Southern Properties Capital, Wholly Owned Subsidiary of Transcontinental Realty Investors, Achieves a Series C Issuance on ...

July 31 2019 - 8:00AM

Business Wire

Southern Properties Capital (SPC) a subsidiary of

Transcontinental Realty Investors Inc., (NYSE: TCI) and Abode

Properties, both Dallas-based real estate investment companies,

announces an expanded bond offering in the Israeli market. The

company raised an additional $78 million bond series C on the Tel

Aviv Stock Exchange. As previously reported, TCI was the first

Dallas-based firm to raise capital on the Israeli bond market with

its Series A and B bonds. Prior to the Southern Properties Capital

issuance, the market was previously dominated by Manhattan based

companies, but has once again shown increased demand for additional

bond issuers throughout the United States.

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20190731005243/en/

SPC, TCI, Abode Properties, and Radhan

complete successful Series C Bond in Israel (Photo: Business

Wire)

The company’s Series A and B bonds raised over 610 million

shekels, approximately $174 million. “This series C offering was

for an additional 275 million shekels, over $78 million,” said

Daniel J. Moos, CEO and President. “We are always evaluating

various alternatives to grow our asset base while continuing to

enhance value for our investors. This expanded offering creates

additional financial strength to our already thriving organization.

With our existing and newly engaged projects and our continuously

burgeoning multifamily asset base, we are continuing to prove

ourselves as a formidable player in the U.S. real estate

market.”

Daniel J. Moos continued, “It is very gratifying that the

offering was significantly over the $75 million subscription we

were allowed to raise for this series. In addition, for various

reasons the interest rate paid on this series C was significantly

less than what was paid on our previous series. This series also

reflects a AAA- S&P rating in comparison to the BBB+ rating

associated with the prior series A and B.”

The deal was led by Yuval Barak and Eden Ozeri from Radhan - a

leading financial consultancy firm out of Israel that continues to

advise the company in the Israeli market. According to Eden Ozeri,

“In a challenging time for US issuers, the tremendous success of

the series C issuance is a vote of confidence in Southern

Properties Capital. It is an unprecedented transaction in this

period and proof that solid companies with proven attention to the

local market continue to succeed.”

About Southern Properties Capital

Southern Properties Capital operates primarily in Texas and

specializes in Class A multifamily assets in emerging markets

throughout the Southern United States, corresponding with both

sustainable and viable economic growth activity. The issuing entity

is backed by over 3,000 multi-family units (out of a total of

approximately 8,000 owned and operated by TCI), as well as over 1.5

million square feet office buildings in Texas. The company has

already used funds to acquire additional multi-family assets within

its strategic footprint, and expects significant expansion by

continuing to utilize the Israeli bond platform.

About Transcontinental Realty Investors

Transcontinental Realty Investors maintains a strong emphasis on

creating greater shareholder value through acquisition, financing,

operation, developing, and sale of real estate across every

geographic region in the United States. A New York Stock Exchange

company, Transcontinental is traded under the symbol "TCI".

Transcontinental produces revenue through the professional

management of apartments, office buildings, warehouses, and retail

centers that are "undervalued" or "underperforming" at the time of

acquisition. Value is added under Transcontinental ownership, and

the properties are repositioned into higher classifications through

physical improvements and improved management. Transcontinental

also develops new properties, such as luxury apartment homes

principally on land it owns or acquires.

About Abode Properties

Abode Properties is a subsidiary of Transcontinental Realty

Investors Inc., (NYSE: TCI), a Dallas-based real estate investment

company. Abode’s investment and strategic focus is to acquire,

develop, and operate a portfolio of desirable multifamily

residential properties, while capitalizing on our ability to obtain

long term and static debt structures. The portfolio stands to

benefit from historically established, proven, and successful

operational practices, seasoned on-site management, and an

experienced leadership team with forward thinking capabilities in

order to realize maximum cash flows and consistent returns, while

maintaining unequaled resident and customer service. We are

disciplined and prudent allocators of capital and we will continue

growing our geographically diverse portfolio from the Southwest to

the Southeast. These markets are geographically located in areas of

the country that correspond with both sustainable and viable

economic growth activity.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20190731005243/en/

Chris Childress, Pillar Income Asset Management 469.522.4275 /

press@pillarincome.com

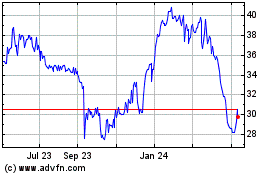

Transcontinental Realty ... (NYSE:TCI)

Historical Stock Chart

From Mar 2024 to Apr 2024

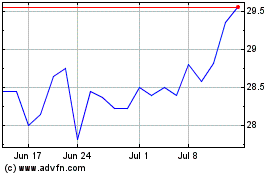

Transcontinental Realty ... (NYSE:TCI)

Historical Stock Chart

From Apr 2023 to Apr 2024