Current Report Filing (8-k)

May 26 2020 - 1:01PM

Edgar (US Regulatory)

0000024545

false

0000024545

2020-05-25

2020-05-26

0000024545

country:CA

2020-05-25

2020-05-26

0000024545

us-gaap:CommonClassAMember

2020-05-25

2020-05-26

0000024545

us-gaap:CommonClassBMember

2020-05-25

2020-05-26

0000024545

tap:SeniorNotesDue2024Member

2020-05-25

2020-05-26

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

Current

Report

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): May 26, 2020

MOLSON COORS BEVERAGE COMPANY

(Exact

name of registrant as specified in its charter)

Commission

File Number: 1-14829

|

Delaware

|

|

84-0178360

|

|

(State or other jurisdiction of incorporation)

|

|

(IRS Employer Identification No.)

|

P.O. Box 4030, NH353, Golden, Colorado 80401

1555

Notre Dame Street East, Montréal, Québec, Canada, H2L 2R5

(Address

of principal executive offices, including zip code)

(303) 927-2337 / (514) 521-1786

(Registrant’s

telephone number, including area code)

Not

applicable

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant

under any of the following provisions:

¨ Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities

registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

|

Trading symbols

|

|

Name of each exchange on which registered

|

|

Class A Common Stock, par value $0.01

|

|

TAP.A

|

|

New York Stock Exchange

|

|

Class B Common Stock, par value $0.01

|

|

TAP

|

|

New York Stock Exchange

|

|

1.25% Senior Notes due 2024

|

|

TAP

|

|

New York Stock Exchange

|

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ¨

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 1.01. Entry into a Material Definitive Agreement.

On May 26, 2020, Molson Coors Brewing Company (UK) Limited (the

“Issuer”), a subsidiary of Molson Coors Beverage Company (the “Company”) that operates and manages the

Company’s business in the United Kingdom, established a commercial paper facility for the purpose of issuing short-term,

unsecured Sterling-denominated notes that are eligible for purchase under the Joint HM Treasury and Bank of England’s COVID

Corporate Financing Facility commercial paper program (the “Program”) in an aggregate principal amount up to £300

million, which may be increased from time to time as provided in the Dealer Agreement (as defined below).

In connection with the Program, the Issuer and the Company entered

into a Dealer Agreement (the “Dealer Agreement”) with Lloyds Bank Corporate Markets PLC, as arranger, and Lloyds Bank

Corporate Markets PLC, as dealer (the “Dealer”), pursuant to which notes may be issued to the Dealer at such prices

and upon such terms as the Issuer and the Dealer may agree. The maturities of the notes will vary but will not be less than seven

days nor greater than 364 days. The Dealer Agreement contains customary representations, warranties, covenants and indemnification

provisions typical for the issuance of commercial paper of this type. In addition, the Company entered into a Deed of Guarantee

(the “Guarantee”) to guarantee the payment of all sums payable from time to time by the Issuer in respect of the notes

to the holders of any notes.

The foregoing descriptions of the Dealer Agreement and the Guarantee

do not purport to be complete and are qualified in their entirety by reference to the full text of the Dealer Agreement and the

Guarantee, which are filed as Exhibits 10.1 and 10.2, respectively, to this Current Report on Form 8-K, and incorporated by reference

herein.

Item 2.03. Creation of a Direct Financial Obligation or an

Obligation Under an Off-Balance Sheet Arrangement of a Registrant.

The information in Item 1.01 above is incorporated by reference

in this Item 2.03.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

Signature

Pursuant to the requirements of the Securities Exchange Act

of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

MOLSON COORS BEVERAGE COMPANY

|

|

|

|

|

|

Date: May 26, 2020

|

By:

|

/s/ E. Lee Reichert

|

|

|

|

E. Lee Reichert

|

|

|

|

Chief Legal & Government Affairs Officer and Secretary

|

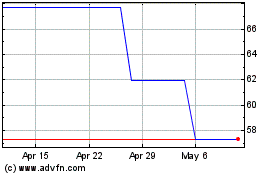

Molson Coors Beverage (NYSE:TAP.A)

Historical Stock Chart

From Mar 2024 to Apr 2024

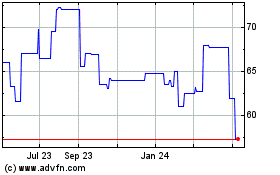

Molson Coors Beverage (NYSE:TAP.A)

Historical Stock Chart

From Apr 2023 to Apr 2024