaining

positive variance was primarily due to improved operating results

driven by increased comparable store net sales. On a non-GAAP

basis, excluding the impact of the secondary offering costs this

year and the impact of the legal matter accrual last year, net

income was $7.1 million, or $0.24 per diluted share, this year

compared to $9.2 million, or $0.31 per diluted share, last

year.

Year-to-Date Results Overview

The following comparisons refer to operating results for the

first three quarters of fiscal 2018 versus the first three quarters

of fiscal 2017 ended October 28, 2017:

- Comparable store net sales, including

e-commerce, increased 3.1%. Comparable store net sales in physical

stores increased 2.2% and represented approximately 87% of total

net sales. E-commerce net sales increased 9.2% and represented

approximately 13% of total net sales. Comparable store net sales,

including e-commerce, increased 1.5% in the first three quarters

last year.

- Total net sales of $427.9 million

increased by $15.3 million, or 3.7%, from $412.6 million last year,

primarily due to increased comparable store net sales and net sales

from seven net new stores.

- Gross profit of $130.9 million

increased by $6.9 million, or 5.6%, from $123.9 million last year.

Gross margin increased to 30.6% from 30.0% last year primarily due

to leveraging lower total occupancy costs on higher total net

sales. Product margins improved by 10 basis points due to lower

markdowns as a percentage of net sales.

- SG&A was $108.8 million, or 25.4%

of net sales, compared to $111.4 million, or 27.0% of net sales,

last year. Last year's SG&A included an estimated $6.8 million

in provisions related to legal matters. This year's SG&A

includes a $1.5 million reduction to such provisions as a result of

the final settlement of the related legal matter in early August

2018, and $0.7 million in expenses associated with our secondary

offering completed in early September 2018. The net year-over-year

impact of these legal matter provisions, partially offset by our

secondary offering expenses, accounted for the improvement in

SG&A as a percentage of net sales. After consideration of the

legal matter impacts and secondary offering costs, primary dollar

increases in SG&A were attributable to an increase in store

payroll of $2.1 million primarily due to minimum wage increases and

higher comparable store net sales, increased corporate bonus

provisions of $1.2 million due to improved operating results, and

increased online marketing costs of $1.1 million associated with

e-commerce net sales growth. On a non-GAAP basis, excluding the

impact of legal provisions from both years and the secondary

offering costs from this year, SG&A was $109.6 million, or

25.6% of net sales, compared to $104.6 million, or 25.3% of net

sales, last year.

- Operating income of $22.0 million, or

5.2% of net sales, increased by $9.5 million compared to $12.5

million, or 3.0% of net sales, last year. Of this $9.5 million

improvement in year-over-year operating income, approximately $7.6

million was attributable to the net aggregate year-over-year impact

of the legal matters and secondary offering expenses noted above,

and approximately $1.9 million was attributable to increased

comparable store net sales results and occupancy reductions. On a

non-GAAP basis, excluding the impact of legal provisions from both

years and the secondary offering costs from this year, operating

income was $21.3 million, or 5.0% of net sales, compared to $19.4

million, or 4.7% of net sales, last year.

- Income tax expense was $6.1 million, or

26.1% of pre-tax income, compared to $5.4 million, or 40.1% of

pre-tax income, last year. The reduction in this year's income tax

rate was primarily attributable to the change in corporate tax

rates signed into law late last year. On a non-GAAP basis,

excluding the impact of legal provisions from both years and the

secondary offering costs from this year, income tax expense was

$5.8 million compared to $8.0 million last year.

- Net income was $17.4 million, or $0.58

per diluted share, compared to $8.0 million, or $0.28 per diluted

share, last year. Of the $0.30 improvement in year-over-year

earnings per share, approximately half was attributable to the

aggregate legal matter and secondary offering expenses noted above,

and the other half was due to improved operating results driven by

increased comparable store net sales and occupancy reductions. On a

non-GAAP basis, excluding the impact of the legal provisions from

both years and the secondary offering costs from this year, net

income was $17.0 million, or $0.57 per diluted share, compared to

$12.1 million, or $0.42 per diluted share, last year.

Balance Sheet and Liquidity

As of November 3, 2018, the Company had $120.5 million of cash

and marketable securities and no debt outstanding. This compares to

$121.9 million of cash and marketable securities and no debt

outstanding as of October 28, 2017. The Company paid special cash

dividends to its stockholders of approximately $29.1 million and

$20.1 million in the aggregate during February of 2018 and 2017,

respectively.

Fiscal 2018 Fourth Quarter Outlook

The Company expects its fourth quarter total net sales to range

from approximately $163 million to $168 million based on an assumed

2% to 5% increase in comparable store net sales. Last year's fourth

quarter included an extra week as a result of the 53rd week in last

year's retail calendar, which accounted for approximately $7.1

million in added sales for such quarter versus the comparable

13-week period this year. The Company expects fourth quarter

operating income to range from approximately $8.5 million to $10.0

million, and earnings per diluted share to range from $0.22 to

$0.26. This outlook assumes an anticipated effective tax rate of

approximately 26% and weighted average shares of approximately 30.1

million.

Pursuant to the settlement terms of the previously noted legal

matter, the Company issued non-transferable discount coupons to

approximately 612,000 existing Tillys customers in early September

2018 which allows for a one-time 50% discount on a single, future

purchase transaction of up to $1,000. Any unused coupons will

expire on September 4, 2019. To date, less than 1% of these coupons

have been redeemed, resulting in no material impact to the

Company's comparable store net sales or operating results as a

whole. Although redemptions have been very low in number thus far,

there can be no assurance that the impact of any future coupon

redemptions during the 2018 holiday season, or during fiscal 2019,

will remain immaterial. Our fourth quarter outlook does not

contemplate any specific impacts from future usage of these

coupons.

Preliminary Fiscal 2019 New Store, Capital Expenditure and

Expense Expectations

The Company expects to open up to 15 to 20 new, full-size stores

and an as-yet undetermined number of RSQ-branded pop-up shops

during fiscal 2019, in each case assuming appropriate lease

economics are obtained. The specific timing of any new store

openings is not yet known. The Company expects total capital

expenditures for fiscal 2019 not to exceed $25 million, comprised

primarily of new store costs supplemented by continuing technology

investments. Finally, the Company expects the impact of legislated

minimum wage increases, merit increases, new systems costs, and the

new lease accounting standard to result in an aggregate increase of

approximately $6 million in its annualized operating costs before

consideration of any comparable store net sales assumption. The

Company estimates that its fiscal 2019 comparable store net sales

would need to increase by approximately 3% in order to absorb these

anticipated cost increases without creating any deleverage of

expenses as a percentage of net sales.

Non-GAAP Financial Measures

In addition to reporting financial measures in accordance with

GAAP, the Company is providing certain non-GAAP financial measures

including "non-GAAP SG&A," "non-GAAP operating income,"

"non-GAAP income tax expense," "non-GAAP net income," and "non-GAAP

income per diluted share." These amounts are not in accordance

with, or an alternative to, GAAP. The Company’s management believes

that these measures help provide investors with insight into the

underlying comparable financial results, excluding items that may

not be indicative of, or are unrelated to, the Company’s core

day-to-day operating results.

For a description of these non-GAAP financial measures and

reconciliations of these non-GAAP financial measures to the most

directly comparable financial measures prepared in accordance with

GAAP, please see the accompanying table titled “Supplemental

Financial Information; Reconciliation of Select GAAP Financial

Measures to Non-GAAP Financial Measures” contained in this press

release.

Conference Call Information

A conference call to discuss these financial results is

scheduled for today, November 28, 2018, at 4:30 p.m. ET (1:30 p.m.

PT). Investors and analysts interested in participating in the call

are invited to dial (877) 407-4018 at 4:25 p.m. ET (1:25 p.m. PT).

The conference call will also be available to interested parties

through a live webcast at www.tillys.com. Please visit the website

and select the “Investor Relations” link at least 15 minutes prior

to the start of the call to register and download any necessary

software.

A telephone replay of the call will be available until December

12, 2018, by dialing (844) 512-2921 (domestic) or (412) 317-6671

(international) and entering the conference identification number:

13684938. Please note participants must enter the conference

identification number in order to access the replay.

About Tillys

Tillys is a leading specialty retailer of casual apparel,

footwear and accessories for young men, young women, boys and girls

with an extensive assortment of iconic global, emerging, and

proprietary brands rooted in an active and social lifestyle. Tillys

is headquartered in Irvine, California and currently operates 229

total stores, including four RSQ pop-up stores, across 33 states

and its website, www.tillys.com.

Forward-Looking Statements

Certain statements in this press release and oral statements

made from time to time by our representatives are forward-looking

statements within the meaning of the Private Securities Litigation

Reform Act of 1995. In particular, statements regarding our future

financial and operating results, including but not limited to

future comparable store net sales, future operating income, future

net income, future earnings per share, future gross, operating or

product margins, anticipated tax rate, future impacts of legal

settlements, future inventory levels, future capital expenditures,

and market share and our business and strategy, including but not

limited to expected store openings and closings, expansion of

brands and exclusive relationships, development and growth of our

e-commerce platform and business, promotional strategy, and any

other statements about our future expectations, plans, intentions,

beliefs or prospects expressed by management are forward-looking

statements. These forward-looking statements are based on

management’s current expectations and beliefs, but they involve a

number of risks and uncertainties that could cause actual results

or events to differ materially from those indicated by such

forward-looking statements, including, but not limited to, our

ability to respond to changing customer preferences and trends,

attract customer traffic at our stores and online, execute our

growth and long-term strategies, expand into new markets, grow our

e-commerce business, effectively manage our inventory and costs,

effectively compete with other retailers, enhance awareness of our

brand and brand image, general consumer spending patterns and

levels, the effect of weather, and other factors that are detailed

in our Annual Report on Form 10-K, filed with the Securities and

Exchange Commission (“SEC”), including those detailed in the

section titled “Risk Factors” and in our other filings with the

SEC, which are available from the SEC’s website at www.sec.gov and

from our website at www.tillys.com under the heading “Investor

Relations”. Readers are urged not to place undue reliance on these

forward-looking statements, which speak only as of the date of this

press release. We do not undertake any obligation to update or

alter any forward-looking statements, whether as a result of new

information, future events or otherwise. This release should be

read in conjunction with our financial statements and notes thereto

contained in our Form 10-K.

Tilly’s, Inc. Consolidated Balance Sheets

(In thousands, except par value)

(unaudited)

November 3,2018 February

3,2018

October 28,2017

ASSETS Current assets: Cash and cash equivalents $ 24,751 $

53,202 $ 38,912 Marketable securities 95,766 82,750 82,961

Receivables 7,608 4,352 3,647 Merchandise inventories 73,772 53,216

62,242 Prepaid expenses and other current assets 10,707

9,534 9,759 Total current assets 212,604 203,054 197,521

Property and equipment, net 78,679 83,321 87,576 Other assets 3,667

3,736 7,805 Total assets $ 294,950 $ 290,111

$ 292,902

LIABILITIES AND STOCKHOLDERS’ EQUITY

Current liabilities: Accounts payable $ 34,352 $ 21,615 $ 27,329

Accrued expenses 20,292 22,731 31,854 Deferred revenue 7,144 10,879

8,335 Accrued compensation and benefits 9,487 6,119 6,005 Dividends

payable — 29,067 — Current portion of deferred rent 5,466 5,220

5,762 Current portion of capital lease obligation — —

155 Total current liabilities 76,741 95,631 79,440 Long-term

portion of deferred rent 31,624 31,340 31,377 Other 1,997

2,715 2,955 Total liabilities 110,362 129,686 113,772

Stockholders’ equity: Common stock (Class A), $0.001 par value;

100,000 shares authorized; 21,536, 14,927 and 14,357 shares issued

and outstanding, respectively 21 15 14 Common stock (Class B),

$0.001 par value; 35,000 shares authorized; 7,944, 14,188 and

14,488 shares issued and outstanding, respectively 8 14 15

Preferred stock, $0.001 par value; 10,000 shares authorized; no

shares issued or outstanding — — — Additional paid-in capital

149,141 143,984 140,240 Retained earnings 35,204 16,398 38,765

Accumulated other comprehensive income 214 14 96

Total stockholders’ equity 184,588 160,425 179,130

Total liabilities and stockholders’ equity $ 294,950 $

290,111 $ 292,902

Tilly’s, Inc.

Consolidated Statements of Operations

(In thousands, except per share data)

(unaudited)

Three Months Ended Nine Months Ended

November 3,2018 October 28,2017

November 3,2018 October 28,2017

Net sales $ 146,826 $ 152,824 $ 427,866 $ 412,581 Cost of goods

sold (includes buying, distribution, and occupancy costs) 101,041

102,730 296,999 288,653 Gross profit 45,785

50,094 130,867 123,928 Selling, general and administrative expenses

37,558 35,982 108,831 111,384 Operating income

8,227 14,112 22,036 12,544 Other income, net 585 375

1,457 810 Income before income taxes 8,812 14,487 23,493

13,354 Income tax expense 2,364 5,730 6,134

5,354 Net income $ 6,448 $ 8,757 $ 17,359 $

8,000 Basic income per share of Class A and Class B common stock $

0.22 $ 0.30 $ 0.59 $ 0.28 Diluted income per share of Class A and

Class B common stock $ 0.21 $ 0.30 $ 0.58 $ 0.28 Weighted average

basic shares outstanding 29,373 28,782 29,221 28,746 Weighted

average diluted shares outstanding 30,075 29,031 29,746 28,954

Tilly’s, Inc. Supplemental Financial

Information Reconciliation of Select GAAP Financial Measures

to Non-GAAP Financial Measures

(In thousands, except per share data)

(unaudited)

Third Quarter Ended Nine Months Ended

November 3,2018 October 28,2017

November 3,2018 October 28,2017

Selling, general and administrative, as reported $ 37,558 $ 35,982

$ 108,831 $ 111,384 Legal settlement — (650 ) 1,458 (6,816 )

Secondary offering costs (714 ) — (714 ) — Non-GAAP

selling, general and administrative $ 36,844 $ 35,332

$ 109,575 $ 104,568 Operating income, as

reported $ 8,227 $ 14,112 $ 22,036 $ 12,544 Legal settlement — 650

(1,458 ) 6,816 Secondary offering costs 714 — 714

— Non-GAAP operating income $ 8,941 $ 14,762

$ 21,292 $ 19,360 Income tax expense,

as reported $ 2,364 $ 5,730 $ 6,134 $ 5,354 Income tax effect of

legal settlement (1) — 255 (386 ) 2,679 Income tax effect of

secondary offering costs (1) 189 — 189 — Income tax effect of

non-deductibility of a portion of secondary offering costs (1) (165

) — (165 ) — Non-GAAP income tax expense $ 2,388

$ 5,985 $ 5,772 $ 8,033 Net

income, as reported $ 6,448 $ 8,757 $ 17,359 $ 8,000 Legal

settlement — 650 (1,458 ) 6,816 Secondary offering costs 714 — 714

— Less: Income tax effects (1) (24 ) (255 ) 362 (2,679 )

Non-GAAP net income $ 7,138 $ 9,152 $ 16,977 $

12,137 Diluted income per share, as reported $ 0.214

$ 0.30 $ 0.584 $ 0.28 Legal settlement, net of taxes (1) — 0.01

(0.036 ) 0.14 Secondary offering costs, net of taxes (1) 0.023

— 0.023 — Non-GAAP diluted income per

share $ 0.237 $ 0.31 $ 0.571 $ 0.42

Weighted average basic shares outstanding 29,373 28,782

29,221 28,746 Weighted average diluted shares outstanding 30,075

29,031 29,746 28,954 (1) The effective tax rate

applied to the $0.7 million of secondary offering costs for the

third quarter and nine months ended November 3, 2018 was 26.5%.

Additionally, this year's income tax expense includes approximately

$0.2 million due to the non-deductibility of a portion of the

secondary offering costs. The effective tax rate applied for

the third quarter and nine months ended October 28, 2017 was 39.3%.

Tilly’s, Inc. Consolidated Statements of

Cash Flows

(In thousands)

(unaudited)

Nine Months Ended November 3,2018

October 28,2017 Cash flows from operating

activities Net income $ 17,359 $ 8,000 Adjustments to

reconcile net income to net cash provided by operating activities:

Depreciation and amortization 16,966 17,644 Stock-based

compensation expense 1,662 1,773 Impairment of assets 786 848 Loss

on disposal of assets 11 170 Gain on marketable securities (983 )

(510 ) Deferred income taxes (419 ) (1,194 ) Changes in operating

assets and liabilities: Receivables (3,256 ) 342 Merchandise

inventories (20,746 ) (14,474 ) Prepaid expenses and other assets

(1,290 ) (777 ) Accounts payable 12,859 9,177 Accrued expenses

(6,006 ) 4,202 Accrued compensation and benefits 3,368 (1,254 )

Deferred rent 530 (4,394 ) Deferred revenue (1,562 ) (1,868 ) Net

cash provided by operating activities 19,279 17,685

Cash flows from investing activities Purchase of property

and equipment (10,394 ) (9,716 ) Purchases of marketable securities

(116,442 ) (112,612 ) Proceeds from marketable securities 104,678

85,134 Net cash used in investing activities (22,158

) (37,194 )

Cash flows from financing activities Dividends

paid (29,067 ) (20,080 ) Proceeds from exercise of stock options

3,606 288 Taxes paid in lieu of shares issued for stock-based

compensation (111 ) (101 ) Payment of capital lease obligation —

(680 ) Net cash used in financing activities (25,572 )

(20,573 ) Change in cash and cash equivalents (28,451 ) (40,082 )

Cash and cash equivalents, beginning of period 53,202 78,994

Cash and cash equivalents, end of period $ 24,751 $

38,912

Tilly's, Inc. Store Count and

Square Footage

StoresOpen atBeginning

ofQuarter

StoresOpenedDuring

Quarter

StoresClosedDuringQuarter

StoresOpen atEnd of

Quarter

Total GrossSquare

FootageEnd of Quarter(in thousands)

2017 Q3 221 — 1 220 1,681

2017 Q4 220 2 3 219 1,668

2018 Q1 219 4 1 222 1,675

2018 Q2 222 4 — 226 1,698

2018 Q3 226 5 4 227 1,693

Note:

Total stores opened during fiscal 2018 includes four RSQ-branded,

pop-up stores.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20181128005695/en/

Investor Relations Contact:Michael

Henry, Chief Financial Officer(949) 609-5599, ext.

17000irelations@tillys.com

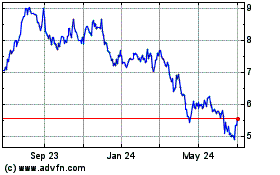

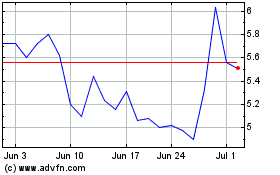

Tillys (NYSE:TLYS)

Historical Stock Chart

From Mar 2024 to Apr 2024

Tillys (NYSE:TLYS)

Historical Stock Chart

From Apr 2023 to Apr 2024