State Street Is Cutting 1,500 Jobs -- Update

January 18 2019 - 5:18PM

Dow Jones News

By Justin Baer

State Street Corp. said Friday it would shed about 1,500

employees, a new sign that the asset-management industry's

struggles are rippling through the rest of Wall Street.

The cuts will sweep through higher-cost offices such as Boston,

New York and London as State Street automates parts of its

operations. They include the 100 or so senior management jobs the

bank had previously announced and represent less than 4% of the

company's roughly 40,000-person workforce.

The job reductions mark a more aggressive phase in the custody

bank's yearslong plan to trim expenses, root out manual processes

and keep pace with the dramatic changes under way at many

investment firms.

What explains the added urgency is a late 2018 market rout that

spooked investors and punished the asset management industry. State

Street provides the bookkeeping and other back-office services to

nearly 90% of the biggest investment firms.

"Market dynamics are changing for our clients," Ronald O'Hanley,

State Street's chief executive, said to analysts on Friday. "The

resulting margin compression for investment managers has led them

to increase pressure on their providers."

Asset managers are wrestling with the challenges posed by uneasy

investors and shaky markets as more firms compete to push prices

lower. Last year clients started to commit less new money to

investment funds and other products. Then a market selloff reduced

the value of assets managed by many of these firms, further

draining the fees they pocket for managing others' money.

BlackRock Inc., the world's biggest asset manager, said this

week that its assets fell by roughly $468 billion in the fourth

quarter. Last week it announced 500 job cuts as a way of coping

with the shifts under way in its industry.

State Street isn't the only service provider to the asset

management industry looking to pare back. Bank of New York Mellon

Corp. said Wednesday it had set aside severance expenses in the

fourth quarter as it began to eliminate layers of managers

throughout the company.

At State Street, the need to take out costs didn't seem quite so

urgent when Mr. O'Hanley spoke last month at an investor conference

and revealed the plans to cut about 15% of senior managers, or

roughly 100 people. That was before the market's selloff steepened

in the final weeks of the year, and investors were confronted with

new worries, including the effects of a prolonged partial shutdown

of the U.S. government, Mr. O'Hanley said.

"We certainly control our destiny," the CEO said in an

interview. "But in terms of the market levels, and the underlying

market sentiment in what investors do, we don't control that."

State Street also said Friday that in the fourth quarter its net

income rose 19% to $398 million, or $1.04 a share, from $334

million, or 89 cents, a year earlier. Excluding charges and other

items, State Street earned $1.68 a share in the most-recent period.

On that basis, analysts had expected a $1.70 profit.

Revenue rose 4.9% to $2.99 billion, slightly above analysts'

average estimate. The bank's shares closed 25 cents higher, at

$71.30.

State Street finished the year with $31.6 trillion in assets

under custody, down from $34 trillion at the end of the third

quarter. The firm had $2.51 trillion in assets under management, an

11% drop from September.

Write to Justin Baer at justin.baer@wsj.com

(END) Dow Jones Newswires

January 18, 2019 17:03 ET (22:03 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

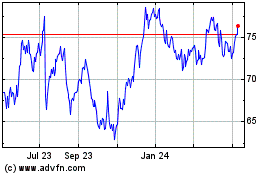

State Street (NYSE:STT)

Historical Stock Chart

From Mar 2024 to Apr 2024

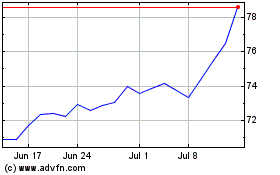

State Street (NYSE:STT)

Historical Stock Chart

From Apr 2023 to Apr 2024