Even Passive Giants Aren't Immune From Investors' Changing Tastes

July 20 2019 - 5:59AM

Dow Jones News

By Justin Baer

The surging popularity of low-cost investment funds has dialed

up the pressure on most asset managers -- including some of the

firms most responsible for the industry's transformation.

Investing giants State Street Corp. and BlackRock Inc. on Friday

reported lower earnings in the second quarter, a period in which

the Dow Jones Industrial Average ascended to a new record high and

both firms posted inflows.

A rallying stock market is usually a boon for the profits of

investment firms, which collect fees on the assets they manage for

clients. When asset prices rise, the managers' fee revenue goes up.

But investors' money is increasingly finding its way to cheaper

mutual and exchange-traded funds -- and rotating out of higher-fee

investments.

"In some cases, you've got firms losing both assets and

revenue," Ron O'Hanley, State Street's chief executive, said in an

interview. "There's a shift from active to passive, and they're

just not participating."

"For us and BlackRock, you're seeing growth but also a movement

into lower-cost products," he added.

BlackRock and State Street are top sellers of ETFs, the product

that helped accelerate investors' shift to index-tracking

funds.

BlackRock, the world's biggest money manager, said Friday that

second-quarter investment and administrative fees fell by 1.4% from

a year earlier even as the assets the firm manages jumped by more

than $500 billion, to $6.84 trillion. State Street's

investment-management division followed suit with a revenue drop

from a year earlier. In that same period, assets under management

rose to $2.9 trillion from $2.7 trillion.

State Street's shares rose $3.79, or 6.7%, to $60.08 on Friday.

BlackRock fell $1.90, or 0.4%, to $473.24.

Friday's results may set the tone for others in an industry

still wrestling with the changes wrought by investors' embrace of

passive investing. Some of the biggest active managers, including

T. Rowe Price Group Inc., Franklin Resources Inc. and Legg Mason

Inc., are slated to report their results in the coming weeks.

"BlackRock is doing much better from an earnings standpoint than

other asset managers," Morgan Stanley analyst Michael Cyprys said.

"Peers are going to be down significantly more."

The results at State Street's core asset-servicing businesses,

which perform key back-office functions to some 90% of the biggest

investment firms, underlined the tough terrain facing asset

managers.

Servicing fees fell 9.3% to $1.25 billion from a year earlier,

the custody bank said Friday.

"Nobody feels good about this industry -- at all," said Brennan

Hawken, an analyst with UBS AG. "That's not new. But it has really

come home to roost in the past three to four years."

On a conference call with analysts, State Street Chief Financial

Officer Eric Aboaf said custody banks have historically lowered

their fees on bookkeeping and other services by 1.5% to 2% a year.

But as many asset-management clients struggled to lower fees, they

pushed their custodians to cut theirs, too. Last year, servicing

fees fell on average by 4% and appear headed for a similar drop in

2019, Mr. Aboaf said.

"This industry is under pressure," said Mr. O'Hanley. "But the

reality is that even taking their custody fees to zero is not going

to solve those pressures. What this industry needs is a fundamental

restructuring of its operating model."

State Street announced plans in January to slash $350 million in

annual expenses this year as it trims jobs and automates tasks once

directed by human hands. On Friday, the custody bank upped its 2019

savings target to $400 million.

State Street's willingness to detail its cost-cutting plan may

signal it has a better handle on how low servicing fees may go

before they stabilize, Mr. Hawken said. "It's a sign they are

getting their hands around the pricing pressure," he said.

Indeed, Mr. Aboaf said Friday that declines in servicing fees

have moderated as the year progressed.

Dawn Lim contributed to this article.

Write to Justin Baer at justin.baer@wsj.com

(END) Dow Jones Newswires

July 20, 2019 05:44 ET (09:44 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

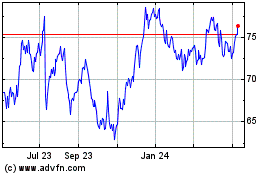

State Street (NYSE:STT)

Historical Stock Chart

From Mar 2024 to Apr 2024

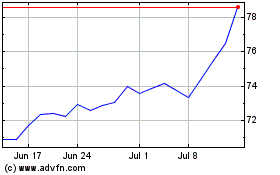

State Street (NYSE:STT)

Historical Stock Chart

From Apr 2023 to Apr 2024