Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

of the Securities Exchange Act of 1934

For the month of September 2019

Commission File Number: 001-13464

Telecom Argentina S.A.

(Translation of registrant’s name into English)

Alicia Moreau de Justo, No. 50, 1107

Buenos Aires, Argentina

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Table of Contents

|

FREE TRANSLATION

|

|

Buenos Aires, September 25, 2019

Comisión Nacional de Valores

Dear Sirs,

RE.: Response to FGS – ANSES

General Ordinary Shareholders’ Meeting and General Extraordinary Shareholders’ Meeting and Class “A” and Class “D” Shares Special Shareholders’ Meetings, summoned for October 10, 2019 (the “Shareholders’ Meetings”).

I am writing to you as Attorney-in-Fact of Telecom Argentina S.A. (“Telecom Argentina” or the “Company”), to submit a copy of the information request received from the shareholder FGS – ANSES regarding the Shareholders’ Meetings and the response delivered today by the Company to the aforementioned information request.

Sincerely,

|

|

|

|

|

Telecom Argentina S.A.

|

|

|

|

|

|

/s/ Andrea V. Cerdán

|

|

|

Attorney in Fact

|

Table of Contents

Buenos Aires, September 25, 2019.

Lic. Miguel J. White

a/c de la Dirección General del Programa Argenta

ANSES

S / D

Re.: Note 5655/19. General Ordinary Shareholders’ Meeting and General Extraordinary Shareholders’ Meeting and Class “A” and Class “D” Shares Special Shareholders’ Meetings to be held on October 10, 2019 (the “Shareholders’ Meetings”).

Dear Mr. White,

I am writing to you in my capacity as Chairman of the Board of Telecom Argentina S.A. (“Telecom Argentina” or the “Company”), to provide the information you requested in the abovementioned Note.

Following the order in which the requirements were stated, I hereby report:

1. Below is the shareholding structure of Telecom Argentina as of September 19, 2019, in accordance with the Shareholder Registry Book carried by the Company – Class A and Class D shares – and the registry carried by Caja de Valores S.A.- Class B and Class C shares-, considering the capital decreases corresponding to treasury shares (according to the provisions of section 67 of Law 26,831) to date:

|

Shareholder

|

Quantity and Class of Shares

|

Percentage of total

Capital Stock

|

Percentage of

Votes

|

|

Cablevisión Holding S.A.

|

406,757,183 Class “D” shares

|

18.84%

|

18.89%

|

|

VLG S.A.U.

(100% owned by Cablevisión Holding S.A.)

|

199,732,125 Class “D” shares

|

9.25%

|

9.27%

|

|

Fintech Telecom LLC

|

448,679,250 Class “A” shares

|

20.78%

|

20.83%

|

|

Trust created on 04-15-2019

|

235,177,350 Class “A” shares

235,177,350 Class “D” shares

|

21.79%

|

21.84%

|

|

Float (without FGS)

(*)(**)

|

387,124,996 Class “B” shares

|

17.93%

|

17.74%

|

|

FGS

|

246,018,839 Class “B” shares

|

11.40%

|

11.42%

|

|

Class “C” shares

(ESOP Residual)

|

210,866 Class “C” shares

|

0.01%

|

0.01%

|

|

Total Shares representing the Capital Stock

|

2,158,877,959

|

100.00%

|

100.00%

|

(*) Of this total, 5,189,948 are treasury shares.

(**) Of this total, 343,088,865 are registered for JPMorgan Chase Bank ADR, which is the depositary of said ADRs and therefore Telecom Argentina does not have a registry of ADR holders.

Table of Contents

2. Annex I includes a copy of the Minutes of Board of Directors Meeting No. 387 of September 9, 2019, in the portion relating to:

i) The call for the General Ordinary Shareholders’ Meeting to be held on October 10, 2019, at 11 a.m. on the first call and at 12 p.m. on the second call (the “Ordinary Shareholders’ Meeting”) and the proposals put forward by the Board to the Shareholders on each of the items to be considered by the Shareholders’ Meeting (published on September 10, 2019 on the Autopista de la Información Financiera (AIF) of the National Securities Commission (CNV) under ID number 2520136); and

ii) The call for the General Extraordinary Shareholders’ Meeting and the Class “A” and Class “D” Shares Special Shareholders’ Meetings, to be held on October 10, 2019, at 12.30 (the “Extraordinary and Special Shareholders’ Meetings”) and the proposals put forward by the Board to the Shareholders on each of the items to be considered by the Shareholders’ Meeting (published on September 10, 2019 on the Autopista de la Información Financiera (AIF) of the National Securities Commission (CNV) under ID number 2520162).

3. Below is the current composition of the Board of Directors, including both regular and alternate members, indicated the dates on which they were appointed and the term of their office.

|

Full Name

|

Position

|

Appointed on

|

Term (*)

|

|

Alejandro Alberto Urricelqui

|

Chairman

|

01.31.2018

|

3 years from appointment

|

|

Mariano Marcelo Ibañez

|

Vice Chairman

|

01.31.2018

|

3 years from appointment

|

|

Sebastián Bardengo

|

Regular Director

|

01.31.2018

|

3 years from appointment

|

|

Ignacio José María Sáenz Valiente

|

Regular Director

|

01.31.2018

|

3 years from appointment

|

|

Damián Fabio Cassino

|

Regular Director

|

01.31.2018

|

3 years from appointment

|

|

Carlos Alejandro Harrison

|

Regular Director

|

01.31.2018

|

3 years from appointment

|

|

Martín Héctor D´Ambrosio

|

Regular Director

|

01.31.2018

|

3 years from appointment

|

|

Germán Horacio Vidal

|

Regular Director

|

01.31.2018

|

3 years from appointment

|

|

Luca Luciani

|

Regular Director

|

01.31.2018

|

3 years from appointment

|

|

Baruki Luis Alberto González

|

Regular Director

|

01.31.2018

|

3 years from appointment

|

|

Alejo Maxit

|

Regular Director

|

01.31.2018

|

3 years from appointment

|

|

María Lucila Romero

|

Alternate Director

|

01.31.2018

|

3 years from appointment

|

|

Sebastián Ricardo Frabosqui Díaz

|

Alternate Director

|

01.31.2018

|

3 years from appointment

|

|

Claudia Irene Ostergaard

|

Alternate Director

|

01.31.2018

|

3 years from appointment

|

|

Nicolás Sergio Novoa

|

Alternate Director

|

01.31.2018

|

3 years from appointment

|

|

José Carlos Cura

|

Alternate Director

|

01.31.2018

|

3 years from appointment

|

|

Miguel Ángel Graña

|

Alternate Director

|

01.31.2018

|

3 years from appointment

|

|

Facundo Martín Goslino

|

Alternate Director

|

01.31.2018

|

3 years from appointment

|

|

Lucrecia María Delfina Moreira Savino

|

Alternate Director

|

01.31.2018

|

3 years from appointment

|

|

Saturnino Jorge Funes

|

Alternate Director

|

01.31.2018

|

3 years from appointment

|

|

Carolina Susana Curzi

|

Alternate Director

|

01.31.2018

|

3 years from appointment

|

|

Santiago Luis Ibarzábal Murphy

|

Alternate Director

|

01.31.2018

|

3 years from appointment

|

(*) The Directors remain in office until the General Shareholders’ Meeting considering the financial statements for fiscal year 2020.

Table of Contents

4. a) Information on Item 2) of the Ordinary Shareholders’ Meeting:

In response to your requirement, below is the evolution of the “Voluntary reserve for future cash dividends” and / or the “Voluntary reserve to maintain the company’s level of investments in capital assets and the current level of solvency”:

Voluntary reserve for future cash dividends:

|

Date of reserve

setup

|

Movements in millions

of pesos

|

Resolved by

|

|

Balance as of December 31, 2018

|

10,984

|

|

|

|

3,300

|

Restatement of the initial balance in terms of the constant currency as of August 31, 2019.

|

|

April 24, 2019

|

8,193

|

According to the Ordinary and Extraordinary Shareholders’ Meeting of April 24, 2019, equivalent to $7,045 million, restated in terms of the constant currency as of August 31, 2019.

|

|

August 16, 2019

|

- 7,045

|

Dividend payment of August 16, 2019.

|

|

Balance as of August 31, 2019

|

15,432

|

Restated in terms of the constant currency as of August 31, 2019.

|

Voluntary reserve to maintain the company’s level of investments in capital assets and the current level of solvency:

|

Date of reserve

setup

|

Movements in pesos

(millions)

|

Resolved by

|

|

Balance as of December 31, 2018

|

11,331

|

|

|

|

3,405

|

Restatement of the initial balance in terms of the constant currency as of August 31, 2019.

|

|

April 24, 2019

|

19,141

|

According to the Ordinary and Extraordinary Shareholders’ Meeting of April 24, 2019, equivalent to $16,460 million, restated in terms of the constant currency as of August 31, 2019.

|

|

Balance as of August 31, 2019

|

33,877

|

Restated in terms of the constant currency as of August 31, 2019.

|

As stated in item 2) of the Agenda, it is being submitted for the consideration of the Ordinary Shareholders’ Meeting that it should be the Shareholders’ Meeting that must decide on that same occasion the total or partial reversal of the “Voluntary reserve for future cash dividends” and / or the “Voluntary reserve to maintain the company’s level of investments in capital assets and the current level of solvency” and the distribution of cash dividends.

If it does not resolve in this manner or concomitantly, the Shareholders’ Meeting may also consider it convenient to delegate powers to the Board of Directors so that, in a future Board of Directors’ Meeting, the Board of Directors’ may decide on said reversal and the distribution of dividends.

Table of Contents

In this regard, the controlling shareholder of the Company, Cablevisión Holding S.A., has expressed to us that it would be its intention to propose a cash dividend payment of US$300,000,000. For that purpose, it would propose to the shareholders to withdraw the amounts necessary to cover the aforementioned amount, firstly from the “Voluntary reserve for future cash dividends” (which amounts, in constant currency as of August 31, 2019 to P$15,431,534,497.59), and in the case that said Reserve would not have been sufficient, from the “Voluntary reserve to maintain the company’s level of investments in capital assets and the current level of solvency” (for these purposes and as of today, the amount to be withdrawn from the “Voluntary reserve to maintain the company’s level of investments in capital assets and the current level of solvency” would be approximately around 5% of this latter Reserve in constant currency as of August 31, 2019).

In this connection, in accordance with the data on the Company’s financial statements as of June 30, 2019 and the projected cash flows, the Company’s cash, financial and economic situation would enable making this dividend payment, if the Shareholders’ Meeting so decides.

This dividend distribution proposal made by the controlling shareholder is consistent with the following criteria that the Company has been applying: i) Maintain and ensure adequate compensation of all our funding sources, both in terms of debt and capital; ii) Develop its investment plan with third party financing lines and debt issuance, keeping a certain leverage ratio; iii) Manage the liquidity level that is most convenient for the Company.

Furthermore, we report that the Company does not have any restriction on the distribution of dividends.

4. b) Information on Item 2) of the Extraordinary and Special Shareholders’ Meetings:

Regarding the proposal to amend sections Four, Five and Six of the Bylaws, whose treatment has been requested by shareholder Fintech Telecom LLC, we report that, since there were no observations from the CNV, the proposed text was submitted for publication in the Daily Gazette of the Stock Exchange on September 24, 2019. Said text is included in Annex II.

The Board of Directors´ has proposed to authorize attorneys Andrea Viviana Cerdán, Alejandra Lea Martínez, Graciela Matilde Lazzati, María Verónica Tuccio, María Lucila Romero, Eugenia Prieri Belmonte, Martín Guillermo Ríos, Lucrecia María Delfina Moreira Savino, and Delfina Lynch, so that any of them acting indistinctly, may perform all the procedures and formalities required to obtain the approval and registration of the amendment of the Corporate Bylaws.

The documents in the Annexes to this memo have been signed and initialed by Andrea Cerdan, the Company’s legal representative, with sufficient powers to that end.

It is stated that this response, together with its requirement, will be made available to the general public at CNV’s Autopista de la Información Financiera (AIF) and the Buenos Aires Stock Exchange.

Table of Contents

Yours sincerely,

|

/s/ Alejandro A. Urricelqui

|

|

For and on behalf of Telecom Argentina S.A.

Alejandro A. Urricelqui

Chairman of the Board of Directors

Table of Contents

Note 5655/19

ANSES

Buenos Aires, September 18, 2019

Re.: General Ordinary Meeting and General Extraordinary Meeting and Special Meetings of Class “A” Shares and Class “D” Shares to be held on October 10, 2019 (the “Meetings”).

To the Chairman,

I am writing to you regarding the General Ordinary Meeting and General Extraordinary Meeting and Special Meetings of Class “A” and “D” Shareholders of Telecom Argentina S.A. to be held on October 10, 2019 at 11 am on the first call and at 12 pm on the second call (General Ordinary Meeting) and at 12.30 pm (Extraordinary and Special Meetings), at Av. Alicia Moreau de Justo 50, PB, Buenos Aires City.

In order to safeguard the right to information vested in us as a shareholder and to enable us to properly exercise our political rights, please answer this request no less than fifteen (15) days prior to the Meeting, in accordance with the analogous application of article 67 of the General Corporations Law No. 19,550.

For that purpose, we request the following information, signed by the legal representative or a duly authorized person:

1. Detailed shareholding structure as of the date hereof (please do not include the shareholder registry of Caja de Valores, but a summary table specifying the percentages corresponding to the controlling shareholder and the float, per class of share, total number of votes and total amount of shares).

2. A signed copy of the Board of Directors Meeting Minutes calling for the Extraordinary Meeting of the Shareholders.

3. The current composition of the Board of Directors (regular and alternate members) with the dates on which they were appointed, and specifying their terms of office.

4. Regarding the following items on the agenda, our requests are listed below:

a. (Ordinary Meeting: item 2) Consideration of the total or partial withdrawal of the “Voluntary Reserve for Future Cash Dividends” and/or of the “Voluntary Reserve to maintain the Company’s level of investments in capital assets and the current level of solvency” and to allocate the funds from those withdrawals to the distribution of cash dividends and/or to delegate to the Board of Directors the powers to release, totally or partially, the aforementioned Reserves and to distribute the withdrawn funds as cash dividends, in the amounts and dates to be determined by the Board of Directors.”

Table of Contents

Provide the detailed evolution of (i) the Voluntary Reserve for Future Cash Dividends(ii) the Voluntary Reserve to maintain the Company’s level of investments in capital assets and the current level of solvency. Specify the current composition of said Reserves, the dates on which they were set up and the last movements.

Additionally, in accordance with the items considered in previous Meetings, report and specify the maximum amounts and terms for the proposed delegation to the Board so that it may decide to withdraw said Reserves, and specify who will be delegated such powers.

Furthermore, report the rationale for this proposal, and provide any other information that is relevant on this matter, for evaluating its convenience. Finally, indicate if the Company has any restriction on dividend distribution that is effective at the time of this Meeting.

b. (Extraordinary Meeting: item 2) Amendment of sections 4, 5 and 6 of the Corporate Bylaws. Appointment of the persons that will be in charge of carrying out the procedures related to the approval and registration of the amendments.

Provide information on the proposed amendment of the abovementioned articles and the reasons for such proposal, with all relevant information on this item on the agenda.

Furthermore, please provide the names of the persons proposed to carry out the abovementioned tasks, as well as a brief description of their position in the Company.

Note: The documentation should be sent to Tucuman 500, Floor 2, Buenos Aires (Sustainability Guarantee Fund – ANSES).

Any documents that are not duly signed by the legal representative or an authorized person will not be accepted.

This letter has been issued under the terms and with the powers granted to the Sustainability Guarantee Fund of the Integrated Social Security System of Argentina (ANSES) by Law No. 27,260 and its regulatory Decree No. 894/16, which includes the power to request information and access the books and documents of the Companies, make communications regarding attendance to Ordinary, Extraordinary and Special Meetings, and any other communications required to exercise shareholding rights, among other competences and powers.

Yours sincerely,

Signed and sealed: Lic. Miguel Jose Mitre, General Management – Argenta Program ANSES

Table of Contents

ANNEX I

FREE TRANSLATION

TELECOM ARGENTINA S.A.

MINUTES OF BOARD OF DIRECTORS’ MEETING No. 387

(Relevant Part)

In the city of Buenos Aires, on this 9th day of September of the year 2019, at 6:30 p.m., the undersigning Directors and Supervisory Committee Members of TELECOM ARGENTINA S.A. (“Telecom Argentina” or the “Company”) meet at the corporate registered offices located at Alicia Moreau de Justo No. 50. Alternate director María Lucila Romero participates with no vote. CFO, Mr. Gabriel P. Blasi; Administration Manager, Mr. Federico Pra; and Corporate Affairs Manager, Mrs. Andrea V. Cerdán, also attend the meeting.

Pursuant to the provisions of section 10 of the Company´s Bylaws, director Luca Luciani, paticipates by remote attendance of this meeting, connected via videoteleconference with the other directors and supervisory committee members, and is considered for the purpose of establishing a quorum as provided by the aforementioned Bylaws’ section.

The meeting is chaired over by the Chairman of the Board of Directors, Mr. Alejandro Urricelqui who, after verifying that there is a quorum, submits the following matters to be considered by those in attendance:

I. CALL TO ORDINARY GENERAL SHAREHOLDERS’ MEETING.

The Chairman of the Board of Directors says that according to the second quarter Financial Statements ended on June 30, 2019, the “Voluntary reserve for future cash dividends” amounted in constant currency as of that date to $21,157 million.

Afterwards, in exercise of the powers delegated by the Ordinary and Extraordinary Shareholders´ Meeting dated April 24, 2019, the Board of Directors at its meeting No. 386 dated August 8, 2019, decided to withdraw $7,045 million of the “Voluntary Reserve for Future Cash Dividends” which were distributed as cash dividends and which were made available to shareholders on August 16, 2019.

The Company has also allocated funds in previous fiscal years to a “Voluntary reserve to maintain the company’s level of investments in capital assets and the current level of solvency” which according to the second quarter Financial Statements ended on June 3, 2019, amounted as of that date to $31,888 million in constant currency.

Table of Contents

The Chairman of the Board informs that on September 5, 2019 the Company received from the controlling shareholder Cablevisión Holding S.A. a letter requesting that a General Ordinary Shareholders´ Meeting be summoned, in order for the shareholders to consider the total or partial withdrawal of the “Voluntary reserve for future cash dividends” and/or of the “Voluntary reserve to maintain the company’s level of investments in capital assets and the current level of solvency” and to allocate the funds from those withdrawals to the distribution of cash dividends and/or to delegate to the Board of Directors the powers to withdraw, totally or partially, the aforementioned Reserves and to distribute the withdrawn funds as cash dividends, in the amounts and dates to be determined by the Board of Directors.

Regarding this matter, the Chairman of the Board explains that Comision Nacional de Valores’ General Resolution Number 777/2018 established regarding earnings distribution, that “earnings distribution shall be considered in the currency as of the Shareholders´ Meeting date using the price index corresponding to the previous month of said Meeting”. Therefore, the Shareholders´ Meeting to be summoned shall consider the amount to be withdrawn from the aforementioned Reserves according to applicable law.

After deliberation, the directors resolve by unanimity to summon to an Ordinary General Shareholders’ Meeting to be held on October 10, 2019, at 11 a.m. on first call, and at 12 p.m. on second call, at the corporate offices at Ave. Alicia Moreau de Justo N° 50, City of Buenos Aires, in order to consider the following items:

AGENDA

1) Appointment of two shareholders to sign the Minutes of the Meeting.

2) Consideration of the total or partial withdrawal of the “Voluntary Reserve for Future Cash Dividends” and/or of the “Voluntary Reserve to maintain the Company’s level of investments in capital assets and the current level of solvency” and to allocate the funds from those withdrawals to the distribution of cash dividends and/or to delegate to the Board of Directors the powers to release, totally or partially, the aforementioned Reserves and to distribute the withdrawn funds as cash dividends, in the amounts and dates to be determined by the Board of Directors.

THE BOARD OF DIRECTORS

Note 1: To be able to attend the Shareholders’ Meeting, the holders of Class B and Class C shares must deposit the book-entry shareholding certificates issued for that purpose by ‘Caja de Valores S.A.’, no later than three business days prior to the date of the Shareholders’ Meeting, at Ave. Alicia Moreau de Justo No. 50, 13th floor, City of Buenos Aires, from 10 a.m. to 12 p.m. and from 3 p.m. to 5 p.m. Within the same term and timetable, the holders of book-entry shares Class A and D must notify their attendance to the Meeting. The deadline is October 4, 2019, at 5 p.m.

Note 2: Within the regulatory term and at the place and time stated in Note 1, hard copies of the documents related to the Shareholders´ Meeting may be obtained, likewise such documents will be available at Telecom Argentina’s website: www.telecom.com.ar.

Table of Contents

Note 3: Pursuant to the provisions set forth in section 22 of Chapter II, Title II of the CNV Rules, at the time of registration to take part in the Shareholders’ Meeting and at the time of attending the Shareholders’ Meeting, shareholders must supply all the details of the holders and their representatives. Legal entities and other legal structures must provide the information and deliver the documentation as required by the CNV Rules in sections 24, 25 and 26 of Chapter II, Title II.

Note 4: Those registered to participate in the Shareholders’ Meeting as custodians or administrators of any third party shareholdings are reminded of the need to fulfill the requirements of section 9, Chapter II, Title II of the CNV Rules, to be able to cast a vote in a divergent manner.

Note 5: Shareholders are requested to be present at least 15 minutes prior to the scheduled time of the Shareholders’ Meeting in order to validate their proxies and sign the Attendance Book.

II. PROPOSALS OF THE BOARD OF DIRECTORS TO THE ORDINARY GENERAL SHAREHOLDERS’ MEETING.

The Chairman of the Board of Directors explains that section 70 of Law No 26,831 requires that the Board of Directors must make available to shareholders the relevant information related to the meeting and the proposals of the Board with 20 calendar days anticipation before a Shareholders´ Meeting. These proposals allow ADR holders to give voting instructions to the Program Administrator. Therefore, the Board must make the proposals it deems convenient regarding the items of the Shareholders´ Meeting Agenda.

After deliberation, the directors resolve by unanimity to make the following proposals to the Shareholders´ Meeting:

Proposal for the First Item on the Agenda:

The proposal to the Shareholders’ Meeting is “that the shareholders appoint those persons that will sign the Minutes”.

Proposal for the Second Item on the Agenda:

The proposal of the Board of Directors is the following: “It is proposed that the shareholders, within the framework of the Shareholders’ Meeting, resolve upon the withdrawal and/or delegation of powers to release the Reserves mentioned in the Agenda and their distribution as cash dividends”.

III. CALL TO GENERAL EXTRAORDINARY SHAREHOLDERS’ MEETING AND CLASS “A” AND CLASS “D” SHARES SPECIAL SHAREHOLDERS’ MEETINGS.

The Chairman of the Board further informs that the Company received from the shareholder Fintech Telecom LLC a letter requesting that a General Extraordinary

Table of Contents

Shareholders´ Meeting be summoned to consider the amendment of sections 4th, 5th and 6th of the Corporate Bylaws, so that Class “A” shares, which are currently book-entry shares, may be certified shares in accordance with applicable law. Cablevisión Holding S.A. sent a letter with that purpose, proposing the same Corporate Bylaws amendment regarding Class “D” shares.

The current text of sections 4, 5 and 6 of the Corporate Bylaws and the amended text proposed in each case (in bold and underlined) are transcribed below:

……………………………………….

As established by section 4 of the Corporate Bylaws, the amendment of Corporate Bylaws requires the approval of Class “A” and Class “D” Shares Special Shareholders’ Meetings.

After deliberation, the directors resolve by unanimity to approve the Corporate Bylaw´s amendment proposal presented by the Chairman.

After deliberation, the directors resolve by unanimity to summon to a General Extraordinary Shareholders’ Meeting and to Class “A” and Class “D” Shares Special Shareholders’ Meetings to be held on October 10, 2019 at 12:30 p.m., at the corporate offices at Ave. Alicia Moreau de Justo N° 50, City of Buenos Aires, in order to consider the following items:

AGENDA

1) Appointment of two shareholders to sign the Minutes of the Meeting.

2) Amendment of sections 4th, 5th and 6th of the Corporate Bylaws. Appointment of those persons that will be in charge of carrying out the procedures related to the approval and registration of the amendments.

THE BOARD OF DIRECTORS

Note 1: Item 2 on the Agenda will be addressed in first place in the Class “A” and Class “D” Shares Special Shareholders’ Meetings and then in the General Extraordinary Shareholders’ Meeting.

Note 2: To be able to attend the Shareholders’ Meeting, the holders of Class B and Class C shares must deposit the book-entry shareholding certificates issued for that purpose by ‘Caja de Valores S.A.’, no later than three business days prior to the date of the Shareholders’ Meeting, at Ave. Alicia Moreau de Justo No. 50, 13th floor, City of Buenos Aires, from 10 a.m. to 12 p.m. and from 3 p.m. to 5 p.m. Within the same term and timetable, the holders of book-entry shares Class A and D must notify their attendance to the Meetings. The deadline is October 4, 2019 at 5 p.m.

Note 3: Within the regulatory term and at the place and time stated in Note 2, hard copies of the documents related to the Shareholders´ Meeting may be obtained, likewise such documents will be available at Telecom Argentina’s website: www.telecom.com.ar.

Table of Contents

Note 4: Pursuant to the provisions set forth in section 22 of Chapter II, Title II of the CNV Rules, at the time of registration to take part in the Shareholders’ Meeting and at the time of attending the Shareholders’ Meeting, shareholders must supply all the details of the holders and their representatives. Legal entities and other legal structures must provide the information and deliver the documentation as required by the CNV Rules in sections 24, 25 and 26 of Chapter II, Title II.

Note 5: Those registered to participate in the Shareholders’ Meeting as custodians or administrators of any third party shareholdings are reminded of the need to fulfill the requirements of section 9, Chapter II, Title II of the CNV Rules, to be able to cast a vote in a divergent manner.

Note 6: Shareholders are requested to be present at least 15 minutes prior to the scheduled time of the Shareholders’ Meeting in order to validate their proxies and sign the Attendance Book.

IV. PROPOSALS OF THE BOARD OF DIRECTORS TO THE GENERAL EXTRAORDINARY SHAREHOLDERS’ MEETING AND CLASS “A” AND CLASS “D” SHARES SPECIAL SHAREHOLDERS’ MEETINGS.

After deliberation, the Board of Directors approve by unanimity the following proposals to the Shareholders’ Meeting:

Proposal for the First Item on the Agenda:

The proposal to the Shareholders’ Meeting is “that the shareholders appoint those persons that will sign the Minutes”

Proposal for the Second Item on the Agenda:

The proposal of the Board of Directors is the following: “It is proposed: i) that the shareholders, within the framework of the Shareholders’ Meeting, approve the proposal of amendment of the Corporate Bylaws as resolved by the Board of Directors, with the modifications that the Comisión Nacional de Valores may require; ii) to delegate powers to the Board of Directors to determine the time, form and terms and conditions of issuance of securities representing certified shares, in the event that the respective Special Shareholders’ Meetings determines so, and iii) to authorize attorneys Andrea Viviana Cerdán, Alejandra Lea Martínez, Graciela Matilde Lazzati, María Verónica Tuccio, María Lucila Romero, Eugenia Prieri Belmonte, Martín Guillermo Ríos, Lucrecia María Delfina Moreira Savino, and Delfina Lynch, so that any of them acting indistinctly, may perform all the procedures and formalities required to obtain the approval and registration of the amendment of the Corporate Bylaws”.

Table of Contents

…………………………………..

The Supervisory Committee members attending the meeting state that director Luca Luciani has paticipated by distance attendance of this meeting, connected via videoteleconference, and that he has voted with due regularity all the items of the agenda of this meeting. Supervisory Committee members also state the regularity of the decisions reached at this meeting.

There being no further matters to discuss, the meeting is adjourned at 7:30 p.m., upon reading and approval hereof by the undersigned Directors and Supervisory Committee members.

Signed: Directors: Mr. Alejandro A. Urricelqui; Mr. Mariano M. Ibáñez; Mr. Sebastián Bardengo; Mr. Ignacio J.M. Sáenz Valiente; Mr. Damián Cassino; Mr. Carlos A. Harrison; Mr. Martín H. D´Ambrosio; Mr. Germán H. Vidal; Mr. Baruki L. A. González; Mr. Alejo Maxit; Mr. Luca Luciani (by videoteleconference).- Supervisory Committee Members: Mr. Pablo A. Buey Fernández; Mr. Pablo G. San Martín; Mr. Eduardo J. Villegas Contte; Mrs. María Ximena Digón.-

Table of Contents

ANNEX II

TELECOM ARGENTINA S.A.

PROPOSAL OF AMENDMENT OF THE CORPORATE BYLAWS

TO BE CONSIDERED BY THE GENERAL EXTRAORDINARY SHAREHOLDERS’ MEETING AND CLASS “A” AND CLASS “D” SHARES SPECIAL SHAREHOLDERS’ MEETINGS SUMMONED FOR OCTOBER 10, 2019

The current text of sections 4, 5 and 6 of the Corporate Bylaws and the amended text proposed in each case (in bold and underlined) are transcribed below:

|

CURRENT TEXT

|

AMENDED TEXT

|

|

|

Section Four: Changes in the capital stock as they arise from capital increases registered with the Public Registry of Commerce are shown in a note to the Financial Statements of the Company. Such note accounts for changes in capital stock during the last three (3) fiscal years, payment thereof and the capital amount authorized for public offering.

The capital stock is represented by Class “A”, “B”, “C” and “D” common book-entry shares, with nominal value of ONE PESO each and entitled to one vote per share.

As long as Class “A” represents at least 15% of the Company’s common stock, approval by a Class “A” special shareholders’ meeting is required to pass any shareholders’ resolution relating to a Special Majority Matter listed in Section Ten of these bylaws, except for the Special Majority Matter listed in paragraph (xxiii) of Section Ten (approval of Business Plan and Annual Budget) in respect of which a Class “A” special shareholders’ meeting will be necessary as long as Class “A” represents at least 20% of the Company’s common stock. In addition, as long as Class “D” represents at least 15% of the Company’s common stock, approval by a Class

|

Section Four: Changes in the capital stock as they arise from capital increases registered with the Public Registry of Commerce are shown in a note to the Financial Statements of the Company. Such note accounts for changes in capital stock during the last three (3) fiscal years, payment thereof and the capital amount authorized for public offering.

The capital stock is represented by Class “A”, “B”, “C” and “D” common shares, with nominal value of ONE PESO each and entitled to one vote per share.

Class “A” and “D” shares may be certified in accordance with applicable law or book-entry as determined by a Class “A” or Class “D” special shareholders’ meeting. Class “B” and “C” shares shall be book-entry.

As long as Class “A” represents at least 15% of the Company’s common stock, approval by a Class “A” special shareholders’ meeting is required to pass any shareholders’ resolution relating to a Special Majority Matter listed in Section Ten of these bylaws, except for the Special Majority Matter listed in paragraph (xxiii) of Section Ten (approval of Business Plan and

|

|

Table of Contents

|

“D” special shareholders’ meeting is required to pass any shareholders’ resolution relating to a Special Majority Matter listed in Section Ten of these bylaws, except for the Special Majority Matter listed in paragraph (xxiii) of Section Ten (approval of Business Plan and Annual Budget) in respect of which a Class “D” special shareholders’ meeting will be necessary as long as Class “D” represents at least 20% of the Company’s common stock. The above mentioned special shareholders’ meetings shall be held pursuant to Section 250 of Law No. 19,550.

Class “A”, “C” and “D” Shares of common stock are convertible into Class “B” Shares of common stock with equal political and economic rights, at a ratio of one to one, at any time, at the request of the holder of one or more shares of common stock who wishes to convert them into another class, through a notice addressed to the Board of Directors. For such purpose, the following procedure will apply: (i) the registered shareholder shall deliver to the Board of Directors a notice including, in the case of an individual, his/her first and last names, ID number, real domicile and special domicile, and in the case of legal entities, its complete legal name, real domicile and special domicile, and in both cases, if applicable, its taxpayer identification number and the number of shares of common stock of the Class held by such shareholder as of that moment, the number of shares which conversion is requested, and the balance of shares of common stock of that Class which such shareholder would hold once the conversion transaction is finished.

The request shall be signed by the registered shareholder or the registered shareholder’s representative authorized by a letter certified by a bank or a Notary Public. Such request will constitute an irrevocable instruction for the Board of Directors to follow the procedure set forth in this Section Four until the exchange of shares, which shall be final; (ii) such request shall remain on hold if it is submitted once a call to a shareholders’ meeting of the Company has been

|

Annual Budget) in respect of which a Class “A” special shareholders’ meeting will be necessary as long as Class “A” represents at least 20% of the Company’s common stock. In addition, as long as Class “D” represents at least 15% of the Company’s common stock, approval by a Class “D” special shareholders’ meeting is required to pass any shareholders’ resolution relating to a Special Majority Matter listed in Section Ten of these bylaws, except for the Special Majority Matter listed in paragraph (xxiii) of Section Ten (approval of Business Plan and Annual Budget) in respect of which a Class “D” special shareholders’ meeting will be necessary as long as Class “D” represents at least 20% of the Company’s common stock. The above mentioned special shareholders’ meetings shall be held pursuant to Section 250 of Law No. 19,550.

Class “A”, “C” and “D” Shares of common stock are convertible into Class “B” Shares of common stock with equal political and economic rights, at a ratio of one to one, at any time, at the request of the holder of one or more shares of common stock who wishes to convert them into another class, through a notice addressed to the Board of Directors. For such purpose, the following procedure will apply: (i) the registered shareholder shall deliver to the Board of Directors a notice including, in the case of an individual, his/her first and last names, ID number, real domicile and special domicile, and in the case of legal entities, its complete legal name, real domicile and special domicile, and in both cases, if applicable, its taxpayer identification number and the number of shares of common stock of the Class held by such shareholder as of that moment, the number of shares which conversion is requested, and the balance of shares of common stock of that Class which such shareholder would hold once the conversion transaction is finished.

The request shall be signed by the registered shareholder or the registered shareholder’s representative authorized by a letter certified by a bank or a Notary Public. Such request will constitute an irrevocable instruction for the Board

|

|

Table of Contents

|

published, in which case the conversion request shall be considered after such shareholders’ meeting; (iii) at the first meeting following receipt of the conversion request, the Board of Directors shall pass a resolution on such request and shall notify the new capital structure to the applicable controlling authority; (iv) the Board of Directors shall immediately request Caja de Valores S.A., which is in charge of the Company’s Stock Ledger, to lock the shares, and shall notify the conversion to the Comisión Nacional de Valores (Argentine Securities and Exchange Commission, “CNV” for its Spanish acronym) and the Bolsa de Comercio de Buenos Aires (Buenos Aires Stock Exchange, “BCBA” for its Spanish acronym) in order to be granted with the authorization of public offering transfer and listing transfer, respectively; and (v) once the authorizations are obtained, Caja de Valores S.A. shall register the shares conversion in the Company’s Stock Ledger.

|

of Directors to follow the procedure set forth in this Section Four until the exchange of shares, which shall be final; (ii) such request shall remain on hold if it is submitted once a call to a shareholders’ meeting of the Company has been published, in which case the conversion request shall be considered after such shareholders’ meeting; (iii) at the first meeting following receipt of the conversion request, the Board of Directors shall pass a resolution on such request and shall notify the new capital structure to the applicable controlling authority; (iv) the Board of Directors shall immediately request Caja de Valores S.A., which is in charge of the Company’s Stock Ledger, to lock the shares, and shall notify the conversion to the Comisión Nacional de Valores (Argentine Securities and Exchange Commission, “CNV” for its Spanish acronym) and the Bolsa de Comercio de Buenos Aires (Buenos Aires Stock Exchange, “BCBA” for its Spanish acronym) in order to be granted with the authorization of public offering transfer and listing transfer, respectively; and (v) once the authorizations are obtained, Caja de Valores S.A. shall register the shares conversion in the Company’s Stock Ledger.

|

|

|

CURRENT TEXT

|

AMENDED TEXT

|

|

|

Section Five: Shares of common stock to be issued in the future will be Class “A”, “B”, “C” or “D” book-entry shares, having the same characteristics as those already issued in accordance with the laws and regulations in force. In any issuance of shares of common stock, the proportion existing between Class “A”, “B”, “C” and “D” shares at the time of the Shareholders’ Meeting that determines such issuance shall be maintained, except if the Shareholders’ Meeting decides to act in accordance with the second paragraph of section 194 of Law No. 19,550. The Shareholders’ Meeting may also decide to issue book-entry preferred shares. Preferred shares may be entitled to preferred payment of their dividend, whether cumulative or not, according to their terms of issue and may also receive an additional share in the profits and/or be subject to early

|

Section Five: Shares of common stock to be issued in the future will be Class “A” or “D” book-entry or certified shares, or Class “B” or “C” book-entry shares, having the same characteristics as those already issued in accordance with the laws and regulations in force. In any issuance of shares of common stock, the proportion existing between Class “A”, “B”, “C” and “D” shares at the time of the Shareholders’ Meeting that determines such issuance shall be maintained, except if the Shareholders’ Meeting decides to act in accordance with the second paragraph of section 194 of Law No. 19,550. The Shareholders’ Meeting may also decide to issue book-entry preferred shares. Preferred shares may be entitled to preferred payment of their dividend, whether cumulative or not, according to their terms of issue and may also receive an additional share in the profits and/or be subject to

|

|

Table of Contents

|

redemption, at the option of the company and under the terms established upon their issue.

The Extraordinary Shareholders’ Meeting may approve the issuance of dividend certificates (“bonos de goce”) pursuant to Section 228 of Law No. 19,550 and the terms of these bylaws, which shall have the rights granted to them herein and in their terms and conditions of issuance. The Extraordinary Shareholders’ Meeting may also decide the total or partial amortization of any paid-in shares, pursuant to Section 223 of Law No. 19,550 and, in case of total amortization of shares, the Company shall issue dividend certificates in favor of the holders of totally amortized shares, pursuant to Section 228 of Law No. 19,550 and the terms of these bylaws. If the amortization of shares is made with the consent of the holder of such shares, no raffle or pro rata basis among all shareholders will be necessary for its implementation, as long as the equal treatment of shareholders principle is observed. In addition, if the Extraordinary Shareholders’ Meeting approves the creation of an unavailable reserve with liquid and realized profits for an amount equal to the par value of the shares to be canceled, then the Extraordinary Shareholders’ Meeting may decide that no capital reduction is necessary and that the shares that remain outstanding may increase their par value so that they may represent by themselves in the aggregate the Company’s capital stock. The Extraordinary Shareholders’ Meeting shall determine the terms and conditions of issuance of any dividend certificates that it may decide to issue, including the determination of a maximum amount of dividends to be collected during their term of duration, their term of duration and the terms and conditions of payment, including their payment currency and the protections that the shareholders’ meeting may provide for the collection of such dividends in the applicable currency. Such dividends may be fixed, variable, eventual or contingent on any event that the shareholders’ meeting may determine, or any combination of the above, with or without preference or priority with respect to dividends to be collected by one or more classes

|

early redemption, at the option of the company and under the terms established upon their issue.

The Extraordinary Shareholders’ Meeting may approve the issuance of dividend certificates (“bonos de goce”) pursuant to Section 228 of Law No. 19,550 and the terms of these bylaws, which shall have the rights granted to them herein and in their terms and conditions of issuance. The Extraordinary Shareholders’ Meeting may also decide the total or partial amortization of any paid-in shares, pursuant to Section 223 of Law No. 19,550 and, in case of total amortization of shares, the Company shall issue dividend certificates in favor of the holders of totally amortized shares, pursuant to Section 228 of Law No. 19,550 and the terms of these bylaws. If the amortization of shares is made with the consent of the holder of such shares, no raffle or pro rata basis among all shareholders will be necessary for its implementation, as long as the equal treatment of shareholders principle is observed. In addition, if the Extraordinary Shareholders’ Meeting approves the creation of an unavailable reserve with liquid and realized profits for an amount equal to the par value of the shares to be canceled, then the Extraordinary Shareholders’ Meeting may decide that no capital reduction is necessary and that the shares that remain outstanding may increase their par value so that they may represent by themselves in the aggregate the Company’s capital stock. The Extraordinary Shareholders’ Meeting shall determine the terms and conditions of issuance of any dividend certificates that it may decide to issue, including the determination of a maximum amount of dividends to be collected during their term of duration, their term of duration and the terms and conditions of payment, including their payment currency and the protections that the shareholders’ meeting may provide for the collection of such dividends in the applicable currency. Such dividends may be fixed, variable, eventual or contingent on any event that the shareholders’ meeting may determine, or any combination of the above, with or without preference or priority with respect to dividends to be collected by one or more classes of shares of

|

|

Table of Contents

|

of shares of the Company. The dividend certificates may be issued as certificated securities or book-entry securities, and they shall be registered and non-endorsable. The Company shall be in charge of the registration of the ownership of the dividend certificates and the dividend payments made to them. The dividend certificates may be totally o partially redeemable at the Company’s exclusive option and pursuant to the terms and conditions established by the Extraordinary Shareholders’ Meeting for such purpose. The Extraordinary Shareholders’ Meeting shall also determine the rights that may correspond to each class of dividend certificates with respect to the Company’s liquidation proceeds, including the right of preference or priority in the liquidation proceeds with respect to one or more classes of shares of the Company, once the par value of such class or classes of shares is reimbursed. Once the dividend corresponding to the dividend certificates is collected, the dividend certificates shall have no right to participate in any other payment or distribution to be made by the Company, during its normal course of business or at its liquidation. The dividend certificates shall have no right to any liquidation proceeds, liquidation dividend or similar receivable if the Company is dissolved without liquidation as a result of being merged into another company that will become its successor, and because the Company would not be liquidated, without detriment to the rights of the dividend certificates to receive dividends pursuant to their terms and conditions of issuance. The Extraordinary Shareholders’ Meeting that decides the amortization of shares and the issuance of dividend certificates pursuant to the terms of Section 228 of Law No. 19,550 may authorize the Board of Directors to issue any kind of dividend certificate pursuant to the terms and conditions that such Shareholders’ Meeting may determine. Neither the dividend certificates nor their holders shall have any preemptive right or right of accrual, nor any right to subscribe new shares of any class or any dividend or participation certificates.

|

the Company. The dividend certificates may be issued as certificated securities or book-entry securities, and they shall be registered and non-endorsable. The Company shall be in charge of the registration of the ownership of the dividend certificates and the dividend payments made to them. The dividend certificates may be totally o partially redeemable at the Company’s exclusive option and pursuant to the terms and conditions established by the Extraordinary Shareholders’ Meeting for such purpose. The Extraordinary Shareholders’ Meeting shall also determine the rights that may correspond to each class of dividend certificates with respect to the Company’s liquidation proceeds, including the right of preference or priority in the liquidation proceeds with respect to one or more classes of shares of the Company, once the par value of such class or classes of shares is reimbursed. Once the dividend corresponding to the dividend certificates is collected, the dividend certificates shall have no right to participate in any other payment or distribution to be made by the Company, during its normal course of business or at its liquidation. The dividend certificates shall have no right to any liquidation proceeds, liquidation dividend or similar receivable if the Company is dissolved without liquidation as a result of being merged into another company that will become its successor, and because the Company would not be liquidated, without detriment to the rights of the dividend certificates to receive dividends pursuant to their terms and conditions of issuance. The Extraordinary Shareholders’ Meeting that decides the amortization of shares and the issuance of dividend certificates pursuant to the terms of Section 228 of Law No. 19,550 may authorize the Board of Directors to issue any kind of dividend certificate pursuant to the terms and conditions that such Shareholders’ Meeting may determine. Neither the dividend certificates nor their holders shall have any preemptive right or right of accrual, nor any right to subscribe new shares of any class or any dividend or participation certificates.

|

|

Table of Contents

|

CURRENT TEXT

|

AMENDED TEXT

|

|

|

Section Six: Book-entry shares must be registered in accounts under the name of their holders, by the issuing company, in a book-entry shares registry to which section 213 of Law No. 19,550 applies, where relevant, or by commercial or investment banks or authorized securities depositaries.

|

Section Six: Book-entry shares must be registered in accounts under the name of their holders, by the issuing company, in a book-entry shares registry to which section 213 of Law No. 19,550 applies, where relevant, or by commercial or investment banks or authorized securities depositaries. The issuing company shall keep a certified shares registry in the form set forth in and as required by section 213 of Law No. 19,550.

|

|

Table of Contents

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

|

|

Telecom Argentina S.A.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Date:

|

September 26, 2019

|

|

By:

|

/s/ Gabriel P. Blasi

|

|

|

|

|

|

Name:

|

Gabriel P. Blasi

|

|

|

|

|

|

Title:

|

Responsible for Market Relations

|

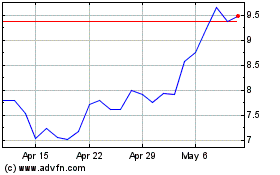

Telecom Argentina (NYSE:TEO)

Historical Stock Chart

From Mar 2024 to Apr 2024

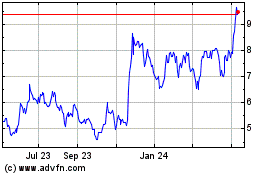

Telecom Argentina (NYSE:TEO)

Historical Stock Chart

From Apr 2023 to Apr 2024