Summit Materials, Inc. Announces Stock Repurchase Program

March 02 2022 - 4:28PM

Business Wire

Board authorizes repurchase of up to $250

million of Summit’s Class A common stock

Complements Summit’s M&A program

Reflects Summit’s Commitment to Sound Capital

Allocation

Summit Materials, Inc. (NYSE: SUM) (“Summit,” “Summit

Materials,” "Summit Inc." or the “Company”), a leading vertically

integrated construction materials company, announces that its Board

of Directors has authorized a share repurchase program of up to

$250 million of Summit’s Class A common stock.

"With our Elevate Summit strategy driving improved execution and

financial performance as evidenced by record 2021 results, we

believe Summit’s common stock currently represents a very

compelling value, and it makes sense to allocate some capital to

share repurchases," said Summit Materials CEO Anne Noonan. "For the

first time in Summit’s history, we have the financial flexibility

to balance the pursuit of acquisition and greenfield opportunities

with other strategic uses of capital. Our improved performance,

including record 2021 reported Net Revenue, Net Income, Adjusted

Cash Gross Profit and Adjusted EBITDA, provides multiple avenues to

drive shareholder value creation. This buyback program complements

our 2022 roadmap which involves optimizing our portfolio, pursuing

self-help initiatives to improve performance, and driving market

leadership to #1 or #2 positions in targeted exurban, higher growth

communities underpinned by strong demand fundamentals."

Brian Harris, CFO of Summit Materials added, "Summit concluded

2021 with its best ever net leverage ratio and a stronger balance

sheet. Our attractive cash position and low leverage now provides

us the financial flexibility to expand our capital allocation

priorities to include acquisitions, greenfields, debt repayment,

and now a share buyback program. We are encouraged by the strength

in all three of Summit’s end-markets, and continued organic growth

opportunities as well."

The timing and actual number of shares repurchased will depend

on a variety of factors, including price, available liquidity,

general business and market conditions and alternative investment

opportunities. Under the stock repurchase program, repurchases can

be made from time to time using a variety of methods, including but

not limited to open market purchases and privately negotiated

transactions, all in compliance with the rules and regulations of

the Securities and Exchange Commission ("SEC") and other applicable

legal requirements.

The repurchase program does not obligate the Company to acquire

any specific dollar amount or number of shares of Class A common

stock, and the repurchase program may be suspended or discontinued

at any time at the Company's discretion.

About Summit Materials

Summit Materials is a leading vertically integrated

materials-based company that supplies aggregates, cement, ready-mix

concrete and asphalt in the United States and British Columbia,

Canada. Summit is a geographically diverse, materials-based

business of scale that offers customers a single-source provider of

construction materials and related downstream products in the

public infrastructure, residential and nonresidential end markets.

Summit has a strong track record of successful acquisitions since

its founding and continues to pursue growth opportunities in new

and existing markets. For more information about Summit Materials,

please visit www.summit-materials.com.

Cautionary Statement Regarding Forward-Looking

Statements

This press release contains "forward-looking statements" within

the meaning of the federal securities laws, which involve risks and

uncertainties. Forward-looking statements include all statements

that do not relate solely to historical or current facts, and you

can identify forward-looking statements because they contain words

such as "believes, " "expects," "may," "will," "should," "seeks,"

"intends," "trends," "plans," "estimates," "projects" or

"anticipates" or similar expressions that concern our strategy,

plans, expectations or intentions. These forward-looking statements

are subject to risks, uncertainties and other factors that may

cause our actual results, performance or achievements to be

different from future results, performance or achievements

expressed or implied by such forward-looking statements. We derive

many of our forward-looking statements from our operating budgets

and forecasts, which are based upon many detailed assumptions.

While we believe that our assumptions are reasonable, it is very

difficult to predict the effect of known factors, and, of course,

it is impossible to anticipate all factors that could affect our

actual results.

In light of the significant uncertainties inherent in the

forward-looking statements included herein, the inclusion of such

information should not be regarded as a representation by us or any

other person that the results or conditions described in such

statements or our objectives and plans will be realized. Important

factors could affect our results and could cause results to differ

materially from those expressed in our forward-looking statements,

including but not limited to the factors discussed in the section

entitled "Risk Factors" in our Annual Report on Form 10-K for the

fiscal year ended January 1, 2022. Such factors may be updated from

time to time in our periodic filings with the Securities and

Exchange Commission ("SEC"), which are accessible on the SEC's

website at www.sec.gov. We undertake no obligation to publicly

update or revise any forward-looking statement as a result of new

information, future events or otherwise, except as required by

law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20220302005972/en/

Karli Anderson EVP, Chief Environmental, Social & Governance

Officer and Head of Investor Relations

karli.anderson@summit-materials.com 303-875-3886

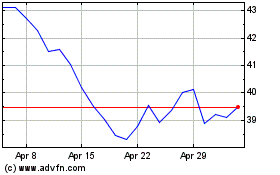

Summit Materials (NYSE:SUM)

Historical Stock Chart

From Mar 2024 to Apr 2024

Summit Materials (NYSE:SUM)

Historical Stock Chart

From Apr 2023 to Apr 2024