0000016918false00000169182021-04-072021-04-070000016918us-gaap:CommonClassAMember2021-04-072021-04-070000016918us-gaap:CommonClassBMember2021-04-072021-04-07

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported) April 7, 2021

CONSTELLATION BRANDS, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Delaware | 001-08495 | 16-0716709 |

(State or other jurisdiction

of incorporation) | (Commission

File Number) | (IRS Employer

Identification No.) |

207 High Point Drive, Building 100, Victor, NY 14564

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code (585) 678-7100

| | |

| Not Applicable |

| (Former name or former address, if changed since last report.) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of Each Class | Trading Symbol(s) | Name of Each Exchange on Which Registered |

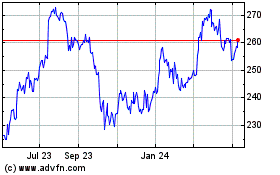

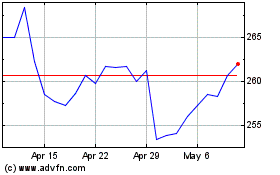

| Class A Common Stock | STZ | New York Stock Exchange |

| Class B Common Stock | STZ.B | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

| | | | | | | | |

| Emerging growth company | | ☐ |

| | |

| If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. | ☐ |

| | | | | |

| Item 2.02 | Results of Operations and Financial Condition. |

On April 8, 2021, Constellation Brands, Inc. (“Constellation” or the “Company”), a Delaware corporation, issued a news release (the “release”) announcing its financial condition and results of operations as of and for the fiscal year and fourth quarter ended February 28, 2021. A copy of the release is attached hereto as Exhibit 99.1 and incorporated herein by reference. The projections constituting the guidance included in the release involve risks and uncertainties, the outcome of which cannot be foreseen at this time; therefore, actual results may vary materially from these forecasts. In this regard, see the information included in the release under the caption “Forward-Looking Statements.”

The information in the release is “furnished” and not “filed” for purposes of Section 18 of the Securities Exchange Act of 1934 and is not otherwise subject to the liabilities of that section. Such information may be incorporated by reference in another filing under the Securities Exchange Act of 1934 or the Securities Act of 1933 only if and to the extent such subsequent filing specifically references the information incorporated by reference herein.

The release contains non-GAAP financial measures; in the release these are referred to as “comparable” or “organic” measures. For purposes of Regulation G, a non-GAAP financial measure is a numerical measure of a registrant’s historical or future financial performance, financial position or cash flows that excludes amounts, or is subject to adjustments that have the effect of excluding amounts, that are included in the most directly comparable measure calculated and presented in accordance with GAAP in the statement of income, balance sheet, or statement of cash flows (or equivalent statements) of the issuer; or includes amounts, or is subject to adjustments that have the effect of including amounts, that are excluded from the most directly comparable measure so calculated and presented. In this regard, GAAP refers to generally accepted accounting principles in the United States. Pursuant to the requirements of Regulation G, the Company has provided reconciliations within the release of the non-GAAP financial measures to the most directly comparable GAAP financial measures.

Comparable measures, including those presenting the impact of the Company’s equity method investment in Canopy Growth Corporation (“Canopy”), and organic net sales measures are provided because management uses this information in monitoring and evaluating the results and underlying business trends of the core operations of the Company, our investment in Canopy, and/or in internal goal setting. In addition, the Company believes this information provides investors valuable insight on underlying business trends and results in order to evaluate year-over-year financial performance.

| | | | | |

| Item 7.01 | Regulation FD Disclosure. |

On April 8, 2021, Constellation issued a news release, a copy of which release is furnished herewith as Exhibit 99.1 and is incorporated herein by reference.

References to Constellation’s website and/or other social media sites or platforms in the release do not incorporate by reference the information on such websites, social media sites or platforms into this Current Report on Form 8-K, and Constellation disclaims any such incorporation by reference. The information in the news release attached as Exhibit 99.1 is incorporated by reference into this Item 7.01 in satisfaction of the public disclosure requirements of Regulation FD. This information is “furnished” and not “filed” for purposes of Section 18 of the Securities Exchange Act of 1934 and is not otherwise subject to the liabilities of that section. Such information may be incorporated by reference in another filing under the Securities Exchange Act of 1934 or the Securities Act of 1933 only if and to the extent such subsequent filing specifically references the information incorporated by reference herein.

On April 7, 2021, the Company’s Board of Directors declared a quarterly cash dividend in the amount of $0.76 per issued and outstanding share of the Company’s Class A Common Stock, $0.69 per issued and outstanding share of the Company’s Class B Common Stock, and $0.69 per issued and outstanding share of the Company’s Class 1 Common Stock, in each case payable on May 18, 2021, to stockholders of record of each respective class as of the close of business on May 4, 2021.

| | | | | |

| Item 9.01 | Financial Statements and Exhibits. |

For the exhibit that is furnished herewith, see the Index to Exhibits immediately following.

INDEX TO EXHIBITS

| | | | | |

| Exhibit No. | Description |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| (99) | ADDITIONAL EXHIBITS |

| |

| (99.1) | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| (104) | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

| |

| |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| Date: | April 8, 2021 | CONSTELLATION BRANDS, INC. |

| | |

| | By: | /s/ Garth Hankinson |

| | | Garth Hankinson |

| | | Executive Vice President and

Chief Financial Officer |

Achieves Strong EPS Growth and Record Cash Flow Results Despite Pandemic Challenges in FY21

Beer Business Delivers FY21 Double-Digit Operating Income Growth on +8% Net Sales; Organic Net Sales +10%

Wine and Spirits Business Well Positioned for Continued Execution of Growth and Premiumization Transformation

| | | | | | | | | | | | | | | | | |

| Net

Sales | Operating

Income | Earnings Before Interest & Taxes

(EBIT) | Diluted Net Income (Loss) Per Share Attributable to CBI

(EPS) | Diluted EPS

Excluding Canopy |

Fiscal Year 2021 Financial Highlights (1) | In millions, except per share data | |

| Reported | $8,615 | $2,791 | NA | $10.23 | NA |

| % Change | 3% | 30% | NA | NM | NA |

| Comparable | $8,615 | $2,888 | $2,773 | $9.97 | $10.44 |

| % Change | 3% | 6% | 9% | 9% | 6% |

Fourth Quarter Fiscal Year 2021 Financial Highlights (1) | |

| Reported | $1,953 | $559 | NA | $1.95 | NA |

| % Change | 3% | 3% | NA | (4%) | NA |

| Comparable | $1,953 | $564 | $531 | $1.82 | $1.93 |

| % Change | 3% | (6%) | (5%) | (12%) | (11%) |

(1) Definitions of reported, comparable, and organic, as well as reconciliations of non-GAAP financial measures, are contained elsewhere in this news release.

NA=Not Applicable NM=Not Meaningful

HIGHLIGHTS

•Despite COVID-related headwinds, achieves fiscal 2021 reported basis EPS of $10.23 and comparable basis EPS of $9.97, including Canopy Growth equity losses of $0.48; excluding Canopy Growth equity losses, achieved comparable basis EPS of $10.44

•Beer business delivers strong shipment and depletion volume growth and margin expansion for fiscal 2021

•Wine and Spirits premiumization strategy continues to gain momentum as marketplace performance for high-end brands outpaced the overall U.S Wine and Spirits category for fiscal 2021

•Closes transactions to sell a portion of the Wine and Spirits business to Gallo, including Nobilo, and all other deals

•Generates record operating and free cash flow of $2.8 billion and $1.9 billion, respectively

•Reduces debt by $1.7 billion during fiscal 2021

•Provides fiscal 2022 reported basis EPS outlook of $6.90 - $7.20 and comparable basis EPS outlook of $9.95 - $10.25

•Provides fiscal 2022 operating cash flow target of $2.4 - $2.6 billion and free cash flow projection of $1.4 - $1.5 billion

•Declares quarterly cash dividend of $0.76 per share Class A and $0.69 per share Class B common stock

| | | | | | | | | | | | | | | | | | | | |

| “Fiscal 2021 was a dynamic and rewarding year as we produced excellent results while managing the challenges of the pandemic. I’d like to thank the Constellation team for driving success in the face of continued adversity. As we head into fiscal 2022, we’re operating from a position of strength. We’re well positioned for continued execution of our growth and premiumization strategy with a great portfolio of iconic brands and an exciting innovation agenda.” | | | “Constellation’s performance remained strong and resilient throughout the pandemic, driving record cash flow results for the year. In fiscal 2022, we expect to continue to have significant capital allocation flexibility, which will enable ongoing progress in returning cash to shareholders while making strategic investments to support long-term growth opportunities.” |

|

| Bill Newlands | | | | Garth Hankinson | |

| President and Chief Executive Officer | | | Chief Financial Officer |

| | | | | |

| Constellation Brands, Inc. FY2021 Earnings Release | #WORTHREACHINGFOR I 1 |

| | | | | | | | | | | | | | | | | | | | | | | |

| beer | | | | | | |

| Shipment

Volume | Organic Shipment Volume (1) | Depletion Volume (1) | Net Sales (2) | Organic Net Sales (1) | Operating Income (2) |

| Year Ended | In millions; branded product, 24-pack, 12-ounce case equivalents |

| February 28, 2021 | 334.6 | 334.6 | | $6,074.6 | $6,074.6 | $2,494.3 |

| February 29, 2020 | 311.9 | 309.4 | | $5,615.9 | $5,523.9 | $2,247.9 |

| % Change | 7.3% | 8.1% | 7.1% | 8% | 10% | 11% |

| Three Months Ended |

| February 28, 2021 | 75.7 | 75.7 | | $1,376.7 | $1,376.7 | $506.3 |

| February 29, 2020 | 65.3 | 64.8 | | $1,187.5 | $1,169.0 | $467.1 |

| % Change | 15.9% | 16.8% | 6.4% | 16% | 18% | 8% |

(2) Year ended and three months ended February 29, 2020, includes (i) $92.0 million and $18.5 million of net sales, respectively, and (ii) $11.2 million and $(0.6) million of gross profit less marketing, respectively, that are no longer part of the beer segment results.

FISCAL YEAR 2021 HIGHLIGHTS

•Constellation’s Beer Business posted depletion growth of more than 7% as strong performance in off-premise channels more than offset the COVID-19 impact of the 51% reduction in on-premise channels.

•Fiscal 2021 marked the 11th consecutive year of volume growth, reinforcing Constellation’s position as a leader in the high-end of the U.S. beer industry due to continued strength of the Modelo and Corona Brand Families.

•Modelo Especial became the #3 selling beer in the U.S. Beer market and continued to be one of the fastest growing, major imported beer brands with depletion growth of 12%.

•Corona Brand Family growth was fueled by the successful launch of Corona Hard Seltzer and nearly 20% depletion growth of Corona Premier.

•Operating margin increased 110 basis points to 41.1%, as benefits from favorable marketing and SG&A as a percent of net sales, pricing, the Ballast Point Divestiture, and foreign currency were partially offset by increased COGS and unfavorable mix.

FOURTH QUARTER 2021 HIGHLIGHTS

•Constellation’s Beer Business posted depletion growth of 6.4% as strong performance in off-premise channels continued to more than offset the COVID-19 impact of the 43% reduction in on-premise channels. When adjusted for one less selling day in the quarter, the beer business generated 7.5% depletion growth.

•Shipment volume significantly outpaced depletion volume as distributor inventories returned to normal levels at year-end.

•Modelo Especial continued to be the #1 import share gainer in IRI channels and delivered 9% depletion growth.

•As expected, operating margin decreased 250 basis points to 36.8%, as higher marketing spend and increased COGS were partially offset by benefits from favorable SG&A as a percent of net sales, the Ballast Point Divestiture, and foreign currency.

•Marketing as a percent of net sales was 12.5% versus 8.7% for fourth quarter fiscal 2020.

•Corona Hard Seltzer Variety Pack #2 is now in market along with Refresca, which relaunched in March of fiscal 2022; Corona Hard Seltzer Limonada planned launch expected in June of fiscal 2022.

| | | | | | | | | | | | | | | | | | | | | | | |

| wine and spirits |

| Shipment

Volume | Organic Shipment Volume (1) | Depletion Volume (1) | Net Sales (3) | Organic Net Sales (1) | Operating Income (3) |

| Year Ended | In millions; branded product, 9-liter case equivalents |

| February 28, 2021 | 45.0 | 45.0 | | $2,540.3 | $2,540.3 | $622.4 |

| February 29, 2020 | 53.6 | 47.3 | | $2,727.6 | $2,496.7 | $708.4 |

| % Change | (16.0%) | (4.9%) | (2.8%) | (7%) | 2% | (12%) |

| Three Months Ended |

| February 28, 2021 | 9.4 | 9.4 | | $576.3 | $576.3 | $114.6 |

| February 29, 2020 | 14.0 | 9.1 | | $715.4 | $535.9 | $206.8 |

| % Change | (32.9%) | 3.3% | (6.8%) | (19%) | 8% | (45%) |

(3) Year ended and three months ended February 29, 2020, includes (i) $230.9 million and $179.5 million of net sales, respectively, and (ii) $86.9 million and $63.0 million of gross profit less marketing, respectively, that are no longer part of the wine and spirits segment results.

FISCAL YEAR 2021 HIGHLIGHTS

•Efforts to increase points of distribution for key brands resulted in double-digit distribution gains in off-premise channels for Kim Crawford, Meiomi, The Prisoner Brand Family, and High West.

•Retained portfolio net sales grew 5% driven by double-digit volume growth for Meiomi, Kim Crawford, and The Prisoner Brand Family, as well as pricing benefits from Woodbridge and SVEDKA.

•Impactful innovation launches drove solid growth contributions which include Meiomi cabernet sauvignon, Kim Crawford Illuminate, and The Prisoner Unshackled, which was the #1 high-end new brand in IRI channels for fiscal 2021.

•Operating margin decreased 150 basis points to 24.5%, as benefits from price and mix were more than offset by the negative impact of wildfires on COGS, wine and spirits divestitures, and increased marketing and SG&A spend.

FOURTH QUARTER 2021 HIGHLIGHTS

•Marketplace performance for high-end wine brands outpaced the total high-end wine category driven by continued double-digit volume growth for Kim Crawford, Meiomi, and The Prisoner Brand Family.

•Continued focus in the direct-to-consumer and eCommerce segment is paying dividends as our wine brands continue to outpace the market with Constellation’s Wine Business growing almost 300% in the 3-tier eCommerce channel.

•Operating margin decreased 900 basis points to 19.9%, primarily reflecting the negative impact of wildfires on COGS, increased marketing and SG&A spend, and wine and spirits divestitures; partially offset by benefits from favorable mix.

| | | | | |

| Constellation Brands, Inc. FY2021 Earnings Release | #WORTHREACHINGFOR I 2 |

| | | | | | | | | | | | | | | | | | | | | | | |

outlook The table sets forth management's current EPS expectations for fiscal 2022 compared to fiscal 2021 actual results, on a reported basis, a comparable basis, and a comparable basis excluding Canopy equity earnings (losses) and related activities. |

| Reported Basis | | Comparable Basis |

| FY22 Estimate | FY21 Actual | | FY22 Estimate (Excl. Canopy) | FY21 Actual | FY21 Actual

(Excl. Canopy) |

| Fiscal Year Ending February 28 | $6.90 - $7.20 | $10.23 | | $9.95 - $10.25 | $9.97 | $10.44 |

| Fiscal 2022 Guidance Assumptions: |

● Beer: net sales growth 7 - 9%; operating income growth 3 - 5% ● Wine and Spirits: net sales decline 22 - 24% and operating income decline 23 - 25%; organic net sales growth 2 - 4% ● Interest expense: $350 - $360 million ● Tax rate: reported approximately 22%; comparable excluding Canopy equity earnings and the Mexicali impairment impact approximately 19% ● Weighted average diluted shares outstanding: approximately 196 million; assumes no share repurchases for fiscal 2022 | ● Operating cash flow: $2.4 - $2.6 billion ● Capital expenditures: $1.0 - $1.1 billion, including approximately $900.0 million targeted for Mexico beer operations expansion activities ● Free cash flow: $1.4 - $1.5 billion |

| Our guidance does not reflect future changes in the fair value of the company’s investment in Canopy’s warrants and convertible debt securities. Additionally, the company continues to evaluate the future potential equity earnings impact from the Canopy equity method investment and related activities and, as such, these items have been excluded from the guidance assumptions noted above. |

| | | | | | | | | | | | | | |

BEER BUSINESS CAPITAL EXPANSION INITIATIVES |

The company has developed plans to invest in the next increment of capacity in Mexico that will provide the long-term flexibility needed to support the expected future growth of the core, high-end Mexican beer portfolio, including the expected growth for the emerging ABA, or Alternative Beverage Alcohol sub-space, which includes hard seltzers. Annual capex spend for the Beer Business is expected to be in the $700 million to $900 million range to support 15 million hectoliters of capacity expansion during the Fiscal 2023 – Fiscal 2025 timeframe. Given the current state of activities in Mexicali, Constellation will be unable to use or repurpose this site for future use. As a result, an impairment of approximately $650 million to $680 million is expected to be recorded in the first quarter of fiscal 2022, which is included above in the Fiscal 2022 Reported Basis EPS guidance. The company will continue to work with government officials in Mexico to pursue various forms of recovery for capitalized costs and additional expenses incurred in establishing the brewery. |

|

WINE & SPIRITS DIVESTITURES

| | | | | | | | | | | | | | | |

| In January 2021, the company sold a portion of the wine and spirits business to E. & J. Gallo Winery (“Gallo”) and in a separate, but related, transaction sold the Nobilo Wine brand to Gallo, collectively (the “Wine and Spirits Divestitures”). Additionally, in January 2021, the company sold the Paul Masson Grande Amber Brandy brand to Sazerac (the “Paul Masson Divestiture”), while in December 2020, the company sold the concentrate business to Vie-Del (the “Concentrate Business Divestiture”). |

| The following table presents selected financial information included in our historical consolidated financial statements that are no longer part of our consolidated results following the transactions described above: |

| | FY21 Q1 | FY21 Q2 | FY21 Q3 | FY21 Q4 |

| (in millions) | | | | | |

| Shipment volume (9-liter case equivalents) | | 4.5 | 4.6 | 5.3 | 1.6 |

| Net sales | | $187 | $181 | $210 | $64 |

| CAM (gross profit less marketing) | | $77 | $67 | $74 | $21 |

| | | | | |

| In November 2019, the company sold the Black Velvet Canadian Whisky business. The approximate fiscal 2020 shipment volume, net sales, and gross profit less marketing totaled 1.6 million 9-liter case equivalents, $50.3 million, and $23.2 million, respectively. |

| | | | | | | | | | | |

| canopy Constellation’s share of Canopy’s equity earnings (losses) and related activities were as follows: |

| Reported

Basis | Comparable

Basis |

| Fiscal Year Ended I In millions | |

February 28, 2021 | $(679.0) | $(146.2) |

February 29, 2020 | $(575.9) | $(221.7) |

| Three Months Ended | | |

February 28, 2021 | $(258.0) | $(37.4) |

February 29, 2020 | $(31.7) | $(41.5) |

Constellation has recognized a $1.1 billion unrealized net gain in reported basis results since the initial Canopy investment in November 2017; a $802 million and $277 million increase in the fair value of Canopy investments was recognized for fiscal 2021 and fourth quarter fiscal 2021, respectively.

| | | | | |

| Constellation Brands, Inc. FY2021 Earnings Release | #WORTHREACHINGFOR I 3 |

QUARTERLY DIVIDEND

On April 7, 2021, Constellation’s board of directors declared a quarterly cash dividend of $0.76 per share of Class A Common Stock and $0.69 per share of Class B Common Stock, payable on May 18, 2021, to stockholders of record as of the close of business on May 4, 2021.

† A copy of this news release, including the attachments and other financial information that may be discussed during the call, will be available on our website cbrands.com under “Investors/Reporting” prior to the call.

| | | | | | | | | | | |

SUPPORTING OUR COLLEAGUES, INDUSTRY, AND COMMUNITIES |

| | | | | | | | |

INVESTING IN BLACK AND MINORITY-OWNED BUSINESSES As part of Constellation’s commitment to invest $100 million in African American/Black and minority-owned businesses by 2030, the company has pledged to invest $10 million in the Clear Vision Impact Fund, LP. Founded by Siebert Williams Shank & Co., LLC, the fund invests in minority-owned businesses, with an emphasis on Black-owned businesses, and works to support enhanced employment, job training, and the accessibility of educational opportunities in historically underserved communities. Click here to learn more. | | SUPPORTING THE REBUILD OF THE RESTAURANT INDUSTRY Many of Constellation’s retailer partners, particularly local restaurants and their employees, have been significantly impacted by the COVID-19 pandemic. The company is proud to share that, in partnership with a number of its iconic beer, wine, and spirits brands, it has made a collective commitment of $1.75 million to sponsor the launch of the National Restaurant Association Educational Foundation’s “Restaurants Advance” campaign and establish a multi-year collaboration to support the rebuilding of the restaurant industry. For more information, read Constellation’s full press release here. |

| | |

ABOUT CONSTELLATION BRANDS At Constellation Brands (NYSE: STZ and STZ.B), our mission is to build brands that people love because we believe sharing a toast, unwinding after a day, celebrating milestones, and helping people connect, are Worth Reaching For. It’s worth our dedication, hard work, and the bold calculated risks we take to deliver more for our consumers, trade partners, shareholders, and communities in which we live and work. It’s what has made us one of the fastest-growing large CPG companies in the U.S. at retail, and it drives our pursuit to deliver what’s next.

Today, we are a leading international producer and marketer of beer, wine, and spirits with operations in the U.S., Mexico, New Zealand, and Italy. Every day, people reach for our high-end, iconic imported beer brands such as Corona Extra, Corona Light, Corona Premier, Modelo Especial, Modelo Negra, and Pacifico, and our high-quality premium wine and spirits brands, including the Robert Mondavi Brand Family, Kim Crawford, Meiomi, The Prisoner Brand Family, SVEDKA Vodka, Casa Noble Tequila, and High West Whiskey.

But we won’t stop here. Our visionary leadership team and passionate employees from barrel room to boardroom are reaching for the next level, to explore the boundaries of the beverage alcohol industry and beyond. Join us in discovering what’s Worth Reaching For.

To learn more, follow us on Twitter @cbrands and visit www.cbrands.com. |

| | | | | | | | | | | | | | | | | |

| MEDIA CONTACTS | INVESTOR RELATIONS CONTACTS |

| Mike McGrew | 773-251-4934 | michael.mcgrew@cbrands.com | Patty Yahn-Urlaub | 585-678-7483 | patty.yahn-urlaub@cbrands.com |

| Amy Martin | 585-678-7141 | amy.martin@cbrands.com | Marisa Pepelea | 312-741-2316 | marisa.pepelea@cbrands.com |

| | | | | |

| | | | | |

| Constellation Brands, Inc. FY2021 Earnings Release | #WORTHREACHINGFOR I 4 |

SUPPLEMENTAL INFORMATION

Reported basis (“reported”) are amounts as reported under generally accepted accounting principles. Comparable basis (“comparable”) are amounts which exclude items that affect comparability (“comparable adjustments”), as they are not reflective of core operations of the segments. The company’s measure of segment profitability excludes comparable adjustments, which is consistent with the measure used by management to evaluate results. The company discusses various non-GAAP measures in this news release. Financial statements, as well as supplemental schedules and tables reconciling non-GAAP measures, together with definitions of these measures and the reasons management uses these measures, are included in this news release.

FORWARD-LOOKING STATEMENTS

The statements made under the heading Outlook, and all statements other than statements of historical fact set forth in this news release regarding Constellation Brands’ business strategy, future operations and business, future financial position, expected effective tax rates and anticipated tax liabilities, estimated revenues, projected costs and expenses, expected net sales and operating income, estimated diluted EPS, expected capital expenditures, expected operating cash flow and free cash flow, future payments of dividends, manner and timing of share repurchases under the share repurchase authorizations, and prospects, plans and objectives of management, as well as information concerning expected actions of third parties, are forward-looking statements (collectively, the “Projections”) that involve risks and uncertainties that could cause actual results to differ materially from those set forth in or implied by the Projections.

During the current quarter, Constellation Brands may reiterate the Projections. Prior to the start of the company’s quiet period, which will begin at the close of business on May 28, 2021, the public can continue to rely on the Projections as still being Constellation Brands’ current expectations on the matters covered, unless the company publishes a notice stating otherwise. During Constellation Brands’ “quiet period,” the Projections should not be considered to constitute the company’s expectations and should be considered historical, speaking as of prior to the quiet period only and not subject to update by the company.

The Projections are based on management’s current expectations and, unless otherwise noted, do not take into account the impact of any future acquisition, merger or any other business combination, divestiture, restructuring or other strategic business realignments, financing, share repurchase that may be completed after the date of this release, or any incremental contingent consideration payment or any specific amount of incremental consideration payment associated with the Wine and Spirits Divestitures. The Projections should not be construed in any manner as a guarantee that such results will in fact occur. The actual impact of COVID-19 and its associated operating environment may be materially different than management’s expectations.

In addition to the risks and uncertainties of ordinary business operations, the Projections of the company contained in this news release are subject to a number of risks and uncertainties, including:

•duration and impact of the COVID-19 pandemic, including but not limited to the closure of non-essential businesses, which may include our manufacturing facilities, and other associated governmental containment actions;

•production or shipment difficulties could adversely affect our ability to supply our customers;

•impact of the Wine and Spirits Divestitures, the Concentration Business Divestiture, and the Paul Masson Divestiture, actual post closing purchase price adjustments, and amount and timing of cost reductions or any future restructuring charge may vary from management’s current expectations;

•amount of contingent consideration, if any, received in the Wine and Spirits Divestitures will depend on actual brand performance;

•beer operations expansion, construction and optimization activities, scope, costs and timing associated with these activities, and amount of impairment from non-recoverable brewery construction assets in Mexico may vary from management’s current estimates due to market conditions, our cash and debt position, receipt of regulatory approvals on the expected dates and terms, results of discussions with government officials, actual amount of non-recoverable brewery construction assets, and other factors determined by management;

•accuracy of supply projections, including those relating to wine and spirits operating activities, beer operations expansion activities, product inventory levels, and glass sourcing;

•operating cash flow, free cash flow, effective tax rate and capital expenditures to support long-term growth may vary from management’s current estimates;

•accuracy of projections associated with market opportunities and with previously announced acquisitions, investments and divestitures;

•accuracy of projections relating to the Canopy investments may vary from management’s current expectations;

•exact duration of the share repurchase implementation and the amount, timing and source of funds for any share repurchases;

•amount and timing of future dividends are subject to the determination and discretion of the board of directors;

•raw material and water supply, production or shipment difficulties could adversely affect the company’s ability to supply its customers;

•general economic, geo-political, domestic, international and regulatory conditions, instability in world financial markets, health epidemics or pandemics, quarantines or curfews, unanticipated environmental liabilities and costs, or enhanced competitive activities;

•changes to international trade agreements and tariffs, accounting standards, elections or assertions, tax laws or other governmental rules and regulations, and other factors which could impact the company’s reported financial position, results of operations or effective tax rate, or accuracy of any associated projections;

•changes in interest rates and the inherent unpredictability of currency fluctuations, commodity prices, and raw material costs; and

•other factors and uncertainties disclosed in the company’s filings with the Securities and Exchange Commission, including its Annual Report on Form 10-K for the fiscal year ended February 29, 2020 which could cause actual future performance to differ from current expectations.

| | | | | |

| Constellation Brands, Inc. FY2021 Earnings Release | #WORTHREACHINGFOR I 5 |

CONSTELLATION BRANDS, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS

(in millions)

(unaudited)

| | | | | | | | | | | |

| February 28,

2021 | | February 29,

2020 |

| ASSETS | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 460.6 | | | $ | 81.4 | |

| Accounts receivable | 785.3 | | | 864.8 | |

| Inventories | 1,291.1 | | | 1,373.6 | |

| Prepaid expenses and other | 507.5 | | | 535.8 | |

| Assets held for sale - current | — | | | 628.5 | |

| Total current assets | 3,044.5 | | | 3,484.1 | |

| Property, plant, and equipment | 5,821.6 | | | 5,333.0 | |

| Goodwill | 7,793.5 | | | 7,757.1 | |

| Intangible assets | 2,732.1 | | | 2,718.9 | |

| Equity method investments | 2,788.4 | | | 3,093.9 | |

| Securities measured at fair value | 1,818.1 | | | 1,117.1 | |

| Deferred income taxes | 2,492.5 | | | 2,656.3 | |

| Assets held for sale | — | | | 552.1 | |

| Other assets | 614.1 | | | 610.7 | |

| Total assets | $ | 27,104.8 | | | $ | 27,323.2 | |

| | | |

| LIABILITIES AND STOCKHOLDER’S EQUITY | | | |

| Current liabilities: | | | |

| Short-term borrowings | $ | — | | | $ | 238.9 | |

| Current maturities of long-term debt | 29.2 | | | 734.9 | |

| Accounts payable | 460.0 | | | 557.6 | |

| Other accrued expenses and liabilities | 779.9 | | | 780.4 | |

| Total current liabilities | 1,269.1 | | | 2,311.8 | |

| Long-term debt, less current maturities | 10,413.1 | | | 11,210.8 | |

| | | |

| Deferred income taxes and other liabilities | 1,493.5 | | | 1,326.3 | |

| Total liabilities | 13,175.7 | | | 14,848.9 | |

| CBI stockholders’ equity | 13,598.9 | | | 12,131.8 | |

| Noncontrolling interests | 330.2 | | | 342.5 | |

| Total stockholders’ equity | 13,929.1 | | | 12,474.3 | |

| Total liabilities and stockholders’ equity | $ | 27,104.8 | | | $ | 27,323.2 | |

| | | | | |

| Constellation Brands, Inc. FY2021 Earnings Release | #WORTHREACHINGFOR I 6 |

CONSTELLATION BRANDS, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF OPERATIONS

(in millions, except per share data)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Years Ended |

| February 28,

2021 | | February 29,

2020 | | February 28,

2021 | | February 29,

2020 |

| Sales | $ | 2,120.6 | | | $ | 2,075.6 | | | $ | 9,355.7 | | | $ | 9,113.0 | |

| Excise taxes | (167.6) | | | (172.7) | | | (740.8) | | | (769.5) | |

| Net sales | 1,953.0 | | | 1,902.9 | | | 8,614.9 | | | 8,343.5 | |

| Cost of product sold | (959.3) | | | (953.1) | | | (4,148.9) | | | (4,191.6) | |

| Gross profit | 993.7 | | | 949.8 | | | 4,466.0 | | | 4,151.9 | |

| Selling, general, and administrative expenses | (453.3) | | | (370.1) | | | (1,665.1) | | | (1,621.8) | |

| | | | | | | |

| Impairment of assets held for sale | — | | | (32.7) | | | (24.0) | | | (449.7) | |

| Gain (loss) on sale of business | 18.9 | | | (1.9) | | | 14.2 | | | 74.1 | |

| Operating income (loss) | 559.3 | | | 545.1 | | | 2,791.1 | | | 2,154.5 | |

| Income (loss) from unconsolidated investments | 19.8 | | | 43.2 | | | 150.3 | | | (2,668.6) | |

| Interest expense | (89.8) | | | (99.4) | | | (385.7) | | | (428.7) | |

| Loss on extinguishment of debt | (4.0) | | | — | | | (12.8) | | | (2.4) | |

| Income (loss) before income taxes | 485.3 | | | 488.9 | | | 2,542.9 | | | (945.2) | |

| (Provision for) benefit from income taxes | (94.7) | | | (79.9) | | | (511.1) | | | 966.6 | |

| Net income (loss) | 390.6 | | | 409.0 | | | 2,031.8 | | | 21.4 | |

| Net income (loss) attributable to noncontrolling interests | (7.7) | | | (10.6) | | | (33.8) | | | (33.2) | |

| Net income (loss) attributable to CBI | $ | 382.9 | | | $ | 398.4 | | | $ | 1,998.0 | | | $ | (11.8) | |

| | | | | | | |

| Net income (loss) per common share attributable to CBI: | | | | | | | |

| Basic – Class A Common Stock | $ | 2.00 | | | $ | 2.10 | | | $ | 10.44 | | | $ | (0.07) | |

| Basic – Class B Convertible Common Stock | $ | 1.81 | | | $ | 1.91 | | | $ | 9.48 | | | $ | (0.07) | |

| | | | | | | |

| Diluted – Class A Common Stock | $ | 1.95 | | | $ | 2.04 | | | $ | 10.23 | | | $ | (0.07) | |

| Diluted – Class B Convertible Common Stock | $ | 1.80 | | | $ | 1.89 | | | $ | 9.42 | | | $ | (0.07) | |

| | | | | | | |

| Weighted average common shares outstanding: | | | | | | | |

| Basic – Class A Common Stock | 170.717 | | | 168.544 | | | 170.239 | | | 168.329 | |

| Basic – Class B Convertible Common Stock | 23.268 | | | 23.306 | | | 23.280 | | | 23.313 | |

| | | | | | | |

| Diluted – Class A Common Stock | 195.942 | | | 194.918 | | | 195.308 | | | 168.329 | |

| Diluted – Class B Convertible Common Stock | 23.268 | | | 23.306 | | | 23.280 | | | 23.313 | |

| | | | | | | |

| Cash dividends declared per common share: | | | | | | | |

| Class A Common Stock | $ | 0.75 | | | $ | 0.75 | | | $ | 3.00 | | | $ | 3.00 | |

| Class B Convertible Common Stock | $ | 0.68 | | | $ | 0.68 | | | $ | 2.72 | | | $ | 2.72 | |

| | | | | |

| Constellation Brands, Inc. FY2021 Earnings Release | #WORTHREACHINGFOR I 7 |

| | | | | | | | | | | |

CONSTELLATION BRANDS, INC. AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF CASH FLOWS (in millions) (unaudited) |

| Years Ended |

| February 28,

2021 | | February 29,

2020 |

| CASH FLOWS FROM OPERATING ACTIVITIES | | | |

| Net income (loss) | $ | 2,031.8 | | | $ | 21.4 | |

| Adjustments to reconcile net income (loss) to net cash provided by operating activities: | | | |

| Unrealized net (gain) loss on securities measured at fair value | (802.0) | | | 2,126.4 | |

| Deferred tax provision (benefit) | 336.4 | | | (1,153.7) | |

| Depreciation | 293.8 | | | 326.5 | |

| Stock-based compensation | 63.0 | | | 60.4 | |

| Equity in (earnings) losses of equity method investees and related activities, net of distributed earnings | 673.4 | | | 560.8 | |

| Noncash lease expense | 83.3 | | | 88.3 | |

| Impairment and amortization of intangible assets | 11.3 | | | 16.7 | |

| Amortization of debt issuance costs and loss on extinguishment of debt | 24.3 | | | 16.1 | |

| Net (gain) loss on sale of unconsolidated investment | — | | | (0.4) | |

| | | |

| Impairment of assets held for sale | 24.0 | | | 449.7 | |

| | | |

| | | |

| | | |

| | | |

| (Gain) loss on sale of business | (14.2) | | | (74.1) | |

| Loss on inventory and related contracts associated with business optimization | 25.8 | | | 123.0 | |

| Loss on settlement of treasury lock contracts | (29.3) | | | — | |

| Change in operating assets and liabilities, net of effects from purchase and sale of business: | | | |

| Accounts receivable | 59.6 | | | (22.0) | |

| Inventories | 193.7 | | | (29.5) | |

| Prepaid expenses and other current assets | 65.7 | | | 8.1 | |

| Accounts payable | (95.7) | | | 16.8 | |

| | | |

| Other accrued expenses and liabilities | (75.0) | | | (58.5) | |

| Other | (63.4) | | | 75.1 | |

| Total adjustments | 774.7 | | | 2,529.7 | |

| Net cash provided by (used in) operating activities | 2,806.5 | | | 2,551.1 | |

| | | |

| CASH FLOWS FROM INVESTING ACTIVITIES | | | |

| Purchase of property, plant, and equipment | (864.6) | | | (726.5) | |

| Purchase of business, net of cash acquired | (19.9) | | | (36.2) | |

| Investments in equity method investees and securities | (222.4) | | | (48.2) | |

| Proceeds from sale of assets | 18.9 | | | 8.3 | |

| Proceeds from sale of unconsolidated investment | — | | | 1.5 | |

| Proceeds from sale of business | 999.5 | | | 269.7 | |

| Other investing activities | 0.6 | | | 0.4 | |

| Net cash provided by (used in) investing activities | (87.9) | | | (531.0) | |

| | | | | |

| Constellation Brands, Inc. FY2021 Earnings Release | #WORTHREACHINGFOR I 8 |

| | | | | | | | | | | |

CONSTELLATION BRANDS, INC. AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF CASH FLOWS (in millions) (unaudited) |

| Years Ended |

| February 28,

2021 | | February 29,

2020 |

| CASH FLOWS FROM FINANCING ACTIVITIES | | | |

| Proceeds from issuance of long-term debt | 1,194.7 | | | 1,291.3 | |

| Principal payments of long-term debt | (2,721.3) | | | (2,195.3) | |

| Net proceeds from (repayments of) short-term borrowings | (238.9) | | | (552.6) | |

| Dividends paid | (575.0) | | | (569.2) | |

| Purchase of treasury stock | — | | | (50.0) | |

| Proceeds from shares issued under equity compensation plans | 58.9 | | | 78.2 | |

| Payments of minimum tax withholdings on stock-based payment awards | (7.7) | | | (14.3) | |

| Payments of debt issuance, debt extinguishment, and other financing costs | (22.3) | | | (8.2) | |

| Distributions to noncontrolling interests | (35.0) | | | — | |

| Payment of contingent consideration | — | | | (11.3) | |

| | | |

| | | |

| | | |

| Net cash provided by (used in) financing activities | (2,346.6) | | | (2,031.4) | |

| | | |

| Effect of exchange rate changes on cash and cash equivalents | 7.2 | | | (0.9) | |

| | | |

| Net increase (decrease) in cash and cash equivalents | 379.2 | | | (12.2) | |

| Cash and cash equivalents, beginning of year | 81.4 | | | 93.6 | |

| Cash and cash equivalents, end of year | $ | 460.6 | | | $ | 81.4 | |

| | | | | |

| Constellation Brands, Inc. FY2021 Earnings Release | #WORTHREACHINGFOR I 9 |

CONSTELLATION BRANDS, INC. AND SUBSIDIARIES

RECONCILIATION OF REPORTED AND ORGANIC NET SALES

(in millions)

(unaudited)

For periods of acquisition, we define organic net sales as current period reported net sales less net sales of products of acquired businesses reported for the current period, as appropriate. For periods of divestiture, we define organic net sales as prior period reported net sales less net sales of products of divested businesses reported for the prior period, for the applicable periods defined below. We provide organic net sales because we use this information in monitoring and evaluating the underlying business trends of our core operations. In addition, we believe this information provides investors valuable insight on underlying business trends and results in order to evaluate year-over-year financial performance.

The divestitures impacting the periods below consists of the Black Velvet Divestiture (sold November 1, 2019), the Ballast Point Divestiture (sold March 2, 2020), the Concentration Business Divestiture (sold December 29, 2020), the Wine and Spirits Divestitures (sold January 5, 2021), and the Paul Masson Divestiture (sold January 12, 2021).

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | | | Years Ended | | |

| February 28,

2021 | | February 29,

2020 | | Percent

Change | | February 28,

2021 | | February 29,

2020 | | Percent

Change |

| Consolidated net sales | $ | 1,953.0 | | | $ | 1,902.9 | | | 3 | % | | $ | 8,614.9 | | | $ | 8,343.5 | | | 3 | % |

Less: divestitures (1) | — | | | (198.0) | | | | | — | | | (322.9) | | | |

| Consolidated organic net sales | $ | 1,953.0 | | | $ | 1,704.9 | | | 15 | % | | $ | 8,614.9 | | | $ | 8,020.6 | | | 7 | % |

| | | | | | | | | | | |

| Beer net sales | $ | 1,376.7 | | | $ | 1,187.5 | | | 16 | % | | $ | 6,074.6 | | | $ | 5,615.9 | | | 8 | % |

Less: divestiture (1) | — | | | (18.5) | | | | | — | | | (92.0) | | | |

| Beer organic net sales | $ | 1,376.7 | | | $ | 1,169.0 | | | 18 | % | | $ | 6,074.6 | | | $ | 5,523.9 | | | 10 | % |

| | | | | | | | | | | |

Wine and Spirits net sales (2) | $ | 576.3 | | | $ | 715.4 | | | (19 | %) | | $ | 2,540.3 | | | $ | 2,727.6 | | | (7 | %) |

Less: divestitures (1) | — | | | (179.5) | | | | | — | | | (230.9) | | | |

| Wine and Spirits organic net sales | $ | 576.3 | | | $ | 535.9 | | | 8 | % | | $ | 2,540.3 | | | $ | 2,496.7 | | | 2 | % |

(1)For the applicable periods:

| | | | | | | | | | | | | | |

| | Three Months Ended

February 29, 2020 | | Year Ended

February 29, 2020 |

| Black Velvet Divestiture | | NA | | 3/1/2019 - 10/31/2019 |

| Ballast Point Divestiture | | 12/1/2019 - 2/29/2020 | | 3/2/2019 - 2/29/2020 |

| Concentrate Business Divestiture | | 12/29/2019 - 2/29/2020 | | 12/29/2019 - 2/29/2020 |

| Wine and Spirits Divestitures | | 1/5/2020 - 2/29/2020 | | 1/5/2020 - 2/29/2020 |

| Paul Masson Divestiture | | 1/12/2020 - 2/29/2020 | | 1/12/2020 - 2/29/2020 |

(2)Our Wine and Spirits retained portfolio net sales is defined as current and prior period reported net sales less net sales of products of divested businesses reported for the current and prior period. The reconciliation of reported and retained portfolio net sales is as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | | | Years Ended | | |

| | February 28,

2021 | | February 29,

2020 | | Percent

Change | | February 28,

2021 | | February 29,

2020 | | Percent

Change |

| Wine and Spirits net sales | | $ | 576.3 | | | $ | 715.4 | | | (19 | %) | | $ | 2,540.3 | | | $ | 2,727.6 | | | (7 | %) |

Less: divested portfolio (i) | | (63.8) | | | (235.7) | | | | | (642.3) | | | (919.6) | | | |

| Wine and Spirits retained portfolio net sales | | $ | 512.5 | | | $ | 479.7 | | | 7 | % | | $ | 1,898.0 | | | $ | 1,808.0 | | | 5 | % |

| | | | | | | | | | | | |

(i)Includes the Black Velvet Divestiture, the Concentrate Business Divestiture, the Wine and Spirits Divestitures, and the Paul Masson Divestiture activity in each fiscal period. |

| | | | | |

| Constellation Brands, Inc. FY2021 Earnings Release | #WORTHREACHINGFOR I 10 |

CONSTELLATION BRANDS, INC. AND SUBSIDIARIES

SUPPLEMENTAL SHIPMENT AND DEPLETION INFORMATION

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | | | Years Ended | | |

| February 28,

2021 | | February 29,

2020 | | Percent

Change | | February 28,

2021 | | February 29,

2020 | | Percent

Change |

| Beer | | | | | | | | | | | |

(in millions, branded product, 24-pack,

12-ounce case equivalents) | | | | | | | | | | | |

| Shipment volume | 75.7 | | | 65.3 | | | 15.9 | % | | 334.6 | | | 311.9 | | | 7.3 | % |

Organic shipment volume (1) | 75.7 | | | 64.8 | | | 16.8 | % | | 334.6 | | | 309.4 | | | 8.1 | % |

| | | | | | | | | | | |

Depletion volume (1) (2) | | | | | 6.4 | % | | | | | | 7.1 | % |

| | | | | | | | | | | |

| Wine and Spirits | | | | | | | | | | | |

| (in millions, branded product, 9-liter case equivalents) | | | | | | | | | | | |

| Shipment volume | 9.4 | | | 14.0 | | | (32.9 | %) | | 45.0 | | | 53.6 | | | (16.0 | %) |

Organic shipment volume (3) (4) (5) | 9.4 | | | 9.1 | | | 3.3 | % | | 45.0 | | | 47.3 | | | (4.9 | %) |

| U.S. Domestic shipment volume | 8.7 | | | 13.1 | | | (33.6 | %) | | 41.5 | | | 49.5 | | | (16.2 | %) |

U.S. Domestic organic shipment volume (3) (4) (5) | 8.7 | | | 8.4 | | | 3.6 | % | | 41.5 | | | 43.4 | | | (4.4 | %) |

| | | | | | | | | | | |

U.S. Domestic depletion volume (2) (3) (4) (5) | | | | | (6.8 | %) | | | | | | (2.8 | %) |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

(1) | Includes an adjustment to remove shipment and depletion volume associated with the Ballast Point Divestiture for the periods December 1, 2019, through February 29, 2020, and March 2, 2019, through February 29, 2020, for the three months and year ended February 29, 2020, respectively. |

(2) | Depletions represent distributor shipments of our respective branded products to retail customers, based on third-party data. |

(3) | Includes an adjustment to remove shipment and depletion volume associated with the Black Velvet Divestiture for the period March 1, 2019, through October 31, 2019, for the year ended February 29, 2020. |

(4) | Includes an adjustment to remove shipment and depletion volume associated with the Wine and Spirits Divestitures for the period January 5, 2020, through February 29, 2020, for the three months and year ended February 29, 2020. |

(5) | Includes an adjustment to remove shipment and depletion volume associated with the Paul Masson Divestiture for the period January 12, 2020, through February 29, 2020, for the three months and year ended February 29, 2020. |

| | | | | |

| Constellation Brands, Inc. FY2021 Earnings Release | #WORTHREACHINGFOR I 11 |

CONSTELLATION BRANDS, INC. AND SUBSIDIARIES

SUMMARIZED SEGMENT AND INCOME (LOSS) FROM UNCONSOLIDATED INVESTMENTS INFORMATION

(in millions)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | | | Years Ended | | |

| February 28,

2021 | | February 29,

2020 | | Percent

Change | | February 28,

2021 | | February 29,

2020 | | Percent

Change |

| Beer | | | | | | | | | | | |

| Segment net sales | $ | 1,376.7 | | | $ | 1,187.5 | | | 16 | % | | $ | 6,074.6 | | | $ | 5,615.9 | | | 8 | % |

| Segment gross profit | $ | 769.5 | | | $ | 657.1 | | | 17 | % | | $ | 3,402.4 | | | $ | 3,125.2 | | | 9 | % |

| % Net sales | 55.9 | % | | 55.3 | % | | | | 56.0 | % | | 55.6 | % | | |

| Segment operating income (loss) | $ | 506.3 | | | $ | 467.1 | | | 8 | % | | $ | 2,494.3 | | | $ | 2,247.9 | | | 11 | % |

| % Net sales | 36.8 | % | | 39.3 | % | | | | 41.1 | % | | 40.0 | % | | |

| | | | | | | | | | | |

| Wine and Spirits | | | | | | | | | | | |

| Wine net sales | $ | 497.2 | | | $ | 620.2 | | | (20 | %) | | $ | 2,208.4 | | | $ | 2,367.5 | | | (7 | %) |

| Spirits net sales | 79.1 | | | 95.2 | | | (17 | %) | | 331.9 | | | 360.1 | | | (8 | %) |

| Segment net sales | $ | 576.3 | | | $ | 715.4 | | | (19 | %) | | $ | 2,540.3 | | | $ | 2,727.6 | | | (7 | %) |

| Segment gross profit | $ | 247.0 | | | $ | 314.6 | | | (21 | %) | | $ | 1,115.2 | | | $ | 1,189.0 | | | (6 | %) |

| % Net sales | 42.9 | % | | 44.0 | % | | | | 43.9 | % | | 43.6 | % | | |

| Segment operating income (loss) | $ | 114.6 | | | $ | 206.8 | | | (45 | %) | | $ | 622.4 | | | $ | 708.4 | | | (12 | %) |

| % Net sales | 19.9 | % | | 28.9 | % | | | | 24.5 | % | | 26.0 | % | | |

| Segment income (loss) from unconsolidated investments | $ | 5.1 | | | $ | 1.8 | | | 183 | % | | $ | 31.7 | | | $ | 36.4 | | | (13 | %) |

| | | | | | | | | | | |

| Corporate Operations and Other | | | | | | | | | | | |

| Segment operating income (loss) | $ | (57.3) | | | $ | (75.2) | | | 24 | % | | $ | (228.6) | | | $ | (223.9) | | | (2 | %) |

| Segment income (loss) from unconsolidated investments | $ | (0.6) | | | $ | (1.4) | | | 57 | % | | $ | (0.4) | | | $ | (3.2) | | | 88 | % |

| | | | | | | | | | | |

Canopy equity earnings (losses) (1) | $ | (37.4) | | | $ | (41.5) | | | 10 | % | | $ | (146.2) | | | $ | (221.7) | | | 34 | % |

| | | | | | | | | | | |

| Consolidated operating income (loss) | $ | 559.3 | | | $ | 545.1 | | | 3 | % | | $ | 2,791.1 | | | $ | 2,154.5 | | | 30 | % |

| Comparable Adjustments | 4.3 | | | 53.6 | | | (92 | %) | | 97.0 | | | 577.9 | | | (83 | %) |

| Comparable operating income (loss) | $ | 563.6 | | | $ | 598.7 | | | (6 | %) | | $ | 2,888.1 | | | $ | 2,732.4 | | | 6 | % |

| | | | | | | | | | | |

| Consolidated income (loss) from unconsolidated investments | $ | 19.8 | | | $ | 43.2 | | | (54 | %) | | $ | 150.3 | | | $ | (2,668.6) | | | NM |

| Comparable Adjustments | (52.7) | | | (84.3) | | | 37 | % | | (265.2) | | | 2,480.1 | | | NM |

| Comparable income (loss) from unconsolidated investments | $ | (32.9) | | | $ | (41.1) | | | 20 | % | | $ | (114.9) | | | $ | (188.5) | | | 39 | % |

| | | | | | | | | | | |

| Consolidated EBIT | $ | 530.7 | | | $ | 557.6 | | | (5 | %) | | $ | 2,773.2 | | | $ | 2,543.9 | | | 9 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

(1) | We recognize our equity in earnings (losses) for Canopy on a two-month lag. The summarized financial information below represents 100% of Canopy’s reported results, prepared in accordance with generally accepted accounting principles in the U.S. (“GAAP”), and converted from Canadian dollars to U.S. dollars using the applicable weighted average exchange rates. |

| | | Three Months Ended | | | | Years Ended | | |

| | | February 28,

2021 | | February 29,

2020 | | Percent Change | | February 28,

2021 | | February 29,

2020 | | Percent Change |

| | Net sales | $ | 117.1 | | | $ | 93.8 | | | 25 | % | | $ | 378.6 | | | $ | 290.2 | | | 30 | % |

| | Gross profit (loss) | $ | 18.9 | | | $ | 31.6 | | | (40) | % | | $ | (14.1) | | | $ | 45.4 | | | (131 | %) |

| | % Net sales | 16.1 | % | | 33.7 | % | | | | (3.7) | % | | 15.6 | % | | |

| | Operating income (loss) | $ | (425.0) | | | $ | (144.5) | | | (194) | % | | $ | (1,496.0) | | | $ | (685.8) | | | (118) | % |

| | % Net sales | NM | | NM | | | | NM | | NM | | |

| | | | | |

| Constellation Brands, Inc. FY2021 Earnings Release | #WORTHREACHINGFOR I 12 |

CONSTELLATION BRANDS, INC. AND SUBSIDIARIES

RECONCILIATIONS OF GAAP TO NON-GAAP FINANCIAL MEASURES

(in millions, except per share data)

(unaudited)

We report our financial results in accordance with GAAP. However, non-GAAP financial measures, as defined in the reconciliation tables below, are provided because we use this information in evaluating the results of our core operations and/or internal goal setting. In addition, we believe this information provides investors valuable insight on underlying business trends and results in order to evaluate year-over-year financial performance. See the tables below for supplemental financial data and corresponding reconciliations of these non-GAAP financial measures to GAAP financial measures for the periods presented. Non-GAAP financial measures should be viewed in addition to, and not as an alternative for, our reported results prepared in accordance with GAAP. Please refer to our website at http://www.cbrands.com/investors/reporting for a more detailed description and further discussion of these non-GAAP financial measures.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended February 28, 2021 | | Three Months Ended February 29, 2020 | | Percent

Change -

Reported

Basis

(GAAP) | | Percent

Change -

Comparable

Basis

(Non-GAAP) |

| Reported

Basis

(GAAP) | Comparable

Adjustments | Comparable

Basis

(Non-GAAP) | | Reported

Basis

(GAAP) | Comparable

Adjustments | Comparable

Basis

(Non-GAAP) | |

| Net sales | $ | 1,953.0 | | | $ | 1,953.0 | | | $ | 1,902.9 | | | $ | 1,902.9 | | | 3 | % | | 3 | % |

| Cost of product sold | (959.3) | | $ | 22.8 | | | | (953.1) | | $ | 21.9 | | | | | | |

| Gross profit | 993.7 | | 22.8 | | $ | 1,016.5 | | | 949.8 | | 21.9 | | $ | 971.7 | | | 5 | % | | 5 | % |

| Selling, general, and administrative expenses | (453.3) | | 0.4 | | | | (370.1) | | (2.9) | | | | | | |

| | | | | | | | | | | |

| Impairment of assets held for sale | — | | | | | (32.7) | | 32.7 | | | | | |

| Gain (loss) on sale of business | 18.9 | | (18.9) | | | | (1.9) | | 1.9 | | | | | |

| Operating income (loss) | 559.3 | | 4.3 | | $ | 563.6 | | | 545.1 | | 53.6 | | $ | 598.7 | | | 3 | % | | (6 | %) |

| Income (loss) from unconsolidated investments | 19.8 | | (52.7) | | | | 43.2 | | (84.3) | | | | | | |

| EBIT | | | $ | 530.7 | | | | | $ | 557.6 | | | NA | | (5 | %) |

| Interest expense | (89.8) | | | | | (99.4) | | | | | | | |

| Loss on extinguishment of debt | (4.0) | | 4.0 | | | | — | | | | | | | |

| Income (loss) before income taxes | 485.3 | | (44.4) | | $ | 440.9 | | | 488.9 | | (30.7) | | $ | 458.2 | | | (1 | %) | | (4 | %) |

(Provision for) benefit from income taxes (1) | (94.7) | | 17.2 | | | | (79.9) | | 33.4 | | | | | | |

| Net income (loss) | 390.6 | | (27.2) | | | | 409.0 | | 2.7 | | | | | | |

| Net income (loss) attributable to noncontrolling interests | (7.7) | | | | | (10.6) | | | | | | | |

| Net income (loss) attributable to CBI | $ | 382.9 | | $ | (27.2) | | $ | 355.7 | | | $ | 398.4 | | $ | 2.7 | | $ | 401.1 | | | (4 | %) | | (11 | %) |

| | | | | | | | | | | |

EPS (2) | $ | 1.95 | | $ | (0.14) | | $ | 1.82 | | | $ | 2.04 | | $ | 0.01 | | $ | 2.06 | | | (4 | %) | | (12 | %) |

| | | | | | | | | | | |

| Weighted average common shares outstanding – diluted | 195.942 | | | 195.942 | | | 194.918 | | | 194.918 | | | | | |

| | | | | | | | | | | |

| Gross margin | 50.9 | % | | 52.0 | % | | 49.9 | % | | 51.1 | % | | | | |

| Operating margin | 28.6 | % | | 28.9 | % | | 28.6 | % | | 31.5 | % | | | | |

| Effective tax rate | 19.5 | % | | 17.6 | % | | 16.3 | % | | 10.1 | % | | | | |

| | | | | |

| Constellation Brands, Inc. FY 2021 Earnings Release | #WORTHREACHINGFOR I 13 |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended February 28, 2021 | | Three Months Ended February 29, 2020 |

| Comparable Adjustments | Acquisitions, Divestitures, and Related Costs (3) | Restructuring and Other Strategic Business Development Costs (4) | Other (5) | Total | | Acquisitions,

Divestitures,

and Related

Costs | Restructuring and Other Strategic Business Development Costs (4) | Other (5) | Total |

| | | | | | | | | |

| Cost of product sold | $ | (0.3) | | $ | (4.1) | | $ | (18.4) | | $ | (22.8) | | | $ | — | | $ | (0.8) | | $ | (21.1) | | $ | (21.9) | |

| Selling, general, and administrative expenses | $ | (1.8) | | $ | (2.3) | | $ | 3.7 | | $ | (0.4) | | | $ | 3.7 | | $ | 0.2 | | $ | (1.0) | | $ | 2.9 | |

| | | | | | | | | |

| Impairment of assets held for sale | $ | — | | $ | — | | $ | — | | $ | — | | | $ | — | | $ | (32.7) | | $ | — | | $ | (32.7) | |

| Gain (loss) on sale of business | $ | 18.9 | | $ | — | | $ | — | | $ | 18.9 | | | $ | (1.9) | | $ | — | | $ | — | | $ | (1.9) | |

| Operating income (loss) | $ | 16.8 | | $ | (6.4) | | $ | (14.7) | | $ | (4.3) | | | $ | 1.8 | | $ | (33.3) | | $ | (22.1) | | $ | (53.6) | |

| Income (loss) from unconsolidated investments | $ | (0.9) | | $ | (108.1) | | $ | 161.7 | | $ | 52.7 | | | $ | (6.0) | | $ | — | | $ | 90.3 | | $ | 84.3 | |

| | | | | | | | | |

| Loss on extinguishment of debt | $ | — | | $ | — | | $ | (4.0) | | $ | (4.0) | | | $ | — | | $ | — | | $ | — | | $ | — | |

(Provision for) benefit from income taxes (1) | $ | (7.4) | | $ | 26.4 | | $ | (36.2) | | $ | (17.2) | | | $ | (17.3) | | $ | (0.4) | | $ | (15.7) | | $ | (33.4) | |

| | | | | | | | | |

| Net income (loss) attributable to CBI | $ | 8.5 | | $ | (88.1) | | $ | 106.8 | | $ | 27.2 | | | $ | (21.5) | | $ | (33.7) | | $ | 52.5 | | $ | (2.7) | |

| | | | | | | | | |

EPS (2) | $ | 0.04 | | $ | (0.45) | | $ | 0.55 | | $ | 0.14 | | | $ | (0.11) | | $ | (0.17) | | $ | 0.27 | | $ | (0.01) | |

(1) The effective tax rate applied to each Comparable Adjustment amount is generally based upon the jurisdiction in which the Comparable Adjustment was recognized. For the three months and year ended February 28, 2021, the (provision for) benefit from income taxes includes a net income tax provision recognized as a result of adjustments to valuation allowances. For the year ended February 28, 2021, the (provision for) benefit from income taxes also includes a net income tax provision related to legislative and governmental initiatives under the Coronavirus Aid, Relief, and Economic Security Act (“CARES Act”). For the three months February 29, 2020, the (provision for) benefit from income taxes includes a net income tax provision recognized as a result of adjustments to valuation allowances. For the year ended February 29, 2020, the (provision for) benefit from income taxes includes a net income tax benefit recognized as a result of tax reform in Switzerland and a net income tax benefit primarily from the reversal of a valuation allowance related to capital loss carryforwards as a result of classifying assets held for sale in connection with the definitive agreement to sell a portion of the wine and spirits business to E. & J. Gallo Winery.

(2) May not sum due to rounding as each item is computed independently. For the year ended February 29, 2020, the comparable adjustments and comparable basis diluted net income (loss) per share are calculated on a fully dilutive basis. (6)

(3) For the three months ended February 28, 2021, acquisitions, divestitures, and related costs consist primarily of a net gain recognized [in connection with or from or on] the Paul Masson Divestiture, partially offset by net losses recognized in connection with the Wine and Spirits Divestitures and related activities and the Concentrate Business Divestiture.

(4) For the three months ended February 28, 2021 restructuring and other strategic business development costs consist of equity losses from Canopy Growth Corporation (“Canopy”) related to costs designed to improve their organizational focus, streamline operations, and align product capability with projected demand. For the three months ended February 29, 2020, restructuring and other strategic business development costs consist of an impairment of long-lived assets held for sale. For the three months ended February 28, 2021 and February 29, 2020, restructuring and other strategic business development costs also consist of costs to optimize our portfolio, gain efficiencies, and reduce our cost structure primarily within the wine and spirits segment.

(5) For the three months ended February 28, 2021, other consists primarily of (i) an unrealized net gain from the mark to fair value of our investment in Canopy, (ii) a net gain from the mark to fair value of undesignated commodity derivative contracts, and (iii) a net decrease in estimated fair value of a contingent liability, partially offset by (i) costs associated with Canopy equity losses, (ii) a net loss as a result of smoke damage sustained during the U.S. West Coast wildfires, and (iii) impairments of certain long-lived assets. For the three months ended February 29, 2020, other consists primarily of an unrealized net gain from the mark to fair value of our investment in Canopy, partially offset by a net loss from the mark to fair value of undesignated commodity derivative contracts.

| | | | | |

| Constellation Brands, Inc. FY 2021 Earnings Release | #WORTHREACHINGFOR I 14 |

CONSTELLATION BRANDS, INC. AND SUBSIDIARIES

RECONCILIATIONS OF GAAP TO NON-GAAP FINANCIAL MEASURES (continued)

(in millions, except per share data)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Year Ended February 28, 2021 | | Year Ended February 29, 2020 | | Percent

Change -

Reported

Basis

(GAAP) | | Percent

Change -

Comparable

Basis

(Non-GAAP) |

| Reported

Basis

(GAAP) | Comparable

Adjustments | Comparable

Basis

(Non-GAAP) | | Reported

Basis

(GAAP) | Comparable

Adjustments | Comparable

Basis

(Non-GAAP) | |

| Net sales | $ | 8,614.9 | | | $ | 8,614.9 | | | $ | 8,343.5 | | | $ | 8,343.5 | | | 3 | % | | 3 | % |

| Cost of product sold | (4,148.9) | | $ | 51.6 | | | | (4,191.6) | | $ | 162.3 | | | | | | |

| Gross profit | 4,466.0 | | 51.6 | | $ | 4,517.6 | | | 4,151.9 | | 162.3 | | $ | 4,314.2 | | | 8 | % | | 5 | % |

| Selling, general, and administrative expenses | (1,665.1) | | 35.6 | | | | (1,621.8) | | 40.0 | | | | | | |

| | | | | | | | | | | |

| Impairment of assets held for sale | (24.0) | | 24.0 | | | | (449.7) | | 449.7 | | | | | |

| Gain (loss) on sale of business | 14.2 | | (14.2) | | | | 74.1 | | $ | (74.1) | | | | | | |

| Operating income (loss) | 2,791.1 | | 97.0 | | $ | 2,888.1 | | | 2,154.5 | | 577.9 | | $ | 2,732.4 | | | 30 | % | | 6 | % |

| Income (loss) from unconsolidated investments | 150.3 | | (265.2) | | | | (2,668.6) | | 2,480.1 | | | | | | |

| EBIT | | | $ | 2,773.2 | | | | | $ | 2,543.9 | | | NA | | 9 | % |

| Interest expense | (385.7) | | | | | (428.7) | | | | | | | |

| Loss on extinguishment of debt | (12.8) | | 12.8 | | | | (2.4) | | 2.4 | | | | | | |

| Income (loss) before income taxes | 2,542.9 | | (155.4) | | $ | 2,387.5 | | | (945.2) | | 3,060.4 | | $ | 2,115.2 | | | NM | | 13 | % |

(Provision for) benefit from income taxes (1) | (511.1) | | 103.9 | | | | 966.6 | | (1,270.7) | | | | | | |

| Net income (loss) | 2,031.8 | | (51.5) | | | | 21.4 | | 1,789.7 | | | | | | |

| Net income (loss) attributable to noncontrolling interests | (33.8) | | | | | (33.2) | | | | | | | |

| Net income (loss) attributable to CBI | $ | 1,998.0 | | $ | (51.5) | | $ | 1,946.5 | | | $ | (11.8) | | $ | 1,789.7 | | $ | 1,777.9 | | | NM | | 9 | % |

| | | | | | | | | | | |

EPS (2) | $ | 10.23 | | $ | (0.26) | | $ | 9.97 | | | $ | (0.07) | | $ | 9.18 | | $ | 9.12 | | | NM | | 9 | % |

| | | | | | | | | | | |

Weighted average common shares outstanding – diluted (6) | 195.308 | | | 195.308 | | | 168.329 | | 26.552 | | 194.881 | | | | | |

| | | | | | | | | | | |

| Gross margin | 51.8 | % | | 52.4 | % | | 49.8 | % | | 51.7 | % | | | | |

| Operating margin | 32.4 | % | | 33.5 | % | | 25.8 | % | | 32.7 | % | | | | |

| Effective tax rate | 20.1 | % | | 17.1 | % | | 102.3 | % | | 14.4 | % | | | | |

| | | | | |

| Constellation Brands, Inc. FY 2021 Earnings Release | #WORTHREACHINGFOR I 15 |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Year Ended February 28, 2021 | | Year Ended February 29, 2020 |

| Comparable Adjustments | Acquisitions, Divestitures, and Related Costs (7) | Restructuring and Other Strategic Business Development Costs (8) | Other (9) | Total | | Acquisitions, Divestitures, and Related Costs (7) | Restructuring and Other Strategic Business Development Costs (8) | Other (9) | Total |

| | | | | | | | | |

| Cost of product sold | $ | (0.4) | | $ | (29.9) | | $ | (21.3) | | $ | (51.6) | | | $ | (1.5) | | $ | (132.1) | | $ | (28.7) | | $ | (162.3) | |

| Selling, general, and administrative expenses | $ | (6.3) | | $ | (23.9) | | $ | (5.4) | | $ | (35.6) | | | $ | 8.5 | | $ | (25.3) | | $ | (23.2) | | $ | (40.0) | |

| | | | | | | | | |

| Impairment of assets held for sale | $ | — | | $ | (24.0) | | $ | — | | $ | (24.0) | | | $ | — | | $ | (449.7) | | $ | — | | $ | (449.7) | |

| Gain (loss) on sale of business | $ | 14.2 | | $ | — | | $ | — | | $ | 14.2 | | | $ | 74.1 | | $ | — | | $ | — | | $ | 74.1 | |

| Operating income (loss) | $ | 7.5 | | $ | (77.8) | | $ | (26.7) | | $ | (97.0) | | | $ | 81.1 | | $ | (607.1) | | $ | (51.9) | | $ | (577.9) | |

| Income (loss) from unconsolidated investments | $ | (2.8) | | $ | (359.6) | | $ | 627.6 | | $ | 265.2 | | | $ | (29.9) | | $ | — | | $ | (2,450.2) | | $ | (2,480.1) | |

| | | | | | | | | |

| Loss on extinguishment of debt | $ | — | | $ | — | | $ | (12.8) | | $ | (12.8) | | | $ | — | | $ | — | | $ | (2.4) | | $ | (2.4) | |

(Provision for) benefit from income taxes (1) | $ | (27.2) | | $ | 99.4 | | $ | (176.1) | | $ | (103.9) | | | $ | 24.8 | | $ | 139.3 | | $ | 1,106.6 | | $ | 1,270.7 | |

| | | | | | | | | |

| Net income (loss) attributable to CBI | $ | (22.5) | | $ | (338.0) | | $ | 412.0 | | $ | 51.5 | | | $ | 76.0 | | $ | (467.8) | | $ | (1,397.9) | | $ | (1,789.7) | |

| | | | | | | | | |

EPS (2) | $ | (0.12) | | $ | (1.73) | | $ | 2.11 | | $ | 0.26 | | | $ | 0.39 | | $ | (2.40) | | $ | (7.17) | | $ | (9.18) | |

(6) We have excluded the following weighted average common shares outstanding from the calculation of diluted net income (loss) per common share, as the effect of including these would have been anti-dilutive for the year ended February 29, 2020, in millions:

| | | | | | | | | | |

| Class B Convertible Common Stock | | | | | | 23.313 |

| Stock-based awards, primarily stock options | | | | | | 3.239 | |

(7) For the year ended February 28, 2021, acquisitions, divestitures, and related costs consist primarily of (i) a net income tax provision recognized for the adjustments to valuation allowances, (ii) net losses in connection with the Wine and Spirits Divestitures and related activities and the Concentrate Business Divestiture, and (iii) a net loss on foreign currency contracts, partially offset by a net gain recognized in connection with the Paul Masson Divestiture and a net gain from a vineyard sale. For the year ended February 29, 2020, acquisitions, divestitures, and related costs consist primarily of (i) a net gain recognized in connection with the sale of the Black Velvet Canadian Whisky business, (ii) a net income tax benefit recognized for the reversal of the valuation allowance, and (iii) and a gain related to the remeasurement of our previously held equity interest in Nelson’s Green Brier to the acquisition-date fair value; partially offset by flow through of inventory basis adjustments associated with our investment in Canopy.

(8) For the year ended February 28, 2021, restructuring and other strategic business development costs consist primarily of equity losses from Canopy related to costs designed to improve their organizational focus, streamline operations, and align product capability with projected demand. For the years ended February 28, 2021, and February 29, 2020, restructuring and other strategic business development costs also included impairments of long-lived assets held for sale and costs to optimize our portfolio, gain efficiencies, and reduce our cost structure primarily within the wine and spirits segment.

(9) For the year ended February 28, 2021, other consists primarily of (i) an unrealized net gain from the mark to fair value of our investment in Canopy, (ii) a net gain from the mark to fair value of undesignated commodity derivative contracts, and (iii) a net decrease in estimated fair value of a contingent liability, partially offset by (i) costs associated with Canopy equity losses, (ii) a net loss as a result of smoke damage sustained during the U.S. West Coast wildfires, (iii) a net income tax provision related to the CARES Act, and (iv) a loss on extinguishment of debt. For the year ended February 29, 2020, other consists primarily of an unrealized net loss from the mark to fair value of our investment in Canopy and costs associated with Canopy equity losses, partially offset by an unrealized gain from the June 2019 modification of the terms of the November 2018 Canopy Warrants and a net income tax benefit recognized as a result of tax reform in Switzerland.

| | | | | |

| Constellation Brands, Inc. FY 2021 Earnings Release | #WORTHREACHINGFOR I 16 |

CONSTELLATION BRANDS, INC. AND SUBSIDIARIES

RECONCILIATIONS OF GAAP TO NON-GAAP FINANCIAL MEASURES (continued)

(in millions, except per share data)

(unaudited)

Canopy Equity Earnings (Losses) and Related Activities (“Canopy EIE”)

Canopy EIE non-GAAP financial measures are provided because management uses this information to monitor our investment in Canopy. In addition, we believe this information provides investors valuable insight on underlying business trends and results in order to evaluate year-over-year financial performance.

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Years Ended |

| February 28,

2021 | | February 29,

2020 | | February 28,

2021 | | February 29,

2020 |

Equity losses and related activities - reported basis, Canopy EIE (GAAP) (1) | $ | (258.0) | | | $ | (31.7) | | | $ | (679.0) | | | $ | (575.9) | |

Comparable Adjustments (2)(3) | 220.6 | | | (9.8) | | | 532.8 | | | 354.2 | |

Equity losses and related activities - comparable basis, Canopy EIE (Non-GAAP) | (37.4) | | | (41.5) | | | (146.2) | | | (221.7) | |

(Provision for) benefit from income taxes (3) | 14.6 | | | 18.4 | | | 52.8 | | | 73.2 | |

| Net income (loss) attributable to CBI - comparable basis, Canopy EIE (Non-GAAP) | $ | (22.8) | | | $ | (23.1) | | | $ | (93.4) | | | $ | (148.5) | |

| | | | | | | |

| | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Years Ended |

| February 28,

2021 | | February 29,

2020 | | February 28,

2021 | | February 29,

2020 |

| EPS - reported basis, Canopy EIE (GAAP) | $ | (0.99) | | | $ | (0.08) | | | $ | (2.62) | | | $ | (2.22) | |

| Comparable Adjustments - Canopy EIE (Non-GAAP) | 0.85 | | | (0.04) | | | 2.09 | | | 1.39 | |

EPS - comparable basis, Canopy EIE (Non-GAAP) (4) | $ | (0.12) | | | $ | (0.12) | | | $ | (0.48) | | | $ | (0.76) | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Years Ended |

| February 28, 2021 | | February 29, 2020 |

| Income (loss) before income taxes | | (Provision for) benefit from income taxes (3) | | Effective tax rate (6) | | Income (loss) before income taxes | | (Provision for) benefit from income taxes (3) | | Effective tax rate (6) |

| Reported basis (GAAP) | $ | 2,542.9 | | | $ | (511.1) | | | 20.1 | % | | $ | (945.2) | | | $ | 966.6 | | | 102.3 | % |

| Comparable Adjustments - (Non-GAAP) | (155.4) | | | 103.9 | | | | | 3,060.4 | | | (1,270.7) | | | |

| Comparable basis (Non-GAAP) | 2,387.5 | | | (407.2) | | | 17.1 | % | | 2,115.2 | | | (304.1) | | | 14.4 | % |

| Comparable basis, Canopy EIE (Non-GAAP) | (146.2) | | | 52.8 | | | | | (221.7) | | | 73.2 | | | |

| Comparable basis, excluding Canopy EIE (Non-GAAP) | $ | 2,533.7 | | | $ | (460.0) | | | 18.2 | % | | $ | 2,336.9 | | | $ | (377.3) | | | 16.1 | % |

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Years Ended |

| February 28,

2021 | | February 29,

2020 | | February 28,

2021 | | February 29,

2020 |

EPS - comparable basis (Non-GAAP) (5) | $ | 1.82 | | | $ | 2.06 | | | $ | 9.97 | | | $ | 9.12 | |

| EPS - comparable basis, Canopy EIE (Non-GAAP) | (0.12) | | | (0.12) | | | (0.48) | | | (0.76) | |

EPS - comparable basis, excluding Canopy EIE (Non-GAAP) (4) | $ | 1.93 | | | $ | 2.18 | | | $ | 10.44 | | | $ | 9.89 | |

| | | | | | | | | | | | | | |

(1) | Equity earnings (losses) and related activities are included in income (loss) from unconsolidated investments. |

(2) | Comparable Adjustments, Canopy EIE include: impact from the June 2019 warrant modification, restructuring and other strategic business development costs, expected credit losses on financial assets and related charges, unrealized net (gain) loss from the mark to fair value of securities measured at fair value and related activities, flow through of inventory step-up, share-based compensation expense related to acquisition milestones, acquisition costs, loss on dilution due to Canopy’s issuance of additional stock, and other (gains) losses. |

(3) | The Comparable Adjustment effective tax rate applied to each Comparable Adjustment amount is generally based upon the jurisdiction in which the adjustment was recognized. The benefit from income taxes effective tax rate applied to our equity in earnings (losses) of Canopy is generally based on the tax rates of the legal entities that hold our investment. |

| | | | | |

| Constellation Brands, Inc. FY2021 Earnings Release | #WORTHREACHINGFOR I 17 |

| | | | | | | | | | | | | | |

(4) | May not sum due to rounding as each item is computed independently. For the year ended February 29, 2020, the comparable adjustments and comparable basis diluted net income per share are calculated on a fully dilutive basis. |

(5) | See reconciliation of the applicable non-GAAP financial measures on pages 13 and 15. |

(6) | Effective tax rate is not considered a GAAP financial measure, for purposes of this reconciliation, we derived the reported GAAP measure based on GAAP results, which serves as the basis for the reconciliation to the comparable non-GAAP financial measure. |

| | | | | | | | | | | |