By Dawn Lim

Money managers that mimic the stock market just became the new

titans of the fund-management world.

Funds that track broad U.S. equity indexes hit $4.27 trillion in

assets as of Aug. 31, according to research firm Morningstar Inc.,

giving them more money than stock-picking rivals for the first-ever

monthly reporting period. Funds that try to beat the market had

$4.25 trillion as of that date.

The passing of the asset crown is the latest chapter in one of

the most dramatic transformations in the history of financial

markets. In the past decade, $1.32 trillion fled actively managed

U.S. equity mutual funds and exchange-traded funds as nearly $1.36

trillion was added to low-cost funds that mimic market indexes.

That shift lowered the price of investing for individuals,

reduced the influence of stock pickers and turned a handful of Wall

Street outsiders into the biggest power brokers in the

industry.

Indexing giants such as BlackRock Inc., Vanguard Group and State

Street Corp. now wield considerable power over corporate America

and can cast pivotal votes that determine everything from who sits

on a company board to how executives deal with issues ranging from

climate change to pay equity.

The rise of indexing has attracted scrutiny from those who are

worried market-mimicking funds could distort prices and exacerbate

market turbulence. Index giants have so far dismissed those

concerns as fear mongering as they continue to grow.

"Let's first define when people talk about indexing getting

big," Vanguard Chief Executive Tim Buckley said in May. "It's not

big enough. There's still too many people getting ripped off by

high-cost active."

The Morningstar data covers a slice of the mutual fund and ETF

world focused on U.S. equities. Industry trade group Investment

Company Institute said its own data showed assets in U.S. equity

index mutual funds and ETFs haven't surpassed actively managed U.S.

stock funds.

Index funds are a long way from dominating the whole stock

market. U.S.-focused index equity funds make up nearly 14% of the

American stock market, up from roughly 7% in 2010, according to the

Investment Company Institute. Index funds generally contribute up

to 5% of U.S. stock-market trading, economists estimate.

Old-fashioned money managers aren't willing to relinquish their

crown so easily. They are experimenting with new fee structures,

leaning more heavily on data science and turning to illiquid bets

in a bid to keep customers and attract new ones. Some also are

using index funds to build their portfolios.

"I look at it much in the same way as Roger Federer looks at

Novak Djokovic," said Andreas Utermann, chief executive of Allianz

Global Investors, in a nod to two tennis titans. "It helps us to

improve our game."

The challenge to traditional stock pickers began more than four

decades ago with Vanguard founder Jack Bogle's introduction of the

first index mutual fund for ordinary investors in 1976. His idea,

which was to allow everyday investors to essentially own a stake in

the entire market at minimal cost, was initially scorned by Wall

Street.

Another threat emerged in the 1990s with the advent of

exchange-traded funds. These are collections of stocks or bonds

that trade on exchanges and give investors rapid exposure to

markets.

Following the 2008 financial crisis, more customers pulled their

money from actively managed funds when they realized pricier

managers had failed to protect them from the market rout. The

outflows snowballed as stock pickers struggled to beat one of the

longest bull runs in history. More than 80% of U.S. actively

managed equity funds underperformed the S&P Composite 1500 in

the decade ended 2018, according to S&P Global.

Three firms -- BlackRock, Vanguard and State Street -- were

major beneficiaries of the shift, cementing a roughly 80% share of

the index fund market. BlackRock and Vanguard collectively took in

a daily average of roughly a billion dollars in total net flows

last year. State Street's SPDR S&P 500 ETF Trust was one of the

most-traded securities in the past year.

These firms face new questions as their power intensifies. One

is how they should wield their newfound influence over companies.

BlackRock, Vanguard and State Street hold about 20% of the S&P

500 through funds they manage, according to FactSet. Big indexers

were key votes in a landmark shareholder victory in 2017 that

pushed oil giant Exxon Mobil Corp. to explain the impact of

climate-change rules.

"The rise of passive investing raises the corporate governance

challenge of the 21st century," said Securities and Exchange

Commission Commissioner Robert Jackson in a statement. "It can give

a few individuals influence over the outcome of elections in the

corporations that control the economic future of millions of

American families."

Others question if index funds are equipped to watch over all

the companies in which they invest. "They have driven real

governance improvements," said Lyndon Park, who heads a business at

ICR that advises companies on shareholders. "But given the large

universe they invest in, their stewardship teams can't follow every

company and sector-specific issue." Indexing managers from

BlackRock to Vanguard have been expanding their stewardship teams

in recent years.

Lynn Blake, who heads equity indexing at State Street Global

Advisors, adds that the firm has to be selective about which

companies it meets and that it uses technology to augment the reach

of its 12-person stewardship team. "We will hold positions for a

very long time," she said. "We want to work closely with directors

and boards so they understand our point of view."

Another concern is the ripple effect index funds have on the

stock market. Some studies show that company share prices get a

boost when they are added to major benchmarks, and stocks can be

vulnerable to short-term price swings as money moves in and out of

index ETFs, especially for shares that are bigger parts of indexes

and less traded.

Asset managers that run index funds say fears that the strategy

could cause widespread market disruptions are overblown. There are

hundreds of index products and they don't all trade in tandem.

Moreover, buying and selling by index funds reflects real shifts in

sentiment by investors, and stock prices should respond regardless

of what kind of fund is used.

But the apostle of the index fund became more concerned about

the unintended consequences of indexing's success in his final

years. If index giants kept growing at the same clip, it would be a

matter of time before governments tried to break them up, the late

Mr. Bogle told close associates. He worried this would put the

future of the index fund in jeopardy.

--Jason Zweig contributed to this article.

Write to Dawn Lim at dawn.lim@wsj.com

(END) Dow Jones Newswires

September 18, 2019 05:44 ET (09:44 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

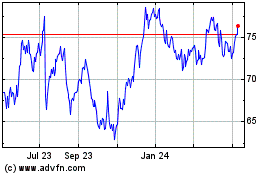

State Street (NYSE:STT)

Historical Stock Chart

From Mar 2024 to Apr 2024

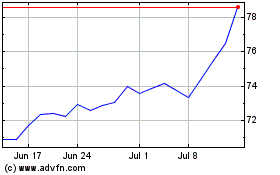

State Street (NYSE:STT)

Historical Stock Chart

From Apr 2023 to Apr 2024