Amended Statement of Beneficial Ownership (sc 13d/a)

October 29 2020 - 4:07PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D

(Rule 13d-101)

Information to

be Included in Statements Filed Pursuant to § 240.13d-1(a) and Amendments Thereto Filed Pursuant to § 240.13d-2(a)

(Amendment No. 3)*

The Container

Store Group, Inc.

(Name of Issuer)

Common

Stock, par value $0.01

(Title of Class of Securities)

210751

103

(CUSIP Number)

Jessica

Hammons

Thompson & Knight LLP

One Arts Plaza

1722 Routh Street Suite 1500

Dallas,

Texas 75201

(214) 969-1700

(Name, Address and Telephone Number of Person

Authorized to Receive Notices and Communications)

October 19,

2020

(Date of Event Which Requires Filing of

Statement on Schedule 13D)

If the filing person has previously filed

a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because

of §§240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), checking the following box. ¨

* The remainder of this cover page shall

be filled out for a reporting person’s initial filing on this form with respect to the subject class of securities, and for

any subsequent amendment containing information which would alter disclosures provided in a prior cover page.

The information required on the remainder

of this cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange

Act of 1934 (“Act”) or otherwise subject to the liabilities of that section of the Act but shall be subject to all

other provisions of the Act (however, see the Notes).

|

|

(1)

|

Name of Reporting Persons:

William Arthur Tindell, III

|

|

|

|

|

(2)

|

Check the Appropriate Box if a Member of a Group (See Instructions):

|

|

|

|

(a)

|

x

|

|

|

|

(b)

|

¨

|

|

|

|

|

(3)

|

SEC Use Only:

|

|

|

|

|

(4)

|

Source of Funds (See Instructions):

OO

|

|

|

|

|

(5)

|

Check

Box if Disclosure of Legal Proceedings Is Required Pursuant to Items 2(d) or 2(e): ¨

|

|

|

|

|

(6)

|

Citizenship or Place of Organization:

United States

|

|

|

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person With:

|

(7)

|

Sole Voting Power

0

|

|

|

|

(8)

|

Shared Voting Power

2,508,790

|

|

|

|

(9)

|

Sole Dispositive Power

0

|

|

|

|

(10)

|

Shared Dispositive Power

2,508,790

|

|

|

|

|

(11)

|

Aggregate Amount Beneficially Owned by Each Reporting Person:

2,508,790

|

|

|

|

|

(12)

|

Check

Box if the Aggregate Amount in Row (11) Excludes Certain Shares (See Instructions): ¨

|

|

|

|

|

(13)

|

Percent of Class Represented by Amount in Row (11):

4.96%*

|

|

|

|

|

(14)

|

Type of Reporting Person (See Instructions):

IN

|

* Based on 50,555,098 shares of Common Stock outstanding as

reported in the Form 10-Q filed by the Issuer on October 21, 2020, and calculated in accordance with Rule 13d-3(d)(1)(i).

|

CUSIP No. 210751 103

|

Schedule 13D

|

|

|

|

(1)

|

Name of Reporting Persons:

Sharon Tindell

|

|

|

|

|

(2)

|

Check the Appropriate Box if a Member of a Group (See Instructions):

|

|

|

|

(a)

|

x

|

|

|

|

(b)

|

¨

|

|

|

|

|

(3)

|

SEC Use Only:

|

|

|

|

|

(4)

|

Source of Funds (See Instructions):

OO

|

|

|

|

|

(5)

|

Check Box if Disclosure of Legal Proceedings Is Required Pursuant to Items 2(d) or 2(e): ¨

|

|

|

|

|

(6)

|

Citizenship or Place of Organization:

United States

|

|

|

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person With:

|

(7)

|

Sole Voting Power

0

|

|

|

|

(8)

|

Shared Voting Power

2,508,790

|

|

|

|

(9)

|

Sole Dispositive Power

0

|

|

|

|

(10)

|

Shared Dispositive Power

2,508,790

|

|

|

|

|

(11)

|

Aggregate Amount Beneficially Owned by Each Reporting Person:

2,508,790

|

|

|

|

|

(12)

|

Check Box if the Aggregate Amount in Row (11) Excludes Certain Shares (See Instructions): ¨

|

|

|

|

|

(13)

|

Percent of Class Represented by Amount in Row (11):

4.96%*

|

|

|

|

|

(14)

|

Type of Reporting Person (See Instructions):

IN

|

* Based

on 50,555,098 shares of Common Stock outstanding as reported in the Form 10-Q filed by the Issuer on October 21, 2020, and calculated

in accordance with Rule 13d-3(d)(1)(i).

|

CUSIP No. 210751 103

|

Schedule 13D

|

|

This Amendment No. 3

(this “Amendment”) amends and supplements the Schedule 13D filed on November 18, 2013 with the Securities

and Exchange Commission (the “Original Schedule 13D” and, as further amended and supplemented by Amendment No. 1

(“Amendment No. 1”) filed on May 10, 2016 and Amendment No. 2 (“Amendment No. 2”)

filed on August 8, 2016, the “Schedule 13D”) by the Reporting Persons with respect to the Common Stock

of the Issuer. Capitalized terms not defined in this Amendment shall have the meaning ascribed to them in the Original Schedule

13D. William A. “Kip” Tindell, III and Sharon Tindell shall be deemed the “Reporting Persons.” This

is the final amendment to the Schedule 13D and constitutes an "exit filing" for the Reporting Persons.

|

|

Item 2.

|

Identity and Background

|

This Amendment amends and restates Item

2(a), Item 2(b) and Item 2(c) of the Original Schedule 13D in its entirety as set forth below:

|

|

(a)

|

This Amendment is being filed by William A. “Kip” Tindell, III and Sharon Tindell.

William A. “Kip” Tindell and Sharon Tindell are married.

|

|

|

(b)

|

The business address of each of the Reporting Persons is c/o John Crow Miller, Holman Robertson

Eldridge PC, 8226 Douglas Avenue, Suite 550, Dallas, Texas 75225.

|

|

|

(c)

|

William A. “Kip” Tindell, III is the former Chief Executive Officer and former

Chairman of the Board of Directors of the Issuer.

|

Sharon Tindell is the former

President and Chief Merchandising Officer and previously served on the Board of Directors of the Issuer.

|

|

Item 4.

|

Purpose of Transaction

|

This Amendment amends and supplements Item

4 of the Schedule 13D as set forth below:

From March 25,

2020 through July 23, 2020, William A. “Kip” Tindell and Sharon Tindell sold through a broker in multiple open

market transactions an aggregate of 361,502 shares of Common Stock.

From September 1,

2020 through October 23, 2020, William A. “Kip” Tindell and Sharon Tindell sold through a broker in multiple open

market transactions an aggregate of 381,137 shares of Common Stock at prices specified in Item 5(c) below. Item 5(c) is

hereby incorporated by reference.

|

|

Item 5.

|

Interest in Securities of the Issuer

|

This Amendment amends Item 5 of the Schedule

13D as set forth below:

(a) and (b) The information contained

on the cover pages to this Schedule 13D is incorporated herein by reference.

The Reporting Persons

collectively beneficially own 2,508,790 shares of Common Stock. William A. “Kip” Tindell and Sharon Tindell share beneficial

ownership of 2,508,790 shares of Common Stock following the consolidation of their respective accounts, in which each of their

shares of Common Stock were previously held separately, into a joint account.

|

CUSIP No. 210751 103

|

Schedule 13D

|

|

(c) This

Amendment amends Item 5(c) of the Schedule 13D as set forth below:

In the past 60 days,

the following sales of shares of Common Stock were effected by the Reporting Persons through a broker in the open market:

|

Date

|

|

Number of Shares of

Common Stock Sold

|

|

|

Average Price per

Common Share

|

|

|

September 1, 2020

|

|

|

15,000

|

|

|

$

|

4.4498 (1

|

)

|

|

September 14, 2020

|

|

|

20,000

|

|

|

$

|

4.906 (2

|

)

|

|

September 15, 2020

|

|

|

20,000

|

|

|

$

|

5.4501 (3

|

)

|

|

September 17, 2020

|

|

|

1,442

|

|

|

$

|

6.4076 (4

|

)

|

|

September 21, 2020

|

|

|

20,704

|

|

|

$

|

6.6792 (5

|

)

|

|

September 22, 2020

|

|

|

17,200

|

|

|

$

|

7.2161 (6

|

)

|

|

September 29, 2020

|

|

|

800

|

|

|

$

|

6.5863 (7

|

)

|

|

October 1, 2020

|

|

|

10,000

|

|

|

$

|

7.6058 (8

|

)

|

|

October 1, 2020

|

|

|

15,000

|

|

|

$

|

7.2199 (9

|

)

|

|

October 1, 2020

|

|

|

25,000

|

|

|

$

|

6.650 (10

|

)

|

|

October 5, 2020

|

|

|

10,000

|

|

|

$

|

8.3009 (11

|

)

|

|

October 5, 2020

|

|

|

5,000

|

|

|

$

|

8.6802 (12

|

)

|

|

October 5, 2020

|

|

|

9,200

|

|

|

$

|

8.4932 (13

|

)

|

|

October 6, 2020

|

|

|

10,000

|

|

|

$

|

9.00 (14

|

)

|

|

October 12, 2020

|

|

|

3,200

|

|

|

$

|

8.6547 (15

|

)

|

|

October 13, 2020

|

|

|

11,513

|

|

|

$

|

8.9268 (16

|

)

|

|

October 13, 2020

|

|

|

20,000

|

|

|

$

|

8.8503 (17

|

)

|

|

October 14, 2020

|

|

|

15,000

|

|

|

$

|

8.950 (18

|

)

|

|

October 15, 2020

|

|

|

25,000

|

|

|

$

|

9.2243 (19

|

)

|

|

October 15, 2020

|

|

|

6,230

|

|

|

$

|

9.4534 (20

|

)

|

|

October 16, 2020

|

|

|

15,000

|

|

|

$

|

9.1073 (21

|

)

|

|

October 19, 2020

|

|

|

20,000

|

|

|

$

|

9.150 (22

|

)

|

|

October 19, 2020

|

|

|

20,000

|

|

|

$

|

9.3081 (23

|

)

|

|

October 19, 2020

|

|

|

5,848

|

|

|

$

|

9.4071 (24

|

)

|

|

October 20, 2020

|

|

|

20,000

|

|

|

$

|

9.2965 (25

|

)

|

|

October 20, 2020

|

|

|

20,000

|

|

|

$

|

10.033 (26

|

)

|

|

October 21, 2020

|

|

|

10,000

|

|

|

$

|

9.1207 (27

|

)

|

|

October 23, 2020

|

|

|

10,000

|

|

|

$

|

9.927 (28

|

)

|

|

|

|

|

TOTAL 381,137

|

|

|

|

|

|

|

|

(1)

|

Such average price per share represents sale prices ranging from $4.42 to $4.46.

|

|

|

(2)

|

Such average price per share represents sale prices ranging from $4.87 to $4.95.

|

|

|

(3)

|

Such average price per share represents sale prices ranging from $5.45 to $5.46.

|

|

|

(4)

|

Such average price per share represents sale prices ranging from $6.40 to $6.42.

|

|

|

(5)

|

Such average price per share represents sale prices ranging from $6.65 to $6.755.

|

|

|

(6)

|

Such average price per share represents sale prices ranging from $7.15 to $7.31.

|

|

|

(7)

|

Such average price per share represents sale prices ranging from $6.55 to $6.62.

|

|

|

(8)

|

Such average price per share represents sale prices ranging from $7.60 to $7.63.

|

|

|

(9)

|

Such average price per share represents sale prices ranging from $7.21 to $7.22.

|

|

|

(10)

|

Such average price per share represents sale prices of $6.65.

|

|

|

(11)

|

Such average price per share represents sale prices ranging from $8.30 to $8.315.

|

|

|

(12)

|

Such average price per share represents sale prices ranging from $8.655 to $8.71.

|

|

|

(13)

|

Such average price per share represents sale prices ranging from $8.46 to $8.52.

|

|

|

(14)

|

Such average price per share represents sale prices of $9.00.

|

|

|

(15)

|

Such average price per share represents sale prices ranging from $8.65 to $8.66.

|

|

|

(16)

|

Such average price per share represents sale prices ranging from $8.80 to $9.035.

|

|

|

(17)

|

Such average price per share represents sale prices ranging from $8.85 to $8.86.

|

|

|

(18)

|

Such average price per share represents sale prices of $8.95.

|

|

|

(19)

|

Such average price per share represents sale prices ranging from $9.20 to $9.34.

|

|

|

(20)

|

Such average price per share represents sale prices ranging from $9.45 to $9.48.

|

|

|

(21)

|

Such average price per share represents sale prices ranging from $9.10 to $9.16.

|

|

|

(22)

|

Such average price per share represents sale prices of $9.15.

|

|

|

(23)

|

Such average price per share represents sale prices ranging from $9.30 to $9.36.

|

|

|

(24)

|

Such average price per share represents sale prices ranging from $9.40 to $9.445.

|

|

|

(25)

|

Such average price per share represents sale prices ranging from $9.25 to $9.32.

|

|

|

(26)

|

Such average price per share represents sale prices ranging from $9.94 to $10.21.

|

|

|

(27)

|

Such average price per share represents sale prices ranging from $9.12 to $9.125.

|

|

|

(28)

|

Such average price per share represents sale prices ranging from $9.91 to $10.00.

|

(e) This

Amendment amends Item 5(e) of the Schedule 13D as set forth below:

As a result of the

dispositions from September 1, 2020 through October 23, 2020 by the Reporting Persons as described in Item 5(c), the

Reporting Persons ceased to be the beneficial owner of more than 5% of the Issuer’s Common Stock, and this Amendment constitutes

an "exit filing" for the Reporting Persons.

Because William A.

“Kip” Tindell, III and Sharon Tindell are husband and wife, they previously were deemed to share voting and investment

control over each other’s shares, and may be deemed to be a group within the meaning of Section 13(d)(3) under

the Securities Exchange Act of 1934, as amended. Following the effectiveness of the retirements from the Company of each of William

A. “Kip” Tindell, III and Sharon Tindell and prior to the date hereof, William A. “Kip” Tindell, III

and Sharon Tindell consolidated the accounts in which they previously held their respective accounts separately into a joint account.

|

|

Item 7.

|

Material to be Filed as Exhibits

|

|

|

Exhibit 5

|

Joint Filing Agreement, dated November 18, 2013 (incorporated by reference to Exhibit 5 to the Reporting Persons’

Original Schedule 13D, filed with the Securities and Exchange Commission on November 18, 2013).

|

SIGNATURE

After reasonable inquiry

and to the best of my knowledge and belief, each of the undersigned certifies that the information set forth in this statement

is true, complete and correct.

Dated: October 29,

2020

|

|

By:

|

/s/ WILLIAM A. TINDELL, III

|

|

|

|

Name: William A. “Kip” Tindell, III

|

|

|

By:

|

/s/

SHARON TINDELL

|

|

|

|

Name: Sharon Tindell

|

|

CUSIP No. 210751 103

|

Schedule 13D

|

|

EXHIBIT INDEX

|

EXHIBIT NO.

|

|

DESCRIPTION

|

|

|

|

|

|

Exhibit 5

|

|

Joint Filing Agreement, dated November 18, 2013 (incorporated by reference to Exhibit 5 to the Reporting Persons’ Original Schedule 13D, filed with the Securities and Exchange Commission on November 18, 2013).

|

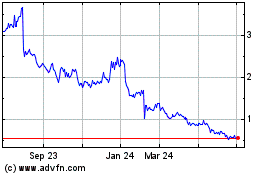

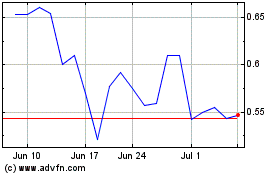

Container Store (NYSE:TCS)

Historical Stock Chart

From Mar 2024 to Apr 2024

Container Store (NYSE:TCS)

Historical Stock Chart

From Apr 2023 to Apr 2024