State Street, Bank of New York Mellon Report Declining Profit

October 16 2020 - 9:23AM

Dow Jones News

By Logan Moore

Custodian banks State Street Corp. and Bank of New York Mellon

Corp. grew assets under management while experiencing

low-to-single-digit declines in profit and revenue, the companies

reported Friday morning.

Total revenue for BNY Mellon was $3.8 billion for the quarter

ended Sept. 30, a decrease of 0.4% compared with the same quarter

last year. The bank grew its assets under management by 8.5% to $2

trillion but its profit dropped 9.3% to $944 million.

"I believe the underlying strength of our franchise will become

more apparent next year, as we expect to have most of the run-rate

impact of lower rates associated with money market fee waivers in

our earnings," said Chief Executive Officer Todd Gibbons in a

release.

State Street Corp. reported an increase in assets under

management of 6.6% in the third-quarter to $3.1 trillion.

Total revenue for State Street fell 4% to $2.8 billion. Profits

were down almost 4.8% to $555 million from $583 million.

"Though persistent low rates depressed net interest income

during the quarter, deposit levels remain strong, allowing us to

lend more to our clients and reinvest in our investment portfolio,"

said Ron O'Hanley, chairman and chief executive officer, in a

release.

Even before the pandemic, custodial banks struggled with low

interest rates and their impact on interest-earning assets.

Those rates are likely to remain low for the long term. Last

month, the Federal Reserve said it would keep rates near zero until

the labor market improves and inflation hits 2%.

Bank of New York Mellon Corp. said it set aside $9 million for

credit losses.

(END) Dow Jones Newswires

October 16, 2020 09:08 ET (13:08 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

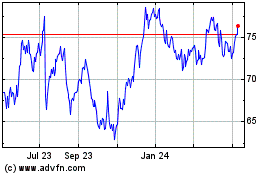

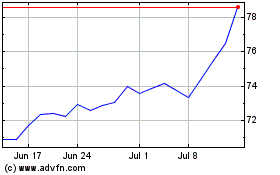

State Street (NYSE:STT)

Historical Stock Chart

From Mar 2024 to Apr 2024

State Street (NYSE:STT)

Historical Stock Chart

From Apr 2023 to Apr 2024