UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer Pursuant to Rule 13a-16 or 15d-16 under the Securities Exchange Act of 1934

For the month of October 2018

Commission File Number: 001-35135

Sequans Communications S.A.

(Translation of Registrant’s name into English)

15-55 boulevard Charles de Gaulle

92700 Colombes, France

Telephone : +33 1 70 72 16 00

(Address of Principal Executive Office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F: Form 20-F

R

Form 40-F

£

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): Yes

£

No

R

Note:

Regulation S-T Rule 101(b)(1) only permits the submission in paper of a Form 6-K if submitted solely to provide an attached annual report to security holders.

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): Yes

£

No

R

Note:

Regulation S-T Rule 101(b)(7) only permits the submission in paper of a Form 6-K if submitted to furnish a report or other document that the registrant foreign private issuer must furnish and make public under the laws of the jurisdiction in which the registrant is incorporated, domiciled or legally organized (the registrant’s “home country”), or under the rules of the home country exchange on which the registrant’s securities are traded, as long as the report or other document is not a press release, is not required to be and has not been distributed to the registrant’s security holders, and, if discussing a material event, has already been the subject of a Form 6-K submission or other Commission filing on EDGAR.

The information in this report, furnished on Form 6-K, shall be incorporated by reference into each of the following Registration Statements under the Securities Act of 1933, as amended, of the registrant: Form S-8 (File Nos. 333-177919, 333-180487, 333-187611, 333-194903, 333-203539, 333-211011, 333-214444 and 333-215911) and Form F-3 (File No. 333-198758).

Entry into Material Definitive Agreements

Effective September 27, 2018, Sequans Communications S.A. (the “Company”) amended the terms of the convertible note issued April 14, 2015 (the “2015 Note”) to Nokomis Capital, L.L.C. (“Nokomis”), one of the Company’s existing shareholders who is represented on the board of directors by Wesley Cummins, to extend by two years the maturity of the note to April 14, 2021. In addition, the conversion price was reduced from $1.85 to $1.70. Lastly, Nokomis agreed to subordinate the 2015 Note to new debt then in negotiation by the Company. All other terms remained unchanged. Also effective September 27, 2018, the Company amended the terms of the convertible note issued to Nokomis on April 27, 2016 (the “2016 Note”) to subordinate the 2016 Note to

new debt then in negotiation by the Company. All other terms remained unchanged. Copies of these amendments to the 2015 Note and the 2016 Note are attached hereto as exhibit 4.1 and 4.2, respectively.

On September 27, 2018, the Company issued and sold a convertible note in the principal amount of $4.5 million (the “2018 Note”) to Nokomis. The 2018 Note shall be convertible into the Company’s American Depositary Shares (“ADSs”), each representing one ordinary share, nominal value €0.02 per share, at a conversion price of $1.70 per ADS. The 2018 Note has the same terms as the 2015 Note as amended above. It is an unsecured obligation of the Company, will mature on April 14, 2021 and is not redeemable prior to maturity at the option of the Company. The accreted principal amount of the 2018 Note is convertible at any time or times on or after the issuance date until maturity, in whole or in part, into ADSs at the conversion rate, subject to certain adjustments for significant corporate events, including dividends, stock splits and other similar events. Interest accrues on the unconverted portion of the 2018 Note at the rate of 7% per year, paid in kind annually on the anniversary of the issuance of the 2018 Note. The 2018 Note also provides for customary events of default which, if any of them occurs, would permit or require the principal of and accrued interest on the 2018 Note to become or to be declared due and payable. A copy of the 2018 Note is attached hereto as exhibit 4.3.

Also on September 27, 2018, the Company issued to Nokomis for a subscription price of $1.00 warrants to acquire 1,800,000 ADSs at an exercise price of $1.70 per ADS. Such warrants are exercisable at any time and expire April 14, 2021. A copy of the Nokomis warrant agreement is attached hereto as exhibit 4.4.

On October 26, 2018, the Company further amended the 2015 Note, the 2016 Note and the 2018 Note with Nokomis to clarify the terms of the subordination of these convertible notes to the Company’s new bondholder. Copies of these amendments to the 2015 Note, the 2016 Note and the 2018 Note are attached hereto as exhibit 4.5, 4.6 and 4.7, respectively.

On October 26, 2018, the Company entered into a bond issuance agreement with Harbert European Specialty Lending Company II S.a.r.l (the “Harbert”) whereby Harbert agreed to loan to the Company €12 million ($13.8 million), at a stated rate of interest of 9%, to be repaid monthly over 42 months (the “Bond”). The Bond is secured by various assets of the Company, including intellectual property, and is senior to the 2015 Note, 2016 Note and 2018 Note. The Bond also provides for customary events of default which, if any of them occurs, would permit or require the principal of and accrued interest on the Bond to become or to be declared due and payable. A copy of the bond issuance agreement is attached hereto as exhibit 4.8.

Also on October 26, 2018, the Company issued to Harbert for a subscription price of $1.00 warrants to acquire 816,716 ADSs at an exercise price of $1.34 per ADS. Such warrants are exercisable at any time and expire October 26, 2028. A copy of the Harbert warrant agreement is attached hereto as exhibit 4.9.

Other Events

On October 30, 2018 and in connection with entering into the bond issuance agreement, the Company retired convertible notes issued on April 27, 2016 and due on April 27, 2020, with a principal amount of $1 million, by paying the principal and accrued interest due as of October 30, 2018 to the noteholder.

On October 30, 2018, the Company issued a press release announcing its financial results for the third quarter ended September 30, 2018 as well as the new debt financings. A copy of the press release is attached to this Form 6-K as Exhibit 99.1 and is incorporated herein by reference.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SEQUANS COMMUNICATIONS S.A.

(Registrant)

|

|

|

Date: October 30, 2018

|

By:

|

/s/ Deborah Choate

|

|

|

|

|

Deborah Choate

|

|

|

|

|

Chief Financial Officer

|

|

|

|

EXHIBIT INDEX

The following exhibit is filed as part of this Form 6-K:

|

|

|

|

|

|

Exhibit

|

Description

|

|

|

|

|

4.1

|

Amendment No. 3, 2015 Note

|

|

4.2

|

Amendment No. 3, 2016 Note

|

|

4.3

|

2018 Note

|

|

4.4

|

Nokomis Warrant Agreement

|

|

4.5

|

Amendment No. 4, 2015 Note

|

|

4.6

|

Amendment No. 4, 2016 Note

|

|

4.7

|

Amendment No. 1, 2018 Note

|

|

4.8

|

Harbert Bond Issue Agreement with Annexes

|

|

4.9

|

Harbert Warrant Issue Agreement

|

|

99.1

|

Press release dated October 30, 2018

|

|

|

|

|

|

|

|

|

|

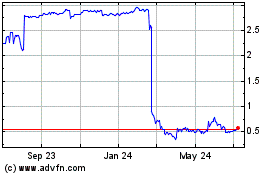

Sequans Communications (NYSE:SQNS)

Historical Stock Chart

From Mar 2024 to Apr 2024

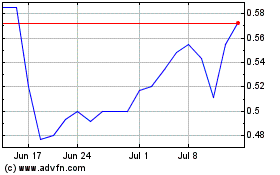

Sequans Communications (NYSE:SQNS)

Historical Stock Chart

From Apr 2023 to Apr 2024