Transcontinental Realty Investors, Inc. (NYSE: TCI), a

Dallas-based real estate investment company is reporting its

Results of Operations for 2018. In November 2018, the Company

created a new subsidiary Victory Abode Apartments, LLC (“VAA”) and

contributed 52 multi-family projects that it owned and operated to

VAA. TCI subsequently sold a 50% interest to a third party and

recorded a $154 million gain.

The Company believes that both the completion of the joint

venture creating Victory Abode Apartments and the issuance of the

Series B Bonds in the Israeli Bond Market has positioned the

company along the strategic lines that it previously indicated. The

Company has created a dynamic platform to continue its expansion in

the multifamily sector. The ongoing plan is to continue to develop

and acquire apartments in the geographic markets where demand

exceeds supply.

Beginning November 19, 2018, TCI began reflecting its ownership

of VAA on the Balance Sheet as an investment and its share of the

Revenues, Operating Expenses, Depreciation, Amortization and

Interest as “Earning from VAA”. The comparative financial

statements and the information below reflect approximately 46 weeks

of operations for the properties contributed to VAA in 2018 in

their traditional categories as compared to a full 52 weeks for

2017

For the year ended December 31, 2018, we reported net income

applicable to common shares of $180.1 million or $20.71 per share

compared to a net loss applicable to common shares of $16.7 million

or ($1.92) per share for the year ended December 31, 2017.

Revenues

Rental and other property revenues were $121.0 million for the

year ended December 31, 2018. This represents a decrease of $4.2

million, as compared to the prior year revenues of $125.2 million.

The decrease is primarily due to the contribution of fifty-two

properties to the joint venture VAA on November 19, 2018.

Expenses

Property operating expenses were $59.4 million for the year

ended December 31, 2018. This represents a decrease of $3.7

million, compared to the prior year operating expenses of $63.1

million. The decrease is primarily due to the contribution of

fifty-two properties to the joint venture VAA on November 19,

2018.

Depreciation and amortization expenses were $22.8 million for

the year ended December 31, 2018. This represents a decrease of

$2.8 million compared to prior year depreciation of $25.6 million.

The decrease is primarily due to the contribution of fifty-two

properties to the joint venture VAA on November 19, 2018.

General and administrative expenses were $11.4 million for the

year ended December 31, 2018. This represents an increase of $5.1

million compared to the prior year expenses of $6.3 million. The

increase in general and administrative expenses was due primarily

to an increase in fees paid associated with finalizing the

formation of VAA as well as and general and professional fees.

Other income (expense)

Interest income was $15.8 million for the year ending December

31, 2018 compared to $13.9 million for the year ended December 31,

2017 for an increase of $1.9 million. This increase was

primarily due to an increase of $2.7 million in interest on

receivable owed from our Advisors, offset by a decrease of $0.8 in

interest on notes receivable from other related parties.

Mortgage and loan interest expense was $58.9 million for the

year ended December 31, 2018. This represents a decrease of $1.0

million compared to the prior year expense of $59.9 million. The

decrease is primarily due to the contribution of fifty-two

properties to the joint venture VAA on November 19, 2018.

No gain on sales of income producing properties was recognized

during the year ended December 31, 2018. Gain on sale of

income-producing properties was $9.8 million for the year ended

December 31, 2017, attributable to the recognition of deferred

gain.

Gain on land sales was $17.4 million and $4.9 million for the

years ended December 31, 2018 and 2017, respectively. The increase

of approximately $12.5 million was primarily due to sales of land

at Mercer Crossing recognized in 2018.

Other income was $28.2 million and $0.6 million for the years

ended December 31, 2018 and 2017, respectively. The increase of

$27.6 million was primarily due to a $17.6 million gain recognized

in September 2018 for deferred income associated with the sale of

assets, as well as income of approximately $7.6 million from

insurance proceeds on Mahogany Run Golf Course.

Gain from the sale of 50% ownership in VAA was $154.1 million

for the year ended December 31, 2018. There was no such gain in

prior years.

About Transcontinental Realty Investors, Inc.

Transcontinental Realty Investors, Inc., a Dallas-based real

estate investment company, holds a diverse portfolio of equity real

estate located across the U.S., including apartments, office

buildings, shopping centers, and developed and undeveloped land.

The Company invests in real estate through direct ownership, leases

and partnerships and invests in mortgage loans on real estate. For

more information, visit the Company’s website at

www.transconrealty-invest.com.

TRANSCONTINENTAL

REALTY INVESTORS, INC. CONSOLIDATED STATEMENTS OF

OPERATIONS For the Years Ended December 31,

2018 2017 2016 (dollars in thousands,

except per share amounts) Revenues: Rental and other

property revenues (including $767, $839 and $708 for the years

ended 2018, 2017 and 2016, respectively, from related parties) $

120,955 $ 125,233 $ 118,471

Expenses: Property

operating expenses (including $943, $929 and $865 for the years

ended 2018, 2017 and 2016, respectively, from related parties)

59,420 63,056 61,918 Depreciation and amortization 22,761 25,558

23,683 General and administrative (including $4,578, $3,120 and

$3,574 for the years ended 2018, 2017 and 2016, respectively, from

related parties) 11,359 6,269 5,476 Net income fee to related party

631 250 257 Advisory fee to related party 10,663

9,995 9,490 Total operating expenses

104,834 105,128 100,824

Net operating income 16,121 20,105 17,647

Other income

(expenses): Interest income (including $13,132, $11,485 and

$13,348 for the years ended 2018, 2017 and 2016, respectively, from

related parties) 15,793 13,862 14,670 Other income 28,150 625 1,816

Mortgage and loan interest (including $423, $1,174 and $568 for the

year ended 2018, 2017 and 2016, respectively, from related parties)

(58,872 ) (59,944 ) (53,088 ) Foreign currency transaction gain

(loss) 12,399 (4,536 ) - Earnings from VAA 44 - - Earnings (losses)

from other unconsolidated investees 1,085 26

(26 ) Total other expenses (1,401 )

(49,967 ) (36,628 ) Income (loss) before gain on disposition

of 50% interest in VAA, gain on land sales, non-controlling

interest, and taxes 14,720 (29,862 ) (18,981 ) Gain on

disposition of 50% interest in VAA 154,126 - - Gain on sale of

income producing properties - 9,842 16,207 Gain on land sales

17,404 4,884 3,121 Net

income (loss) from continuing operations before taxes 186,250

(15,136 ) 347 Income tax expense - current (1,210 ) (180 ) (24 )

Income tax expense - deferred (2,000 ) -

- Net income (loss) from continuing operations

183,040 (15,316 ) 323 Discontinued operations: Net income (loss)

from discontinued operations - - (2 ) Income tax benefit (expense)

from discontinued operations - -

1 Net income (loss) from discontinued operations -

- (1 ) Net income (loss) 183,040

(15,316 ) 322 Net (income) attributable to non-controlling interest

(1,590 ) (499 ) (285 ) Net income (loss)

attributable to Transcontinental Realty Investors, Inc. 181,450

(15,815 ) 37 Preferred dividend requirement (900 )

(900 ) (900 ) Net income (loss) applicable to common shares

$ 180,550 $ (16,715 ) $ (863 )

Earnings per share

- basic Net income (loss) from continuing

operations $ 20.71 $ (1.92 ) $ (0.10 ) Net income (loss)

applicable to common shares $ 20.71 $ (1.92 ) $ (0.10 )

Earnings per share - diluted Net

income (loss) from continuing operations $ 20.71 $ (1.92 ) $

(0.10 ) Net income (loss) applicable to common shares $ 20.71

$ (1.92 ) $ (0.10 ) Weighted average common shares

used in computing earnings per share 8,717,767 8,717,767 8,717,767

Weighted average common shares used in computing diluted earnings

per share 8,717,767 8,717,767 8,717,767

Amounts attributable to

Transcontinental Realty Investors, Inc. Net income (loss) from

continuing operations $ 181,450 $ (15,815 ) $ 38 Net income from

discontinued operations - - (1 )

Net income (loss) applicable to Transcontinental Realty, Investors,

Inc. $ 181,450 $ (15,815 ) $ 37

TRANSCONTINENTAL REALTY INVESTORS, INC. CONSOLIDATED

BALANCE SHEETS December 31, 2018

2017 (dollars in thousands, except share and par

value amounts) Assets Real estate, at cost $ 461,718 $

1,112,721 Real estate subject to sales contracts at cost 2,014

45,739 Less accumulated depreciation (79,228 )

(178,590 )

Total real estate

384,504 979,870 Notes and interest receivable (including

$51,945 in 2018 and $45,155 in 2017 from related parties) 83,541

70,166 Cash and cash equivalents 36,358 33,563 Restricted cash

70,207 54,779 Investment in joint venture 68,399 - Investment in

other unconsolidated investees 22,172 2,472 Receivable from related

party 133,642 111,665 Other assets 63,557

60,907 Total assets $ 862,380 $ 1,313,422

Liabilities and Shareholders’ Equity Liabilities:

Notes and interest payable $ 277,237 $ 892,149 Notes related to

real estate held for sale - 376 Notes related to real estate

subject to sales contracts - 1,957 Bonds and bond interest payable

158,574 113,047 Deferred revenue (including $21,034 in 2018 and

$40,574 in 2017 to related parties) 17,522 60,949 Deferred tax

liability 2,000 - Accounts payable and other liabilities (including

$3 in 2018 and $7,236 in 2017 to related parties) 26,646

36,683 Total liabilities 481,979 1,105,161

Shareholders’ equity: Preferred Stock, Series D: $0.01 par

value, authorized 100,000 shares; issued 100,000 shares in 2018 and

2017; outstanding 0 shares in 2018 and 100,000 shares in 2017

(liquidation preference $100 per share) - 1 Common stock, $0.01 par

value, authorized 10,000,000 shares; issued 8,717,967 shares in

2018 and 2017; outstanding 8,717,767 shares in 2018 and 2017 87 87

Treasury stock at cost, 200 shares in 2018 and 2017 (2 ) (2 )

Paid-in capital 258,050 268,949 Retained earnings (deficit)

101,585 (79,865 ) Total Transcontinental Realty

Investors, Inc. shareholders' equity 359,720 189,170

Non-controlling interest 20,681 19,091

Total shareholders' equity 380,401 208,261

Total liabilities and shareholders' equity $ 862,380

$ 1,313,422

View source

version on businesswire.com: https://www.businesswire.com/news/home/20190401005962/en/

Transcontinental Realty Investors, Inc.Investor

RelationsGene Bertcher (800)

400-6407investor.relations@transconrealty-invest.com

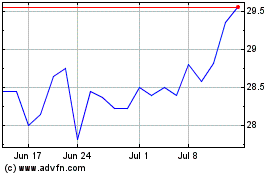

Transcontinental Realty ... (NYSE:TCI)

Historical Stock Chart

From Mar 2024 to Apr 2024

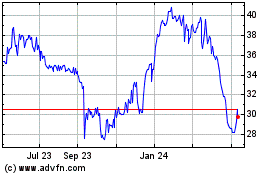

Transcontinental Realty ... (NYSE:TCI)

Historical Stock Chart

From Apr 2023 to Apr 2024