Amended Tender Offer Statement by Issuer (sc To-i/a)

December 03 2019 - 6:03PM

Edgar (US Regulatory)

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE TO

TENDER OFFER STATEMENT UNDER SECTION 14(d)(1) OR 13(e)(1)

OF THE SECURITIES EXCHANGE ACT OF 1934

(AMENDMENT NO. 1)

TARO

PHARMACEUTICAL INDUSTRIES LTD.

(Name of Subject Company (Issuer))

TARO PHARMACEUTICAL INDUSTRIES LTD. (ISSUER)

(Names of Filing Persons (Issuer and Offeror))

ORDINARY SHARES, NOMINAL (PAR) VALUE NIS 0.0001 PER SHARE

(Title of Class of Securities)

M8737E108

(CUSIP Number

of Class of Securities)

Mariano Balaguer

Chief Financial Officer

Taro Pharmaceutical Industries Ltd.

C/o Taro Pharmaceuticals U.S.A., Inc.

3 Skyline Drive

Hawthorne, NY 10532

Tel:

(914) 345-9000

Fax: (914) 345-6169

(Name, Address and Telephone Number of Person Authorized to Receive Notices and Communications on Behalf of Filing Persons)

Copy to:

Richard

B. Alsop, Esq.

Shearman & Sterling LLP

599 Lexington Avenue

New

York, New York 10022

(212) 848-4000

CALCULATION OF FILING FEE

|

|

|

|

|

TRANSACTION VALUATION(1)

|

|

AMOUNT OF FILING FEE(2)

|

|

$225,000,000

|

|

$29,205

|

|

|

|

(1)

|

Estimated solely for purposes of calculating the filing fee. This amount is based upon the offer to purchase

for up to $225 million in value of ordinary shares of Taro Pharmaceutical Industries Ltd. at a price not greater than $92.00 per share nor less than $80.00 per share.

|

|

(2)

|

The amount of the filing fee, calculated in accordance with

Rule 0-11 of the Securities and Exchange Act of 1934, as amended, equals $129.80 per million of the value of the transaction.

|

|

☒

|

Check the box if any part of the fee is offset as provided by Rule

0-11(a)(2) and identify the filing with which the offsetting fee was previously paid. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|

|

|

|

|

Amount Previously Paid: $29,205

|

|

Filing Party: Taro Pharmaceutical Industries Ltd.

|

|

Form or Registration No.: Schedule TO

|

|

Date Filed: November 15, 2019

|

|

☐

|

Check the box if the filing relates solely to preliminary communications made before the commencement of a

tender offer.

|

Check the appropriate boxes to designate any transactions to which the statement relates

|

|

☐

|

third-party tender offer subject to Rule 14d-1.

|

|

|

☒

|

issuer tender offer subject to Rule 13e-4.

|

|

|

☐

|

going-private transaction subject to Rule 13e-3.

|

|

|

☐

|

amendment to Schedule 13D under Rule 13d-2.

|

Check the following box if the filing is a final amendment reporting the results of the tender offer: ☐

If applicable, check the appropriate box(es) below to designate the appropriate rule provision(s) relied upon:

|

|

☐

|

Rule 13e-4(i) (Cross-Border Issuer Tender Offer)

|

|

|

☐

|

Rule 14d-1(d) (Cross-Border Third-Party Tender Offer)

|

INTRODUCTION

This Amendment No. 1 (this “Amendment”) amends and supplements the Tender Offer Statement on Schedule TO originally filed with

the Securities and Exchange Commission (the “SEC”) on November 15, 2019 (the “Schedule TO”) relating to the offer by Taro Pharmaceutical Industries Ltd., a company incorporated under the laws of the State of Israel, to

purchase up to $225 million in value of its ordinary shares, nominal (par) value NIS 0.0001 per share, at a price not greater than $92.00 per share nor less than $80.00 per share, to the seller in cash, less any applicable withholding taxes and

without interest, upon the terms and subject to the conditions set forth in the Offer to Purchase dated November 15, 2019 and the related Letter of Transmittal, copies of which are filed as Exhibits (a)(1)(A) and (a)(1)(B) to the Schedule TO,

respectively.

Only those items amended are reported in this Amendment. Except as specifically provided herein, the information contained

in the Schedule TO, the Offer to Purchase and the related Letter of Transmittal remains unchanged. This Amendment should be read in conjunction with the Schedule TO, the Offer to Purchase and the related Letter of Transmittal.

ITEM 4. TERMS OF THE TRANSACTION.

The information

set forth in Item 4 is hereby amended and supplemented by the following:

|

(1)

|

The last sentence of the final paragraph on page 24 of the Conditions of the Tender Offer in Section 7 of

the Offer to Purchase is amended by adding the following language after “Any determination by us concerning the events described in this section will be final and binding upon all persons”:

|

“, subject to a shareholder’s right to challenge our determination in a court of competent jurisdiction.”

|

(2)

|

The first paragraph on page 23 and the last paragraph on page 24 of the Conditions of the Tender Offer in

Section 7 of the Offer to Purchase are amended by inserting the following immediately after the words “in our reasonable judgment and regardless of the circumstances giving rise to the event or events” and “may be asserted by us

regardless of the circumstances giving rise to any of these conditions,” respectively:

|

“(other than any

action or omission to act by us)”

|

(3)

|

The condition set forth in the third sub-bullet under the first main

bullet on page 23 of the Conditions of the Tender Offer in Section 7 of the Offer to Purchase (“a material change in United States or any other currency exchange rates or a suspension of or limitation on the markets therefor;”) is

hereby deleted in its entirety.

|

|

(4)

|

The fourth sub-bullet under the first main bullet on page 23 of the

Conditions of the Tender Offer in Section 7 of the Offer to Purchase is hereby deleted in its entirety and replaced with the following:

|

“the commencement or any material escalation of a war, armed hostilities or other similar national or international calamity involving

the United States or Israel;”

|

(5)

|

The fifth sub-bullet under the first main bullet on page 23 of the

Conditions of the Tender Offer in Section 7 of the Offer to Purchase is hereby deleted in its entirety and replaced with the following:

|

“a decrease of more than 10% in the market price for the shares, the Dow Jones Industrial Average, the NYSE Composite Index or the

S&P 500 Composite Index since November 15, 2019; or”

|

(6)

|

Subsection (iii) of the condition in the second main bullet on page 23 of the Conditions of the Tender

Offer in Section 7 of the Offer to Purchase is amended by deleting the words “or be material to holders of the shares in deciding whether to tender in the Offer” at the end thereof.

|

|

(7)

|

The condition set forth in third main bullet on page 24 of the Conditions of the Tender Offer in Section 7

of the Offer to Purchase (“any approval, permit, authorization, favorable review or consent of any governmental entity required to be obtained in connection with the Offer, and of which we have been notified after the date of the Offer, has not

been obtained on terms satisfactory to us in our reasonable discretion;”) is hereby deleted in its entirety.

|

|

(8)

|

In the Conditions of the Tender Offer in Section 7 of the Offer to Purchase, the following language is

added before the last sentence of the last paragraph on page 24:

|

“Our failure at any time to exercise any of the

foregoing rights will not be deemed a waiver of any right, and each such right will be deemed an ongoing right that may be asserted at any time and from time to time until the Offer shall have expired or been terminated. However, once the Offer has

expired, then all of the conditions to the Offer must have been satisfied or waived. In certain circumstances, if we waive any of the conditions described above, we may be required to extend the Expiration Time.”

ITEM 11. ADDITIONAL INFORMATION.

The information

set forth in Item 11 is hereby amended and supplemented by the following:

|

(1)

|

The changes described above in Item 4 of this Amendment are hereby incorporated into Item 11 by reference.

|

|

(2)

|

The second paragraph under the section entitled “Important” on page ii of the Offer to Purchase is

hereby deleted in its entirety and replaced with the following:

|

“We are not making the Offer to, and will not

accept any tendered shares from, shareholders in any jurisdiction or in any circumstances where it would be illegal to do so, provided that we will comply with the requirements of Rule 13e-4(f)(8) promulgated

under the Securities Exchange Act of 1934, as amended (the “Exchange Act”). However, we may, at our discretion, take any actions necessary for us to make the Offer to shareholders in any such jurisdiction. In any jurisdiction where the

securities or blue sky laws require the Offer to be made by a licensed broker or dealer, the Offer is being made on our behalf by the Dealer Manager or one of more registered brokers or dealers, which are licensed under the laws of such

jurisdiction.”

ITEM 12. EXHIBITS.

The

information set forth in Item 12 is hereby amended and supplemented by adding the following exhibits:

|

|

|

|

|

|

|

|

(a)(5)(A)

|

|

Annual Report on Form 20-F for the fiscal year ended March 31, 2019 filed with the SEC on June 20, 2019 (incorporated by reference to such filing).

|

|

|

|

|

(a)(5)(B)

|

|

Report on 6-K furnished to the SEC on August 8, 2019 (incorporated by reference to such filing).

|

|

|

|

|

(a)(5)(C)

|

|

Report on 6-K furnished to the SEC on November 4, 2019 (incorporated by reference to such filing).

|

SIGNATURE

After due inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

Date: December 3, 2019

|

|

|

|

|

|

|

TARO PHARMACEUTICAL INDUSTRIES LTD.

|

|

|

|

|

By:

|

|

/s/ Mariano Balaguer

|

|

|

|

Name:

|

|

Mariano Balaguer

|

|

|

|

Title:

|

|

Chief Financial Officer

|

EXHIBIT INDEX

|

|

|

|

|

|

|

|

(a)(1)(A)

|

|

Offer to Purchase dated November 15, 2019.*

|

|

|

|

|

(a)(1)(B)

|

|

Letter of Transmittal.*

|

|

|

|

|

(a)(1)(C)

|

|

Notice of Guaranteed Delivery.*

|

|

|

|

|

(a)(1)(D)

|

|

Letter to Brokers, Dealers, Commercial Banks, Trust Companies and Other Nominees.*

|

|

|

|

|

(a)(1)(E)

|

|

Letter to Clients for use by Brokers, Dealers, Commercial Banks, Trust Companies and Other Nominees.*

|

|

|

|

|

(a)(1)(F)

|

|

Declaration of Status for Israeli Income Tax Purposes.*

|

|

|

|

|

(a)(1)(G)

|

|

Press Release dated November 15, 2019.*

|

|

|

|

|

(a)(1)(H)

|

|

Summary Advertisement dated November 15, 2019.*

|

|

|

|

|

(a)(5)(A)

|

|

Annual Report on Form 20-F for the fiscal year ended March 31, 2019 filed with the SEC on June 20, 2019 (incorporated by reference to such filing).

|

|

|

|

|

(a)(5)(B)

|

|

Report on 6-K furnished to the SEC on August 8, 2019 (incorporated by reference to such filing).

|

|

|

|

|

(a)(5)(C)

|

|

Report on 6-K furnished to the SEC on November 4, 2019 (incorporated by reference to such filing).

|

|

|

|

|

(b)

|

|

Not Applicable.

|

|

|

|

|

(d)(1)

|

|

Taro Pharmaceutical Industries 1999 Stock Incentive Plan (incorporated herein by reference to the Company’s Registration Statement on Form S-8 filed on August 24, 2001 (File No. 333-13840)).*

|

|

|

|

|

(d)(2)

|

|

Amendment No. 1 to Taro Pharmaceutical Industries 1999 Stock Incentive Plan (incorporated herein by reference to Exhibit 4.4 to the Company’s Annual Report on Form 20-F for the

fiscal year ended December 31, 2005 filed on March 20, 2007 (File No. 000-22286)).*

|

|

|

|

|

(d)(3)

|

|

Amendment No. 2 to Taro Pharmaceutical Industries 1999 Stock Incentive Plan (incorporated herein by reference to Exhibit 4.5 to the Company’s Annual Report on Form 20-F for the

fiscal year ended December 31, 2005 filed on March 20, 2007 (File No. 000-22286)).*

|

|

|

|

|

(g)

|

|

Not Applicable.

|

|

|

|

|

(h)

|

|

Not Applicable.

|

|

*

|

Previously filed with the Schedule TO filed November 15, 2019.

|

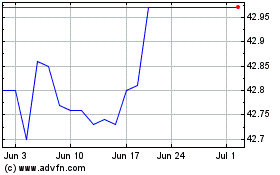

Taro Pharmaceutical Indu... (NYSE:TARO)

Historical Stock Chart

From Mar 2024 to Apr 2024

Taro Pharmaceutical Indu... (NYSE:TARO)

Historical Stock Chart

From Apr 2023 to Apr 2024