Following is a summary of the key elements of our executive compensation program:

We use base salary as a level of fixed compensation that is meant to be competitive with our peers. Base salary is reviewed annually by the Compensation & HR Committee and adjusted based on considerations such as positioning vs. our peer group, experience and performance in role, as well as scope of responsibilities.

For 2020, the Compensation & HR Committee approved the following NEO salaries and adjustments, other than for Mr. Hattersley whose salary was approved by our Board after recommendation by the Compensation & HR Committee upon appointment to the role of Company CEO in September 2019.

Due to the revitalization plan directed by Mr. Hattersley in the third quarter of 2019 upon his appointment as CEO, certain employees including Ms. St. Jacques and Messrs. Hattersley, Cox and Reichert received salary adjustments to reflect their updated roles in the new structure effective in late 2019 and were not eligible for merit adjustments in 2020 as would normally be considered. Ms. Joubert received no such adjustment within the revitalization plan and therefore was eligible for, and received, a merit adjustment in 2020.

Below are the threshold, target and maximum levels of achievement at the Enterprise, North America and Europe levels for 2020 and corresponding adjusted underlying results.

The following table summarizes the calculation of final 2020 MCIP awards for our NEOs after review by the Compensation & HR Committee (and our Board in the case of Mr. Hattersley) based on the payout percentages noted above. The individual goal multiplier for each NEO (with the exception of the CEO) is recommended by the CEO to and then approved by the Compensation & HR Committee, based on a 2020 performance assessment against individual goals. The “Grants of Plan Based Awards” table on page 61 provides information on each NEO’s threshold, target and maximum MCIP award.

We use our LTIP to provide variable pay compensation in the form of equity that rewards executives when we achieve long-term results that align with our stockholders’ interests.

Under our LTIP, we grant executives three types of awards, which are administered under the Incentive Compensation Plan: PSUs, RSUs and stock options. Each NEO is awarded an aggregate LTIP value, which is allocated among the three types of awards. For 2020, we continued with our 2019 mix of awards (see table below) to provide a balance of performance- and retention-based compensation to support our long-term strategy. This mix of awards is designed to tie executive compensation to TSR, balance performance focus with retention value, and mitigate the risk of over-focus on a single metric.

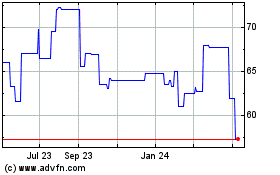

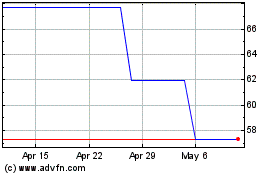

The number of PSUs and RSUs awarded to each NEO is determined at the date of grant by dividing the target value of the award by the closing price of our Class B common stock on that date. The number of stock options is determined by dividing the target value of the award by the Black-Scholes value of the award on that date. The number of PSUs, RSUs and stock options granted to each NEO in 2020 is detailed in the “Grants of Plan Based Awards” table beginning on page 61.

The target value of the LTIP awards granted to the NEOs in 2020 is shown below.

Our 2018 PSU award with adjusted PACC modified by Relative TSR as the performance metrics, had a scheduled vesting date of March 6, 2021 (where the 3-year performance period ended December 31, 2020) but achieved a 0% payout based on performance. The first chart below shows the full award performance matrix, and the subsequent charts show a breakout by component of how the Compensation & HR Committee determined final results. Points between results in the below charts are interpolated on a linear basis.

Relative TSR vs. the S&P 500 over the performance period was at the 9th percentile, and thus resulted in a 70% Relative TSR multiplier.

The result of PACC performance (0%) is multiplied (or modified) by the result of Relative TSR performance (70%) for the total payout result of 0% (0% PACC performance multiplied (x) by 70% Relative TSR performance equals (=) 0%). As a result, none of the previously reported 2018 PSU summary compensation table value was delivered at the March 6, 2021 vesting date.

In addition to the executive compensation program elements described above, we provide certain limited perquisites to our executives, including the NEOs, which we believe are appropriate and competitive. These perquisites are described below and in the narrative following the “Summary Compensation Table” on page 59.

Generally, executive officers participate in the same retirement, 401(k) and pension plans as do other salaried employees in their home country. In addition to our 401(k) plans in the U.S., we provide supplemental defined contribution plans to highly-compensated U.S. employees to address the Internal Revenue Service (IRS) income and benefit limits placed on retirement plans. Similarly, in addition to the standard retirement plans provided in the U.K., we provide an Employer Financed Retirement Benefit Scheme (EFRBS) to highly-compensated legacy U.K. employees to address Her Majesty’s Revenue and Customs income and benefit limits. These supplemental plans are further discussed below under Deferred Compensation.

Messrs. Hattersley and Cox, as well as Ms. Joubert participate in various pension plans where benefits were frozen prior to 2010.

Details regarding the operation of our retirement and pension plans are provided in the narrative following the “Pension Benefits” table beginning on page 65.

For highly-compensated U.S. employees we established a Supplemental Thrift Plan and the MillerCoors Deferred Compensation Plan. These plans were merged in 2018 and renamed the Molson Coors Deferred Compensation Plan (DCP). The DCP is substantially similar in structure and operation to our tax-qualified 401(k) plan and is intended to make employees whole on Company contributions which would otherwise be made to our 401(k) plan were it not for certain IRS limits. Additionally, the DCP allows certain highly-compensated executives of the Company the ability to defer up to 75% of their base pay and up to 100% of MCIP award payments. All U.S.-based NEOs participate in these plans.

Up until April 4, 2009, when the UK defined benefit pension plan was frozen, Mr. Cox’s pension benefits were accruing under the Molson Coors (U.K.) Pension Plan, a registered U.K. pension scheme. Beginning on April 5, 2009 we established an unfunded individual EFRBS (a non-registered UK pension scheme) for Mr. Cox in the U.K. This allows certain tax benefits to be realized during the accumulation of the retirement benefits given Mr. Cox has reached the general limits on tax-deductible pension accumulation in the U.K.

We believe these benefits to be competitive to similarly situated executives and market practices.

Details regarding the operation of our deferred compensation plans are contained in the “Non-Qualified Deferred Compensation” section beginning on page 66.

Through the combination of our change in control program (as amended, CIC Program) and our Severance Pay Plan, we provide protection to executives in situations involving termination “not for cause” following a change in control. All U.S. NEOs participate in the CIC Program and Severance Pay Plan. Mr. Cox has a Directors Service Agreement in the U.K. which entitles him to severance in the event the Company terminates his employment without notice.

As a condition of participating in the CIC Program, eligible employees are required to enter into confidentiality and non-compete agreements in favor of the Company. The non-compete provisions of the CIC Program protect us whether or not a change in control occurs.

Under the CIC Program, a participant is entitled to certain “double-trigger” benefits following a change in control, that is, CIC Program benefits are payable if both (a) a change in control occurs and (b) if the participant is terminated by the Company other than for cause, death or disability or if the participant resigns for good reason, in each case, on or within a certain period of time (for NEOs, two years) after the change in control of the Company. Benefits are also payable if a qualifying termination occurs up to six months prior to the change in control at the request of a third party involved in or contemplating a change in control of the Company. The CIC Program does not include any excise tax gross-ups.

Additional information about our CIC Program, Severance Pay Plan and Mr. Cox’s Directors Service Agreement is provided in the “Potential Payments Upon Termination or Change in Control” section beginning on page 67.

The Compensation & HR Committee generally evaluates and approves annual equity grants at or about the same time as it determines and approves annual salary adjustments and annual incentive payouts. Annual equity grants typically are made in early March at a special meeting of the Compensation and HR Committee, except for the CEO, which occurs on the same date at a special meeting of the Board.

Individual recognition equity awards may be granted at other times during the year, typically on the first trading day of a month, related to special circumstances, such as acquisitions, establishment of joint ventures, promotions, extraordinary performance, retention and other events. Awards of stock options, RSUs or other equity incentives to new executive officers also typically occur at the time the individual joins the organization or first becomes an officer.

Equity awards made to NEOs during 2020 are further described under the header “Long-Term Incentive (LTIP) Results” on page 55. These awards are also reflected in the relevant compensation tables beginning on page 59.

We have stock ownership guidelines for our executives, including the NEOs, because we believe that it is important for the leadership team to have a meaningful stake in the Company to further align management’s interests with those of our stockholders. Under the guidelines, executives must accumulate shares and share equivalents having a market value equal to a prescribed multiple of annual salary. All of our currently serving NEOs satisfy the applicable stock ownership guidelines or are within the applicable phase-in period, which are set forth below.

In 2015, we enhanced our clawback policy which allows for the recovery of incentive compensation from current and former executive officers and certain other employees, if designated by the Compensation & HR Committee, in the event we are required to prepare an accounting restatement due to material noncompliance with required financial reporting requirements under the securities laws, regardless of whether the officer was at fault in the circumstances leading to the restatement. This enhancement applies to incentives related to 2015 performance and beyond and will apply to current and former executive officers and certain other employees designated by the Compensation & HR Committee. The Compensation & HR Committee will further modify this recovery policy based on the requirements to be issued by the NYSE pursuant to the mandate under the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 (Dodd-Frank Act) once the NYSE rules are finalized.

We also negotiate pay back terms for certain items in executive offer letters, such as sign-on bonuses and relocation expenses.

A description of our hedging, pledging and short sale policies can be found in the “Board of Directors and Corporate Governance—Certain Governance Policies—Hedging, Pledging and Short Sale Policies” section of this Proxy Statement.

The Compensation & HR Committee has also taken into consideration the results of the 2020 stockholder advisory vote to approve executive compensation. The result of the vote was that stockholders approved, on an advisory basis, the compensation of our NEOs presented in our 2020 proxy statement (receiving approximately 95.8% of votes cast in favor). The Compensation & HR Committee has followed a similar approach to compensation in 2021. The Compensation & HR Committee will continue to consider the result of say-on-pay votes when making future compensation decisions for the NEOs.

|

Proposal Snapshot

|

|

What am I voting on?

|

|

Stockholders are being asked to approve the amendment and restatement of the Molson Coors Beverage Company Incentive Compensation Plan (the Plan), including the authorization of additional shares for issuance under the Plan and extension of the term of the Plan.

|

|

Voting Recommendation:

|

|

Our Board recommends a vote FOR the amendment and restatement of the Molson Coors Beverage Company Incentive Compensation Plan.

|

We are asking stockholders to approve the amendment and restatement of the Plan to:

Increase the number of shares of the Company’s Class B common stock that may be issued under the Plan by 3,500,000 shares. When stockholders previously approved the Plan at our 2005 and 2012 annual meetings, they authorized the issuance of up to 20,000,000 shares, of which 1,400,749 shares remained available for issuance as of March 17, 2021.

Extend the term of the Plan for ten years, to May 26, 2031.

We also amended the Plan to incorporate certain sound corporate governance practices, including to establish an annual limit for non-employee director compensation (both cash and equity) at $750,000 per year, and make other changes.

The Board of Directors believes that the Company’s ability to attract, retain and motivate selected employees, directors and third-party service providers is vital to the Company’s success. The Board also believes that the interests of the Company and its stockholders will be advanced if the Company can continue to offer such employees, directors and third-party service providers the opportunity to acquire or increase their proprietary interests in the Company by receiving awards under the Plan. However, the Board believes that there is an insufficient number of shares of Class B common stock remaining for future awards under the Plan to effectively and appropriately incentivize the employees, directors and third-party service providers. Accordingly, the Board of Directors on March 2, 2021, upon the recommendation of the Compensation & HR Committee, approved the amendment and restatement of the Plan, subject to stockholder approval, to increase the Plan share pool by 3,500,000 shares and extend the term of the Plan. The amendment and restatement of the Plan will become effective upon receipt of approval by the stockholders at the Annual Meeting. If the amendment and restatement of the Plan is not approved by our stockholders, awards may continue to be made from the remaining shares under the Plan.

Key Features of the Plan

The Plan includes several features that are consistent with the interests of our stockholders and sound corporate governance practices, including the following:

No discounted stock options or stock appreciation rights (SARs): Stock options and SARs may not be granted with an exercise or grant price lower than the fair market value of the underlying shares on the date of grant.

No repricing of stock options or SARs without stockholder approval: The Plan prohibits the direct or indirect repricing of stock options or SARs without prior stockholder approval.

No liberal share counting or “recycling” of shares: Shares withheld by or delivered to the Company to satisfy the exercise or grant price of stock options and SARs or tax withholding obligations upon exercise or vesting of awards will not be available for future grants.

2021

Proxy Statement - MOLSON COORS BEVERAGE CO. 71

Back to Contents

No liberal change-in-control definition: Change-in-control benefits are triggered only by the occurrence, rather than by stockholder approval, of a merger or other change-in control event.

Double-trigger change-in-control vesting: If stock options or RSUs are replaced by a successor company in connection with a change in control, such awards will not automatically vest and pay out solely as a result of the change in control.

Limit on Non-Employee Director awards: The Plan establishes an aggregate limit on the amount of compensation (cash and equity) that may be paid to a non-employee director in any plan year.

No dividends on unearned awards: Dividends or dividend equivalents may not be paid on unvested or unearned awards.

Awards subject to clawback policy: Awards granted under the Plan are subject to the Company’s clawback policy.

No transferability: Awards generally may not be transferred for value prior to their vesting or exercise.

No automatic share replenishment or “evergreen” provision: There is no evergreen provision pursuant to which the shares authorized for issuance under the Plan can be automatically replenished.

Moderate burn rate: Our three-year average burn rate (adjusting for full-share awards) of approximately 1.5% is lower than the industry guidance established by certain major proxy advisory firms.(1)

Summary of the Plan

The complete text of the Plan is attached to this Proxy Statement as Appendix A. The following description of the Plan is a summary of certain provisions of the Plan as proposed to be amended and restated, and is qualified in its entirety by reference to Appendix A.

PURPOSE AND ELIGIBILITY

The purpose of the Plan is to provide a means whereby employees, directors and third-party service providers of the Company develop a sense of proprietorship and personal involvement in the development and financial success of the Company, and to encourage them to devote their best efforts to the business of the Company. A further purpose of the Plan is to provide a means through which the Company may attract able individuals to become employees or serve as directors or third-party service providers of the Company and to provide a means for such individuals to acquire and maintain stock ownership, thereby strengthening their concern for the welfare of the Company. As of March 17, 2021, the numbers of persons eligible to receive awards under the Plan were approximately 742 employees and other service providers and 12 non-employee directors. As of that date, approximately 883 persons held outstanding awards under the Plan.

SHARES AVAILABLE FOR ISSUANCE

Subject to adjustment as provided in the Plan, a maximum of 23,500,000 shares of Class B common stock, plus the number of shares of Class B common stock that remain available for issuance under the Company’s prior Adolph Coors Company Equity Incentive Plan, which has expired, may be issued under the Plan. To satisfy awards under the Plan, the Company may use authorized, but unissued shares of Class B common stock or shares of Class B common stock held in treasury. The closing price of the Class B common stock as reported on the NYSE on March 17, 2021 was $48.66 per share.

Shares covered by an award under the Plan are counted as used to the extent such shares are actually delivered. Shares subject to awards under the Plan or under the Company’s prior plans that lapse are forfeited or canceled or are settled without the issuance of stock will be available for awards under the Plan. Shares actually issued under the Plan in a stock option exercise, shares not issued or delivered as the result of the net settlement of an outstanding SAR or stock option and shares used to pay the exercise price or withholding taxes related to an outstanding award will not be again made available for issuance.

Subject to adjustment as provided in the Plan, the aggregate value of cash compensation and the grant date fair value of shares subject to all awards that may be granted or awarded to any one non-employee director in any one plan year solely with respect to service as a non-employee director, excluding awards made pursuant to deferred compensation arrangements in lieu of all or a portion of cash retainers, may not exceed $750,000.

(1)

We calculated our burn rate by: (i) applying a factor of three to each full value award and a factor of one to options granted during each calendar year and (ii) dividing the resulting number by the weighted average number of shares of our Class B common stock outstanding for each respective year.

2021

Proxy Statement - MOLSON COORS BEVERAGE CO. 72

Back to Contents

The following limits, subject to adjustment as provided in the Plan, will apply to grants of awards to individual participants:

Stock Options: the maximum aggregate number of shares subject to stock options granted in any one plan year to any one participant is 500,000 shares;

SARs: the maximum number of shares subject to SARs granted in any one plan year to any one participant is 500,000 shares;

Restricted Stock or RSUs: the maximum aggregate grant with respect to awards of restricted stock or RSUs in any one plan year to any one participant is 250,000 shares;

PUs or Performance Share Units: the maximum aggregate award of PUs or performance share units that any one participant may receive in any one plan year is 250,000 shares if such award is payable in shares, or equal to the value of 250,000 shares if such award is payable in cash or property other than shares with such amount determined as of the earlier of the vesting date or the payout date;

Cash-Based Awards: the maximum aggregate amount awarded or credited with respect to cash-based awards in any one plan year to any one participant is $10,000,000;

Other Stock-Based Awards: the maximum aggregate grant with respect to other stock-based awards in any one plan year to any one participant is 250,000 shares.

For purposes of the above limits, the term “plan year” is the Company’s fiscal year unless the Compensation & HR Committee or other committee designated by the Board of Directors to administer the Plan (the Plan Committee) designates a calendar year for a particular award.

In the event of any corporate event or transactions (including, but not limited to, a change in the shares of the Company or the capitalization of the Company), such as a merger, consolidation, reorganization, recapitalization, separation, stock dividend, stock split, reverse stock split, split up, spin-off or other distribution of stock or property of the Company, combination of shares, exchange of shares, dividend in kind, or other like change-in-capital structure or distribution (other than normal cash dividends) to stockholders of the Company or any similar corporate event or transaction, the Plan Committee, in its sole discretion, in order to prevent dilution or enlargement of a participant’s rights under the Plan, shall substitute or adjust, as applicable, the number and kind of shares that may be issued under the Plan or under particular forms of awards, the number and kinds of shares subject to outstanding awards, the option price or grant price applicable to outstanding awards, the annual award limits and other valuable determinations applicable to outstanding awards.

ADMINISTRATION

Under the terms of the Plan, the Plan Committee has full and exclusive discretionary power to:

interpret the terms and the intent of the Plan and any award agreement, other agreement or document ancillary to, or in connection with, the Plan;

determine eligibility for awards; and

adopt such rules, regulations, forms, instruments and guidelines for administering the Plan as the Plan Committee may deem necessary or proper.

The Plan Committee’s authority includes selecting award recipients, establishing all award terms and conditions, including the terms and conditions set forth in award agreements, granting awards as an alternative to, or as the form of payment for, grants or rights earned or due under compensation plans, or arrangements of the Company and, subject to terms of the Plan, adopting modifications and amendments to the Plan or any award agreement, including any that are necessary to comply with the laws of the jurisdictions in which the Company and/or its affiliates operate.

The Plan Committee may delegate to one or more of its members, or to one or more officers of the Company or its affiliates, or to one or more agents or advisors such administrative duties or powers as it may deem advisable. The Plan Committee, or any individuals to whom it has delegated duties or powers, may employ one or more individuals to render advice with respect to any responsibility the Plan Committee or such individuals may have under the Plan. The Plan Committee may authorize one or more officers of the Company to designate employees to be recipients of awards and determine the size of any such awards, subject to a limitation established by the Plan Committee, except that the Plan Committee may not delegate such responsibilities for awards granted to an officer or director of the Company or person otherwise determined by the Board to be an “insider” as that term is defined in the Plan.

STOCK OPTIONS

Stock options to purchase shares of the Company’s Class B common stock may be granted to participants in such number, and upon such terms, and at any time, from time to time, as the Plan Committee determines in its sole discretion. Stock options intended to meet the requirements of Section 422 of the Code, which are referred to as incentive stock options, may be granted only to eligible employees of the Company or of any parent or subsidiary corporation (as permitted by Section 422 of the Code).

2021

Proxy Statement - MOLSON COORS BEVERAGE CO. 73

Back to Contents

The exercise price for each stock option is determined by the Plan Committee, provided that the exercise price must be:

based on 100% of the fair market value of the shares on the grant date;

set at a premium to the fair market value of the underlying shares on the grant date; or

indexed to the fair market value of the underlying shares on the grant date; except that the exercise price on the grant date must be at least equal to 100% of the fair market value of the underlying shares on the grant date.

The term of stock options cannot exceed ten years. Stock options are exercisable at such times and subject to such restrictions and conditions as the Plan Committee approves.

STOCK APPRECIATION RIGHTS

Under the Plan, SARs may be granted to participants at any time as determined by the Plan Committee. The Plan Committee may grant freestanding SARs, tandem SARs, or any combination of these forms of SARs. Subject to the terms and conditions of the Plan, the Plan Committee has complete discretion in determining the number of SARs granted to each participant and in determining the terms and conditions pertaining to such SARs. The grant price for each grant of a freestanding SAR is determined by the Plan Committee, provided that the grant price shall be:

based on 100% of the fair market value of the underlying shares on the date of grant;

set at a premium to the fair market value of the underlying shares on the date of grant; or

indexed to the fair market value of the shares on the date of grant, provided that the grant price must be at least equal to 100% of the fair market value of the underlying shares on the date of grant.

The grant price of tandem SARs will be equal to the exercise price of the related option. The term of an SAR is determined by the Plan Committee, in its sole discretion, but the term of an SAR shall not exceed ten years. SARs are exercisable at such times and subject to such restrictions and conditions as the Plan Committee approves.

RESTRICTED STOCK AND RESTRICTED STOCK UNITS

Subject to the terms and provisions of the Plan, the Plan Committee at any time may grant awards as restricted stock and/or RSUs.

The Plan Committee may impose such conditions or restrictions on any shares of restricted stock or RSUs granted pursuant to the Plan as it may deem advisable including, without limitation, a requirement that participants pay a stipulated purchase price for each share of restricted stock or each RSU, restrictions based upon the achievement of specific performance goals, time-based restrictions on vesting following the attainment of the performance goals, time-based restrictions, or restrictions under applicable laws or under the requirements of any stock exchange or market upon which such shares are listed or traded, or holding requirements or sale restrictions placed on the shares by the Company upon vesting of such restricted stock or RSUs.

Unless otherwise determined by the Plan Committee, to the extent permitted or required by law, participants holding shares of restricted stock granted under the Plan may be granted the right to exercise full voting rights with respect to those shares during the restriction period. A participant has no voting rights with respect to any RSUs granted. Participants are not entitled to the crediting of dividend equivalents on RSUs granted unless designated by the Plan Committee.

PERFORMANCE UNITS/PERFORMANCE SHARE UNITS

Subject to the terms and provisions of the Plan, the Plan Committee may grant performance units (PUs) or performance share units (PSUs) to participants in such amounts and upon such terms as the Plan Committee determines. Each PU will have an initial value that is established by the Plan Committee at the time of grant and each PSU will have an initial value equal to the fair market value of the underlying Class B common stock on the grant date. In connection with the grant of PUs or PSUs, the Plan Committee will set performance goals in its discretion which, depending on the extent to which such goals are met, will determine the value or number of PUs or PSUs paid to the participant.

The form and timing of payment of earned PUs and PSUs will be determined by the Plan Committee. The Plan Committee, in its sole discretion, may pay earned PUs and PSUs in the form of cash or in shares (or in a combination thereof) equal to the value of the earned PUs or PSUs, as applicable, at the close of the performance period. Any shares may be granted subject to restrictions deemed appropriate by the Plan Committee.

2021

Proxy Statement - MOLSON COORS BEVERAGE CO. 74

Back to Contents

CASH-BASED AWARDS AND OTHER STOCK-BASED AWARDS

Subject to the terms and provisions of the Plan, the Plan Committee may grant cash-based awards to participants in such amounts and upon such terms as the Plan Committee determines, including the achievement of specific performance goals. The Plan Committee may also grant other types of equity-based or equity-related awards not otherwise described by the terms of the Plan (including the grant or offer for sale of unrestricted shares of Class B common stock) in amounts and subject to such terms and conditions, as the Plan Committee may determine. Such awards may involve the transfer of actual shares to participants or payment in cash or otherwise of amounts based on the value of shares, and may include, without limitation, awards designed to comply with, or take advantage of, the applicable local laws of jurisdictions other than the United States.

Each cash-based award will specify a payment amount or payment range as determined by the Plan Committee. Each stock-based award will be expressed in terms of shares or units based on shares, as determined by the Plan Committee. The Plan Committee may establish performance goals with respect to such awards in its discretion. If the Plan Committee exercises its discretion to establish performance goals, the number or value of cash-based awards or other stock-based awards that will be paid out to the participant will depend on the extent to which the performance goals are met. Payment, if any, with respect to a cash-based award or stock-based award will be made, in cash or shares, in accordance with the terms the Plan Committee determines.

PERFORMANCE MEASURES

Subject to the terms of the Plan, the performance goals established by the Plan Committee for the payment or vesting of an award may include but are not limited to the following performance measures: net earnings or net income (before or after taxes); earnings per share; net sales or revenue growth; net operating profit; return measures (including, but not limited to, return on assets, capital, invested capital, equity, revenue or sales); cash flow (including, but not limited to, operating cash flow, free cash flow and cash flow return on equity); earnings before or after taxes, interest, depreciation and/or amortization; gross or operating margins; productivity ratios; share price (including, but not limited to, growth measures and total stockholder return); expense targets; margins; operating efficiency; market share; Profit After Capital Charge (PACC); customer satisfaction; and balance sheet and statement of cash flow measures (including, but not limited to, working capital amounts and levels of short and long-term debt).

Any performance measure may be used to measure the performance of the Company and/or its affiliates as a whole or any business unit of the Company and/or its affiliates or any combination thereof, for one performance period or averaged over time, as the Plan Committee may deem appropriate, or any of the above performance measures as compared to the performance of a group of comparative companies, or published or special index that the Plan Committee, in its sole discretion, deems appropriate, and may, but need not be, based on a change or an increase or positive result. The Plan Committee also has the authority to provide for accelerated vesting of any award based on the achievement of performance goals pursuant to the performance measures specified by the Plan Committee or such other factors as the Plan Committee determines.

The Plan Committee may provide in any such award that any evaluation of performance may include or exclude any of the following items: litigation or claim judgments or settlements; the effects of changes in tax laws, accounting principles or other laws or provisions affecting reported results; foreign exchange gains and losses; and special items and non-core items (as those terms are defined in the Plan).

CHANGE IN CONTROL

Unless the Plan Committee determines otherwise in the instrument evidencing the award or as otherwise provided in a written employment, service or other agreement between the participant and the Company, upon a change in control (as defined in the Plan), all then outstanding stock options and SARs and all other then-outstanding awards that are service vesting awards for which the participant has received a replacement award (as described in the Plan) shall be treated as follows. Upon a termination of employment or service occurring in connection with or during the period of two years after a change in control, other than for cause, all replacement awards held by the participant will become fully vested and, if applicable, exercisable and free of restrictions. All stock options and SARs held by the participant immediately before the termination of employment or service that the participant held as of the date of the change in control or that constitute replacement awards will remain exercisable for not less than one year following such termination or until the expiration of the stated terms of such stock option or SAR, if shorter, unless otherwise specified in the applicable award agreement.

Unless the Plan Committee determines otherwise in the instrument evidencing the award or as otherwise provided in a written employment, service or other agreement between the participant and the Company, upon a change in control, all then outstanding stock options and SARs and all other then-outstanding awards that are service vesting awards for which the participant has not received a replacement award will vest in full and be free of restrictions. The treatment of any other awards is as determined by the Plan Committee and reflected in the applicable award agreement.

2021

Proxy Statement - MOLSON COORS BEVERAGE CO. 75

Back to Contents

TRANSFERABILITY OF AWARDS

Except as otherwise provided in the Plan or a particular award agreement, a participant’s awards may not be sold, transferred, pledged, assigned or otherwise alienated or hypothecated other than by will or the laws of descent and distribution. During the participant’s lifetime, only the participant may exercise any rights under an award. Stock options and SARs generally may not be transferred unless the transfer is approved by the Plan Committee and is for no consideration.

CLAWBACK

The Company has adopted a clawback policy that applies to awards under the Plan. Under the policy, the Company will use reasonable efforts to recoup from its current and former executive officers and other employees designated by the Compensation & HR Committee any excess incentive based compensation awarded as a result of an accounting restatement due to material noncompliance with financial reporting requirements under the U.S. federal securities laws regardless of whether such officers were at fault in the circumstances leading to the restatement.

The Compensation & HR Committee will also modify this recovery policy based on the requirements to be issued by the NYSE pursuant to the mandate of the Dodd-Frank Act once the requirements of the NYSE rules are finalized.

DURATION OF THE PLAN

Unless sooner terminated in accordance with its terms, the Plan will terminate on May 26, 2031. After the plan is terminated, no awards may be granted under the Plan, but awards previously granted will remain outstanding in accordance with their applicable terms and conditions and the Plan’s terms and conditions.

AMENDMENT, MODIFICATION, SUSPENSION AND TERMINATION

Subject to the terms of the Plan, the Plan Committee may, at any time and from time to time, amend, modify, suspend or terminate the Plan and any award agreement in whole or in part, except that no amendment of the Plan may be made without stockholder approval if stockholder approval is required by law, regulation or stock exchange rule; including, but not limited to, the Exchange Act, the Code and, if applicable, the NYSE Listed Company Manual.

NO REPRICING WITHOUT STOCKHOLDER APPROVAL

Without the prior approval of the Company’s stockholders and except as provided under the Plan, stock options or SARs granted under the Plan will not be repriced by lowering the exercise or grant price of a previously granted option or SAR, cancelling an option or SAR at a time when its exercise price exceeds the fair market value of the underlying shares in exchange for cash, another option, restricted stock or any other equity award, or any other action that is treated as a repricing under U.S. generally accepted accounting principles.

The Plan Committee may make adjustments in the terms and conditions of, and the criteria included in, awards in recognition of unusual or nonrecurring events affecting the Company or the financial statements of the Company or of changes in applicable laws, regulations or accounting principles whenever the Plan Committee determines that such adjustments are appropriate in order to prevent unintended dilution or enlargement of the benefits or potential benefits intended to be made available under the Plan. With respect to a stock option or SAR, any such substitutions or adjustments may not be made if it would cause such stock option or SAR to be treated as deferred compensation subject to taxes and penalties under Section 409A of the Code.

2021

Proxy Statement - MOLSON COORS BEVERAGE CO. 76

Back to Contents

Description of Certain Federal Income Tax Consequences Under the Plan

The following is a summary of certain U.S. federal income tax consequences of awards under the Plan to the Company and to participants in the Plan who are citizens or residents of the U.S. for federal tax purposes. The summary is based on the Code, applicable Treasury Regulations and administrative and judicial interpretations thereof, each as in effect on the date of this Proxy Statement and is, therefore, subject to future changes in the law, possibly with retroactive effect. The summary is general in nature and does not purport to be legal or tax advice. Furthermore, the summary is not intended to be exhaustive and does not address all matters which may be relevant to a particular participant based on his or her specific circumstances. The summary expressly does not discuss the tax laws of any state, municipality or non-U.S. taxing jurisdiction, or any gift, estate, excise or other tax laws. Because individual circumstances may vary, participants are encouraged to consult their own tax advisors concerning the tax implications of awards granted under the Plan.

Stock Options and Stock Appreciation Rights. Stock option grants under the Plan generally are intended to be nonqualified stock options. A participant generally will not recognize taxable income upon the grant or vesting of a nonqualified stock option or stock appreciation right with an exercise or grant price at least equal to the fair market value of our Class B common stock on the date of grant and no additional deferral feature. Upon the exercise of a nonqualified stock option or stock appreciation right, a participant generally will recognize compensation taxable as ordinary income in an amount equal to the difference between the fair market value of the shares underlying the nonqualified stock option or stock appreciation right on the date of exercise and the exercise or grant price. Any gain or loss recognized upon any later disposition of the shares generally will be a long-term or short-term capital gain or loss. Special rules apply if the shares received upon exercise of a nonqualified stock option or stock appreciation right are subject to a substantial risk of forfeiture by the participant or if a participant uses shares of our Class B common stock already held by the participant to pay the exercise price of a nonqualified stock option.

Restricted Stock. A grant of restricted shares of Class B common stock generally will not result in taxable income to the participant in the year of grant. The value of such restricted stock (less the amount, if any, paid by the participant with respect to the shares) will be taxable to a participant as compensation taxable as ordinary income in the year in which the restrictions lapse. If a participant makes an election under Section 83(b) of the Code, the timing of the tax recognition event and the amount of income recognized will differ from that described above.

Restricted Stock Units. A participant generally will not recognize income at the time a RSU is granted. When any part of a RSU is issued or paid, the participant generally will recognize compensation taxable as ordinary income at the time of such issuance or payment in an amount equal to the cash and then fair market value of any shares the participant receives.

Performance Share Units, Performance Units and Other Awards. A participant generally will not recognize income upon the grant of PSUs or PUs. Upon the distribution of cash or shares to the participant pursuant to the terms of the PSUs or PUs, the participant generally will recognize compensation taxable as ordinary income equal to the excess of the amount of cash and the fair market value of any shares transferred to the participant over any amount paid by the participant with respect to the PSUs or PUs. The U.S. federal income tax consequences of other awards under the plan will depend upon the specific terms of each award.

Tax Consequences to the Company. In the foregoing cases, we generally will be entitled to a deduction at the same time, and in the same amount, as a participant recognizes ordinary income, subject to certain limitations imposed under the Code.

Section 409A of the Code. We intend that awards granted under the Plan comply with, or otherwise be exempt from, section 409A of the Code, but make no representation or warranty to that effect.

Tax Withholding. We are authorized to deduct or withhold from any award granted or payment due under the Plan, or require a participant to remit to us, the amount of any withholding taxes due in respect of the award or payment and to take such other action as may be necessary to satisfy all obligations for the payment of applicable withholding taxes. We are not required to issue any shares of our Class B common stock or otherwise settle an award under the Plan until all tax withholding obligations are satisfied.

2021

Proxy Statement - MOLSON COORS BEVERAGE CO. 77

Back to Contents

Plan Benefits

All awards under the Plan are made at the discretion of the Plan Committee. Therefore, the benefits and amounts that will be received or allocated under the Plan are not determinable at this time. Please refer to the description of grants made to the NEOs in the last fiscal year described in the Grants of Plan Based Awards for 2020 table beginning on page 61. Grants made to our non-employee directors in the last fiscal year are described in the Director Compensation section beginning on page 37.

AGGREGATE PAST GRANTS UNDER THE PLAN

The following table sets forth information with respect to options and other awards granted under the Plan since its initial approval in 2005 through March 17, 2021 to the individuals and groups described in the table (including 5,357,833 shares that have been cancelled):

|

Name and Position/Group

|

Number of Shares

Covered by Awards

|

|

Gavin D.K. Hattersley

President and CEO of Molson Coors

|

871,162

|

|

Tracy I. Joubert

CFO of Molson Coors

|

290,189

|

|

Michelle St. Jacques

CMO of Molson Coors

|

91,696

|

|

Simon J. Cox

President and Chief Executive Officer of Molson Coors Europe

|

371,552

|

|

E. Lee Reichert

Chief Legal & Government Affairs Officer and Secretary of Molson Coors

|

164,548

|

|

All executive officers as a group

|

1,893,414

|

|

All non-employee directors as a group

|

1,364,710

|

|

All employees, including all executive officers and non-employee directors, as a group

|

25,335,588

|

Equity Compensation Plan Information

The following table summarizes information about the Incentive Compensation Plan as of December 31, 2020. All outstanding awards shown in the table below relate to our Class B common stock.

|

Plan Category

|

A

Number of

securities to be

issued upon

exercise of

outstanding

options, warrants

and rights

|

B

Weighted-average

exercise price of

outstanding

options, warrants

and rights

|

C

Number of securities

remaining available for

future issuance under

equity compensation

plans (excluding

securities reflected in

Column A)

|

|

Equity compensation plans approved by security holders(1)

|

3,640,266

|

$66.32

|

2,303,746

|

|

Equity compensation plans not approved by security holders

|

—

|

N/A

|

—

|

|

TOTAL

|

3,640,266

|

$66.32

|

2,303,746

|

(1)

Under the Incentive Compensation Plan, we may issue restricted stock units (RSUs), deferred stock units (DSUs), performance share units (PSUs) and stock options. Amount in column A includes 1,098,748 RSUs and DSUs, 702,594 PSUs (assuming the target award is met) and 1,838,924 options outstanding as of December 31, 2020. See Part II—Item 8 Financial Statements and Supplementary Data, Note 13, “Share-Based Payments” of our Annual Report for further discussion. Outstanding RSUs, DSUs and PSUs do not have exercise prices and therefore have been disregarded for purposes of calculating the weighted-average exercise price.

|

2021

Proxy Statement - MOLSON COORS BEVERAGE CO. 78

Back to Contents

Audit Committee Report

Primary Responsibilities

The role of the Audit Committee is to prepare this report and to represent and assist our Board in its oversight of: (1) the integrity of our financial reporting process and our financial statements; (2) our compliance with legal and regulatory requirements, and our ethics and compliance program, including our Code of Business Conduct; (3) our systems of internal control over financial reporting and disclosure controls and procedures; (4) our internal audit function; (5) our corporate responsibility, alcohol policy and sustainability efforts and related performance; (6) our cybersecurity program and related risk management; and (7) the qualifications, engagement, compensation and performance of the independent registered public accounting firm, its conduct of the annual audit and its engagement for any lawful purpose.

The Audit Committee reviews its written charter annually. The Audit Committee also reviews and discusses with our management, internal audit and independent auditors our policies and procedures with respect to risk assessment and risk management. Our management is responsible for the preparation, presentation and integrity of our financial statements and the effectiveness of internal control over financial reporting. Management is also responsible for maintaining our accounting and financial reporting principles and internal controls and procedures reasonably designed to assure compliance with accounting standards and applicable laws and regulations. We have a full-time Internal Audit Department that reports regularly to the Audit Committee. The Internal Audit Department is responsible for objectively reviewing and evaluating the adequacy and effectiveness of our network of risk management, internal controls and governance processes relating, for example, to the reliability and integrity of our financial information and safeguarding our assets. PwC, our independent registered public accounting firm, is responsible for auditing our financial statements and expressing an opinion as to their conformity with accounting principles generally accepted in the U.S.

Audit Committee Report

In the performance of its oversight function, the Audit Committee has reviewed and discussed the audited financial statements in the Annual Report with management and PwC. The Audit Committee has discussed with PwC the matters required to be discussed by the applicable requirements of The Public Company Accounting Oversight Board (PCAOB), and the SEC, and has received the written disclosures and the letter from PwC required by applicable requirements of the PCAOB regarding PwC’s communications with the Audit Committee concerning independence. The Audit Committee has also discussed with PwC its independence. The Audit Committee has ultimate authority and responsibility to select, evaluate, and, when appropriate, replace our independent registered public accounting firm. The non-audit services performed by PwC were pre-approved by the Audit Committee and were also considered in the discussions of independence. Audit Committee members are not employees of our Company and do not perform the functions of auditors or accountants. As such, it is not the duty or responsibility of the Audit Committee or its members to conduct “field work” or other types of auditing or accounting reviews or procedures or to set auditor independence standards. Members of the Audit Committee rely on the information provided to them by management and PwC. Accordingly, the Audit Committee’s considerations and discussions referred to above do not assure that the audit of our financial statements has been carried out in accordance with standards of the PCAOB that the financial statements are presented in accordance with accounting principles generally accepted in the U.S. or that PwC is in fact “independent.”

Based upon the review and discussions described in this report, and subject to the limitations on the roles and responsibilities of the Audit Committee referred to above and in its charter, the Audit Committee recommended to our Board that the audited financial statements be included in the Annual Report for the fiscal year ended December 31, 2020, as filed with the SEC on February 11, 2021. The Audit Committee also appointed PwC as the independent registered public accounting firm for our Company for the fiscal year ending December 31, 2021, subject to ratification by our stockholders.

SUBMITTED BY THE AUDIT COMMITTEE

|

Roger G. Eaton (Chair)

|

Charles M. Herington

|

Nessa O’Sullivan

|

James “Sandy” A.

Winnefeld, Jr.

|

2021

Proxy Statement - MOLSON COORS BEVERAGE CO. 81

Back to Contents

Beneficial Ownership

The following table contains information about the beneficial ownership of our capital stock as of March 17, 2021 (unless otherwise noted), for each of our current directors and nominees, each of our NEOs, all current directors and executive officers as a group and each stockholder known by us to own beneficially more than 5% of any class of our voting common stock and/or the exchangeable shares issued by Exchangeco. Unless otherwise indicated, and subject to any interests of the holder’s spouse, the person or persons named in the table have sole voting and investment power, based on information furnished by such holders. Shares of common stock subject to RSUs, DSUs, stock options or other rights currently exercisable or exercisable and vesting within 60 days following March 17, 2021, are deemed outstanding for computing the share ownership and percentage of the person holding such RSUs, DSUs, stock options or rights, but are not deemed outstanding for computing the percentage of any other person. All share numbers and ownership percentage calculations below assume that all Class A exchangeable shares and Class B exchangeable shares have been converted on a one-for-one basis into corresponding shares of Class A common stock and Class B common stock, respectively.

|

Name of Beneficial Owner

|

Number of

Class A Shares

|

|

Percent of

class (%)(1)

|

|

Number of

Class B Shares(2)

|

|

Percent of

class (%)(1)

|

|

|

5% Stockholders:

|

|

|

|

|

|

|

|

|

|

Adolph Coors Company LLC

|

5,044,534

|

(3)(4)

|

95.5

|

%

|

21,522,798

|

(4)

|

10.2

|

%

|

|

Adolph Coors Jr. Trust

|

5,044,534

|

(3)(4)

|

95.5

|

%

|

5,830,000

|

(4)

|

2.8

|

%

|

|

Pentland Securities (1981) Inc.

|

5,044,534

|

(3)

|

95.5

|

%

|

3,449,600

|

(5)

|

1.6

|

%

|

|

4280661 Canada Inc.

|

5,044,534

|

(3)

|

95.4

|

%

|

—

|

|

—

|

|

|

Dodge & Cox

|

—

|

|

—

|

|

29,588,242

|

(6)

|

14.0

|

%

|

|

The Vanguard Group

|

—

|

|

—

|

|

19,211,272

|

(7)

|

9.1

|

%

|

|

BlackRock, Inc.

|

—

|

|

—

|

|

14,698,818

|

(8)

|

6.9

|

%

|

|

Directors and Director Nominees:

|

|

|

|

|

|

|

|

|

|

Julia M. Brown

|

—

|

|

—

|

|

|

—

|

*

|

|

|

David S. Coors

|

—

|

(9)

|

—

|

|

49,253

|

(11)

|

*

|

|

|

Peter H. Coors

|

2,000

|

(9)

|

*

|

|

618,626

|

(10)

|

*

|

|

|

Roger G. Eaton

|

—

|

|

—

|

|

26,534

|

(12)

|

*

|

|

|

Mary Lynn Ferguson-McHugh

|

—

|

|

—

|

|

6,050

|

|

|

|

|

Gavin D.K. Hattersley

|

—

|

|

—

|

|

264,597

|

(13)

|

*

|

|

|

Charles M. Herington

|

—

|

|

—

|

|

33,677

|

(14)

|

*

|

|

|

Andrew T. Molson

|

100

|

|

*

|

|

3,452,786

|

(15)

|

1.6

|

%

|

|

Geoffrey E. Molson

|

1,632

|

(19)

|

*

|

|

18,510

|

(16)

|

*

|

|

|

Nessa O’Sullivan

|

—

|

|

—

|

|

1,635

|

(17)

|

*

|

|

|

Iain J.G. Napier

|

—

|

|

—

|

|

24,222

|

(18)

|

*

|

|

|

H. Sanford Riley

|

—

|

|

—

|

|

47,061

|

(19)

|

*

|

|

|

Douglas D. Tough

|

—

|

|

—

|

|

15,596

|

(20)

|

*

|

|

|

Louis Vachon

|

—

|

|

—

|

|

17,727

|

(21)

|

*

|

|

|

James “Sandy” A. Winnefeld, Jr.

|

—

|

|

—

|

|

3,500

|

|

*

|

|

|

Management:

|

|

|

|

|

|

|

|

|

|

Tracey I. Joubert

|

—

|

|

—

|

|

101,768

|

(22)

|

*

|

|

|

Simon J. Cox

|

—

|

|

—

|

|

129,609

|

(23)

|

*

|

|

|

E. Lee Reichert

|

—

|

|

—

|

|

45,597

|

(24)

|

*

|

|

|

Michelle St. Jacques

|

—

|

|

—

|

|

14,674

|

(25)

|

*

|

|

|

All directors and executive officers as a group (19 persons)

|

3,732

|

(27)

|

*

|

|

4,900,469

|

(26)

|

2.3

|

%

|

(1)

Except as set forth above and based solely upon reports of beneficial ownership required to be filed with the SEC pursuant to Rule 13d-1 under the Exchange Act, we do not believe that any other person beneficially owned, as of March 17, 2021, greater than 5% of our outstanding Class A common stock or Class B common stock. Ownership percentage calculations are based on 5,279,937 shares of Class A common stock (which assumes the conversion on a one-to-one basis of 2,718,267 Class A exchangeable shares) and 211,634,700 shares of Class B common stock (which assumes the conversion on a one-to-one basis of 11,104,565 shares of Class B exchangeable shares), in each case, outstanding as of March 17, 2021.

(2)

Includes DSUs held by directors and shares underlying outstanding options currently exercisable or exercisable within 60 days following March 17, 2021 (Current Options), where applicable. Does not include unvested RSUs for retirement eligible executives (except for Mr. Peter H. Coors).

|

2021

Proxy Statement - MOLSON COORS BEVERAGE CO. 82

Back to Contents

(3)

Shares of Class A common stock (or shares directly exchangeable for Class A common stock) consists beneficial ownership of 1,857,476 shares owned by Pentland, 667,058 shares owned by 4280661 Canada Inc. (Subco), and 2,520,000 shares owned by Adolph Coors Company LLC (ACC), as Trustee of the Coors Trust, due to shared voting power resulting from a Voting Agreement, dated February 2, 2005, among Pentland, Subco and the Coors Trust. Pursuant to the Voting Agreement, the parties agreed that the shares of Class A common stock (and shares directly exchangeable for Class A common stock) are to be voted in accordance with the voting provisions of certain Voting Trust Agreements among the parties and certain trustees. Pentland is the sole owner of Subco. The address for each of the Coors Trust and ACC is 2120 Carey Avenue, Suite 412, Cheyenne, Wyoming 82001. The address for each of Pentland and Subco is 335 8th Avenue S.W., Suite 2300, Calgary, Alberta, Canada T2P 1C9.

(4)

This information is derived from the Schedule 13D/A filed by ACC and the Coors Trust with the SEC on March 17, 2020. Shares of Class B common stock beneficially owned by ACC includes 300,000 shares directly owned by ACC, 5,830,000 shares directly held by the Coors Trust and 15,392,798 shares beneficially owned by ACC and as Trustee of other Coors Family Trusts (as defined below) and Manager of Coors Family LLCs (defined below), all of which are included in the Class B shares beneficially owned by ACC. ACC is a Wyoming limited liability company which serves as trustee for the Coors Trust, the Bertha Coors Munroe Trust B, the Grover C. Coors Trust, the Herman F. Coors Trust, the Louise Coors Porter Trust and the May Kistler Coors Trust (collectively, the Coors Family Trusts), and as sole Manager of Cotopaxi Capital, LLC and COTEX Descendants LLC, successors in interest to the Class B shares previously held by the Augusta Coors Collbran Trust (the Coors LLCs). The members of ACC are the various Coors Family Trusts. The Board of Directors of ACC consists of 7 members who are various members of the Coors family, including Peter H. Coors and David S. Coors. The Board of Directors of ACC has sole investment power with respect to each Coors Family Trust and each Coors LLC. Each member of ACC’s Board of Directors disclaims beneficial ownership of the shares owned by ACC on behalf of the respective Coors Family Trusts except to the extent of his or her pecuniary interest in each trust. An aggregate of 14,600,000 shares of Class B common stock are pledged as collateral by ACC for the guaranty of the repayment of a loan made by a bank to ACC Financing, LLC and CoorsTek, LLC, each of which is an affiliate of ACC (down from 17,160,860 shares of Class B common stock pledged at March 2019). These pledged shares represent approximately $710.4 million in total value (down from $835.1 million at March 2019), or approximately 6.7% of our total market capitalization (down from 8.6% at March 2019), as of March 17, 2021. ACC has agreed to provide notice to us as soon as practicable upon becoming aware of any active steps to enforce the pledged collateral under the applicable pledge documents for the loans. Based on average daily trading volume in March 2021, it would take approximately six trading days to unwind the total shares pledged by ACC.

|

(5)

Consists of 3,449,600 Class B common stock (or shares exchangeable for Class B common stock) directly owned by Pentland, of which: (i) 437,000 shares of Class B exchangeable shares are pledged as collateral with an unaffiliated third party for a loan in aggregate principal amount of approximately $20 million; and (ii) 478,000 Class B exchangeable shares are pledged as collateral with an unaffiliated third party for a loan in the aggregate principal amount of approximately $25 million. Pentland has agreed to provide notice to us as soon as practicable after Pentland is notified that active steps to enforce any of the pledged collateral under any of these loans. Based on average daily trading volume in March 2021, it would take approximately two trading days to unwind the total shares pledged by Pentland, assuming conversion of the Class B exchangeable shares into Class B common stock.

(6)

This information is derived solely from the Schedule 13G/A filed by Dodge & Cox with the SEC on February 11, 2021, reporting on beneficial ownership as of December 31, 2020. The address for Dodge & Cox is 555 California Street, 40th Floor, San Francisco, CA 94104.

(7)

This information is derived solely from the Schedule 13G/A filed by The Vanguard Group with the SEC on February 10, 2021, reporting on beneficial ownership as of December 31, 2020. The address for The Vanguard Group is 100 Vanguard Boulevard, Malvern, PA 19355.

(8)

This information is derived solely from the Schedule 13G/A filed by BlackRock, Inc. with the SEC on January 29, 2021, reporting on beneficial ownership as of December 31, 2020. The address for BlackRock, Inc. is 55 East 52nd Street, New York, NY 10055.

(9)

Beneficial ownership for each of Peter H. Coors and David S. Coors does not include 2,520,000 shares of Class A common stock held indirectly by ACC as trustee for the Coors Trust, nor any shares of Class B common stock held by ACC for itself or on behalf of the Coors Family Trusts or Coors LLCs. Each of Peter H. Coors and David S. Coors disclaims beneficial ownership of all shares of Class A common stock and Class B common stock held by ACC except to the extent of his pecuniary interest therein. If Peter H. Coors or David S. Coors were to be attributed beneficial ownership of the shares of Class A common stock held by ACC, each would beneficially own approximately 47.7% of the Class A common stock, subject to the Voting Agreement.

(10)

Represents (i) 150,668 shares of Class B common stock held directly by Mr. Coors; (ii) 1,064 shares of Class B common stock held by his wife, Marilyn E. Coors; (iii) 8,740 unvested RSUs; and (iv) 458,154 shares of Class B common stock held indirectly by Mr. Coors, as a manager of various LLCs, and through related entities.

(11)

Represents (i) 3,500 shares of Class B common stock held directly by Mr. Coors, and (ii) 45,503 shares of Class B common stock held indirectly as trustee for various family trusts.

(12)

Includes 15,817 DSUs.

(13)

Includes 187,540 Current Options.

(14)

Includes 22,758 DSUs.

(15)

Represents 186 shares of Class B exchangeable shares held directly by Mr. Molson, 3,000 shares of Class B common stock held indirectly by Molbros AT Inc., and 3,449,600 shares of Class B common stock (or shares exchangeable for Class B common stock) owned by Pentland. Mr. Molson is the President of Pentland and shares dispositive power of the Class B common stock beneficially owned by Pentland. The Class B common stock beneficially owned by Pentland are included in Mr. Molson’s beneficial ownership as a result of arrangements under the Amended and Restated Stockholders Agreement dated February 9, 2005, between Lincolnshire Holdings Limited, Nooya Investments Limited, Pentland, Eric Molson and Stephen Molson with respect to the securities held by and governance of Pentland. Molbros AT Inc. is a holding company controlled by Mr. Molson.

(16)

Mr. Molson’s Class A holdings represents 1,260 shares of Class A common stock held directly and 372 shares of Class A common stock (or shares directly exchangeable tor Class A common stock) indirectly held in a retirement savings plan. His shares of Class B common stock include: 1,198 shares held indirectly in a retirement savings plan, 1,006 shares (or shares directly exchangeable for Class B common stock) held directly and 692 shares (or shares directly exchangeable for Class B common stock) indirectly held in a retirement savings plan.

(17)

Represents 1,635 DSUs.

(18)

Includes 8,453 DSUs.

(19)

Includes 16,560 shares directly exchangeable for Class B common stock and 15,668 DSUs.

(20)

Includes 4,076 DSUs.

(21)

Includes 8,759 DSUs.

(22)

Includes 82,583 Current Options.

(23)

Includes 104,954 Current Options.

(24)

Includes 29,416 Current Options.

(25)

Includes 8,955 Current Options.

(26)

The group’s beneficial ownership of Class B common stock includes 8,740 unvested RSUs for Peter H. Coors, 77,166 DSUs, 432,300 Current Options and 3,468,044 Class B exchangeable shares as described in the footnotes above. See footnotes above concerning the beneficial ownership of the Class A common stock.

|

2021

Proxy Statement - MOLSON COORS BEVERAGE CO. 83

Back to Contents

Questions and Answers

Proxy Materials and Voting Information

The outstanding classes of our voting securities include our Class A common stock, par value $0.01 per share (Class A common stock) and our Class B common stock, par value $0.01 per share (Class B common stock). In addition, we have outstanding one share of our Special Class A voting stock, par value $0.01 per share (Special Class A voting stock) and one share of Special Class B voting stock, par value $0.01 per share (Special Class B voting stock) through which the holders of the Class A exchangeable shares (Class A exchangeable shares) issued by Molson Coors Canada Inc., a Canadian corporation and our wholly-owned indirect subsidiary (Exchangeco), and the holders of the Class B exchangeable shares (Class B exchangeable shares) issued by Exchangeco, respectively, may exercise their voting rights with respect to Molson Coors.

Through the voting rights of the special voting stock and a voting trust arrangement, the holders of the Class A exchangeable shares and the Class B exchangeable shares are effectively, subject to additional steps described below, entitled to vote at the Annual Meeting on an equivalent basis with holders of our Class A common stock and Class B common stock, respectively.

Each holder of record of our Class A common stock, our Class B common stock, the Class A exchangeable shares (through our Special Class A voting stock) and the Class B exchangeable shares (through our Special Class B voting stock) is entitled to one vote for each share held, without the ability to cumulate votes on the election of directors.

For more details regarding our various classes of stock, including the differences between our Class A common stock and Class B common stock and our Special Class A voting stock and Special Class B voting stock, and regarding the exchangeable shares issued by Exchangeco, please refer to “Common Stock and Exchangeable Shares”, on page 90 of this Proxy Statement.

To

attend and participate in the Annual Meeting, you will need the 16-digit control number included in your Notice of Internet Availability

of Proxy Materials, on your proxy card or on the instructions that accompanied your proxy materials. If your shares are held in

“street name,” you should contact your bank, broker or other nominee (Broker) to obtain your 16-digit control number

or otherwise vote through the Broker. Only stockholders with a valid 16-digit control number will be able to attend the Annual

Meeting and vote, ask questions and access the list of stockholders as of the Record Date for the Annual Meeting. The Annual

Meeting webcast will begin promptly at 11:00 a.m. Eastern Time. We encourage you to access the Annual Meeting virtual site prior

to the start time. Online check-in will begin at 10:45 a.m. Eastern Time, and you should allow ample time for the check-in procedures.

The Record Date for the Annual Meeting is April 1, 2021. Owners of record of our Class A common stock, our Class B common stock, the Class A exchangeable shares (through our Special Class A voting stock) and the Class B exchangeable shares (through our Special Class B voting stock) at the close of business on the Record Date are entitled to:

receive notice of the Annual Meeting; and

vote at the Annual Meeting and any adjournments or postponements of the Annual Meeting.

For additional information about how an owner or a beneficial owner of exchangeable shares issued by Exchangeco may vote at the Annual Meeting, please refer to Question 7.

As of the close of business on the Record Date, there were outstanding 2,561,670 shares of Class A common stock, and 200,531,416 shares of Class B common stock, one share of Special Class A voting stock (representing 2,718,267 votes related to the then-outstanding Class A exchangeable shares) and one share of Special Class B voting stock (representing 11,104,565 votes related to the then-outstanding Class B exchangeable shares).

2021

Proxy Statement - MOLSON COORS BEVERAGE CO. 84

Back to Contents

|

Proposal

|

Eligible

to Vote

|

Voting

Choices and Board

Recommendation

|

Voting

Standard

|

|

Proposal

1: Election of Directors Election of eleven Class A Directors

|

Class

A common stock

Class A exchangeable

shares(1)

|

vote

withhold on all nominees

vote

withhold on specific nominees

Our Board recommends a vote FOR each of the nominees.

|

Plurality

of votes cast, voting together as a class; cumulative voting is not permitted

|

|

Proposal

1: Election of Directors Election of three Class B Directors

|

Class

B common stock

Class B exchangeable

shares(1)

|

vote

for specific nominees

vote

withhold on all nominees

vote

withhold on specific nominees

Our Board recommends a vote FOR each of the nominees.

|

Plurality

of votes cast, voting together as a class; cumulative voting is not permitted

|

|

Proposal

2: Advisory Vote to Approve Named Executive Officer Compensation (the Advisory Say-on-Pay

Vote)

|

Class

A common stock

Class B common

stock

Class A exchangeable

shares(1)

Class B exchangeable

shares(1)

|

vote

against the proposal

abstain

from voting on the proposal

Our Board recommends a vote FOR the advisory say-on-pay vote.

|

Majority

of votes cast, voting together as a single class

|

|

Proposal

3: Approval of the Amendment and Restatement of the Molson Coors Beverage Company Incentive

Compensation Plan

|

Class

A common stock

Class A exchangeable

shares(1)

|

vote

against the proposal

abstain

from voting on the proposal

Our Board recommends a vote FOR the approval of the amendment and restatement of the plan.

|

Majority

of votes cast, voting together as a class

|

|

Proposal

4: Ratify Appointment of PwC as our Independent Registered Public Accounting Firm

for the Fiscal Year Ending December 31, 2021

|

Class

A common stock

Class A exchangeable

shares(1)

|

vote

for the ratification

vote

against the ratification

abstain

from voting on the ratification

Our Board recommends a vote FOR the ratification.

|

Majority

of votes cast, voting together as a class

|

(1)

The

voting rights for the exchangeable shares issued by Exchangeco are exercised through the share of our Special Class A voting stock

and the share of our Special Class B voting stock, as applicable.

|

At the Annual Meeting, votes may not be cast for a greater number of director nominees than the 14 nominees named in the Proxy Statement.

Common Stock. If you own Class A common stock or Class B common stock registered directly in your name through Computershare Trust Company, N.A., our transfer agent, you are considered a stockholder of record with respect to those shares; and

Exchangeable Shares. If you own Class A exchangeable shares or Class B exchangeable shares issued by Exchangeco, you are considered a stockholder of record with respect to those shares.

If your shares are held in a brokerage account or by a bank, you are considered a beneficial owner of those shares.

2021

Proxy Statement - MOLSON COORS BEVERAGE CO. 85

Back to Contents

All stockholders of record (including owners of record of exchangeable shares) can vote by written proxy/voting instruction card. If you own exchangeable shares, AST Trust Company (AST), as trustee of our special voting stock, will vote your shares in accordance with your voting instruction card. If you are a beneficial owner of our common stock or the exchangeable shares, you will receive a written proxy/voting instruction card from your Broker relating to those shares.

All stockholders of record (including owners of record of exchangeable shares) may also submit a proxy/voting instruction card by touch-tone telephone from the U.S., Puerto Rico and Canada using the toll-free telephone number on the proxy/voting instruction card, or via the Internet, using the procedures and instructions described on the proxy/voting instruction card. Beneficial owners (including beneficial owners of exchangeable shares) may submit a proxy/voting instruction card by telephone or via the Internet if their Broker makes those methods available, in which case, the Broker will enclose the instructions with the proxy materials. The telephone and Internet proxy/voting instruction procedures are designed to authenticate stockholders’ identities, to allow stockholders to submit a proxy/voting instruction card for their shares and to confirm that their instructions have been properly recorded.