Gold Nears Six-Week High on Caution Over Economy, Trade

December 23 2019 - 10:32AM

Dow Jones News

By Joe Wallace

Gold prices are trading close to their highest level in six

weeks, as investors remain cautious about the world economy and

geopolitics despite record highs in the U.S. stock market.

Gold futures rose 0.3% to $1,485.60 a troy ounce on Monday in

New York, extending their advance in December to 1.4%. The haven

metal is on course to rise 16% over the course of 2019, which would

be its biggest one-year rally since 2010.

"The fact that investors are still holding a decent chunk of

gold gives you a good feeling as to how they are literally hedging

their bets," said Altaf Kassam, head of investment strategy for

State Street Global Advisors in Europe, the Middle East and Africa.

"Gold is definitely not looking like a bad place to store some

value or have a hedge."

Gold prices have kept climbing in recent weeks even though

improving economic data and President Trump's provisional trade

deal with China have pushed U.S. stocks to a series of all-time

highs. The yield on 10-year U.S. Treasury notes has also risen,

from 1.782% at the start of December to 1.916% Monday. Higher bond

yields typically make gold, which pays no interest, less attractive

for investors to own.

Gold's resilience shows that the limited trade pact -- which

Washington and Beijing haven't so far signed -- hasn't dispelled

concerns about the outlook for global growth. China's Finance

Ministry said Monday that Beijing would cut import tariffs on a

range of goods in 2020, as the two sides attempt to complete their

so-called phase-one agreement.

"Worries about the state of geopolitics and the world in general

haven't really gone away completely," said Rhona O'Connell, head of

market analysis for EMEA and Asia at INTL FCStone. "There is still

some concern about the fact the deal is yet to be signed," she

said.

Ms. O'Connell thinks gold prices are unlikely to fall

significantly in the coming months because speculative investors

who made short-term bets on the metal have already exited the

market. That has left a "bedrock" of fund managers who intend to

own gold for a longer period, she said, adding that demand for

physical gold could rise ahead of Lunar New Year on Jan. 25.

David Govett, head of precious metals at London-based brokerage

Marex Spectron, agrees. "The market is happily long," he said.

"It's proper money in there."

Money managers are still wagering that gold prices will rise,

though they have trimmed the size of these bets since late

September. As of Dec. 17, investors held 219,268 more long

contracts than short contracts, the Commodity Futures Trading

Commission said on Friday, up from 56,949 at the start of 2019.

Other precious metals are also having a strong end to the year.

Silver rose 0.8% to $17.36 a troy ounce on Monday, while palladium

has surged 10% in the fourth quarter.

Still, Mr. Kassam said that accelerating global growth means

precious metals are unlikely to rise much further in 2020, barring

an unexpected spike in inflation or weakening in the U.S. economy.

State Street's absolute-return strategy recently sold some gold

futures and bought commodities such as oil and copper, which Mr.

Kassam said are more likely to benefit if the world economy picks

up speed next year.

Elsewhere in commodity markets on Monday, natural-gas futures

dropped 4.6% to $2.22 a million British thermal units. The decline

extends a recent slump and comes after Russia and Ukraine clinched

a transit agreement for gas deliveries into Europe, warding off

disruptions in the New Year.

U.S. crude-oil futures fell 0.4% to $60.23 a barrel, and copper

futures fell 0.7% to $2.81 a pound.

Write to Joe Wallace at Joe.Wallace@wsj.com

(END) Dow Jones Newswires

December 23, 2019 10:17 ET (15:17 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

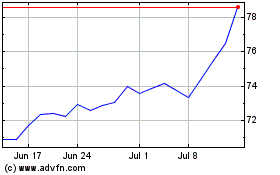

State Street (NYSE:STT)

Historical Stock Chart

From Mar 2024 to Apr 2024

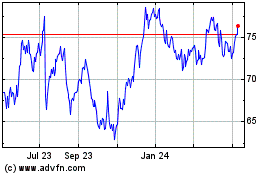

State Street (NYSE:STT)

Historical Stock Chart

From Apr 2023 to Apr 2024