Transcontinental Realty Investors, Inc. (NYSE: TCI), a

Dallas-based real estate investment company, today reported results

of operations for the second quarter ended June 30, 2019. For the

three months ended June 30, 2019, we reported net loss applicable

to common shares of $6.3 million or ($0.73) per diluted loss per

share compared to a net income applicable to common shares of $7.0

million or ($0.81) per share for the same period ended 2018.

We would like to take a brief moment to share with you our

recent successes for TCI and affiliated Companies and thank you for

your steadfast dedication to the company.

2018 and 2019 have been met with unprecedented expansion and

repositioning for Pillar, TCI, SPC, and affiliated Companies. We

ended 2018 with our largest and most strategic transactions, the

newly created subsidiary Victory Abode Apartments, LLC (“VAA”)

Joint Venture and Bond Series B raised on the Tel Aviv Stock

Exchange. In 2019, the company recently raised an additional $78

million bond series C on the Tel Aviv Stock Exchange. This expanded

offering creates additional financial strength to our already

thriving organization. With these existing and newly engaged

projects and our continuously burgeoning multifamily asset base, we

are committed to the continued growth and education of our

staff.

The JV’s primary focus is to create a business platform that

will allow dramatic expansion in the multifamily arena. The intent

is to increase the overall size of the portfolio over the next

several years through strategic buildout of its robust development

pipeline alongside opportunistic acquisitions.

All of these initiatives further demonstrate our ability to

increase shareholder value, aligning with the strategic direction

we announced three years ago. Our company has been dramatically

transformed to a highly viable operating company with solid

development capabilities in the multifamily arena. Our main goal

has always been to act in the best interest of the company and

protect asset value for its investors. We continue to invest in new

development projects and grow the company’s asset base.

Revenues

Rental and other property revenues were $11.8 million for the

three months ended June 30, 2019, compared to $31.6 million for the

same period in 2018. The $19.8 million decrease is primarily due to

a decrease in the amount of multifamily residential apartment

buildings currently in our portfolio of nine as compared to

fifty-three multifamily residential apartment buildings for the

same period a year ago as a result of the deconsolidation of

forty-nine residential apartment properties that were sold into the

VAA Joint Venture during the fourth quarter of 2018. As the assets

are now treated as unconsolidated investments, our share of rental

revenues is part of income from unconsolidated investments in the

current period and are no longer treated as rental income.

Expenses

Property operating expenses decreased by $8.2 million to $7.3

million for the three months ended June 30, 2019 as compared to

$15.5 million for the same period in 2018. The decrease in property

operating expenses is primarily due to the deconsolidation of

forty-nine residential apartment properties that were sold into the

VAA Joint Venture during the fourth quarter of 2018 which resulted

in a decrease in salary and related payroll expenses of $1.8

million, real estate taxes of approximately $2.4 million,

management fees paid to third parties of $0.7 million, and other

general property operating and maintenance expenses of $3.3

million.

Depreciation and amortization decreased by $3.1 million to $3.4

million during the three months ended June 30, 2019 as compared to

$6.5 million for the three months ended June 30, 2018. This

decrease is primarily due to the deconsolidation of the residential

apartments in connection with our previous sale and contribution of

our interests to the VAA Joint Venture.

General and administrative expense was $3.3 million for the

three months ended June 30, 2019 and $2.2 million for the same

period in 2018. The increase of $1.1 million in general and

administrative expenses is due primarily to increases in fees paid

to our Advisors of $0.9 million and professional fees of $0.2

million.

Other income (expense)

Interest income was $4.9 million for the three months ended June

30, 2019, compared to $3.5 million for the same period in 2018. The

increase of $1.4 million was due primarily to an increase of $1.3

million in interest on the receivables owed by our Advisors.

Other income was $0.7 million for the three months ended June

30, 2019, compared to $7.5 million for the same period in 2018. The

decrease of $6.8 million was due primarily to cash proceeds of $0.2

million received during the quarter ended June 30, 2019, from the

collection of tax increment incentives related to infrastructure

development work at Mercer Crossing, located in Farmers Branch,

Texas, and other miscellaneous income of $0.5 million, compared to

insurance proceeds received during the second quarter of 2018 of

approximately $6.6 million as a result of damages caused by a

hurricane to one of our properties that was subsequently sold

during the same quarter.

Mortgage and loan interest expense was $7.6 million for the

three months ended June 30, 2019 as compared to $14.2 million for

the same period in 2018. The decrease of $6.6 million is due to the

deconsolidation of residential apartment properties into the VAA

Joint Venture which were encumbered by mortgage debt.

Foreign currency transaction was a loss of $2.3 million for the

three months ended June 30, 2019 as compared to a gain of $5.9

million for the same period in 2018. The foreign currency loss is

due primarily to a decrease in the exchange rate of our Israel New

Shekels (NIS) denominated corporate bonds registered on the

Tel-Aviv Stock Exchange. The exchange rate of the NIS to USD went

from 3.63 at the beginning of the second quarter to an exchange

rate of 3.58 at June 30, 2019. As of June 30, 2019, we have

outstanding bonds of $159.4 million (or NIS 570 million) and

accrued interest payable of approximately $2.8 million (or NIS 10.1

million).

Loss from unconsolidated investments was a net of $0.2 million

for the three months ended June 30, 2019 as compared to a loss of

$0.009 million for the three months ended June 30, 2018. The loss

from unconsolidated investments during the second quarter just

ended was driven primarily from our share in the losses reported by

our VAA Joint Venture of $0.2 million.

Loss from the sale of income-producing property increased for

the three months ended June 30, 2019 as compared to the prior

period. In the current period, we sold a multifamily residential

property, located in Mary Ester, Florida for a sales price of $3.1

million and recorded a loss of $0.08 million. There were no

apartment sales for the three months ended June 30, 2018.

Gain on land sales increased for the three months ended June 30,

2019 as compared to the prior period. In the current period, we

sold 41.6 acres of land for an aggregate sales price of $7.6

million and recorded a gain of $2.1 million. There were no land

sales for the three months ended June 30, 2018.

About Transcontinental Realty Investors, Inc.

Transcontinental Realty Investors, Inc., a Dallas-based real

estate investment company, holds a diverse portfolio of equity real

estate located across the U.S., including apartments, office

buildings, shopping centers, and developed and undeveloped land.

The Company invests in real estate through direct ownership, leases

and partnerships and invests in mortgage loans on real estate. For

more information, visit the Company’s website at

www.transconrealty-invest.com.

TRANSCONTINENTAL REALTY

INVESTORS, INC.

CONSOLIDATED STATEMENTS OF

OPERATIONS

Three Months Ended June

30,

Six Months Ended June

30,

2019

2018

2019

2018

(dollars in thousands, except

per share amounts)

Revenues:

Rental and other property revenues (including $203 and $208 for the

three months and $413 and $415 for the six months ended 2019 and

2018, respectively, from related parties)

$

11,840

$

31,607

$

23,769

$

62,689

Expenses:

Property operating expenses (including $246 and $231 for the three

months ended and $504 and 458 for the six months ended 2019 and

2018, respectively, from related parties)

7,322

15,492

13,319

29,947

Depreciation and amortization

3,439

6,522

6,548

12,968

General and administrative (including $919 and $1,187 for the three

months ended and $2,420 and $2,280 for the six months ended 2019

and 2018, respectively, from related parties)

3,334

2,173

5,662

4,365

Net income fee to related party

90

53

190

106

Advisory fee to related party

1,035

2,726

2,683

5,474

Total operating expenses

15,220

26,966

28,402

52,860

Net operating (loss) income

(3,380

)

4,641

(4,633

)

9,829

Other income (expenses):

Interest income (including $4,580 and $3,486 for the three months

ended and $8,892 and $6,722 for the six months ended 2019 and 2018,

respectively, from related parties)

4,878

3,544

9,436

7,420

Other income

688

7,482

4,580

9,308

Mortgage and loan interest (including $513 and $327 for the three

months ended and $1,003 and $645 for the six months ended 2019 and

2018, respectively, from related parties)

(7,646

)

(14,175

)

(15,605

)

(28,268

)

Foreign currency transaction (loss) gain

(2,325

)

5,889

(8,143

)

7,645

Equity loss from VAA

(236

)

-

(1,291

)

-

Earnings (losses) from other unconsolidated investees

2

(9

)

(5

)

2

Total other (expenses) income

(4,639

)

2,731

(11,028

)

(3,893

)

(Loss) income before gain on land sales, non-controlling interest,

and taxes

(8,019

)

7,372

(15,661

)

5,936

Loss on sale of income producing properties

(80

)

-

(80

)

-

Gain on land sales

2,133

-

4,349

1,335

Net (loss) income from continuing operations before taxes

(5,966

)

7,372

(11,392

)

7,271

Net (loss) income from continuing operations

(5,966

)

7,372

(11,392

)

7,271

Net (loss) income

(5,966

)

7,372

(11,392

)

7,271

Net (income) attributable to non-controlling interest

(379

)

(126

)

(562

)

(258

)

Net (loss) income attributable to Transcontinental Realty

Investors, Inc.

(6,345

)

7,246

(11,954

)

7,013

Preferred dividend requirement

-

(224

)

-

(446

)

Net (loss) income applicable to common shares

$

(6,345

)

$

7,022

$

(11,954

)

$

6,567

(Loss) earnings per share -

basic

Net (loss) income from continuing operations

$

(0.73

)

$

0.81

$

(1.37

)

$

0.75

Net (loss) income applicable to common shares

$

(0.73

)

$

0.81

$

(1.37

)

$

0.75

(Loss) earnings per share -

diluted

Net (loss) income from continuing operations

$

(0.73

)

$

0.81

$

(1.37

)

$

0.75

Net (loss) income applicable to common shares

$

(0.73

)

$

0.81

$

(1.37

)

$

0.75

Weighted average common shares used in computing earnings per share

8,717,767

8,717,767

8,717,767

8,717,767

Weighted average common shares used in computing diluted earnings

per share

8,717,767

8,717,767

8,717,767

8,717,767

Amounts attributable to

Transcontinental Realty Investors, Inc.

Net (loss) income from continuing operations

$

(6,345

)

$

7,246

$

(11,954

)

$

7,013

Net (loss) income applicable to Transcontinental Realty, Investors,

Inc.

$

(6,345

)

$

7,246

$

(11,954

)

$

7,013

TRANSCONTINENTAL REALTY

INVESTORS, INC.

CONSOLIDATED BALANCE

SHEETS

June 30,

December 31,

2019

2018

(unaudited)

(audited)

(dollars in thousands, except

share and par value amounts)

Assets

Real estate, at cost

$

454,350

$

461,718

Real estate subject to sales contracts at

cost

1,626

2,014

Real estate held for sale at cost, net of

depreciation

14,737

-

Less accumulated depreciation

(84,213

)

(79,228

)

Total real estate

386,500

384,504

Notes and interest receivable (including

$68,687 in 2019 and $51,945 in 2018 from related parties)

116,864

83,541

Cash and cash equivalents

37,579

36,358

Restricted cash

44,602

70,207

Investment in VAA

67,078

68,399

Investment in other unconsolidated

investees

22,167

22,172

Receivable from related party

125,430

133,642

Other assets

53,667

63,557

Total assets

$

853,887

$

862,380

Liabilities and Shareholders’

Equity

Liabilities:

Notes and interest payable

$

283,780

$

277,237

Bonds and bond interest payable

157,328

158,574

Deferred revenue (including $13,837 in

2019 and $17,522 in 2018 to related parties)

13,837

17,522

Deferred tax liability

2,000

2,000

Accounts payable and other liabilities

(including $931 in 2019 and $3 in 2018 to related parties)

28,045

26,646

Total liabilities

484,990

481,979

Shareholders’ equity:

Common stock, $0.01 par value, authorized

10,000,000 shares; issued 8,717,967 shares in 2019 and 2018;

outstanding 8,717,767 shares in 2019 and 2018

87

87

Treasury stock at cost, 200 shares in 2019

and 2018

(2

)

(2

)

Paid-in capital

257,938

258,050

Retained earnings

89,631

101,585

Total Transcontinental Realty Investors,

Inc. shareholders' equity

347,654

359,720

Non-controlling interest

21,243

20,681

Total shareholders' equity

368,897

380,401

Total liabilities and shareholders'

equity

$

853,887

$

862,380

View source

version on businesswire.com: https://www.businesswire.com/news/home/20190814005772/en/

Transcontinental Realty Investors, Inc. Investor

Relations Michele Rougon (800) 400-6407

investor.relations@transconrealty-invest.com

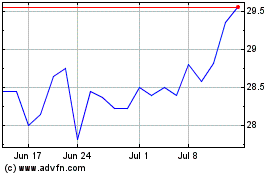

Transcontinental Realty ... (NYSE:TCI)

Historical Stock Chart

From Mar 2024 to Apr 2024

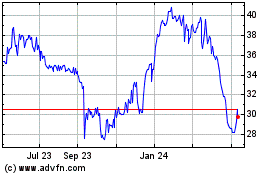

Transcontinental Realty ... (NYSE:TCI)

Historical Stock Chart

From Apr 2023 to Apr 2024