State Street to Provide ETF Servicing to Fidelity for First Semi-Transparent ETF Suite Utilizing Proxy Basket Structure

June 09 2020 - 9:30AM

Business Wire

State Street Corporation (NYSE:STT) today announced that it has

been appointed ETF servicing agent for Fidelity Investments new

range of semi-transparent, actively managed ETFs. Fidelity is the

first asset manager to receive regulatory approval for three

investment strategies, Fidelity Blue Chip Growth ETF (FBCG),

Fidelity Blue Chip Value ETF (FBCV) and Fidelity New Millennium ETF

(FMIL), which will be available through Fidelity’s proprietary

proxy basket methodology. The structure will allow Fidelity to

deliver its actively-managed investment strategies in these ETF

vehicles without the daily holdings disclosure requirement of fully

transparent ETFs.

“The approval of semi-transparent proxy basket ETFs opens a new

avenue for active managers to offer investment strategies, while

protecting its intellectual property. We are excited to be working

with Fidelity on this unique offering and look forward to using our

extensive experience, expertise, and innovative ETF servicing

technology to support the firm with this exciting new product,”

said Frank Koudelka, global ETF product specialist at State

Street.

State Street will provide services including basket creation,

dissemination, settlement, custody, financial reporting, fund

accounting, order-taking, performance and investment analytics and

transfer agency services to Fidelity’s new suite of funds.

“Fidelity is pleased to work with State Street, an innovative

leader in the exchange traded fund ecosystem,” said Greg Friedman,

Fidelity’s Head of ETF Management and Strategy. “Leveraging our

heritage of active management, we believe that our new active

equity ETFs and methodology will help asset managers offer

differentiated strategies that had previously been unavailable in

the ETF investment wrapper. We are also excited to offer the

opportunity to license our active equity ETF technology.”

State Street has serviced ETFs since their inception more than

twenty years ago. Today, the firm is the largest global ETF

servicer, servicing close to 70% of US ETF assets, and is the only

provider serving all major ETF regions.

About State Street Corporation

State Street Corporation (NYSE: STT) is one of the world's

leading providers of financial services to institutional investors

including investment servicing, investment management and

investment research and trading. With $31.86 trillion in assets

under custody and/or administration and $2.69 trillion* in assets

under management as of March 31, 2020, State Street operates

globally in more than 100 geographic markets and employs

approximately 39,000 worldwide. For more information, visit State

Street's website at www.statestreet.com.

*Assets under management as of March 31, 2020 includes

approximately $50 billion of assets with respect to which State

Street Global Advisors Funds Distributors, LLC (SSGA FD) serves as

marketing agent; SSGA FD and State Street Global Advisors are

affiliated.

Investing involves risk including the risk of loss of

principal.

The information provided does not constitute investment advice

and it should not be relied on as such. It should not be considered

a solicitation to buy or an offer to sell a security. It does not

take into account any investor's particular investment objectives,

strategies, tax status or investment horizon. You should consult

your tax and financial advisor. All material has been obtained from

sources believed to be reliable. There is no representation or

warranty as to the accuracy of the information and State Street

shall have no liability for decisions based on such

information.

The views expressed in this material are the views of State

Street through the period ended May 27, 2020 and are subject to

change based on market and other conditions.

This news announcement contains forward-looking statements as

defined by United States securities laws, including statements

about the financial outlook and business environment. Those

statements are based on current expectations and involve a number

of risks and uncertainties, including those set forth in State

Street's 2015 annual report and subsequent SEC filings. State

Street encourages investors to read the corporation's annual

report, particularly the section on factors that may affect

financial results, and its subsequent SEC filings for additional

information with respect to any forward-looking statements and

prior to making any investment decision. The forward-looking

statements contained in this press release speak only as of the

date hereof, June 8, 2020 and the company will not undertake

efforts to revise those forward-looking statements to reflect

events after this date.

State Street Corporation One Lincoln Street, Boston, MA

02111-2900. The whole or any part of this work may not be

reproduced, copied or transmitted or any of its contents disclosed

to third parties without State Street’s express written

consent.

© 2020 State Street Corporation - All Rights Reserved

Expiration Date: 6/30/2021

3115340.1.1.AM.RTL

View source

version on businesswire.com: https://www.businesswire.com/news/home/20200609005486/en/

Brendan Paul 401 664-9182 BPaul2@StateStreet.com

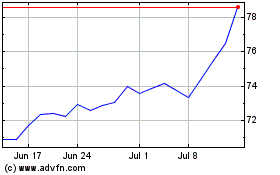

State Street (NYSE:STT)

Historical Stock Chart

From Mar 2024 to Apr 2024

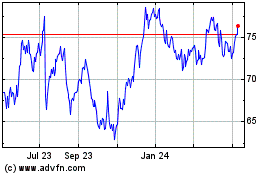

State Street (NYSE:STT)

Historical Stock Chart

From Apr 2023 to Apr 2024