UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the month of September, 2021.

Commission File Number 001-38755

Suzano S.A.

(Exact name of registrant as specified in its

charter)

SUZANO INC.

(Translation of Registrant’s Name into

English)

Av. Professor Magalhaes

Neto, 1,752

10th Floor, Rooms 1010

and 1011

Salvador, Brazil 41 810-012

(Address of principal

executive office)

Indicate by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F.

Form 20-F x Form

40-F ¨

Indicate by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(1): ¨

Indicate by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(7): ¨

INCORPORATION

BY REFERENCE

This report and exhibits are incorporated by reference

in our registration statements on Form F-3 filed with the U.S. Securities and Exchange Commission on January 24, 2020 (File Nos. 333-236083, 333-236083-01 and 333-236083-02), and shall be deemed to be a part thereof from the date on which this report is furnished to the SEC,

to the extent not superseded by documents or reports subsequently filed or furnished.

Table of Contents

MANAGEMENT’S

DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The following discussion

of the consolidated financial condition and operating results of Suzano S.A. (“Suzano” or the “Company”)

should be read together with Suzano’s unaudited condensed consolidated interim financial information for the six-month period ended

June 30, 2021.

The following discussion

contains forward-looking statements that involve risks and uncertainties. The actual results of Suzano may differ significantly from

those discussed in the forward-looking statements for several reasons, including, without limitation, the risks described in “Forward-Looking

Statements” and “Item 3D. Risk Factors” in Suzano’s 2020 Form 20-F for the year ended December 31, 2020,

filed with the SEC on April 29, 2021 (SEC File No. 001-38755).

New

Accounting Policies and Changes in the Accounting Policies Adopted

Interest Rate Reform – IAS 39 / IFRS 7 and IFRS 9 –

Phase 2 (Applicable on / or after January 1, 2021, early adoption permitted)

We have adopted phase 2 of

the interest rate reform, summarized as follows:

|

|

(i)

|

changes in contractual cash flows: practical expedient that allows, as a consequence of the reform,

the replacement of the effective interest rate of a financial asset or financial liability with a new economically equivalent rate, without

derecognizing the contract;

|

|

|

(ii)

|

hedge accounting requirements: end of exemptions for evaluating the effectiveness of hedge accounting

relationships (Phase 1), and

|

|

|

(iii)

|

disclosure: requirements of disclosure of risks to which we are exposed as a consequence of the

reform, risk management and evolution of the IBORs transition.

|

We have assessed the content of this pronouncement

and do not expect it to have significant impacts on our debts and derivatives linked to LIBOR (as described on note 3.1.1.1 to our unaudited

condensed consolidated interim financial information for the six-month period ended June 30, 2021).

Business combination – IFRS 3

This pronouncement was amended

to update IFRS 3 so that it refers to the 2018 Conceptual Framework instead of the 1989 Structure. It also includes in IFRS 3 a requirement

that, for obligations within the scope of IAS 37, the buyer applies IAS 37 to determine whether there is a present obligation on the acquisition

date due to past events. For a tax within the scope of IFRIC 21 – Levies, the buyer applies IFRIC 21 to determine whether the event

that resulted in the obligation to pay the tax occurred up to the date of acquisition. The amendments add an explicit statement that the

buyer does not recognize contingent assets acquired in a business combination.

The changes are applicable

to business combinations whose acquisition date occurs on or after the beginning of the first reporting period beginning on/or after January

1, 2022. Early adoption is permitted if the entity also adopts all other updated references (published together with the updated Conceptual

Framework) on the same date or earlier.

Lease – IFRS 16 – update of the original issued on

June 16, 2020 (Applicable on/or after April 1, 2021, early adoption permitted)

On March 31, 2021, IFRS 16

was changed because of the benefits granted due to COVID-19 under lease agreements. We assessed the content of this pronouncement and

did not identify any impacts, because the terms of our current lease agreements remained unchanged.

New standards, revisions and interpretations not yet in force

There are no other IFRSs or

IFRIC interpretations that are not yet effective that would be expected to have a material impact on our unaudited consolidated condensed

interim financial information.

Results

of Operations – Six Months ended June 30, 2021 compared to Six Months ended June 30, 2020

The following discussion of

our results of operations is based on (i) our audited consolidated financial statements as of December 31, 2020 and 2019 and for

the three years ended December 31, 2020, which we refer to as “Audited Consolidated Financial Statements,” prepared in

accordance with the International Financial Reporting Standards (IFRS) as issued by IASB, and (ii) our unaudited condensed consolidated

interim financial information for the six-month period ended June 30, 2021 presented in accordance with IAS 34 Interim Financial Reporting,

as issued by IASB. References to increases or decreases in any year or period are made by comparison with the corresponding prior year

or period, except as the context otherwise indicates.

|

|

|

For the six-month period ended June 30,

|

|

|

|

|

2021

|

|

|

2021

|

|

|

2020

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Thousands of US$ (3)

|

|

|

(in thousands of R$), except per share data

|

|

|

Net sales

|

|

|

3,745,073

|

|

|

|

18,733,605

|

|

|

|

14,976,466

|

|

|

Cost of sales

|

|

|

(1,923,691

|

)

|

|

|

(9,622,689

|

)

|

|

|

(9,608,693

|

)

|

|

Gross profit

|

|

|

1,821,382

|

|

|

|

9,110,916

|

|

|

|

5,367,773

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating income (expenses)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Selling

|

|

|

(215,645

|

)

|

|

|

(1,078,700

|

)

|

|

|

(1,062,034

|

)

|

|

General and administrative

|

|

|

(147,047

|

)

|

|

|

(735,558

|

)

|

|

|

(650,551

|

)

|

|

Income (loss) from associates and joint ventures

|

|

|

18,065

|

|

|

|

90,364

|

|

|

|

(2,952

|

)

|

|

Other, net

|

|

|

285,154

|

|

|

|

1,426,396

|

|

|

|

212,402

|

|

|

Operating profit before net financial income (expenses)

|

|

|

1,761,909

|

|

|

|

8,813,418

|

|

|

|

3,864,638

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net financial income (expenses)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Financial expenses

|

|

|

(384,449

|

)

|

|

|

(1,923,092

|

)

|

|

|

(2,119,550

|

)

|

|

Financial income

|

|

|

14,092

|

|

|

|

70,490

|

|

|

|

203,173

|

|

|

Derivative financial instruments

|

|

|

247,666

|

|

|

|

1,238,873

|

|

|

|

(10,835,114

|

)

|

|

Monetary and exchange variations, net

|

|

|

337,690

|

|

|

|

1,689,192

|

|

|

|

(15,349,795

|

)

|

|

Net income (loss) before taxes

|

|

|

1,976,908

|

|

|

|

9,888,881

|

|

|

|

(24,236,648

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income taxes and social contribution

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Current

|

|

|

(31,119

|

)

|

|

|

(155,663

|

)

|

|

|

(57,829

|

)

|

|

Deferred

|

|

|

(490,140

|

)

|

|

|

(2,451,778

|

)

|

|

|

8,822,898

|

|

|

Net income (loss) for the period

|

|

|

1,455,649

|

|

|

|

7,281,440

|

|

|

|

(15,471,579

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Result of the period attributed to the controlling shareholders

|

|

|

1,454,933

|

|

|

|

7,277,867

|

|

|

|

(15,479,631

|

)

|

|

Result of the period attributed to non-controlling shareholders

|

|

|

714

|

|

|

|

3,573

|

|

|

|

8,052

|

|

|

Earnings (loss) per share

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic (1)

|

|

|

1.07835

|

|

|

|

5.39412

|

|

|

|

(11.47301

|

)

|

|

Diluted (2)

|

|

|

1.07816

|

|

|

|

5.39318

|

|

|

|

(11.47301

|

)

|

(1) Basic earnings

per share is calculated using the income attributable to controlling shareholders divided by the weighted average number of outstanding

common shares.

(2) Diluted earnings

per share is calculated based on the results attributable to the controlling shareholders divided by the weighted average number of outstanding

common shares, subtracted from the potential dilutive effect generated by the conversion of all common shares.

Due to the loss recorded

in the period, we do not consider the dilution effect in the calculation

(3) In thousands of US$, except per share data. For

convenience purposes only, amounts in reais in the six months ended June 30, 2021 have been translated to U.S. dollars using

a rate of R$5.0022 to US$1.00, the commercial selling rate for U.S. dollars at June 30, 2021 as reported by the Central Bank of

Brazil. These translations should not be considered representations that any such amounts have been, could have been or could be

converted into U.S. dollars at that or at any other exchange rate.

Net sales revenue

Suzano’s net sales

revenue increased 25.1%, or R$3,757.1 million, from R$14,976.5 million in the six months ended June 30, 2020 to R$18,733.6

million in the corresponding period in 2021, mainly due to (i) a 24% increase in the average pulp price in U.S. dollars and (ii) an

8.8% increase of the U.S. dollar against the Brazilian real, partially offset by (iii) a 6% decrease in sales volume between

the periods.

Suzano’s net sales revenue

from pulp increased 24.7%, or R$3,176.0 million, from R$12,862.9 million in the six months ended June 30, 2020 to R$16,039.0 million in

the corresponding period in 2021 mainly due to (i) depreciation of the average Brazilian real against the U.S. dollar and (ii)

a 24% increase in pulp price from US$464 in the six months ended June 30, 2020 to US$574 in the corresponding period in 2021, partially

offset by a 8% decrease in pulp sales volume between the periods. Suzano’s net sales revenue from pulp represented 85.6% of total

net sales revenue in the six months ended June 30, 2021, compared to 85.9% in the corresponding period in 2020.

Suzano’s net sales revenue

from pulp exports increased 24.0%, or R$2,903.4 million, from R$12,121.4 million in the six months ended June 30, 2020 to R$15,024.8 million

in the corresponding period in 2021, mainly due to (i) the depreciation of the average Brazilian real against the U.S. dollar and

(ii) a 23.8%, or US$112/ton, increase in pulp price from US$470/ton in the six months ended June 30, 2020 to US$582/ton in the corresponding

period in 2021, which offset the 8.6% decrease in international pulp sales volume. Net revenues from pulp exports represented 93.7% of

total net pulp revenues in the six months ended June 30, 2021, compared to 94.2% in the corresponding period in 2020.

As indicated above, Suzano’s

average international net sales price of pulp in the six months ended June 30, 2021 increased 23.8%, or US$112/ton, from US$470/ton in

the six months ended June 30, 2020 to US$582/ton in the corresponding period in 2021, mainly due to global supply and demand for pulp.

In the domestic market, our average net pulp sales price increased 34.2% from R$1,890/ton in the six months ended June 30, 2020 to R$2,536/ton

in the corresponding period in 2021.

Suzano’s net sales revenue

from paper increased 27.5%, or R$581.1 million, from R$2,113.5 million in the six months ended June 30, 2020 to R$2,694.6 million in the

corresponding period in 2021. Net sales revenue from paper represented 14.1% of total net sales in the six months ended June 30, 2020,

compared to 14.4% in the corresponding period in 2021. The increase in net sales revenue from paper in the six months ended June 30, 2021

compared to the corresponding period in 2020 is largely due to an increase in the paper price by 9.3%, or R$391.00, and a 16.6% increase

in paper sales volumes between the periods. Net revenues from paper exports represented 30.0% of total net revenues from paper in the

six months ended June 30, 2021. Our net sales revenue from paper in the domestic market increased 37.4%, or R$513.6 million, from

R$1,372.4 million in the six months ended June 30, 2020 to R$1,886.0 million in the corresponding period in 2021, impacted mainly by a

8.5.% increase in the average net domestic paper sales price and a 26.6% increase in domestic paper sales volumes between the periods.

The average international

net paper sales price in 2021 increased 1.0%, or US$8/ton, from US$836/ton in the six months ended June 30, 2020 to US$844/ton in the

corresponding period in 2021. In the domestic market, the average net paper sales price increased 8.5%, or R$363/ton, from R$4,247/ton

in the six months ended in June 30, 2020 to R$4,610/ton in the corresponding period in 2021.

Cost of sales

Suzano’s total cost

of sales increased 0.1%, or R$14.0 million, from R$9,608.7 million in the six months ended June 30, 2020 to R$9,622.7 million in the corresponding

period in 2021, which were impacted by (i) the depreciation of the average Brazilian real against the U.S. dollar, (ii) an increase

of commodities’ price and (iii) a higher Brent price. Suzano’s decrease in sales volume of 0.4 million ton compared to the

corresponding period in 2020 partially offset the effects mentioned above.

Gross profit

Our gross profit increased

69.7%, or R$3,743.1 million, from R$5,367.8 million in the six months ended June 30, 2020 to R$9,110.9 million in the corresponding period

in 2021. Our gross margin in the six months ended June 30, 2020 was 35.8% compared to 48.6% in the corresponding period in 2021. This

increase is mainly due to the factors mentioned above.

Selling, general and administrative

Our selling expenses increased

1.6%, or R$16.7 million, from R$1,062.0 million in the six months ended June 30, 2020 to R$1,078.7 million in the corresponding period

in 2021. The main variation is due to (i) the increase in personnel expenses of R$12.2 million and (ii) an increase in depreciation and

amortization of R$10.3 million related to the new logistics operations in the port of Santos.

General and administrative

expenses increased 13.1%, or R$85.0 million, from R$650.6 million in the six months ended June 30, 2020 to R$ 735.6 million in the corresponding

period in 2021. The variation is due to additional personnel expenses of R$110.1 million, which were impacted by (i) the increase of the

average U.S. dollar against the Brazilian real and by (ii) increase in variable remuneration provision.

Other, net

Suzano’s other operating

income (expenses) increased 571.6% or R$1,214.0 million, from an income of R$212.4 million in the six months ended June 30, 2020 to an

income of R$1,426.4 million in the corresponding period in 2021. The fluctuation is mainly due to the impact of (i) R$390.8 million on

fair value adjustment of biological assets, (ii) R$472.4 million substantially related with the gain on the sale of rural properties and

forests to Turvinho and Bracell in the six months ended June 30, 2021 (for further information see note 1.2.2. of our unaudited condensed

consolidated interim financial information for the six-month period ended June 30, 2021) and (iii) R$315.4 million related to Tax credits

- gains in tax lawsuit (ICMS from the PIS/COFINS calculation basis) (for further information see note 20.3 of our unaudited condensed

consolidated interim financial information for the six-month period ended June 30, 2021) .

Operating profit before net financial income (expenses)

Suzano’s operating profit

before net financial income increased 128.1%, or R$4,948.8 million, from a profit of R$3,864.6 million in the six months ended June 30,

2020 to a profit of R$8,813.4 million in the corresponding period in 2021, due to an increase in pulp and paper prices and a more favorable

exchange rate, despite a pulp sales volume decrease. Suzano’s operating margin in the six months ended June 30, 2020 was 25.8% compared

to 47.0% in the corresponding period in 2021. This increase is mainly due to the factors mentioned above.

Net financial income (expenses)

Suzano’s net financial

income increased 103.8% or R$29,176.7 million, from a net financial expense of R$28,101.3 million for the six months ended June 30, 2020

to a net financial gain of R$1,075.5 million in the corresponding period on 2021. This variation was mainly due to (i) a decrease in expenses

from derivatives financial instruments of R$12,074.0 million and (ii) a decrease in monetary and exchange variation of R$17,039.0 million

for the six months ended June 30, 2021 compared to the period of 2020.

Net income (loss) before taxes

Suzano’s net income

before taxes increased 140.8% or R$34,125.5 million, from a net loss of R$24,236.6 million in the six months ended June 30, 2020 to a

net gain of R$9,888.9 million in the same period in 2021. This result was largely impacted by the factors mentioned above.

Income taxes

Suzano recorded a decrease

in income tax expenses of 129.7% or R$11,372.5 million, from an income tax expense of R$8,765.1 million in the six months ended June 30,

2020 compared to an income tax credit of R$2,607.4 million during the corresponding period in 2021. This decrease was largely due to (i)

the higher effective rate of income and social contribution tax expenses of 36.2% in the six-month period ended June 30, 2020 compared

to 26.4% in the same period of 2021, due to an increase on profit of wholly-owned subsidiaries and a decrease in thin capitalization due

to an increase in exchange rate variation that affected the equity of subsidiaries abroad and (ii) a decrease of R$34,125.5 million on

loss before taxes.

Net income (loss) for the Period

Suzano’s net income

increased 147.1% or R$22,753.0 million, from a net loss of R$15,471.6 million in the six months ended June 30, 2020 to a net gain of R$7,281.4

million during the corresponding period in 2021. This result was mainly due to a decrease in the financial result due to a smaller variation

in the exchange rate in the period. The net financial result decreased R$29,176.7 million for the six months ended June 30, 2021 compared

to the same period of 2020.

Indebtedness

As of June 30, 2021, Suzano’s

total consolidated outstanding indebtedness (which includes current and non-current loans, financing and debentures) was R$68,477.0 million,

of which R$1,920.1 million represented current indebtedness, of which R$1,909.8 million refers to current indebtedness from loans and

financing and R$10.2 million refers to current indebtedness related to debentures; and R$66,556.9 million represented non-current indebtedness,

of which R$61,140.4 million refers to non-current indebtedness from loans and financing and R$5,416.6 million refers to non-current indebtedness

related to debentures. Below is a description of Suzano’s consolidated financings and loans:

|

|

|

|

|

|

|

|

Current

|

|

|

Non-current

|

|

|

Total

|

|

|

|

|

|

|

|

|

|

June

30,

2021

|

|

|

December

31,

2020

|

|

|

June

30,

2021

|

|

|

December

31,

2020

|

|

|

June

30,

2021

|

|

|

December

31,

2020

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Type

|

|

Interest

rate

|

|

Average annual

interest rate - %

|

|

|

(in

thousands of R$)

|

|

|

In foreign currency

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

BNDES

|

|

UMBNDES

|

|

|

4.74

|

|

|

|

8,727

|

|

|

|

2,506

|

|

|

|

16,946

|

|

|

|

24,486

|

|

|

|

25,673

|

|

|

|

26,992

|

|

|

Bonds

|

|

Fixed

|

|

|

5.44

|

|

|

|

787,364

|

|

|

|

779,046

|

|

|

|

35,845,562

|

|

|

|

37,232,554

|

|

|

|

36,632,926

|

|

|

|

38,011,600

|

|

|

Export credits (ACC – pre-payment)

|

|

Libor/Fixed

|

|

|

1.86

|

|

|

|

120,315

|

|

|

|

718,623

|

|

|

|

18,422,352

|

|

|

|

19,400,208

|

|

|

|

18,542,667

|

|

|

|

20,118,831

|

|

|

Others

|

|

|

|

|

|

|

|

|

855

|

|

|

|

2,516

|

|

|

|

|

|

|

|

|

|

|

|

855

|

|

|

|

2,516

|

|

|

|

|

|

|

|

|

|

|

|

917,261

|

|

|

|

1,502,691

|

|

|

|

54,284,860

|

|

|

|

56,657,248

|

|

|

|

55,202,121

|

|

|

|

58,159,939

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

In local currency

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

BNDES

|

|

TJLP

|

|

|

6.90

|

|

|

|

70,955

|

|

|

|

276,441

|

|

|

|

323,252

|

|

|

|

1,254,222

|

|

|

|

394,207

|

|

|

|

1,530,663

|

|

|

BNDES

|

|

TLP

|

|

|

10.29

|

|

|

|

24,379

|

|

|

|

25,535

|

|

|

|

512,934

|

|

|

|

522,367

|

|

|

|

537,313

|

|

|

|

547,902

|

|

|

BNDES

|

|

Fixed

|

|

|

4.89

|

|

|

|

27,090

|

|

|

|

29,115

|

|

|

|

34,690

|

|

|

|

47,177

|

|

|

|

61,780

|

|

|

|

76,292

|

|

|

BNDES

|

|

SELIC

|

|

|

5.35

|

|

|

|

35,491

|

|

|

|

98,531

|

|

|

|

775,354

|

|

|

|

1,068,959

|

|

|

|

810,845

|

|

|

|

1,167,490

|

|

|

CRA (“Agribusiness Receivables Certificates”)

|

|

CDI/IPCA

|

|

|

9.66

|

|

|

|

806,554

|

|

|

|

32,156

|

|

|

|

2,345,661

|

|

|

|

3,025,527

|

|

|

|

3,152,215

|

|

|

|

3,057,683

|

|

|

Export credit note

|

|

CDI

|

|

|

7.71

|

|

|

|

19,381

|

|

|

|

15,184

|

|

|

|

1,275,687

|

|

|

|

1,275,045

|

|

|

|

1,295,068

|

|

|

|

1,290,229

|

|

|

Rural producer certificate

|

|

CDI

|

|

|

9.18

|

|

|

|

3,637

|

|

|

|

2,738

|

|

|

|

273,715

|

|

|

|

273,578

|

|

|

|

277,352

|

|

|

|

276,316

|

|

|

Export credits (“Pre payment”)

|

|

Fixed

|

|

|

8.06

|

|

|

|

23,400

|

|

|

|

77,570

|

|

|

|

1,314,199

|

|

|

|

1,313,661

|

|

|

|

1,337,599

|

|

|

|

1,391,231

|

|

|

Debentures

|

|

CDI

|

|

|

8.39

|

|

|

|

10,247

|

|

|

|

7,590

|

|

|

|

5,416,574

|

|

|

|

5,415,061

|

|

|

|

5,426,821

|

|

|

|

5,422,651

|

|

|

Others (Working

capital and Industrial Development Fund (“FDI”) and fair value adjustment on business combination)

|

|

Fixed

|

|

|

0.40

|

|

|

|

(18,323

|

)

|

|

|

(24,165

|

)

|

|

|

|

|

|

|

3,651

|

|

|

|

(18,323

|

)

|

|

|

(20,514

|

)

|

|

|

|

|

|

|

|

|

|

|

1,002,811

|

|

|

|

540,695

|

|

|

|

12,272,066

|

|

|

|

14,199,248

|

|

|

|

13,274,877

|

|

|

|

14,739,943

|

|

|

|

|

|

|

|

|

|

|

|

1,920,072

|

|

|

|

2,043,386

|

|

|

|

66,556,926

|

|

|

|

70,856,496

|

|

|

|

68,476,998

|

|

|

|

72,899,882

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest on financing

|

|

|

|

|

|

|

|

|

923,461

|

|

|

|

935,010

|

|

|

|

|

|

|

|

|

|

|

|

923,461

|

|

|

|

935,010

|

|

|

Non-current funding

|

|

|

|

|

|

|

|

|

996,611

|

|

|

|

1,108,376

|

|

|

|

66,556,926

|

|

|

|

70,856,496

|

|

|

|

67,553,537

|

|

|

|

71,964,872

|

|

|

|

|

|

|

|

|

|

|

|

1,920,072

|

|

|

|

2,043,386

|

|

|

|

66,556,926

|

|

|

|

70,856,496

|

|

|

|

68,476,998

|

|

|

|

72,899,882

|

|

For further information, see

Suzano’s unaudited condensed consolidated interim financial information for the six-month period ended June 30, 2021.

RECENT

DEVELOPMENTS

COVID-19

Since the beginning of the

pandemic, Suzano has adopted and maintained preventive and mitigating measures intend to minimize, to the extent possible, the harmful

effects of the pandemic of COVID-19, also known as the coronavirus. These measures have been implemented in compliance with the rules

and policies established by national and international health authorities, and are based on the pillars of safety of people, society and

our businesses.

With respect to the goal of

people and society, Suzano has adopted a series of measures aimed at minimizing the exposure of its team and/or mitigating exposure risks

in order to provide security to its employees and third parties involved in its operations. Such measures include:

•

Support to payroll costs of service providers for 90 days (until the end of June 2020).

•

Donations of personal hygiene products produced by the Company (e.g. toilet paper, napkins and disposable diapers), cups and face

shields to vulnerable areas.

•

Donations of over 159 respirators and approximately 1 million hospital masks to Federal and State Governments.

•

Partnerships to deliver 6,500 respirators.

•

Construction of a field hospital in the city of Teixeira de Freitas, Bahia, together with Veracel, which was handed over to the

state government and opened in July 2020.

•

Establishment of a partnership with Fatec university of Capão Bonito, in the state of

São Paulo, for the production of sanitizing alcohol gel.

•

Lending of forklifts to move donations received by the Red Cross.

•

Support programs to small suppliers and customers, as well as indigenous, quilombola and other communities.

•

Support to the state of Maranhão to set up the Imperatriz temporary hospital.

•

Provision of oxygen to the state of Amazonas.

•

Construction of a new treatment center for COVID-19 in São Paulo in partnership with Gerdau, BTG Pactual, Península

Participações and in joint efforts with Hospital Israelita Albert Einstein and the Municipal Government of São Paulo.

•

Creation of (i) a support program for small suppliers, (ii) a social support program for small farmers to sell their products through

home delivery systems in 38 communities supported by Suzano's Rural and Territorial Development Program (“PDRT”) in five Brazilian

states and (iii) a social program with the objective of providing 125,000 masks in communities for donation in five Brazilian states.

•

Launch of a program to support our portfolio of small and medium-sized paper customers called “Tamo Junto,” which aims

to ensure that those companies have the financial and management capacity to resume their activities.

• Donation

of oxygen concentrators acquired in a joint initiative involving Suzano, Bradesco, BRF, B3, Embraer, Gerdau, Ultra Group,

Itaú Unibanco, Magazine Luiza, Marfrig, Natura&Co and Unipar, which were delivered to the Brazilian Ministry of Health,

who will be responsible for carrying out the logistics for the distribution of concentrators.

•

Donation of 65,696 cubic meters of oxygen to the town of Imperatriz in the state of Maranhão and 1,300 cubic meters to the

town of Aracruz in the state of Espírito Santo.

Regarding the protection of

its business, Suzano has implemented a crisis management committee, while continuing with its regular operations. The World Health Organization

(WHO) and several countries recognized the paper and pulp sector as a producer of essential goods, and therefore Suzano has taken measures

to ensure, to the greatest extent possible, operational normality and full service to its customers. Such measures include increasing

the level of wood and raw material inventories in the factories and advancing its inventories of finished goods product, bringing them

closer to their customers to mitigate possible risks of disruption in the factories' supply chain and the sale of products. Suzano has

also been continuously monitoring the evolution of credit risk and implementing measures to mitigate it, and so far, there has been no

significant financial impact.

Due to quarantine and isolation

measures adopted globally, as well as school and office closures and switch to remote work, the demand for printing and writing papers

was reduced. In light of this, Suzano and several other paper producers around the world temporarily reduced its paper production volume

by means of temporary stoppage at paper production lines. Suzano temporarily suspended the paper production lines of the Mucuri and Rio

Verde units, having resumed and maintained the activities since the beginning of July 2020 and have been maintained.

Finally, Suzano has increased

efforts to maintain interaction with its main stakeholders, aimed at guaranteeing adequate transparency and flow of information in a timely

manner in light of the social and economic conjuncture. The COVID-19 pandemic has had, and will likely continue to have, an impact on

our business, financial condition, results of operations and prospects. Further information on measures and activities in the context

of COVID-19 are available on Suzano’s Investor Relations website. We will continue to closely monitor and evaluate the nature and

extent of the impact of COVID-19 on our operations, liquidity, financial condition, results of operations and prospects. We may also take

further actions that alter our business operations, as may be required by local authorities, or that we determine are in the best interests

of our employees, communities and clients.

Issuance

of Sustainability-Linked Notes due 2032

On July 1, 2021, our subsidiary

Suzano Austria GmbH (“Suzano Austria”), issued US$1 billion in aggregate principal amount of 3.125% sustainability-linked

notes due 2032, fully guaranteed by the Company (“2032 Notes”). The 2032 Notes contain environmental key performance indicators

(“KPIs”) associated with goals of (i) reducing the Company’s industrial water withdrawal intensity and (ii) achieving

30% in the representation of women in leadership positions in the Company. The Company disclosed that it expected to use the proceeds

from the 2032 Notes issuance to repay existing debt, and otherwise for general corporate purposes.

Make-Whole

Redemption of 2024 Notes

On July 26, 2021, our subsidiary

Fibria Overseas Finance Ltd. (“Fibria Overseas”) exercised its right to redeem all of the outstanding aggregate principal

amount of its 5.250% Notes due 2024 (“2024 Notes”) outstanding, in the total aggregate principal amount of US$352.8 million.

Part of the proceeds from the 2032 Notes issuance was used to pay for the redemption of the 2024 Notes. Upon the redemption, the 2024

Notes ceased to be listed on the NYSE, and the related guarantee by the guarantor was cancelled and any obligation thereunder extinguished.

Prepayment

of Export Prepayment Agreement

On July 27, 2021, our subsidiary

Suzano Pulp and Paper Europe S.A. used part of the proceeds from the 2032 Notes issuance to prepay in full the aggregate principal amount

outstanding of US$333.2 million in an export prepayment agreement dated as of December 4, 2018.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: September 8, 2021

|

|

|

SUZANO S.A.

|

|

|

|

|

|

|

By:

|

/s/ Marcelo Feriozzi Bacci

|

|

|

|

Name:

|

Marcelo Feriozzi Bacci

|

|

|

|

Title:

|

Chief Financial Officer and Investor Relations Director

|

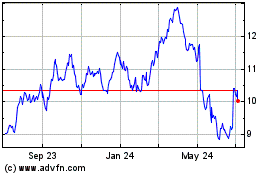

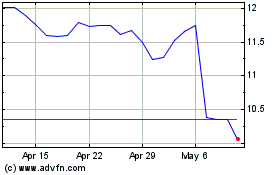

Suzano (NYSE:SUZ)

Historical Stock Chart

From Mar 2024 to Apr 2024

Suzano (NYSE:SUZ)

Historical Stock Chart

From Apr 2023 to Apr 2024