By Simon Constable

The three largest index-fund managers have grown so big that

they ultimately could hamper the performance of public companies

and the economy, according to research from corporate-governance

scholars.

The researchers -- Lucian Bebchuk, professor of law, economics

and finance at Harvard Law School, and Scott Hirst, a law professor

at Boston University School of Law -- recently published two papers

that raise issues for investors.

Together, the largest fund managers -- BlackRock Inc., Vanguard

Group and State Street Corp.'s State Street Global Advisors --

control an average of one in five shares of S&P 500 companies,

and that portion is likely to jump to more than 33% of shares over

the next two decades, the professors say in a working paper issued

by the National Bureau of Economic Research in June. The fund

managers own 16.5% of shares in companies in the Russell 3000

index, the research shows, a total that the professors say could

grow to 30.1% over the next two decades.

Also, these large fund managers collectively fall short in their

role, as shareholders, of oversight of public companies, the

researchers find in a second report to be published later this

year.

"We show and document that the Big Three have incentives to

underinvest in stewardship and to be excessively deferential to the

corporate managers of portfolio companies," says Prof. Bebchuk.

"Given this analysis and empirical evidence, we worry that the

increased concentration of shares in the hands of institutional

investors will not produce the improved oversight of public

companies that would be beneficial for public companies and the

economy," he says.

Leaders at BlackRock, Vanguard and State Street all disagree

with the analysis, saying that they act in the best interests of

their shareholders.

The professors also say that the influence of the fund firms is

greater than the portion of shares they own. These three firms are

together responsible for 25% of the votes cast in company ballots

for S&P 500 companies and 22% of the votes cast at Russell 3000

companies, the paper says.

If the same relationship between control of shares and votes

cast holds in the future and the funds' ownership of shares grows

as predicted, then the three index-fund companies could together

account for more than 40% of all votes, on average, on shareholder

resolutions at S&P 500 companies.

Cautious approach?

In their second report, due to be published in the December 2019

issue of the Columbia Law Review, Profs. Bebchuk and Hirst say the

index firms are found to be extremely cautious when it comes to

their own spending on corporate stewardship or taking action to

change the way public companies do business.

The three fund managers "very rarely" oppose corporate managers

in votes on executive compensation "and are less likely than other

investors to oppose managers in proxy fights against activists,"

says the new report.

"Our analysis of the voting guidelines and stewardship reports

of the Big Three [BlackRock, Vanguard and State Street] indicates

that their stewardship focuses on governance structures and

processes and pays limited attention to financial

underperformance," the report continues.

These firms don't agree with the professors' conclusions.

Last year, State Street voted against 266 companies on

pay-related issues and took more action against company directors

than advisory firm Institutional Shareholder Services recommended,

says Rakhi Kumar, head of ESG (environmental, social and

governance) investments and asset stewardship at State Street. At

the same time, the firm takes a nuanced approach to activist

proposals, she says: "We also have to hold activists

accountable."

In a statement, Vanguard said that voting is "only one part of

the larger corporate governance process. We regularly engage with

companies on our shareholders' behalf and believe that engagement

and broader advocacy, in addition to voting, can effect meaningful

changes that generate long-term value for all shareholders."

Asked for comment, BlackRock pointed to multiple past comments,

including Chief Executive Officer Larry Fink's 2018 letter to

shareholders and the company's ViewPoint publication of July 2018.

"We must be active, engaged agents on behalf of the clients

invested with BlackRock," Mr. Fink said in his letter to

shareholders. "This responsibility goes beyond casting proxy votes

at annual meetings -- it means investing the time and resources

necessary to foster long-term value."

What they spend

The professors' coming paper asserts that the amount of cash the

three fund-management firms spend on corporate governance is

minuscule.

"We show that the Big Three devote an economically negligible

fraction of their fee income to stewardship, and that their

stewardship staffing enables only limited and cursory stewardship

for the vast majority of their portfolio companies," the report

says.

The professors estimate that spending on stewardship by

BlackRock, Vanguard, and State Street is less than 0.2% of the fee

income each receives. Staffing also is thin, the professors

say.

BlackRock's July 2018 ViewPoint publication states: "BlackRock

has over 30 professionals in this area, which represents the

largest dedicated investment stewardship capability in the asset

management industry to our knowledge, and we have announced plans

to continue to invest in this function." BlackRock also said in

that publication that some clients choose not to delegate voting

authority to BlackRock. That's the case for around 9% of the shares

that BlackRock holds in funds with so-called "equity mandates," the

company said; those are funds that are set up to hold stocks. The

firm has also stated that proxy services can hold even greater

influence over shareholder votes.

Vanguard says it has "invested considerably" in stewardship.

"They are using a framework that for us is not relevant," says

State Street's Ms. Kumar, pointing to extensive thought-leadership

work that the company believes influences corporate behavior.

Mr. Constable is a writer in Edinburgh, Scotland. He can be

reached at reports@wsj.com.

(END) Dow Jones Newswires

July 08, 2019 22:19 ET (02:19 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

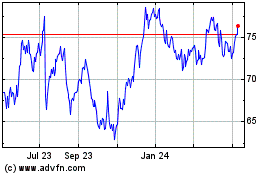

State Street (NYSE:STT)

Historical Stock Chart

From Mar 2024 to Apr 2024

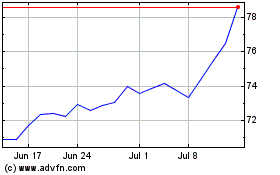

State Street (NYSE:STT)

Historical Stock Chart

From Apr 2023 to Apr 2024