Transcontinental Realty Investors, Inc. (NYSE: TCI), a

Dallas-based real estate investment company, today reported results

of operations for the first quarter ended March 31, 2019.

In November 2018 the Company created a new subsidiary Victory

Abode Apartments, LLC (“VAA”) and contributed 52 multi-family

projects that it owned and operated to VAA. TCI subsequently sold a

50% interest to a third party and recorded a $154 million gain.

Beginning November 19, 2018, TCI began reflecting its ownership of

VAA on the Balance Sheet as an investment and its share of the

Revenues, Operating Expenses, Depreciation, Amortization and

Interest as “Earning from VAA”. The Statement of Operations for the

three months ended March 31, 2018 and the information thereon

reflect the operations for the properties contributed to VAA on a

consolidated basis.

The Company believes that the completion of the joint venture

creating Victory Abode Apartments has positioned the company with a

dynamic platform to continue its expansion in the multifamily

sector. The ongoing plan is to continue to develop and acquire

apartments in the geographic markets where demand exceeds

supply.

For the three months ended March 31, 2019, we reported a net

loss applicable to common shares of $5.6 million or ($0.64) per

diluted loss per share compared to a net loss applicable to common

shares of $0.5 million or ($0.05) per diluted loss per share for

the same period ended 2018.

Revenues

Rental and other property revenues were $11.9 million for the

three months ended March 31, 2019, compared to $31.1 million for

the same period in 2018. The $19.2 million decrease is primarily

due to a decrease in the amount of multifamily residential

apartment buildings currently in our portfolio of nine as compared

to 53 multifamily residential apartment buildings for the same

period a year ago as a result of the deconsolidation of 49

residential apartment properties that were sold into the VAA Joint

Venture during the fourth quarter of 2018. As the assets are now

treated as unconsolidated investments, our share of rental revenues

is part of income from unconsolidated investments in the current

period and are no longer treated as rental income.

Expense

Property operating expenses decreased by $8.5 million to $6.0

million for the three months ended March 31, 2019 as compared to

$14.5 million for the same period in 2018. The decrease in property

operating expenses is primarily due to the deconsolidation of 49

residential apartment properties that were sold into the VAA Joint

Venture during the fourth quarter of 2018 which resulted in a

decrease in salary and related payroll expenses of $1.7 million,

real estate taxes of approximately $3.0 million and general

property operating and maintenance expenses of $3.8 million.

Depreciation and amortization decreased by $3.3 million

to $3.1 million during the three months

ended March 31, 2019 as compared to $6.4

million for the three months ended March 31, 2018.

This decrease is primarily due to the deconsolidation of the

residential apartments in connection with our previous sale and

contribution of our interests to the VAA Joint Venture.

General and administrative expense was $2.3 million for the

three months ended March 31, 2019, compared to $2.2 million for the

same period in 2018. The increase of $0.1 million in general and

administrative expenses is the result of increases in advisory and

management fees of approximately $0.4 million and professional and

finance fees of $0.3 million offset by a decrease in accounting,

tax and other general administrative fees of $0.6 million.

Other income (expense)

Interest income was $4.6 million for the three months ended

March 31, 2019, compared to $3.9 million for the same period in

2018. The increase of $0.7 million was due to an increase of

$1.3 million in interest on receivable owed from our Advisors,

offset by a decrease of $0.8 in interest on notes receivable from

other related parties.

Other income was $3.9 million for the three months ended March

31, 2019, compared to $1.8 million for the same period in 2018. The

increase is primarily the result of a $3.6 million gain recognized

for deferred income associated with the sale of land during the

quarter just ended held by IOR to third parties.

Mortgage and loan interest expense was $7.9

million for the three months ended March 31,

2019 as compared to $14.1 million for the same

period in 2018. The decrease of $6.2 million is due to the

deconsolidation of residential apartment properties into the VAA

Joint Venture which were encumbered by mortgage debt.

Foreign currency transaction was a loss of $5.8 million for

the three months ended March 31, 2019 as compared to a gain of $1.8

million for the same period in 2018. During the first quarter just

ended, we paid $10.4 million in principal and $5.8 million in

interests payments to our bonds denominated in Israel Shekels.

Loss from unconsolidated investments was $1.1 million for the

three months ended March 31, 2019 as compared to earnings of $11

thousand for the three months ended March 31, 2018. The loss from

unconsolidated investments during the first quarter just ended was

driven primarily from our share in the losses reported by the VAA

Joint Venture.

Gain on land sales was $2.2 for the three months ended March 31,

2019, compared to $1.3 million for the same period in 2018. In the

current period we sold approximately 22.3 acres of land for a sales

price of $8.7 million which resulted in a gain of $2.2 million. For

the same period in 2018, we sold 112.2 acres of land for a sales

price of $7.2 million and recorded a total gain of $1.3

million.

About Transcontinental Realty Investors, Inc.

Transcontinental Realty Investors, Inc., a Dallas-based real

estate investment company, holds a diverse portfolio of equity real

estate located across the U.S., including apartments, office

buildings, shopping centers, and developed and undeveloped land.

The Company invests in real estate through direct ownership, leases

and partnerships and invests in mortgage loans on real estate. For

more information, visit the Company’s website at

www.transconrealty-invest.com.

TRANSCONTINENTAL REALTY INVESTORS,

INC. CONSOLIDATED STATEMENTS OF OPERATIONS

(unaudited) For the Three Months Ended March

31, 2019 2018 (dollars in thousands, except

per share amounts) Revenues: Rental and other property

revenues (including $113 and $208 for the three months ended 2019

and 2018, respectively, from related parties) $ 11,929 $ 31,082

Expenses: Property operating expenses (including $257

and $227 for the three months ended 2019 and 2018, respectively,

from related parties) 5,997 14,455 Depreciation and amortization

3,109 6,446 General and administrative (including $1,500 and $1,093

for the three months ended 2019 and 2018, respectively, from

related parties) 2,328 2,192 Net income fee to related party 100 53

Advisory fee to related party 1,648 2,748

Total operating expenses 13,182 25,894

Net operating (loss) income (1,253 ) 5,188

Other

income (expenses): Interest income (including $4,285 and $3,236

for the three months ended 2019 and 2018, respectively, from

related parties) 4,558 3,876 Other income 3,892 1,826 Mortgage and

loan interest (including $490 and $318 for the three months ended

2019 and 2018, respectively, from related parties) (7,959 ) (14,093

) Foreign currency transaction (loss) gain (5,818 ) 1,756 Equity

loss from VAA (1,055 ) - (Losses) earnings from other

unconsolidated investees (7 ) 11 Total other

expenses (6,389 ) (6,624 ) Loss before gain on land

sales, non-controlling interest, and taxes (7,642 ) (1,436 ) Gain

on land sales 2,216 1,335 Net loss from

continuing operations before taxes (5,426 ) (101 )

Net loss from continuing operations (5,426 ) (101 ) Net loss (5,426

) (101 ) Net (income) attributable to non-controlling interest

(183 ) (132 ) Net loss attributable to

Transcontinental Realty Investors, Inc. (5,609 ) (233 ) Preferred

dividend requirement - (222 ) Net loss

applicable to common shares $ (5,609 ) $ (455 )

Earnings

per share - basic Net loss from continuing

operations $ (0.64 ) $ (0.05 ) Net loss applicable to common shares

$ (0.64 ) $ (0.05 )

Earnings per share - diluted

Net loss from continuing operations $ (0.64 ) $ (0.05

) Net loss applicable to common shares $ (0.64 ) $ (0.05 )

Weighted average common shares used in computing earnings per share

8,717,767 8,717,767 Weighted average common shares used in

computing diluted earnings per share 8,717,767 8,717,767

Amounts

attributable to Transcontinental Realty Investors, Inc. Net

loss from continuing operations $ (5,609 ) $ (233 ) Net loss

applicable to Transcontinental Realty, Investors, Inc. $ (5,609 ) $

(233 )

TRANSCONTINENTAL

REALTY INVESTORS, INC. CONSOLIDATED BALANCE SHEETS

March 31, December 31, 2019 2018

(unaudited) (audited)

(dollars in thousands, except share

and par value amounts) Assets Real estate, at cost $

452,761 $ 461,718 Real estate subject to sales contracts at cost

4,325 2,014 Real estate held for sale at cost, net of depreciation

14,737 - Less accumulated depreciation (81,885 )

(79,228 ) Total real estate 389,938 384,504 Notes and

interest receivable (including $48,646 in 2019 and $51,945 in 2018

from related parties) 82,469 83,541 Cash and cash equivalents

28,156 36,358 Restricted cash 51,983 70,207 Investment in VAA

67,229 68,399 Investment in other unconsolidated investees 22,164

22,172 Receivable from related party 143,437 133,642 Other assets

67,238 63,557 Total assets $ 852,614

$ 862,380

Liabilities and Shareholders’

Equity Liabilities: Notes and interest payable $ 283,934 $

277,237 Bonds and bond interest payable 151,465 158,574 Deferred

revenue (including $13,977 in 2019 and $17,522 in 2018 to related

parties) 13,977 17,522 Deferred tax liability 2,000 2,000 Accounts

payable and other liabilities (including $6 in 2019 and $3 in 2018

to related parties) 26,330 26,646 Total

liabilities 477,706 481,979 Shareholders’ equity: Common

stock, $0.01 par value, authorized 10,000,000 shares; issued

8,717,967 shares in 2019 and 2018; outstanding 8,717,767 shares in

2019 and 2018 87 87 Treasury stock at cost, 200 shares in 2019 and

2018 (2 ) (2 ) Paid-in capital 257,983 258,050 Retained earnings

95,976 101,585 Total Transcontinental

Realty Investors, Inc. shareholders' equity 354,044 359,720

Non-controlling interest 20,864 20,681

Total shareholders' equity 374,908 380,401

Total liabilities and shareholders' equity $ 852,614

$ 862,380

View source

version on businesswire.com: https://www.businesswire.com/news/home/20190515005930/en/

Transcontinental Realty Investors, Inc.Investor

RelationsGene Bertcher (800)

400-6407investor.relations@transconrealty-invest.com

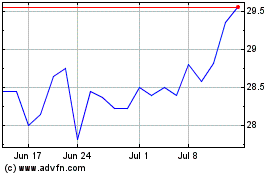

Transcontinental Realty ... (NYSE:TCI)

Historical Stock Chart

From Mar 2024 to Apr 2024

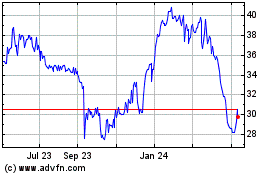

Transcontinental Realty ... (NYSE:TCI)

Historical Stock Chart

From Apr 2023 to Apr 2024