State Street Corporation

(“State Street”) (NYSE: STT) today announced that, pursuant to the

previously announced cash tender offer (the “Tender Offer”) by its

principal banking subsidiary, State Street Bank and Trust Company

(the “Bank”) for any and all of the outstanding Floating Rate

Junior Subordinated Debentures due 2047 listed in the table below

(the “2047 Debentures”), which were issued by State Street,

approximately $289.8 million in aggregate principal amount of the

2047 Debentures were validly tendered and not validly withdrawn on

or prior to 5:00 p.m., New York City time, on November 1, 2019 (the

“Early Tender Deadline”). The terms of the Tender Offer are

described in the Offer to Purchase, dated October 21, 2019 (the

“Offer to Purchase”) and remain unchanged.

The table below summarizes

certain information regarding the 2047 Debentures and the Tender

Offer:

Title of Security

CUSIP Number

Issuer

Aggregate Principal Amount

Outstanding

Interest Rate

Tender Offer Consideration

(1)

Early Tender

Payment (1)

Total Consideration

(1)(2)

Principal Amount

Tendered

Floating Rate Junior Subordinated

Debentures

due 2047

857477AY9

State Street Corporation

$800,000,000

LIBOR plus 1.00%

$820

$30

$850

$289,820,000

(1) Per $1,000 principal amount of 2047 Debentures validly

tendered (and not validly withdrawn) and accepted for purchase.

Excludes accrued and unpaid interest, which will be paid on 2047

Debentures accepted for purchase as described herein.

(2) Includes the Early Tender Payment for 2047 Debentures

validly tendered prior to the Early Tender Date (and not validly

withdrawn) and accepted for purchase.

Holders of 2047 Debentures

validly tendered and not validly withdrawn on or prior to the Early

Tender Deadline, which has now passed, are eligible to receive the

applicable Total Consideration (as defined below), which includes

an early tender payment of $30 per $1,000 principal amount of 2047

Debentures tendered by such holders and accepted for purchase by

the Bank (the “Early Tender Payment”). Accrued and unpaid interest up to, but not including,

the settlement date will be paid in cash on all validly tendered

2047 Debentures accepted and purchased by the Bank in the Tender

Offer.

The Tender Offer is scheduled

to expire at 5:00 pm, New York City time, on November 20, 2019, or

any other date and time to which the Bank extends the Tender Offer

(such date and time, as it may be extended, the “Expiration Date”),

unless the Tender Offer is earlier terminated. The settlement date

for the 2047 Debentures that are validly tendered on or prior to

the Expiration Date is expected to be November 22, 2019, the second

business day following the Expiration Date, assuming the conditions

to the satisfaction of the Tender Offer including termination of

State Street’s Replacement Capital Covenant (as described below)

are satisfied.

The consideration (the “Total

Consideration”) offered per $1,000 principal amount of 2047

Debentures validly tendered and accepted for purchase pursuant to

the Tender Offer will be as specified in the table above. The

“Tender Offer Consideration” is equal to the Total Consideration

minus the Early Tender Payment. Holders of 2047 Debentures who

validly tender their 2047 Debentures after the Early Tender

Deadline, which has now passed, but prior to the Expiration Date

will be eligible to receive only the Tender Offer Consideration and

not the Early Tender Payment.

The Bank’s obligation to accept for payment and to pay for

the 2047 Debentures validly tendered in the Tender Offer is not

subject to any minimum tender condition but is subject to the

satisfaction or waiver of the conditions described in the Offer to

Purchase, including termination of State Street’s Replacement

Capital Covenant dated April 30, 2007 and amended May 13, 2016,

which is expected to occur following the settlement of State

Street’s previously announced partial redemption of its Floating

Rate Junior Subordinated Deferrable Interest Debentures, Series A,

due May 15, 2028 on November 20, 2019 (the “Redemption”). The Bank

reserves the right, subject to applicable law, to: (i) waive any

and all conditions to the Tender Offer; (ii) extend or terminate

the Tender Offer; or (iii) otherwise amend the Tender Offer in any

respect.

Information Relating to the Tender

Offer

Deutsche Bank Securities Inc. and J.P. Morgan Securities LLC are

acting as the dealer managers (the “Dealer Managers”) for the

Tender Offer. The information agent and tender agent is D.F. King

& Co. (“D.F. King”). Copies of the Offer to Purchase and

related offering materials are available by contacting D.F. King at

(800) 659-6590 (U.S. toll-free) or (212) 269-5550 (banks and

brokers). Questions regarding the Tender Offer should be directed

to Deutsche Bank Securities Inc., Liability Management Group, at

(212) 250-2955 (collect) or (866) 627-0391 (toll-free) or J.P.

Morgan Securities LLC, Liability Management Group at (212) 834-8553

(collect) or (866) 834-4666 (toll-free).

None of the Bank, State Street or their affiliates, their

respective boards of directors or managing members, the Dealer

Managers, D.F. King or the trustee of the 2047 Debentures is making

any recommendation as to whether holders of 2047 Debentures should

tender any 2047 Debentures in response to the Tender Offer, and

neither the Bank nor any such other person has authorized any

person to make any such recommendation. Holders of 2047 Debentures

must make their own decision as to whether to tender any of their

2047 Debentures, and, if so, the principal amount of 2047

Debentures to tender.

This press release shall not constitute an offer to sell, a

solicitation to buy or an offer to purchase or sell any securities.

The Tender Offer is being made only pursuant to the Offer to

Purchase and only in such jurisdictions as is permitted under

applicable law.

The full details of the Tender Offer, including complete

instructions on how to tender 2047 Debentures, are included in the

Offer to Purchase. The Offer to Purchase contains important

information that should be read by holders of 2047 Debentures

before making a decision to tender any 2047 Debentures. The Offer

to Purchase may be downloaded from D.F. King’s website at

www.dfking.com/statestreet or obtained from D.F. King, free of

charge, by calling toll-free at (800) 249-7120 (bankers and brokers

can call collect at (212) 269-5550).

About State Street

Corporation

State Street Corporation (NYSE: STT) is one of the world's

leading providers of financial services to institutional investors,

including investment servicing, investment management and

investment research and trading. With $32.90 trillion in assets

under custody and administration and $2.95 trillion* in assets

under management as of September 30, 2019, State Street operates

globally in more than 100 geographic markets and employs

approximately 40,000 worldwide. For more information, visit State

Street's website at www.statestreet.com.

* Assets under management include the assets of the SPDR® Gold

ETF and the SPDR® Long Dollar Gold Trust ETF (approximately $44

billion as of September 30, 2019), for which State Street Global

Advisors Funds Distributors, LLC (SSGA FD) serves as marketing

agent; SSGA FD and State Street Global Advisors are affiliated.

Forward Looking

Statements

This press release contains forward-looking statements that

are not historical in nature. Such forward-looking statements are

subject to risks and uncertainties, including the risks related to

the acceptance of any tendered 2047 Debentures, the expiration and

settlement of the Tender Offer, the satisfaction of conditions to

the Tender Offer, whether the Tender Offer will be consummated in

accordance with terms set forth in the Offer to Purchase or at all,

the completion of the Redemption and the timing of any of

the foregoing, competitive factors, government regulation and

general economic conditions and other risks and uncertainties

described in State Street’s periodic reports on file with the U.S.

Securities and Exchange Commission including the most recent Annual

Report on Form 10-K of State Street, as filed with the U.S.

Securities and Exchange Commission. In some cases, you can identify

these statements by forward-looking words, such as “anticipate,”

“believe,” “could,” “estimate,” “expect,” “forecast,” “intend,”

“looking ahead,” “may,” “plan,” “possible,” “potential,” “project,”

“should,” “will,” and similar words or expressions, the negative or

plural of such words or expressions and other comparable

terminology. Actual results may differ materially from anticipated

results. Neither State Street nor the Bank undertake to update its

forward-looking statements or any of the information contained in

this press release, including to reflect future events or

circumstances.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20191104005358/en/

Ilene Fiszel Bieler +1 617-664-3477

Marc Hazelton +1 617-513-9439

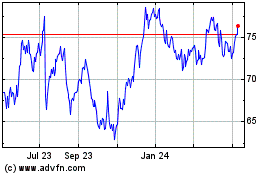

State Street (NYSE:STT)

Historical Stock Chart

From Mar 2024 to Apr 2024

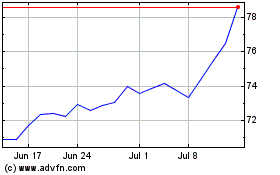

State Street (NYSE:STT)

Historical Stock Chart

From Apr 2023 to Apr 2024