Current Report Filing (8-k)

April 03 2020 - 4:06PM

Edgar (US Regulatory)

false0000098362

0000098362

2020-04-03

2020-04-03

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_________

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

|

|

|

|

|

|

Date of Report (Date of earliest event reported):

|

April 3, 2020

|

THE TIMKEN COMPANY

(Exact name of registrant as specified in its charter)

Commission file number: 1-1169

|

|

|

|

|

|

|

|

Ohio

|

|

34-0577130

|

|

(State or other jurisdiction of incorporation or organization)

|

|

(I.R.S. Employer Identification No.)

|

|

|

|

|

|

|

4500 Mount Pleasant Street NW

|

|

|

|

North Canton

|

Ohio

|

|

44720-5450

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

234.262.3000

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions.

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Securities Exchange Act of 1934:

|

|

|

|

|

|

|

|

|

|

|

|

Title of each class

|

|

Trading Symbol

|

|

Name of each exchange on which registered

|

|

|

|

Common Shares, without par value

|

|

TKR

|

|

The New York Stock Exchange

|

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.03. Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant

As previously disclosed, The Timken Company (“Timken” or the “Company”) is party to the Fourth Amended and Restated Credit Agreement (the “Credit Agreement”) with Bank of America, N.A. and KeyBank National Association, as Co-Administrative Agents, KeyBank National Association as Paying Agent, L/C Issuer and Swing Line Lender, and the other lenders party thereto, which provides for a $650 million unsecured revolving credit facility that matures on June 25, 2024 (the “Senior Credit Facility”). A copy of the Credit Agreement was filed as an exhibit to the Company’s Current Report on Form 8-K filed with the Securities and Exchange Commission on June 25, 2019.

On April 3, 2020, the Company drew $350 million on the Senior Credit Facility, which is now almost fully drawn. The Company increased its borrowings under the Senior Credit Facility as a precautionary measure to increase its cash position and enhance its financial flexibility during this period of uncertainty in the global markets resulting from the ongoing coronavirus (“COVID-19”) pandemic. The draw-down proceeds from the Senior Credit Facility are currently being held on the Company’s balance sheet and may be used for general corporate purposes.

|

|

|

|

Item 7.01.

|

Regulation FD Disclosure

|

Timken is also providing an update regarding the ongoing COVID-19 pandemic. The Company continues to adhere to mandates and other guidance from local governments and health authorities, as well as the World Health Organization and the Centers for Disease Control and Prevention. Timken’s main priority is the health of its employees and others in the communities where it does business.

The Company continues to reduce production schedules and has temporarily idled certain plants in response to customer shut-downs, changes in demand and other government-imposed restrictions on operations. The Company has also begun to implement cost reduction actions across the enterprise.

The extent and duration of the impact of COVID-19 and resulting effect on the Company’s operations remains uncertain. As a result of the evolving impact of COVID-19 on the economy, Timken is withdrawing its 2020 financial outlook provided on February 5, 2020. Further updates will be provided when the Company reports first quarter 2020 results.

Timken has ample liquidity to meet its near-term needs with over $700 million of cash and cash equivalents on the balance sheet as of April 3, 2020. This includes the recent draw of $350 million on its Senior Credit Facility described in Item 2.03.

The information in this Item 7.01 shall not be deemed to be “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934 (the “Exchange Act”) or otherwise subject to the liabilities of that section, nor shall it be incorporated by reference into a filing under the Securities Act of 1933, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

Forward-looking Statements

Certain statements in this filing (including statements regarding the Company’s beliefs, estimates and expectations) that are not historical in nature are "forward-looking" statements within the meaning of the Private Securities Litigation Reform Act of 1995. The Company cautions that actual results may differ materially from those projected or implied in forward-looking statements due to a variety of important factors, including: the Company’s ability to respond to changes in its end markets that could affect demand for the Company’s products or services; unanticipated changes in business relationships with customers or their purchases from the Company; changes in the financial health of the Company’s customers, which may have an impact on the Company’s revenues, earnings and impairment charges; fluctuations in material and energy costs; the impact of changes to the Company’s accounting methods; political risks associated with government instability; recent world events that have increased the risk posed by international trade disputes, tariffs and sanctions; weakness in global or regional economic conditions and capital markets; the Company’s ability to satisfy its obligations under its debt agreements and renew or refinance borrowings on favorable terms; fluctuations in currency valuations; changes in the expected costs associated with product warranty claims; the ability to achieve satisfactory operating results in the integration of acquired companies, including realizing any accretion within expected timeframes or at all; the impact on operations of general economic conditions; fluctuations in customer demand; the impact on the Company’s pension obligations and assets due to changes in interest rates, investment performance and other tactics designed to reduce risk; the introduction of new disruptive technologies; unplanned plant shutdowns; the Company’s ability to maintain appropriate relations with unions and works councils; negative impacts to the Company’s business as a result of COVID-19 or other epidemics or pandemics; and the Company’s ability to complete and achieve the benefits of announced plans, programs, initiatives, acquisitions and capital investments. Additional factors are discussed in the Company’s filings with the Securities and Exchange Commission, including the Company’s Annual Report on Form 10-K for the year ended Dec. 31, 2019, quarterly reports on Form 10-Q and current reports on Form 8-K. Except as required by the federal securities laws, the Company undertakes no obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future events or otherwise.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

THE TIMKEN COMPANY

|

|

|

|

|

|

|

|

|

By:

|

/s/ Philip D. Fracassa

|

|

|

|

|

Philip D. Fracassa

|

|

|

|

|

Executive Vice President and Chief Financial Officer

|

|

Date:

|

|

April 3, 2020

|

|

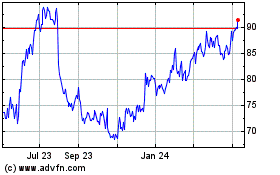

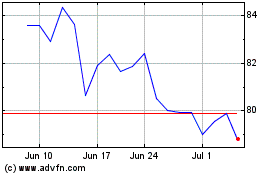

Timken (NYSE:TKR)

Historical Stock Chart

From Mar 2024 to Apr 2024

Timken (NYSE:TKR)

Historical Stock Chart

From Apr 2023 to Apr 2024